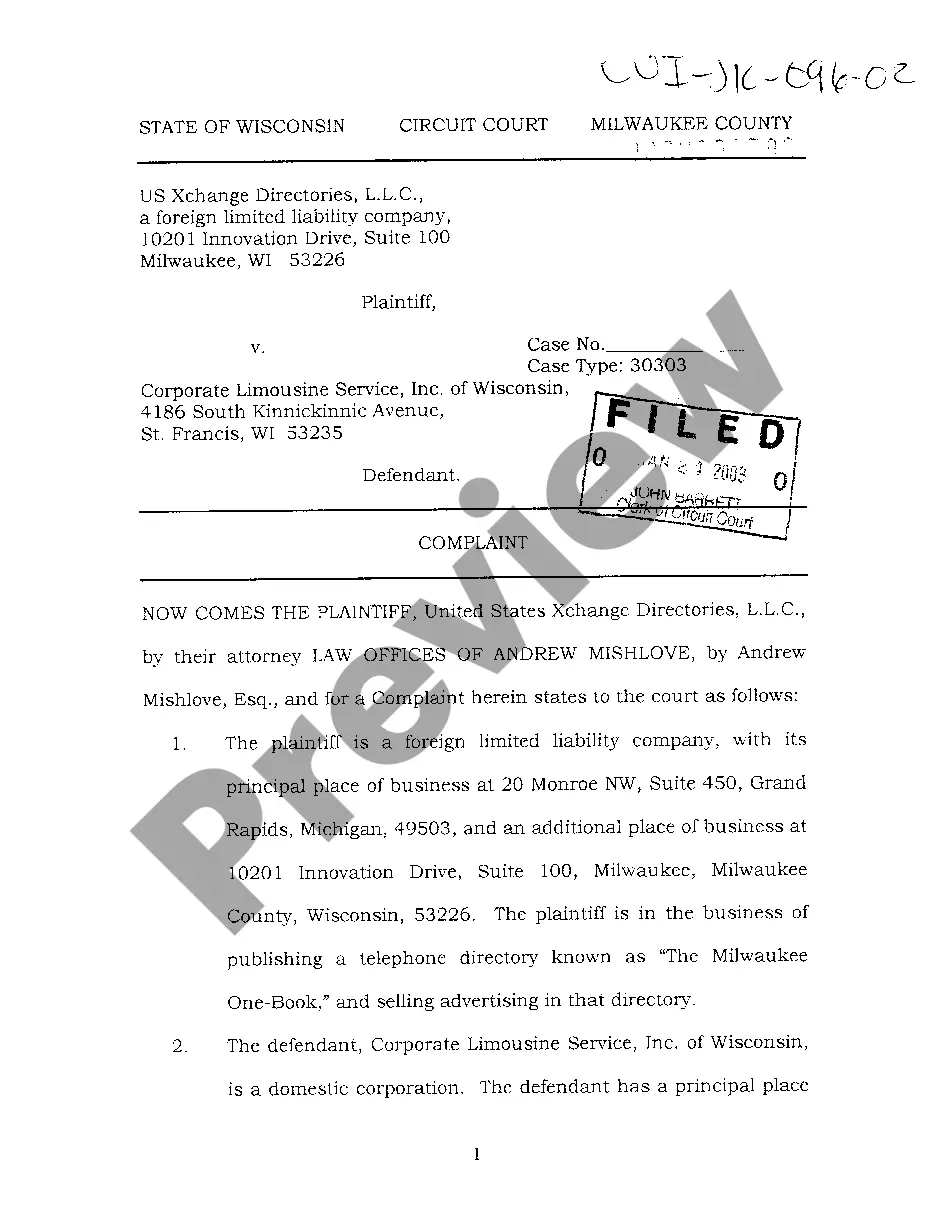

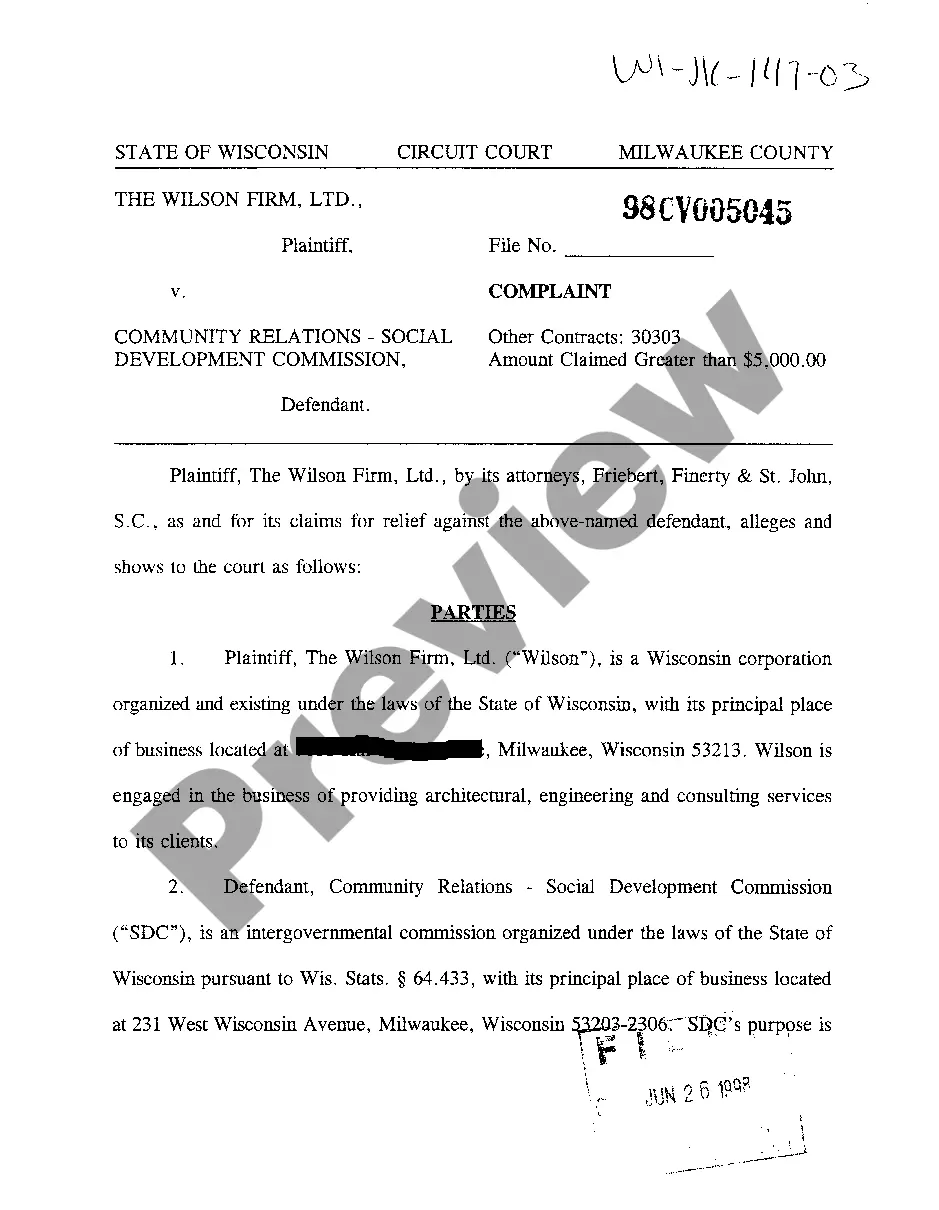

Wisconsin Complaint regarding Nonpayment for Consulting Services Rendered by Self-Employed Independent Contractor

Description

How to fill out Wisconsin Complaint Regarding Nonpayment For Consulting Services Rendered By Self-Employed Independent Contractor?

Out of the great number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its extensive library of 85,000 templates is categorized by state and use for efficiency. All of the forms available on the service have been drafted to meet individual state requirements by licensed legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and obtain access to your Form name from the My Forms; the My Forms tab holds all of your saved forms.

Keep to the tips below to obtain the form:

- Once you discover a Form name, make sure it is the one for the state you really need it to file in.

- Preview the template and read the document description before downloading the template.

- Search for a new template through the Search field in case the one you have already found is not appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform offers easy and fast access to samples that suit both lawyers as well as their customers.

Form popularity

FAQ

As an independent contractor, you have the right to market your services to other businesses and can work with more than one client at a time. Even if you have a long-term contract with a particular client, you can choose to work on additional projects as well.

CARES Act II contains a new provision: unemployed or underemployed independent contractors who have an income mix from self-employment and wages paid by an employer are still eligible for PUA. Under CARES Act I, any such worker was typically eligible only for a state-issued benefit based on their wages.

