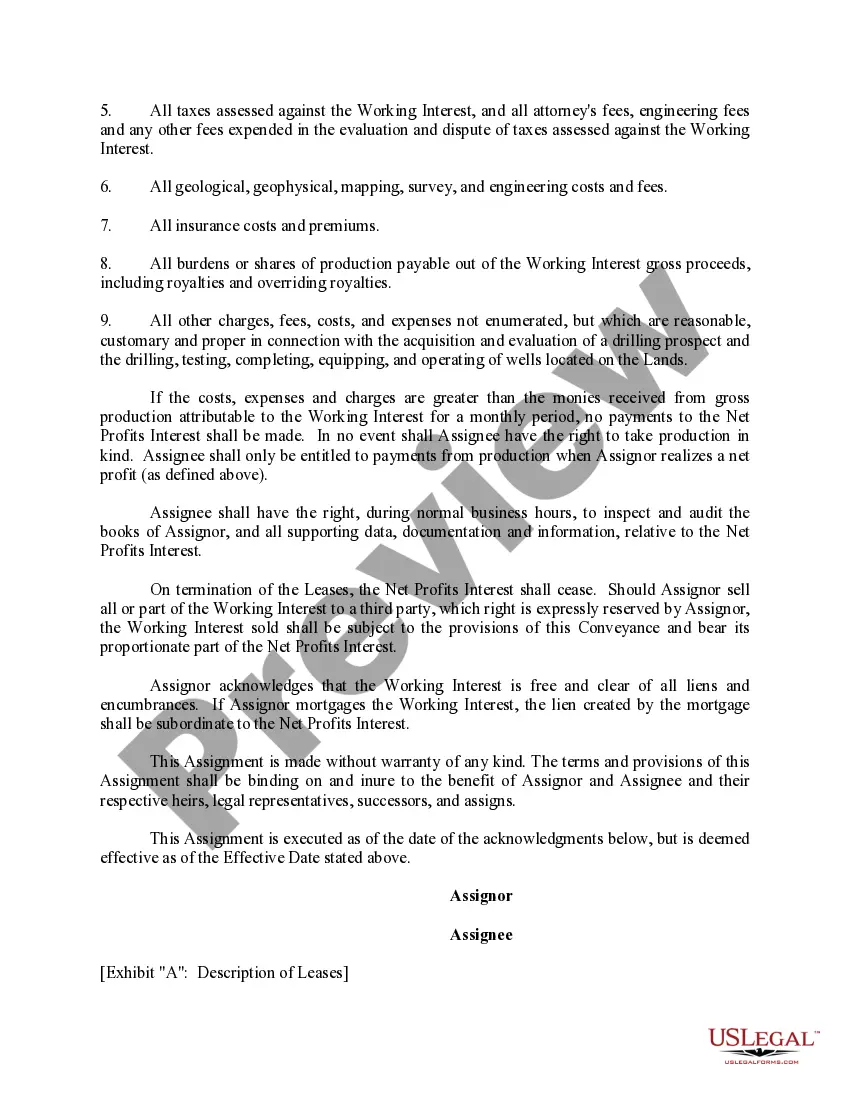

This form is used when Assignor grants, assigns, and conveys to Assignee a percentage of the net profit interest in the Working Interest. The Net Profits Interest is the stated percentage interest in the share of monies payable for gross production attributable to the Working Interest less the costs and expenses attributable to the Working Interest.

Washington Assignment of Net Profits Interest

Description

How to fill out Assignment Of Net Profits Interest?

You may spend several hours on-line searching for the lawful document web template that meets the state and federal demands you need. US Legal Forms gives a huge number of lawful kinds which are analyzed by experts. It is possible to download or produce the Washington Assignment of Net Profits Interest from your services.

If you already have a US Legal Forms accounts, you are able to log in and click the Download option. Afterward, you are able to comprehensive, edit, produce, or signal the Washington Assignment of Net Profits Interest. Each lawful document web template you get is yours permanently. To have an additional backup of the bought develop, go to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms website initially, keep to the simple instructions beneath:

- Initially, make sure that you have selected the best document web template for your region/area of your liking. Browse the develop explanation to make sure you have picked the proper develop. If available, use the Review option to search throughout the document web template too.

- If you would like locate an additional edition from the develop, use the Look for industry to find the web template that suits you and demands.

- Upon having located the web template you want, click on Buy now to move forward.

- Select the prices strategy you want, type in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal accounts to purchase the lawful develop.

- Select the file format from the document and download it for your product.

- Make alterations for your document if needed. You may comprehensive, edit and signal and produce Washington Assignment of Net Profits Interest.

Download and produce a huge number of document themes making use of the US Legal Forms site, which offers the most important collection of lawful kinds. Use professional and express-distinct themes to deal with your business or personal requires.

Form popularity

FAQ

Properly designed, profits interests convey an ownership share of future profits and equity upside without a capital stake in the past. This powerful incentive plan requires no buy-in; is not taxable at grant or vesting; and, its capital liquidations are taxed as capital gains.

The grant of a profits interest has a distinguishing feature in current US tax law: It is a transfer of true equity without the typical buy-in or tax friction associated with most equity transfers.

Example: A company is worth $1,000,000 and is later sold for $2,000,000. A worker who receives 10% in stock immediately owns $100,000 of the company's value and receives $200,000 when the company is sold. A worker who receives a 10% profits interest grant owns $0 of the company's value upon receiving the interest.

?Catch-Up? Capabilities A catch-up provision typically provides that the holder of a profits interest is allocated the first dollars of income, after income allocations equal to the distribution threshold, until the holder has received allocations so that he or she is ?caught-up? on his or her proportionate interest.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement. It is a non-operating interest that may be created when the owner of a property, typically an oil and gas property, leases it out to another party for development and production.

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.

A capital interest is a type of equity commonly issued by LLCs, under which the member of the LLC contributes capital to the LLC and has an ownership interest. Unlike a capital interest, profits interests do not represent ownership in the LLC.

What Is a Profits Interest? Profits interest refers to an equity right based on the future value of a partnership awarded to an individual for their service to the partnership. The award consists of receiving a percentage of profits from a partnership without having to contribute capital.