The Wisconsin Increase Surplus Account — Resolution For— - Corporate Resolutions is a specialized legal document used by corporations in the state of Wisconsin to authorize the increase of the surplus account. This form is typically utilized when a corporation needs to allocate additional funds to its surplus account in order to meet legal requirements or for strategic financial purposes. The surplus account refers to the portion of a corporation's retained earnings that is set aside for various purposes such as future investments, debt reduction, or potential business expansion. By increasing the surplus account, a corporation can enhance its financial stability and flexibility. The Wisconsin Increase Surplus Account — Resolution For— - Corporate Resolutions is designed to ensure legal compliance and proper corporate governance. This form involves a series of resolutions that need to be adopted by the corporation's board of directors or shareholders, depending on the company's structure and bylaws. Some key fields and sections found in the Wisconsin Increase Surplus Account — Resolution For— - Corporate Resolutions can include: 1. Corporate Information: The form typically requires the name, registered office address, and other identification details of the corporation. 2. Resolutions: This section encompasses the resolutions that authorize the increase of the surplus account. It may include specific details such as the amount of the increase, the purpose for which the surplus account will be used, and any restrictions or guidelines related to the allocation of these funds. 3. Authorized Signatures: The form usually necessitates the signatures of the authorized individuals such as directors, officers, or shareholders who have the power to approve the increase of the surplus account. These signatures certify the resolutions made and add legal validity to the document. Additionally, it is important to note that variations of the Wisconsin Increase Surplus Account — Resolution For— - Corporate Resolutions may be available based on the specific needs and requirements of different corporations. For instance, there could be separate forms for different types of corporations such as LCS (Limited Liability Companies), S-Corps (S Corporations), or C-Corps (C Corporations). The fundamental purpose of these variations remains the same — to authorize the increase of the surplus account — but they may feature specific provisions or formatting tailored to the legal framework of each type of corporate entity. In conclusion, the Wisconsin Increase Surplus Account — Resolution For— - Corporate Resolutions is a crucial legal document that allows corporations in Wisconsin to formally authorize the increase of their surplus account. It enables proper financial management, legal compliance, and safeguards the interests of the corporation and its stakeholders.

Wisconsin Increase Surplus Account - Resolution Form - Corporate Resolutions

Description

How to fill out Wisconsin Increase Surplus Account - Resolution Form - Corporate Resolutions?

If you need to finalize, acquire, or create legal document templates, utilize US Legal Forms, the broadest array of legal forms that are accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have located the template you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Wisconsin Increase Surplus Account - Resolution Form - Corporate Resolutions with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to obtain the Wisconsin Increase Surplus Account - Resolution Form - Corporate Resolutions.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines outlined below.

- Step 1. Ensure you have selected the document for your specific city/region.