Independent contractors are not employees, and therefore they are not covered under most federal employment statutes. They are not protected from employment discrimination by Title VII, nor are they entitled to leave under the Family Medical Leave Act.

California is an employment-at-will state, meaning that the employer can choose to fire you at any time without providing a reason. It also means that you can stop working for the employer at any time.It is important to note that independent contractors are not allowed to bring lawsuits against employers.

The Bottom Line The CARES Act makes state unemployment benefits available to self-employed, freelance, independent contractor and other gig workers unemployed or underemployed by the COVID-19 pandemic. Benefits are boosted by $600 over regular state benefits, and can be claimed for up to 39 weeks.

Independent contractors whose wages are not paid may sue the person who hired them under contract theories of law. Employees may sue employers who do not pay them under State and Federal wage laws. Though both laws can provide for payment, they have meaningful legal differences.

If you pay independent contractors, you may have to file Form 1099-NEC, Nonemployee Compensation, to report payments for services performed for your trade or business. If the following four conditions are met, you must generally report a payment as nonemployee compensation.

It is important to understand at the outset that an independent contractor does not have the same protection under employment law as does an employee.For example, the independent contractor cannot lodge an unfair dismissal dispute with the CCMA or the Bargaining Council.

As an independent contractor, you have the right to market your services to other businesses and can work with more than one client at a time. Even if you have a long-term contract with a particular client, you can choose to work on additional projects as well.