Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Four (4) Individuals does NOT include Alternate Beneficiary Provision

Definition and meaning

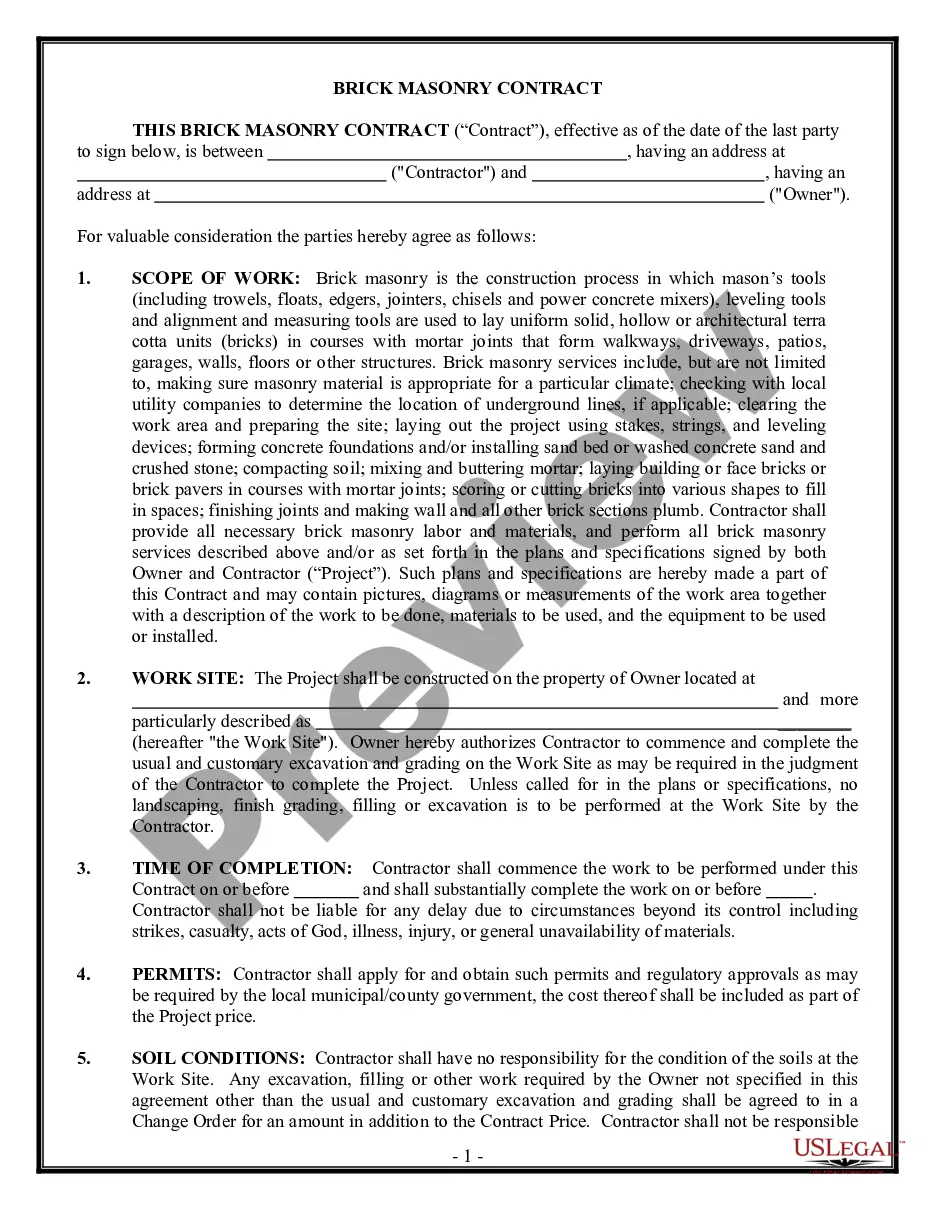

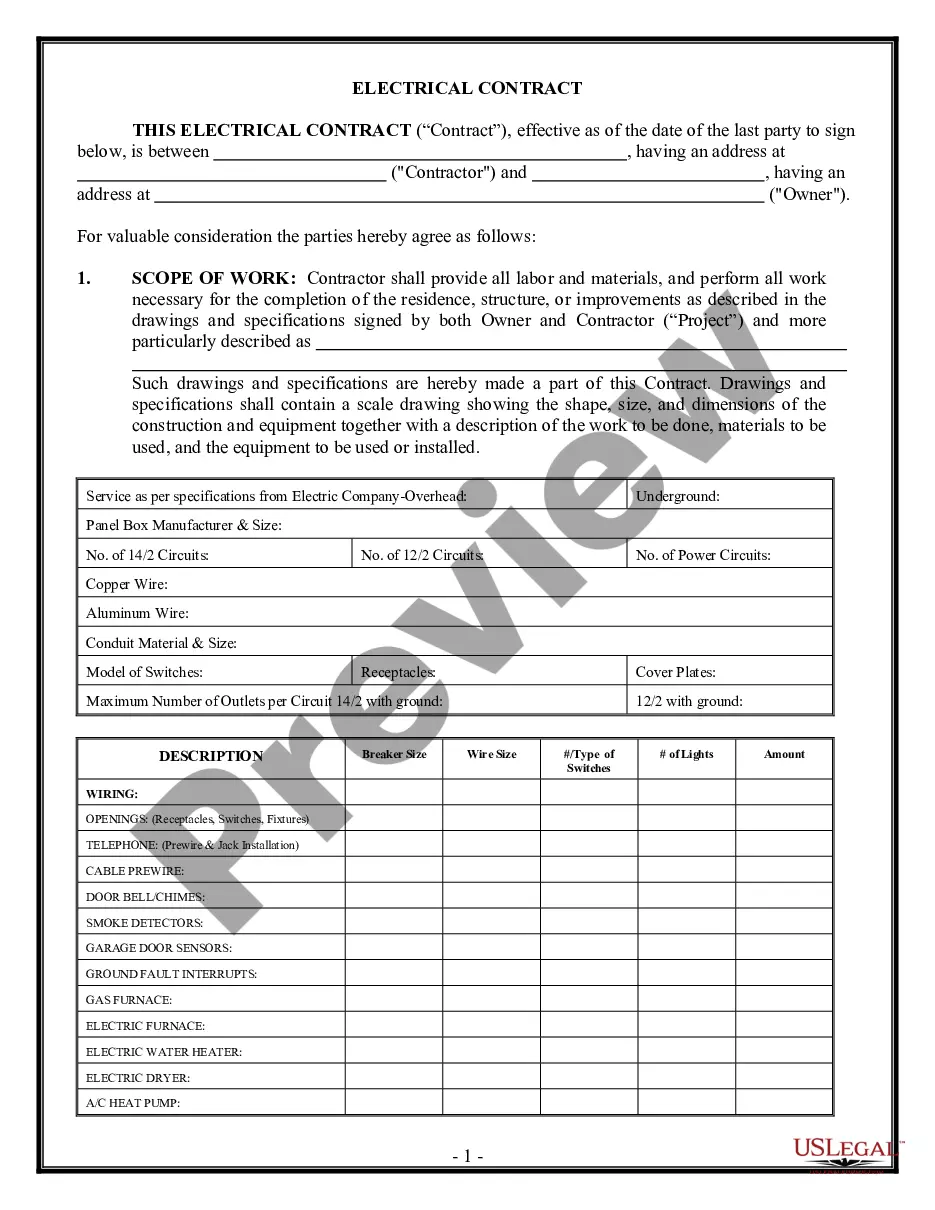

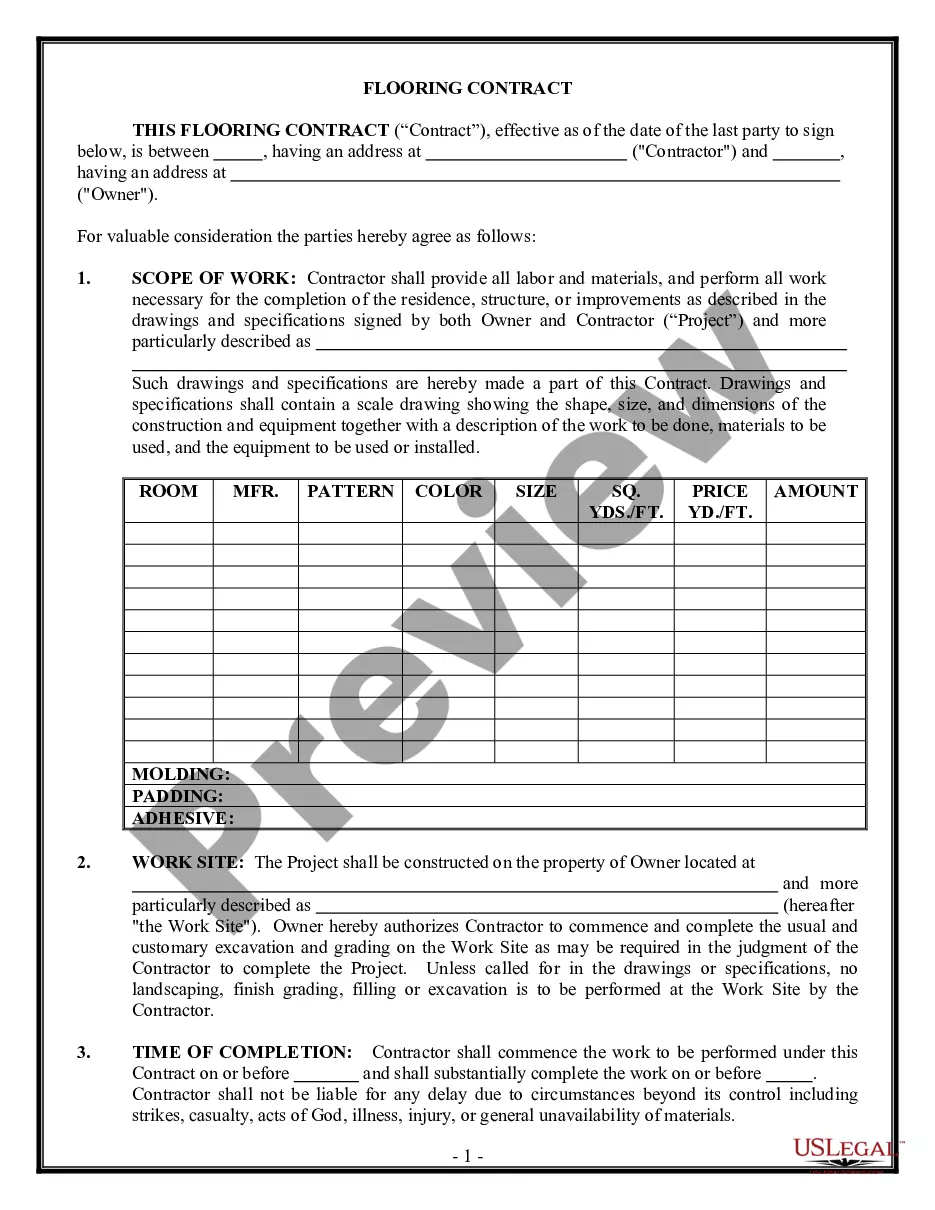

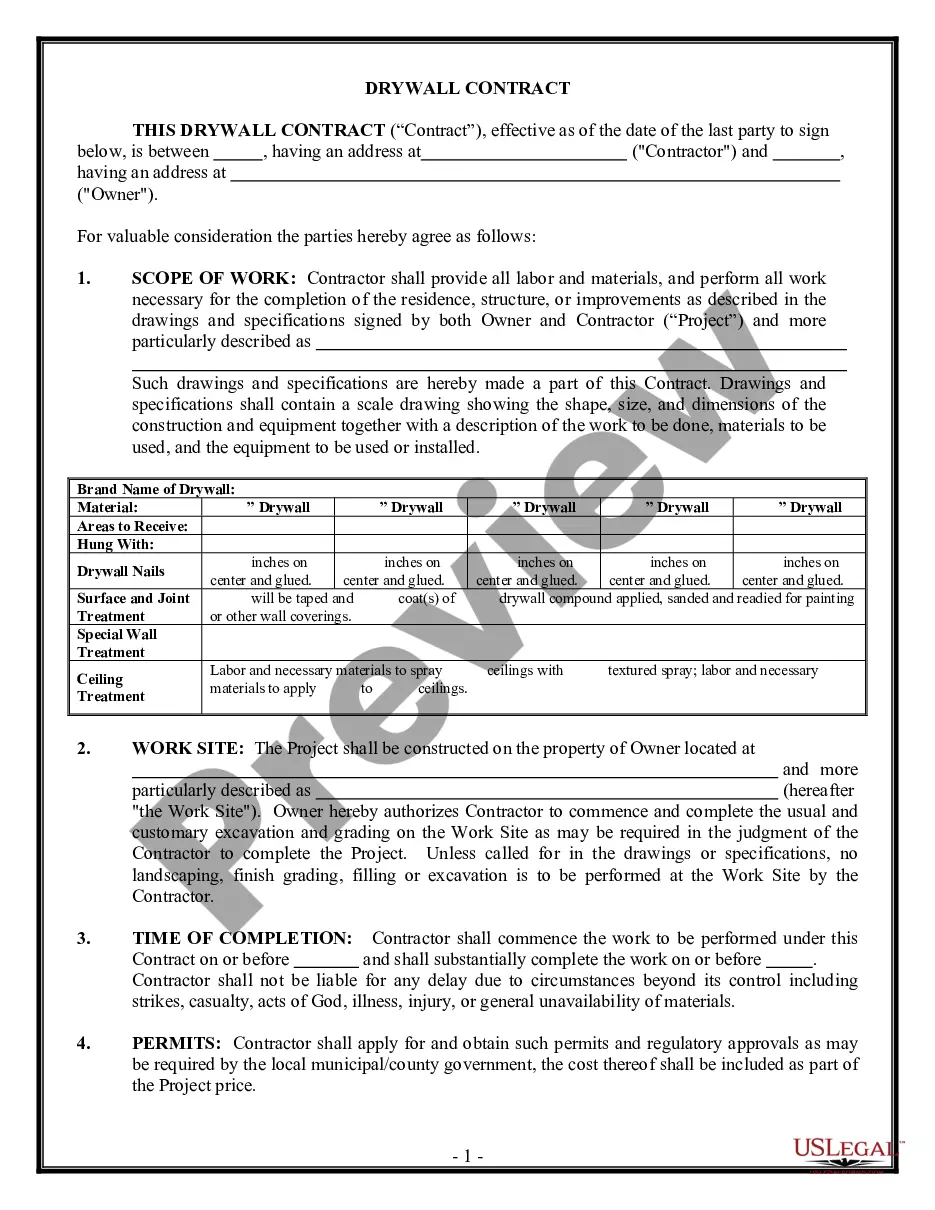