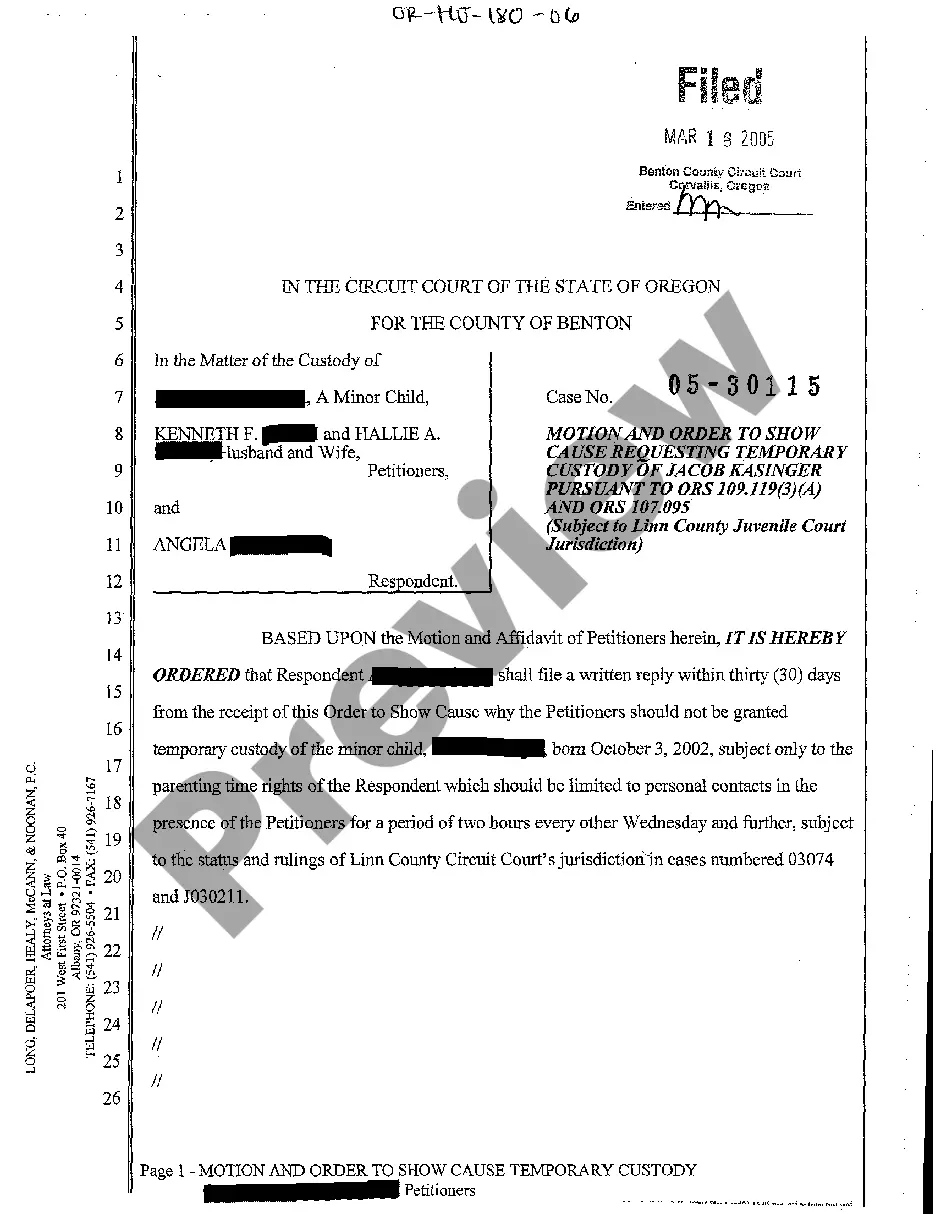

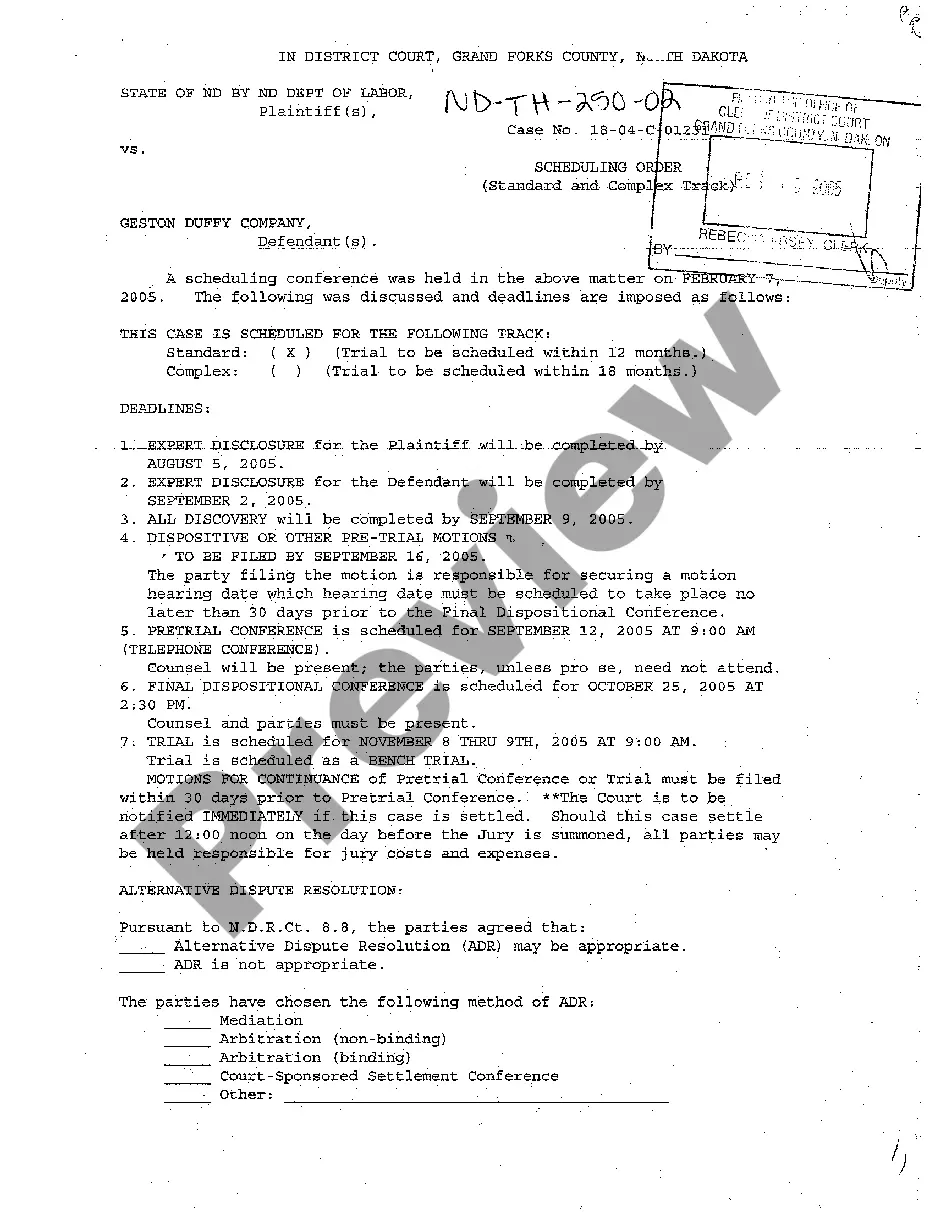

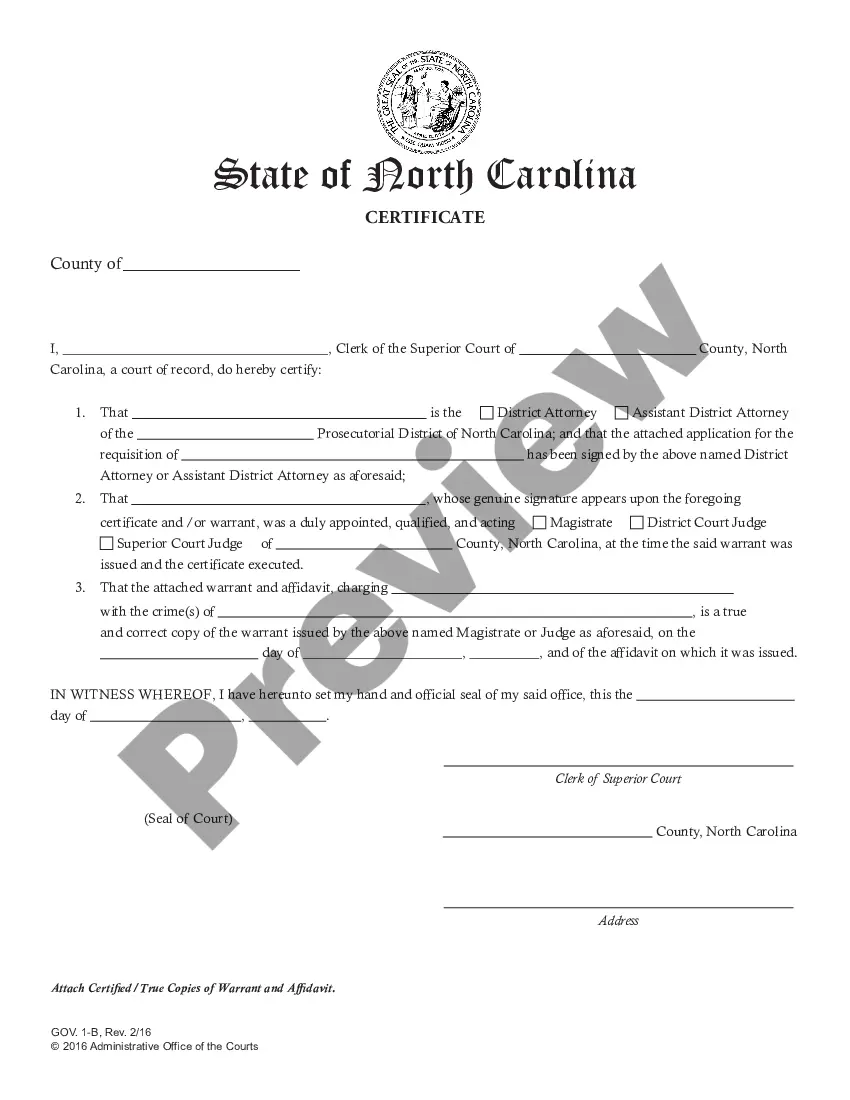

