Washington Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

Choosing the right legitimate papers template might be a have difficulties. Needless to say, there are a lot of layouts available on the Internet, but how would you find the legitimate type you want? Take advantage of the US Legal Forms internet site. The services provides 1000s of layouts, such as the Washington Term Sheet - Convertible Debt Financing, that you can use for enterprise and private demands. Each of the types are checked by experts and fulfill federal and state specifications.

Should you be currently authorized, log in to the bank account and click on the Down load key to get the Washington Term Sheet - Convertible Debt Financing. Utilize your bank account to check with the legitimate types you possess bought previously. Visit the My Forms tab of your respective bank account and acquire yet another backup of your papers you want.

Should you be a whole new consumer of US Legal Forms, listed below are simple directions that you can adhere to:

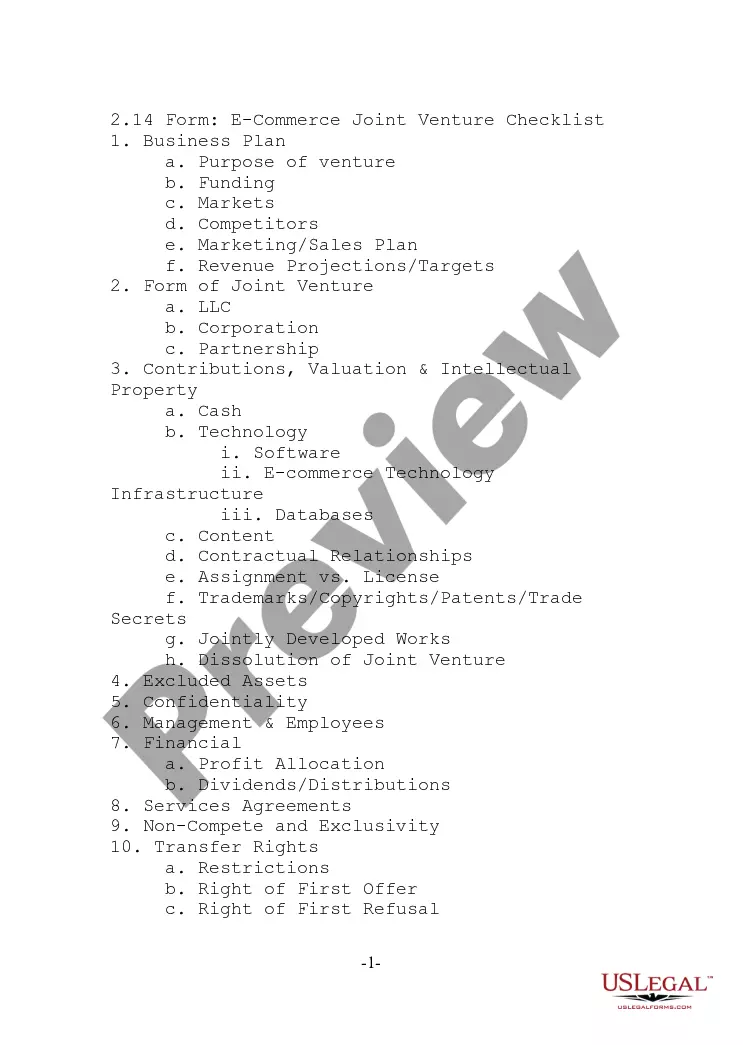

- First, ensure you have chosen the right type to your area/region. You may examine the form while using Review key and read the form information to guarantee it will be the best for you.

- If the type fails to fulfill your needs, utilize the Seach industry to find the correct type.

- When you are certain that the form would work, click on the Get now key to get the type.

- Pick the prices program you need and type in the required information and facts. Build your bank account and pay for an order with your PayPal bank account or credit card.

- Choose the data file structure and down load the legitimate papers template to the gadget.

- Total, edit and printing and indicator the attained Washington Term Sheet - Convertible Debt Financing.

US Legal Forms will be the largest catalogue of legitimate types that you can see numerous papers layouts. Take advantage of the service to down load expertly-made papers that adhere to state specifications.

Form popularity

FAQ

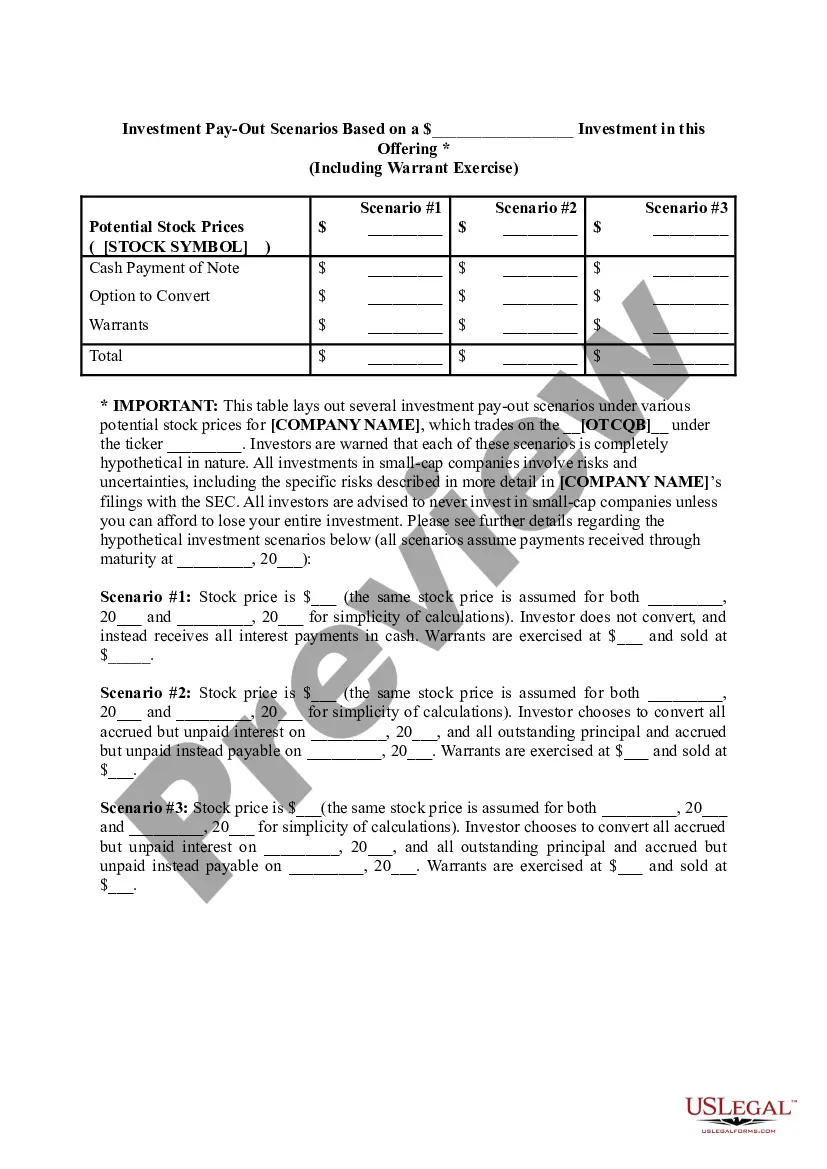

The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

Convertible notes are recorded as debt on the company's balance sheet up until the conversion event. After conversion, they become equity in the company. As debt instruments, convertible notes also have a maturity date and can earn interest (two key differences with SAFEs, as outlined further down).

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Copyright PURE Asset Management 2022. A convertible note, also called a hybrid security or hybrid, refers to a debt instrument that can be converted into equity (ownership in a company) at some point in time in the future.