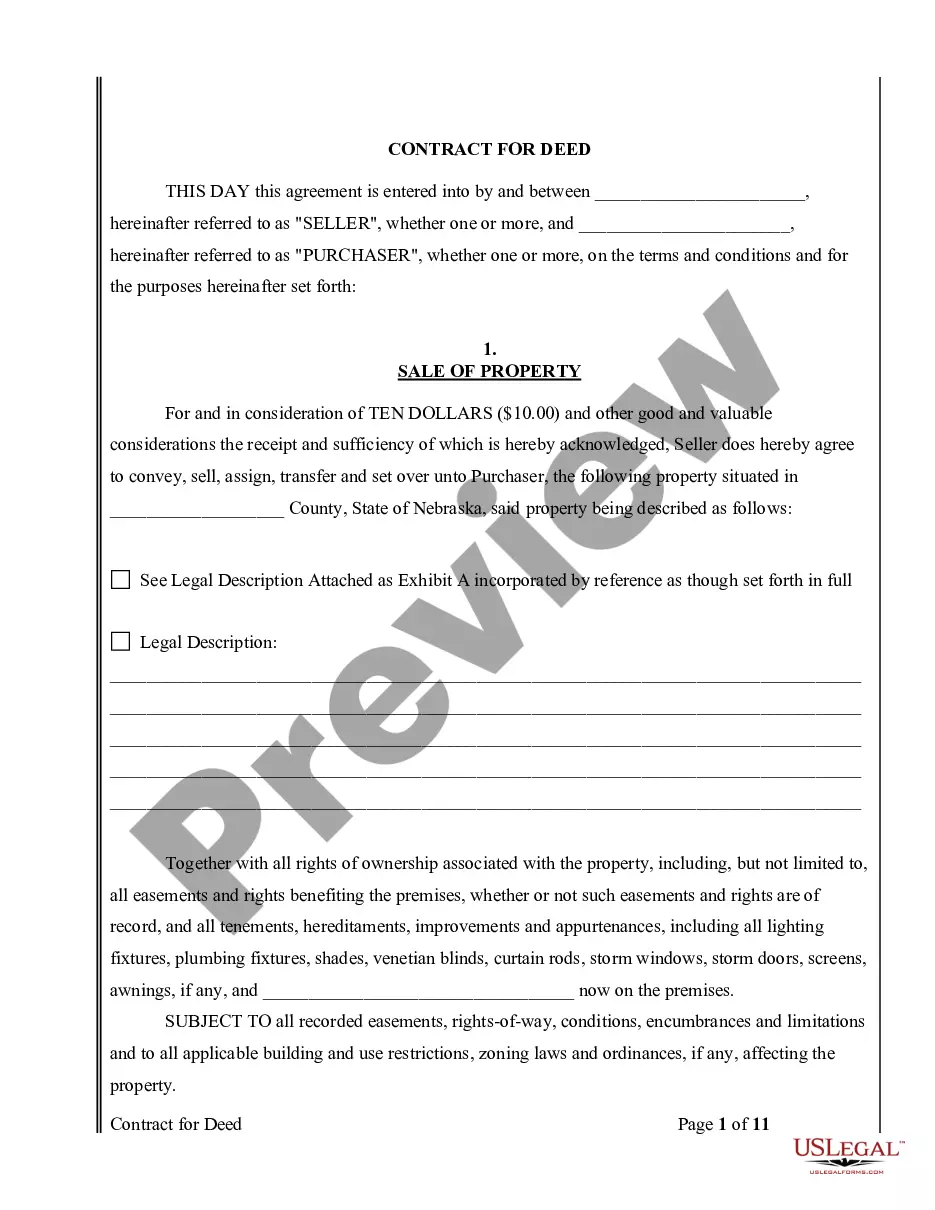

The Wisconsin Transfer on Death Deed (TOD) allows a property owner, known as the Grantor, to transfer real estate to one or more beneficiaries upon their death, without the property going through probate. This deed is also referred to as a beneficiary deed, which simplifies the transfer process. In this specific instance, the deed transfers ownership to four individual beneficiaries, without any alternate beneficiary provisions.