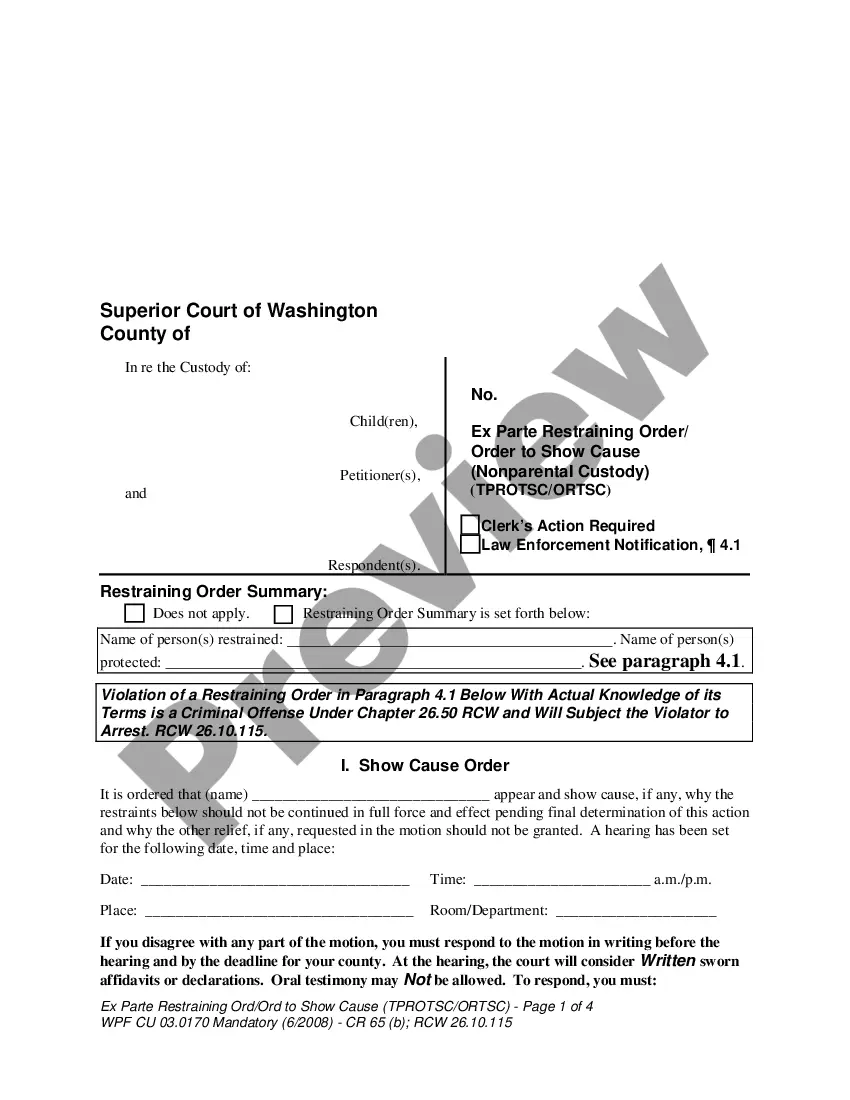

- Step 2. Utilize the Review feature to examine the form's content. Remember to read through the description.

- Step 3. If you are not satisfied with the document, use the Lookup area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.