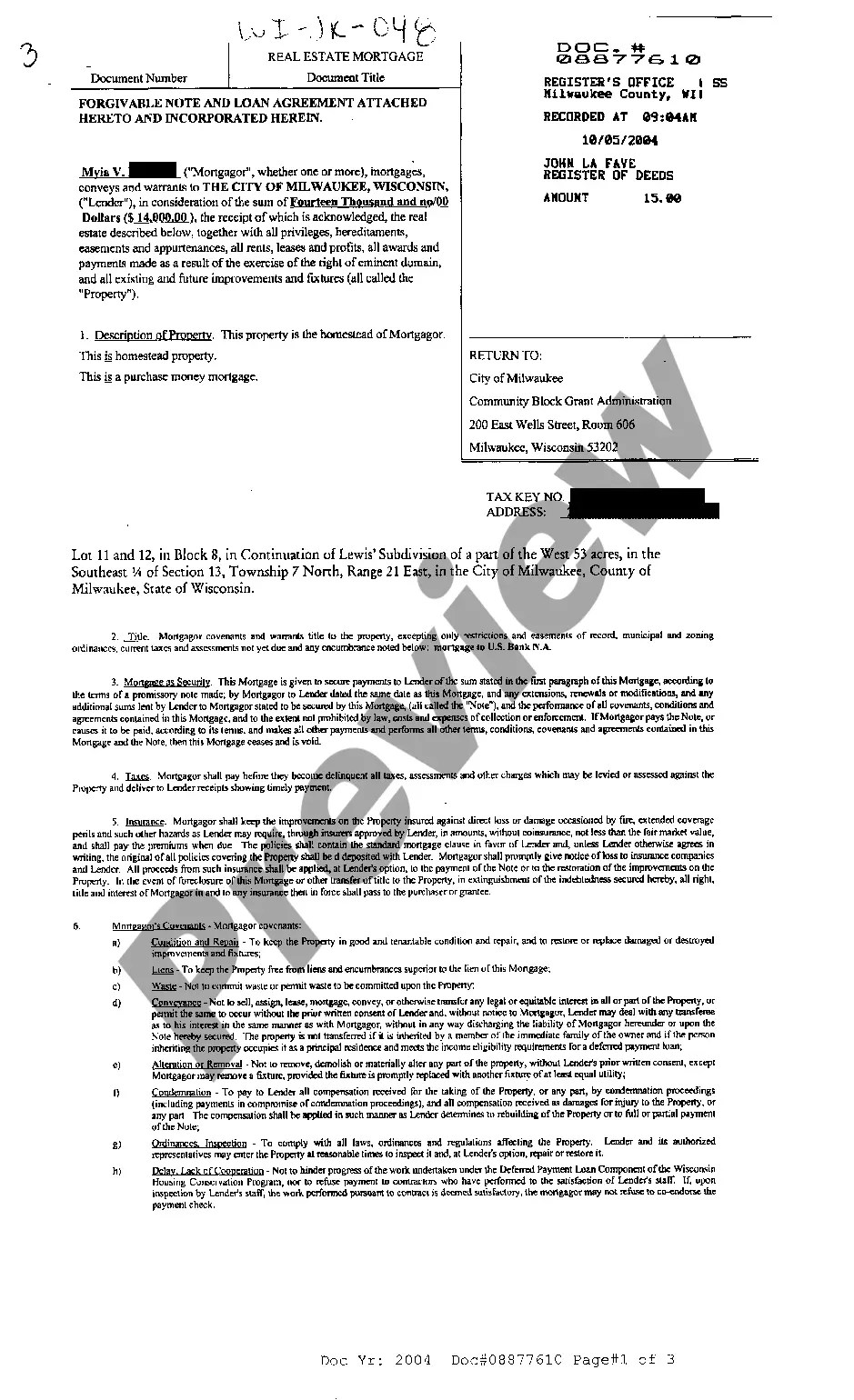

Wisconsin Real Estate Mortgage for Forgivable Note and Loan Agreement

Description

How to fill out Wisconsin Real Estate Mortgage For Forgivable Note And Loan Agreement?

Out of the multitude of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for efficiency. All the forms available on the platform have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the template, press Download and access your Form name from the My Forms; the My Forms tab keeps your saved documents.

Keep to the guidelines below to get the document:

- Once you see a Form name, make sure it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Search for a new sample through the Search engine in case the one you have already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

After you have downloaded your Form name, you can edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform offers fast and easy access to templates that fit both attorneys and their customers.

Form popularity

FAQ

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

A promissory note is a borrower's promise to repay a loan; a mortgage puts the title to a home up as security (collateral) for the loan. When you take out a home loan, the lender will probably require you to sign both a promissory note and a mortgage.

The Mortgage Follows the Note Further, perfection of a security interest in the mortgage note (whether in favor of a buyer or a lender with a security interest to secure an obligation) also perfects the security interest in the buyer's or lender's security interest in the seller's or borrower's rights in the mortgage.

A mortgage holder, more accurately called a note holder or simply the holder, is the owner of your loan. The holder has the right to enforce the loan agreement.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.If the note is lost, then the owner of the loan might have a problem.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.