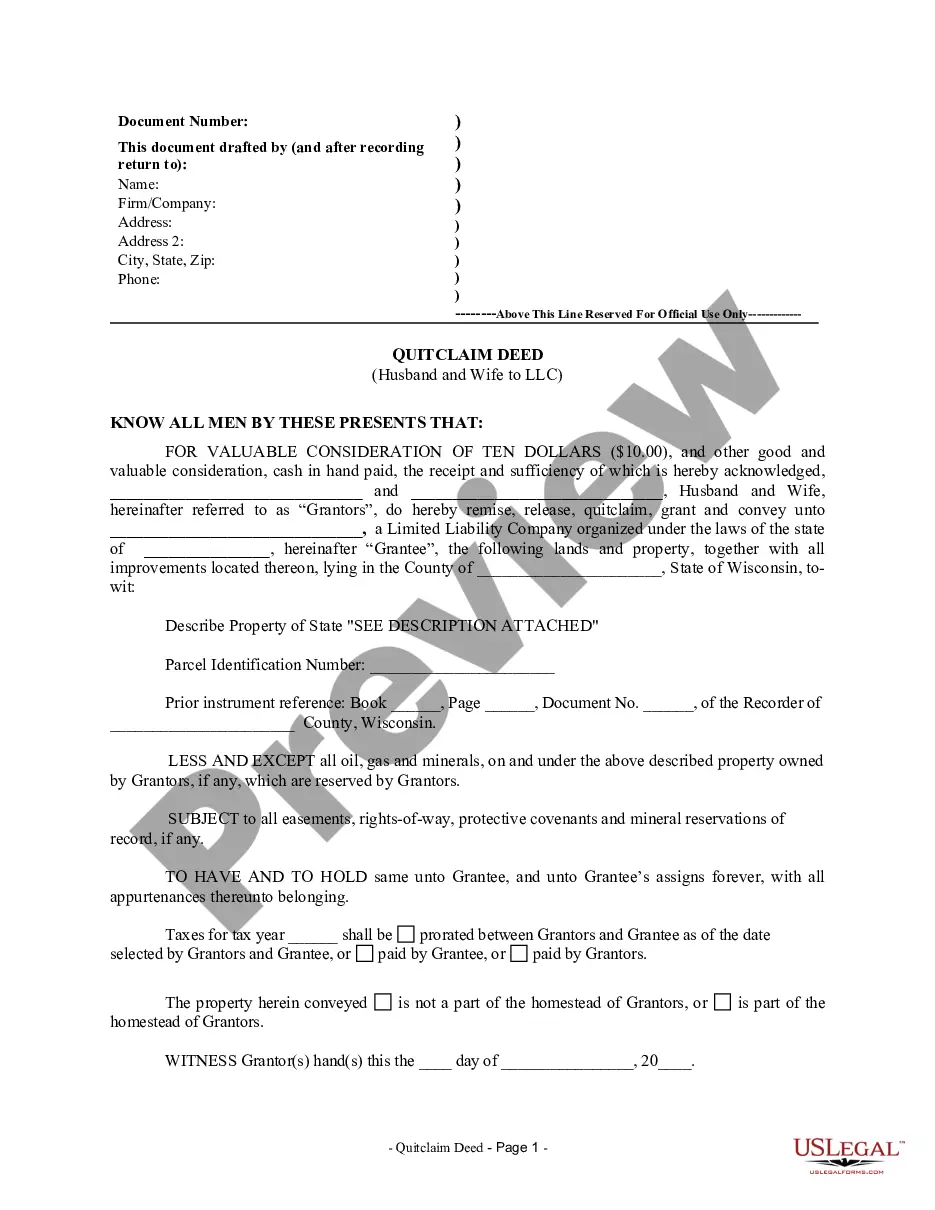

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Wisconsin Quitclaim Deed from Husband and Wife to LLC

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer interest in real property. The grantor (sender) terminates any right and claims to the property, allowing the right or claim to transfer to the grantee (receiver).

LLC (Limited Liability Company): A business structure in the United States whereby the owners are not personally liable for the company's debts or liabilities.

Interspousal Transfers: Transfers of property between spouses, often used for estate planning or marital dissolution purposes.

Step-by-Step Guide to Transferring Property via Quitclaim Deed from Husband and Wife to LLC

- Review the Property Title: Confirm that the title is clear and owned jointly by the husband and wife.

- Choose the Right Legal Forms: Obtain a quitclaim deed form, specifically addressing 'husband wife LLC' ownership if applicable, especially for properties in states like Texas.

- Complete the Quitclaim Deed Form: Fill in details about the property and how the husband and wife own the property. Specify the receiving LLCs details.

