Wisconsin Option to Purchase Stock - Long Form

Description

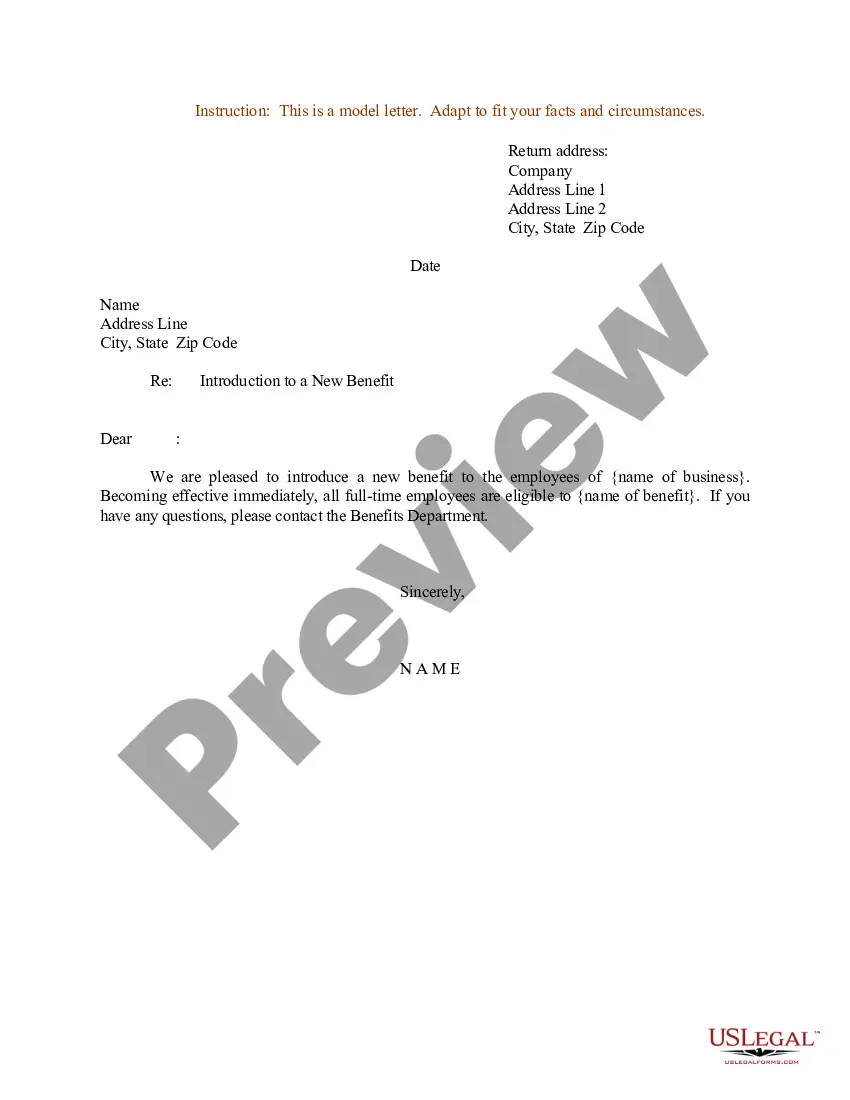

How to fill out Option To Purchase Stock - Long Form?

You have the ability to spend numerous hours online searching for the correct legal format that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that have been reviewed by professionals.

You can obtain or print the Wisconsin Option to Purchase Stock - Long Form through my assistance.

If you wish to find another version of the document, use the Search feature to locate the format that fits your needs.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Following this, you can complete, modify, print, or sign the Wisconsin Option to Purchase Stock - Long Form.

- Each legal format you download is yours permanently.

- To obtain another copy of any purchased document, navigate to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct format for the county/city of your choice.

- Review the form outline to confirm you have chosen the appropriate document.

Form popularity

FAQ

You can access Wisconsin tax forms directly from the Wisconsin Department of Revenue's website. Alternatively, various online platforms such as uslegalforms provide an extensive collection of Wisconsin tax forms and related resources. This can simplify your searching process and ensure you have the correct documents when needed.

You can obtain local tax forms from your local county or municipal office. Many local governments also provide forms on their official websites. For a comprehensive solution, consider using uslegalforms, which provides access to local and state tax forms, including those relevant to Wisconsin.

Yes, Wisconsin tax forms are available online for easy access. You can find the necessary forms on the Wisconsin Department of Revenue website. Additionally, you may explore platforms like uslegalforms, which offers a variety of state-specific tax forms, simplifying your filing process.

Wisconsin has tuition reciprocity agreements with several states, including Minnesota and Illinois. These agreements allow residents of these states to attend certain universities at reduced tuition rates. If you are considering college options across state lines, our US Legal Forms services can assist with necessary enrollment documentation.

Yes, Wisconsin has a school of choice program that allows parents to select educational options outside their assigned public school. This program enhances educational opportunities for students by providing access to various schools within the state. For those navigating the school selection process, our platform contains helpful forms and guidelines to make informed decisions.

Wisconsin taxes long-term capital gains as ordinary income, which means they are subjected to the state income tax rates. However, some specific exclusions, such as the 30 percent exclusion, can apply. To ensure you are maximizing your benefits and minimizing your liabilities, explore our US Legal Forms platform to equip yourself with necessary documentation and insights.

Yes, Wisconsin provides a 30 percent exclusion for capital gains realized from the sale of certain assets. This exclusion encourages investment in local businesses and can significantly reduce your tax liability. If you are looking to understand how this applies to your situation, our resources can help clarify the process.

Pass-through withholding in Wisconsin refers to the state income tax withheld from the income generated by partnerships and S corporations. This withholding is essential for reporting income accurately and ensuring tax compliance. For detailed guidance on reporting and withholding obligations, our platform offers valuable templates and forms.

Yes, Wisconsin offers genetic counseling licensure. This licensure ensures that genetic counselors meet specific qualifications and adhere to professional standards in their practice. For individuals seeking to establish themselves in this field, consider our US Legal Forms services to access necessary documents for licensure.

A Wisconsin Form 5S is a document used by taxpayers in Wisconsin to report income from pass-through entities for the state income tax. This form is essential for individuals claiming certain credits and deductions tied to their investments. If you find the process challenging, consider using our US Legal Forms platform to help you navigate these forms efficiently.