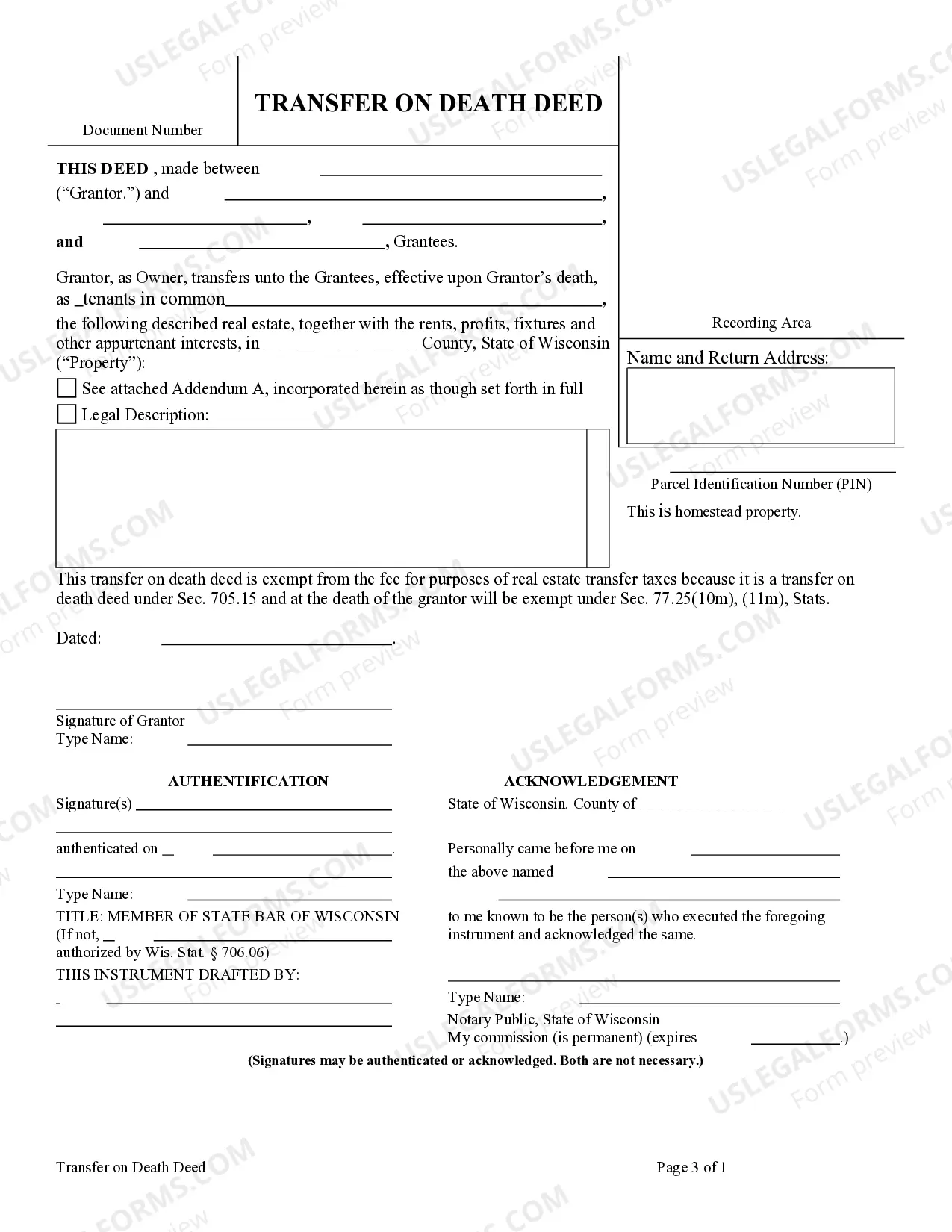

How to complete a form

To complete the Wisconsin Transfer on Death Deed, follow these steps:

- Gather necessary information about the property and beneficiaries.

- Fill out the form, including the Grantor's details and the legal description of the property.

- Specify the names of the four beneficiaries.

- Obtain the required signatures, including your own and that of a notary public.

- Ensure all sections are fully completed to avoid any errors.

Who should use this form

This form is suitable for individuals who wish to pass their real estate to multiple beneficiaries in Wisconsin without the complications of probate. It is particularly useful for those who want to ensure a smooth transition of property ownership outside of the court system, making it ideal for parents or individuals with specific estate planning needs.

Key components of the form

The Wisconsin Transfer on Death Deed includes several key components:

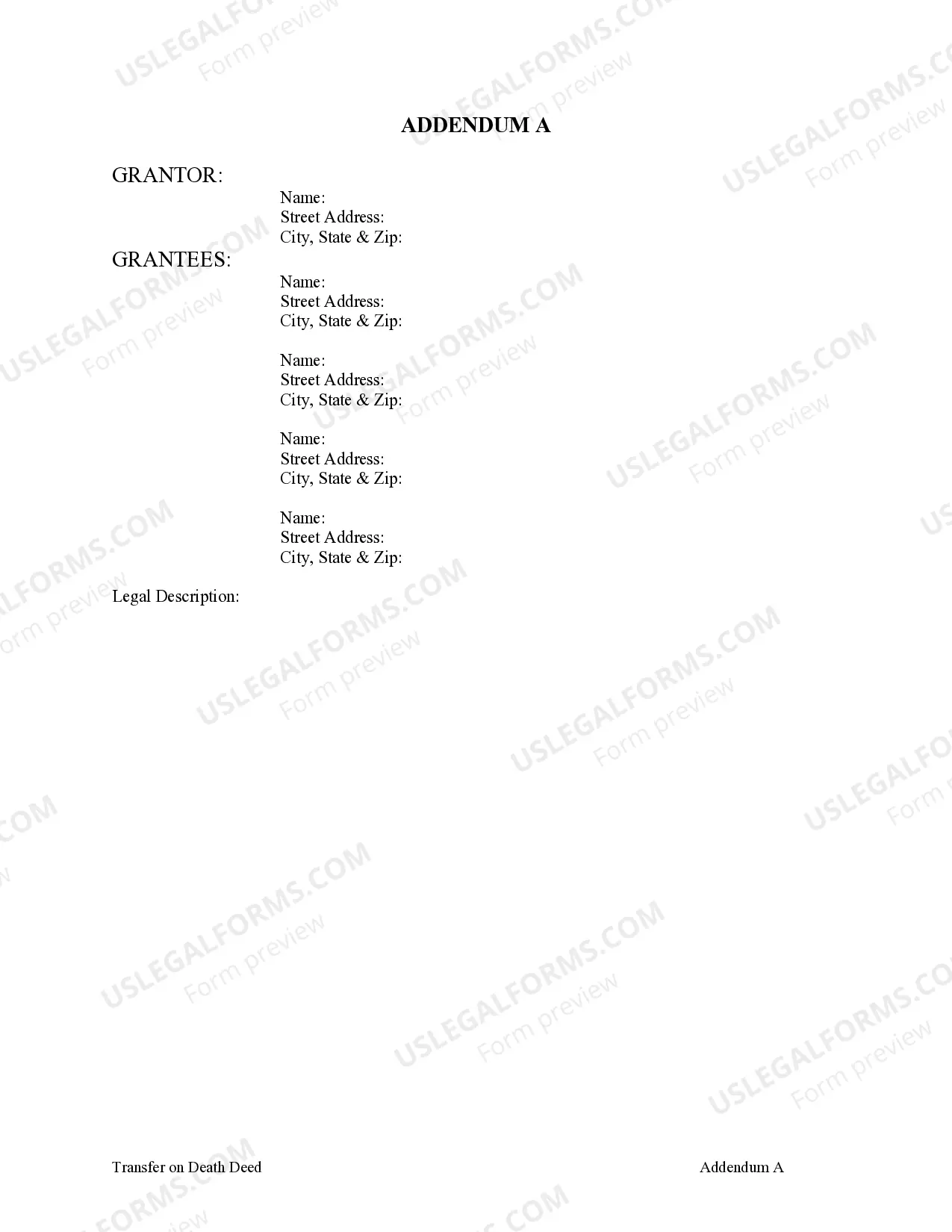

- Grantor Information: The name and signature of the individual transferring the property.

- Grantee Information: Names and addresses of the four beneficiaries receiving the property.

- Legal Description: A detailed description of the property being transferred.

- Notarization: A section requiring a notary public’s verification to authenticate the deed.