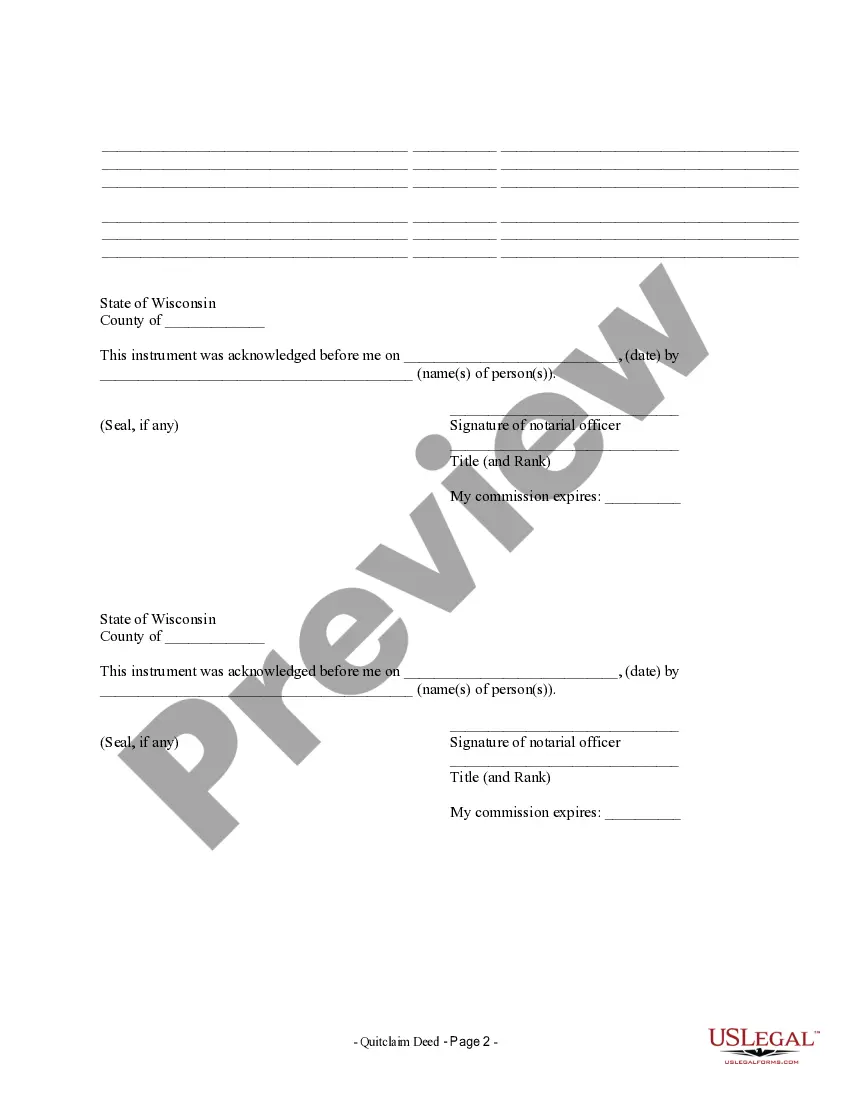

- Sign the Deed: Use services like airSlate SignNow to digitally sign the deed, ensuring it is legally binding and recognized.

- Notarize the Document: Have the document notarized to validate the authenticity of the signatures.

- Record the Deed: File the deed with the county clerk's office where the property is located to make the transfer public record.

Risk Analysis in Transferring Property through a Quitclaim Deed

- Potential for Title Issues: Quitclaim deeds do not guarantee a clear title; previous liens or claims may still pose a risk.

- No Warranty: Unlike warranty deeds, quitclaim deeds do not provide the grantee with any warranty on the title, meaning if issues arise, the LLC absorbs the risks.

- Impact on Ownership Structure: Transferring property into an LLC can alter ownership structures, potentially complicating future financial or legal situations.

Key Takeaways

Ensure Accuracy: Double-check all legal forms and data.

