This office lease provision states that it is an unpermitted assignment for partners to have a change in their share of partnership ownership and thus a default under the lease. Generally, this type of change in ownership is couched in those provisions dealing with changes in share ownerships of corporations.

Washington Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

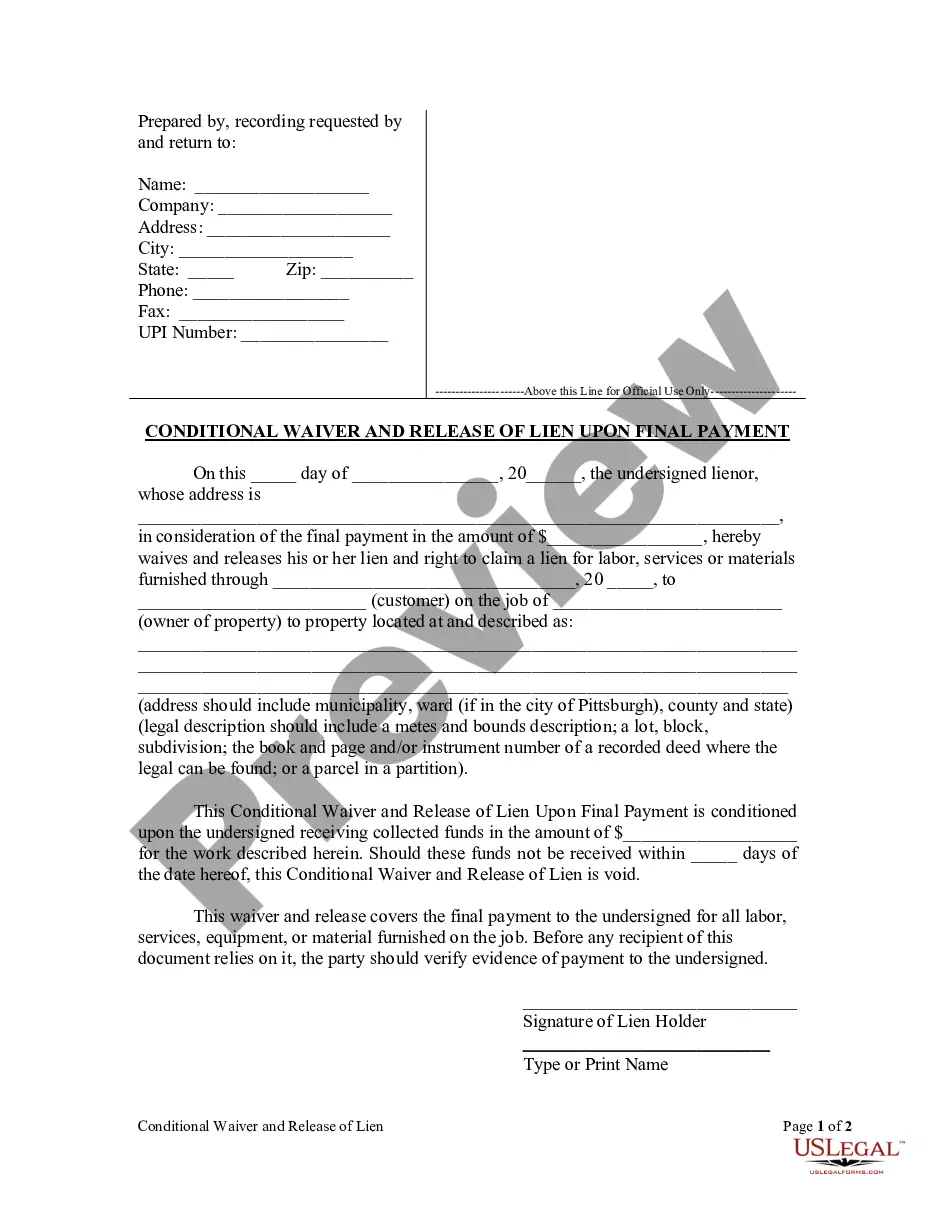

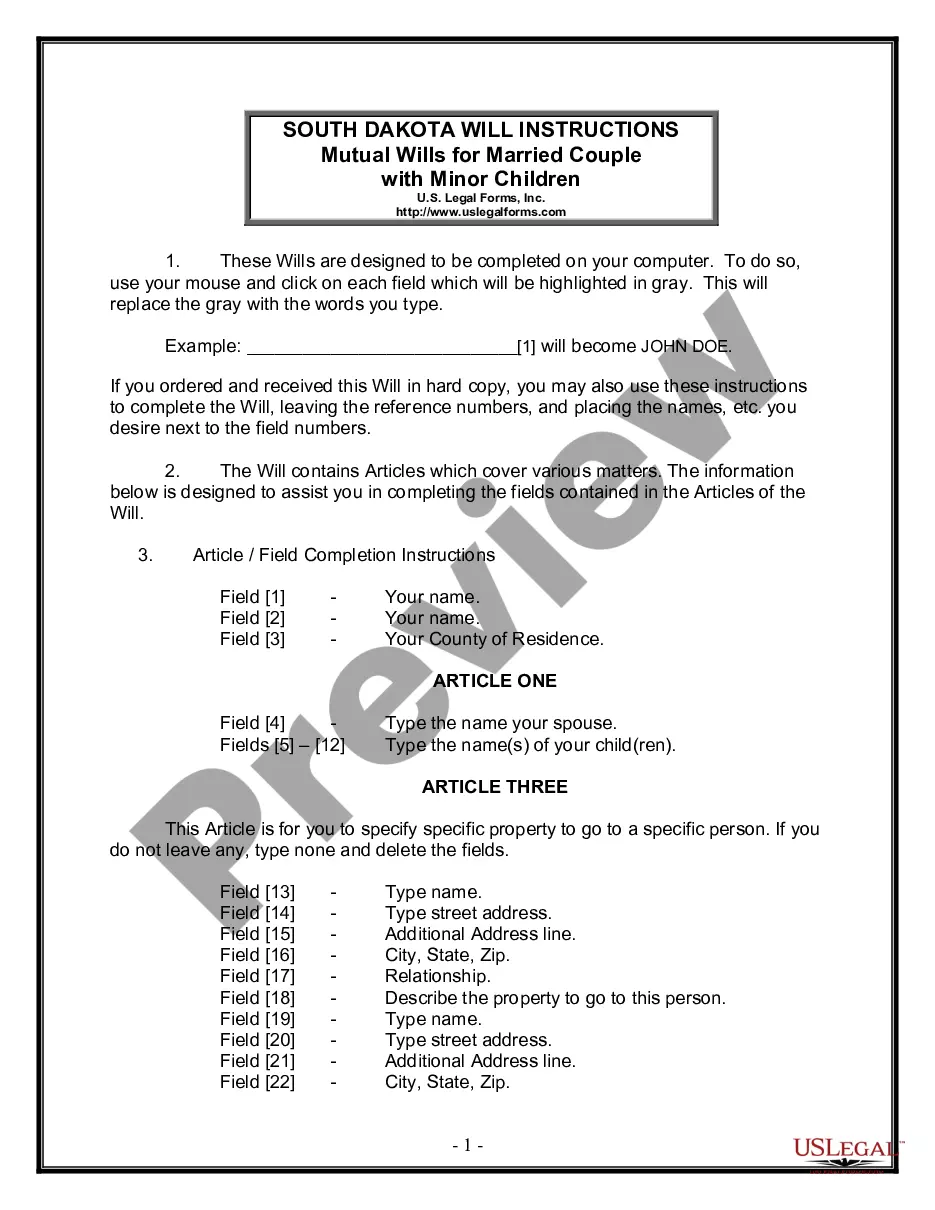

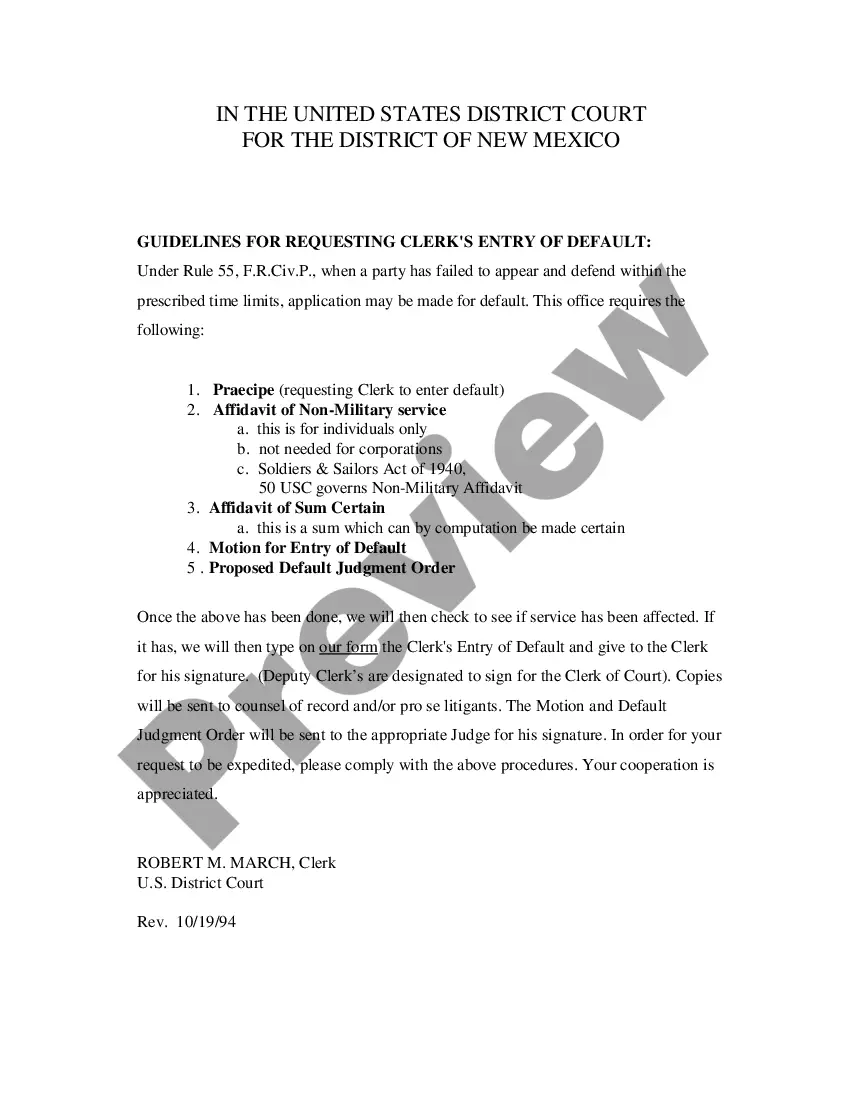

How to fill out Provision Dealing With Changes In Share Ownership Of Corporations And Changes In Share Ownership Of Partnership?

You can devote hrs online attempting to find the legitimate record design that meets the state and federal requirements you need. US Legal Forms supplies a large number of legitimate varieties which can be reviewed by professionals. You can actually acquire or print the Washington Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership from our assistance.

If you have a US Legal Forms accounts, you may log in and click on the Down load switch. Afterward, you may total, edit, print, or indication the Washington Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership. Each and every legitimate record design you get is your own property eternally. To have yet another backup of any purchased develop, go to the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms web site initially, keep to the basic directions listed below:

- First, be sure that you have selected the right record design for your region/town of your liking. Look at the develop information to ensure you have picked out the right develop. If available, make use of the Review switch to check throughout the record design at the same time.

