This term sheet summarizes the principal terms with respect to a potential private placement of convertible preferred equity securities. It is not a legally binding document, but rather a basis for further discussions.

Washington Convertible Preferred Equity Securities Term Sheet

Description

How to fill out Convertible Preferred Equity Securities Term Sheet?

US Legal Forms - one of many most significant libraries of legal varieties in the USA - delivers a wide range of legal papers layouts it is possible to acquire or produce. Using the site, you will get a huge number of varieties for enterprise and specific reasons, categorized by classes, claims, or key phrases.You can get the most up-to-date models of varieties just like the Washington Convertible Preferred Equity Securities Term Sheet in seconds.

If you already possess a monthly subscription, log in and acquire Washington Convertible Preferred Equity Securities Term Sheet from your US Legal Forms local library. The Download key will appear on each develop you see. You have access to all earlier downloaded varieties within the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, here are straightforward guidelines to get you started:

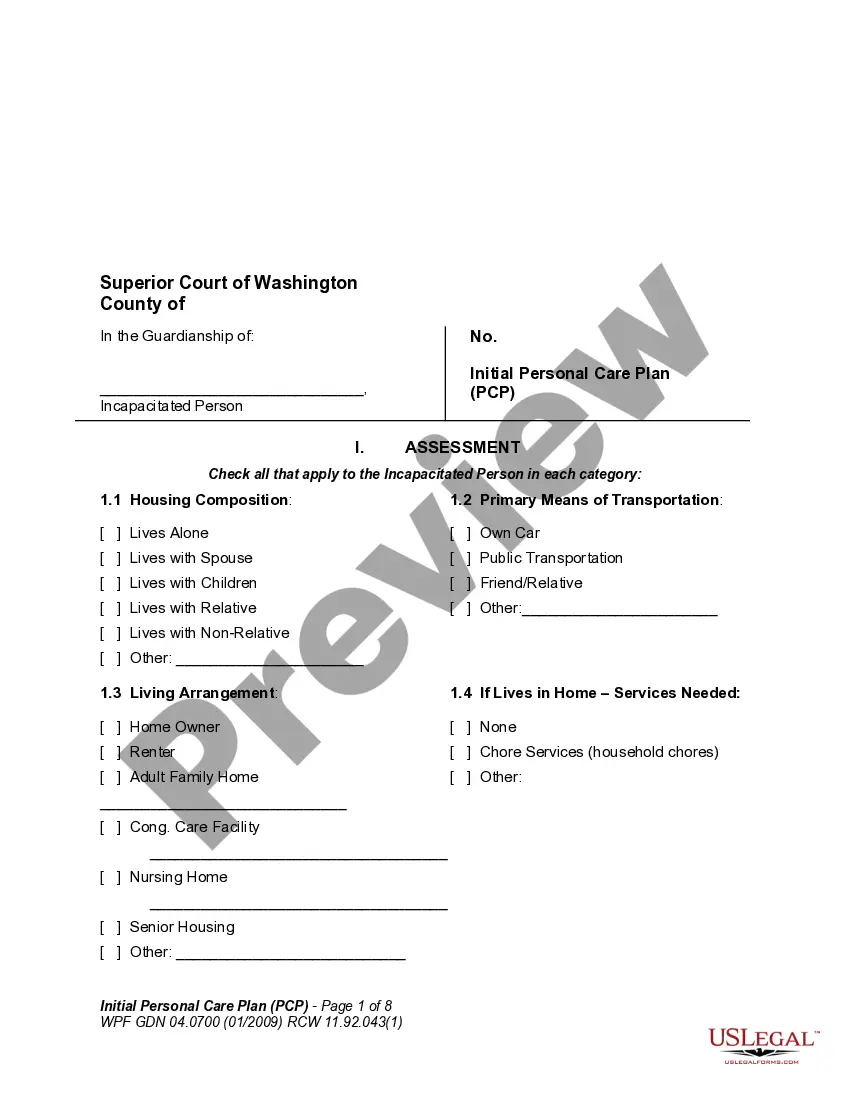

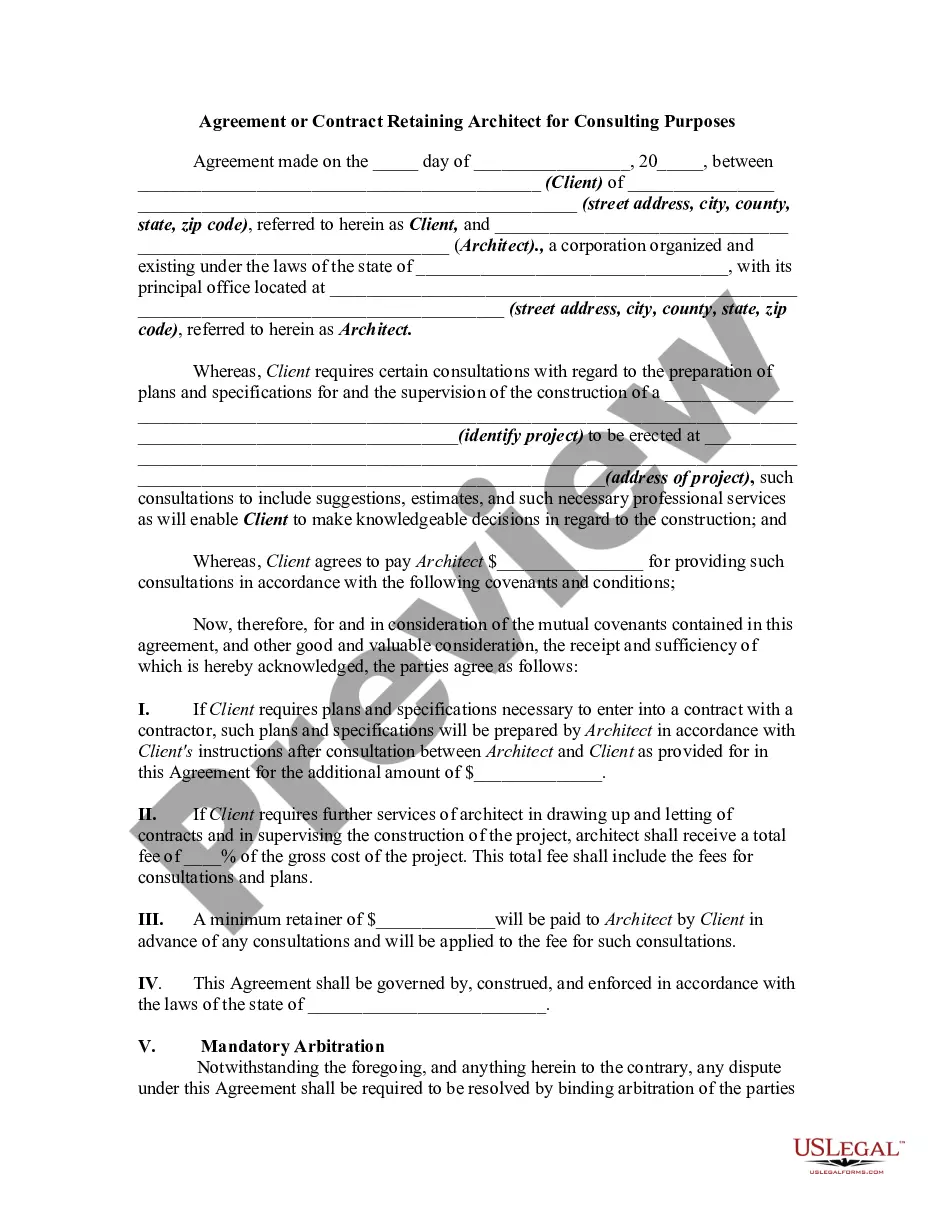

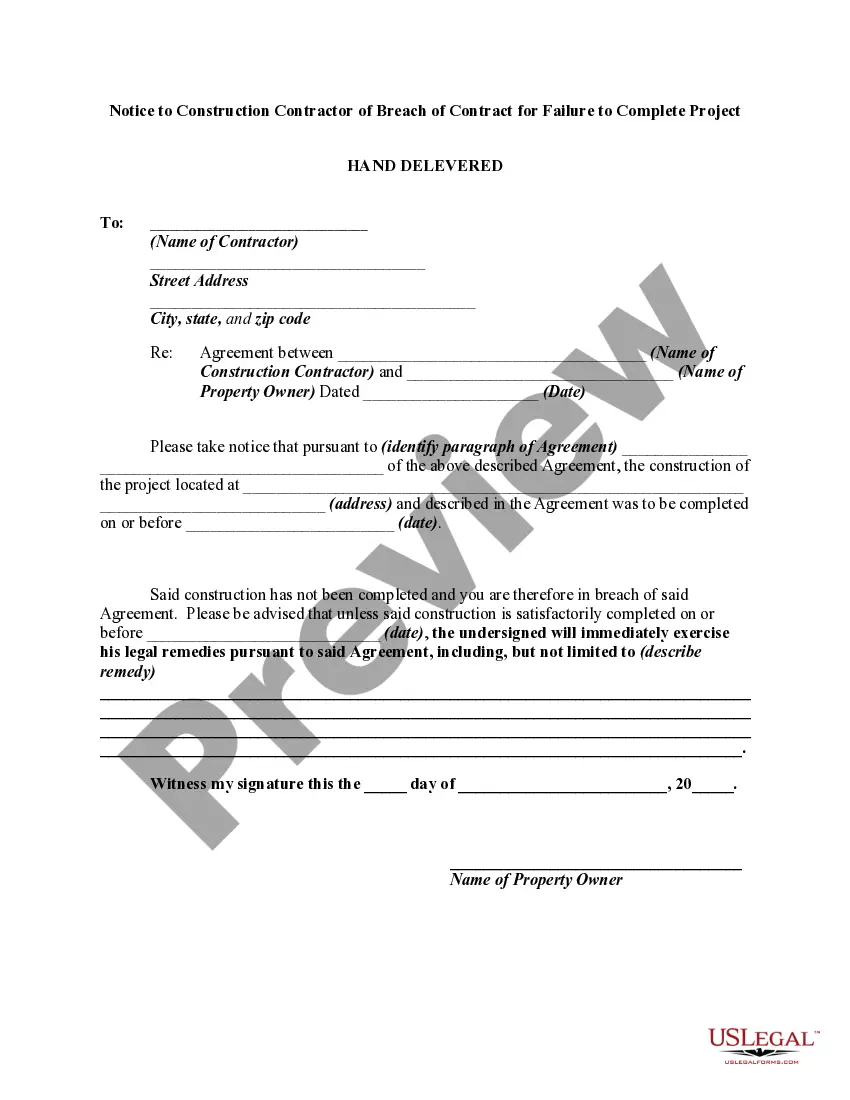

- Ensure you have selected the best develop for your personal metropolis/county. Go through the Review key to analyze the form`s information. See the develop information to actually have selected the proper develop.

- In case the develop does not fit your specifications, utilize the Look for industry at the top of the display screen to discover the the one that does.

- In case you are happy with the shape, confirm your decision by simply clicking the Purchase now key. Then, opt for the costs plan you want and supply your references to register to have an bank account.

- Method the financial transaction. Make use of bank card or PayPal bank account to complete the financial transaction.

- Select the file format and acquire the shape in your system.

- Make alterations. Complete, change and produce and indicator the downloaded Washington Convertible Preferred Equity Securities Term Sheet.

Each and every format you put into your money does not have an expiry date which is yours forever. So, in order to acquire or produce one more copy, just proceed to the My Forms area and then click on the develop you want.

Get access to the Washington Convertible Preferred Equity Securities Term Sheet with US Legal Forms, by far the most considerable local library of legal papers layouts. Use a huge number of expert and express-particular layouts that meet your business or specific requires and specifications.

Form popularity

FAQ

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio.

Convertible preference shares usually carry rights to a fixed dividend for a particular term. At the end of the term, the company can choose to convert it into ordinary shares or leave them as they are. Conversion prices must be specified in the company's constitution.

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.