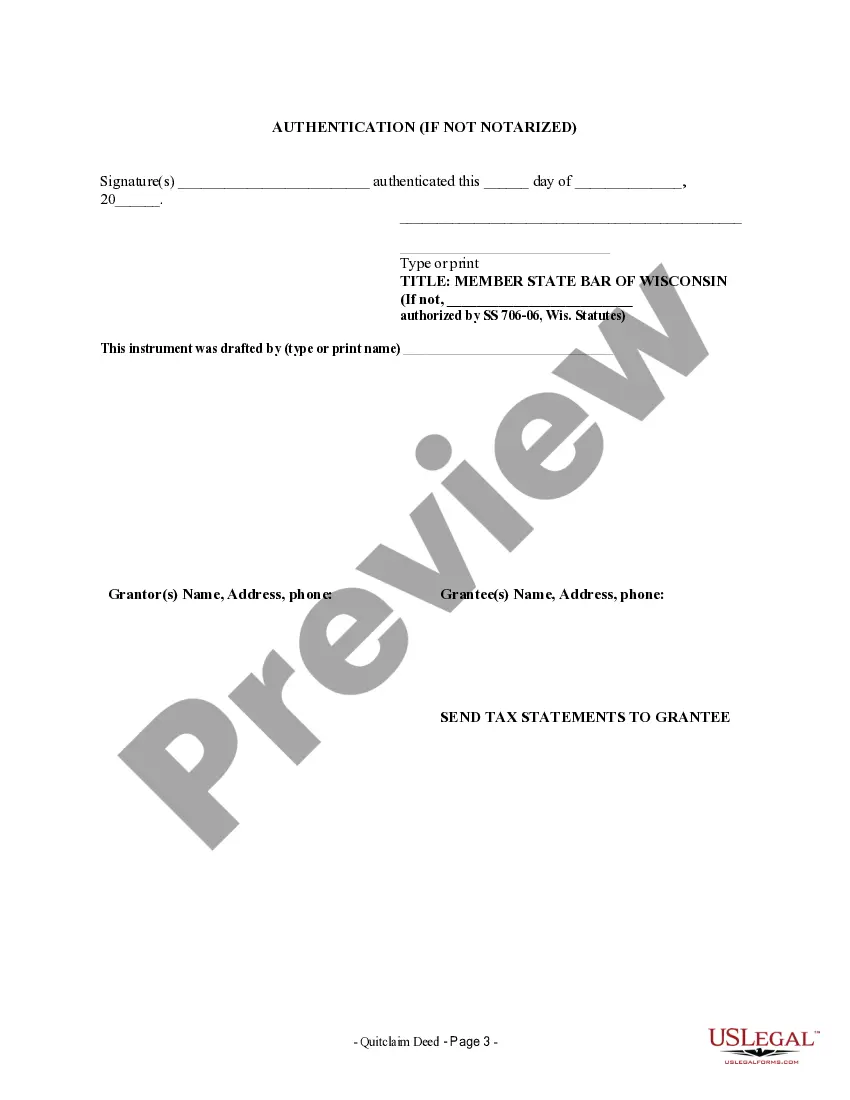

Legal Compliance: Always comply with state-specific requirements, such as using a 'texas form' for properties in Texas.

Consult Experts: Consider consulting a legal expert to navigate interspousal transfers and LLC implications effectively.

Common Mistakes & How to Avoid Them

- Inaccurate Forms: Using an incorrect form or one not tailored to state-specific laws can invalidate the transaction. Ensure the forms meet local requirements.

- Skipping Professional Advice: Not consulting a tax professional or attorney can lead to oversight of critical implications, especially in 'husband wife LLC' structures.

- Overlooking Future Implications: Understanding the long-term implications on taxes, estate planning, and liability shifts when using quitclaim deeds to move property to an LLC.

How to fill out Wisconsin Quitclaim Deed From Husband And Wife To LLC?

Out of the large number of services that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its extensive catalogue of 85,000 templates is categorized by state and use for simplicity. All of the documents available on the platform have already been drafted to meet individual state requirements by certified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, click Download and access your Form name from the My Forms; the My Forms tab keeps your saved documents.

Keep to the guidelines below to obtain the form:

- Once you discover a Form name, make certain it is the one for the state you need it to file in.

- Preview the template and read the document description just before downloading the sample.

- Look for a new template using the Search engine in case the one you have already found isn’t correct.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service offers quick and easy access to templates that suit both attorneys as well as their customers.

Form popularity

FAQ

A quitclaim deed will remove the out-spouse (or departing spouse) from the title to the property, effectively relinquishing their equity or ownership in the home. The execution of a quitclaim deed is typically a requirement of a divorce settlement in order to complete the division of assets.

The good news is that, though it may not be an attractive option to many buyers, you can still sell the property normally. The title will still have been transferred to you. The quitclaim deed affects ownership and the name on the deed, but it does not affect the name on the mortgage.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

The quitclaim deed only transfers the type of title you own. Deed transfers of any kind impact only the ownership and do not change or affect any mortgage on the property.

Usually, taking off names from the deed must be agreed upon by the parties/owners involved. If in case that you don't have a consent from the person whose name is to be removed, it could be a more complex situation. You'd need to get a legal advice on this and consult a lawyer.

You can actually draw up a quitclaim deed on your own without a lawyer, though you should visit a notary public and get the form notarized. As with the creation of other legal documents, like a last will and testament, you may be able to find a quitclaim deed form online that you can easily fill out.

Based on that interpretation, it shouldn't ruin your credit if you signed over the condo with a quitclaim deed. Most sellers who do this sort of financing don't report to the credit bureaus unless they do a lot of buying and selling of properties to people who can't qualify for mortgages on their own.

A quitclaim deed is a poor way to give legal ownership of a property back to a previous owner -- or to transfer it to anyone except those close to you -- because there is no guarantee that your ownership interest is valid and uncontested. The other party likely will insist on a grant deed or a warranty deed.

Using a quitclaim bill of sale can have benefits for both seller and buyer. A seller is able to sell the property without having to ensure the title is clear. They sell it without guarantees, so if, for example, there is a lien against the property, that lien passes with the property to the buyer.

A quitclaim deed is often used if the grantor is not sure of the status of the title (whether it contains any defects) or if the grantor wants no liability under the title covenants.