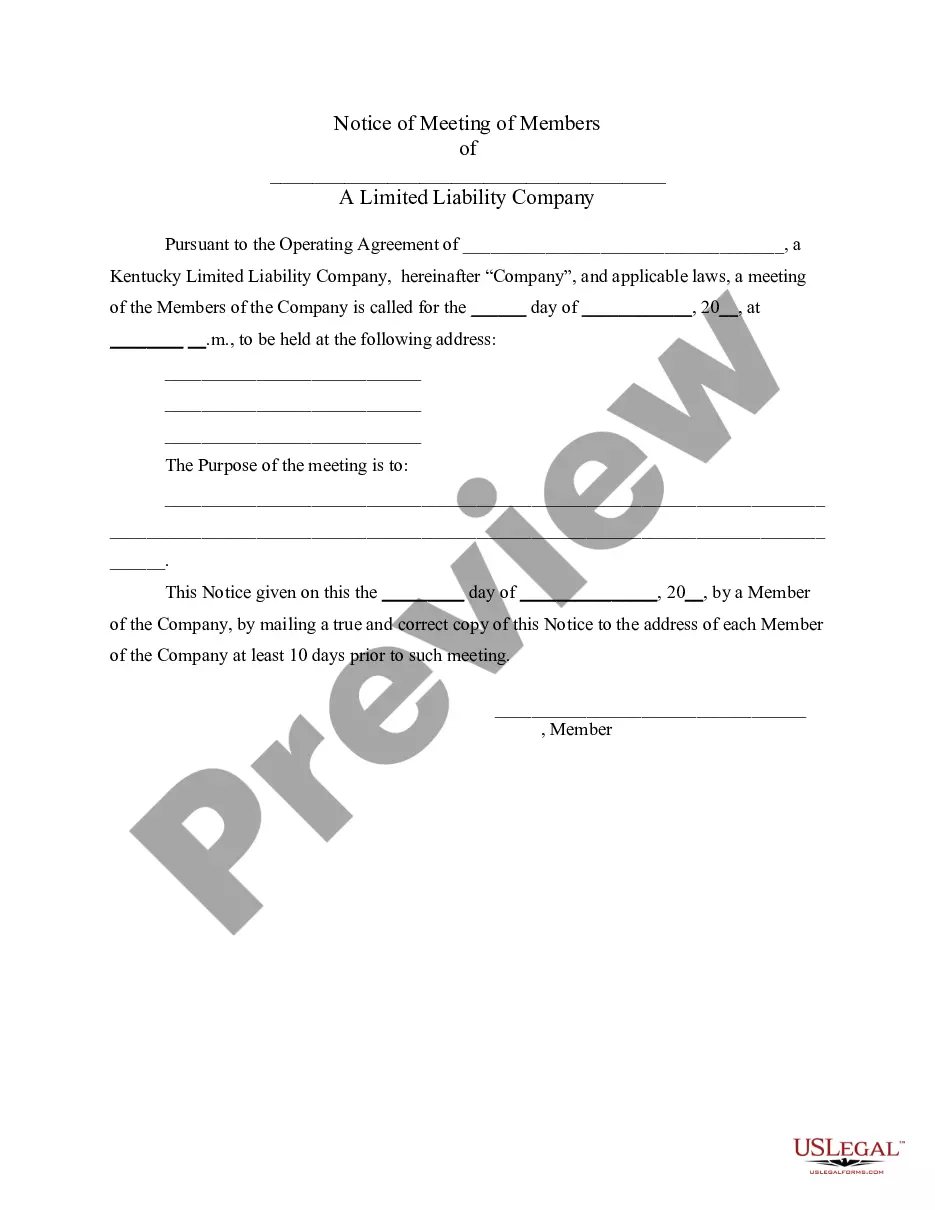

Common mistakes to avoid when using this form

When completing the Wisconsin Transfer on Death Deed, users should avoid the following common mistakes:

- Leaving sections incomplete, particularly the legal description of the property.

- Failing to secure notarization, which is essential for the deed’s legitimacy.

- Not understanding the implications of not having alternate beneficiaries.

- Mistyping or misspelling names, as this can lead to legal complications.

What to expect during notarization or witnessing

During the notarization process for the Wisconsin Transfer on Death Deed, you can expect the following:

- You and the notary public will review the completed deed together.

- You will need to sign the document in the presence of the notary.

- The notary will then sign and affix their seal to the deed, confirming its authenticity.

Form popularity

FAQ

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

File an Affidavit of Death form, an original certified death certificate, executor approval for the transfer, a Preliminary Change of Ownership Report form and a transfer tax affidavit. All signed forms should be notarized. Pay all applicable fees to get the title deed, which is the official notice of ownership.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.