- In order to discover yet another model in the develop, make use of the Lookup discipline to discover the design that suits you and requirements.

- Upon having located the design you want, click on Get now to carry on.

- Find the pricing plan you want, key in your qualifications, and register for a free account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal accounts to cover the legitimate develop.

- Find the file format in the record and acquire it to the system.

- Make changes to the record if necessary. You can total, edit and indication and print Washington Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership.

Down load and print a large number of record templates while using US Legal Forms web site, that offers the biggest assortment of legitimate varieties. Use specialist and state-distinct templates to tackle your small business or specific needs.

Form popularity

FAQ

A Limited Liability Partnership* is like a General Partnership except that normally a partner does not have personal liability for the negligence of another partner. This business structure is used most often by professionals such as accountants and lawyers.

In Washington, all partnerships except GPs must register with the state and pay a filing fee along with filing any additionally required paperwork. Out-of-state businesses have additional requirements. General partnerships (GP): GPs may need to file Assumed Business Name Registration (DBA).

To make updates to your Washington LLC's Certificate of Formation, you'll need to file an Amended Certificate of Formation form with the Washington Secretary of State, Corporations and Charities Division. You can file your Amended Certificate of Formation in person, by mail or online for a $30 fee.

The most common way is to sell the business to another person or company. If you own the business along with partners, you may reapportion ownership among the multiple partners. Another way is to gift the business to someone else. You can also transfer ownership through a merger or acquisition.

A partnership is a single business where two or more people share ownership. Each partner contributes to all aspects of the business, including money, property, labor or skill. In return, each partner shares in the profits and losses of the business.

Washington Laws on Removing an LLC Member 131 (2022) allows a member to withdraw any time. The state previously required all the other members to vote on approving a withdrawal, but the most recent version of the law allows a member to leave at will.

member LLC can choose to be taxed as a corporation or disregarded as an entity separate from its owner, essentially treated as a sole proprietorship (a husband and wife, who are owners of an LLC and share in the profits, can file as a single member if they reside in a Community Property State such as ...

You need to submit a new Voluntary Election Form listing your current corporate officers. It is important to ensure we have updated records of your corporate officers. If you have questions or concerns, please contact our Registration and Rates Unit at status@esd.wa.gov or 360-902-9360.

After you have filed your Certificate of Formation with the Secretary of State, you can make amendments to the document by filing a Certificate of Amendment. Once the Certificate of Amendment is processed, the newly amended information will appear in the official record of your Washington LLC.

If you need to make amendments to your limited liability company (LLC), you'll submit a completed Amended Certificate of Formation form by mail, in person, or via fax. The form goes to the Secretary of State.