Washington Agreement for Sales of Data Processing Equipment

Description

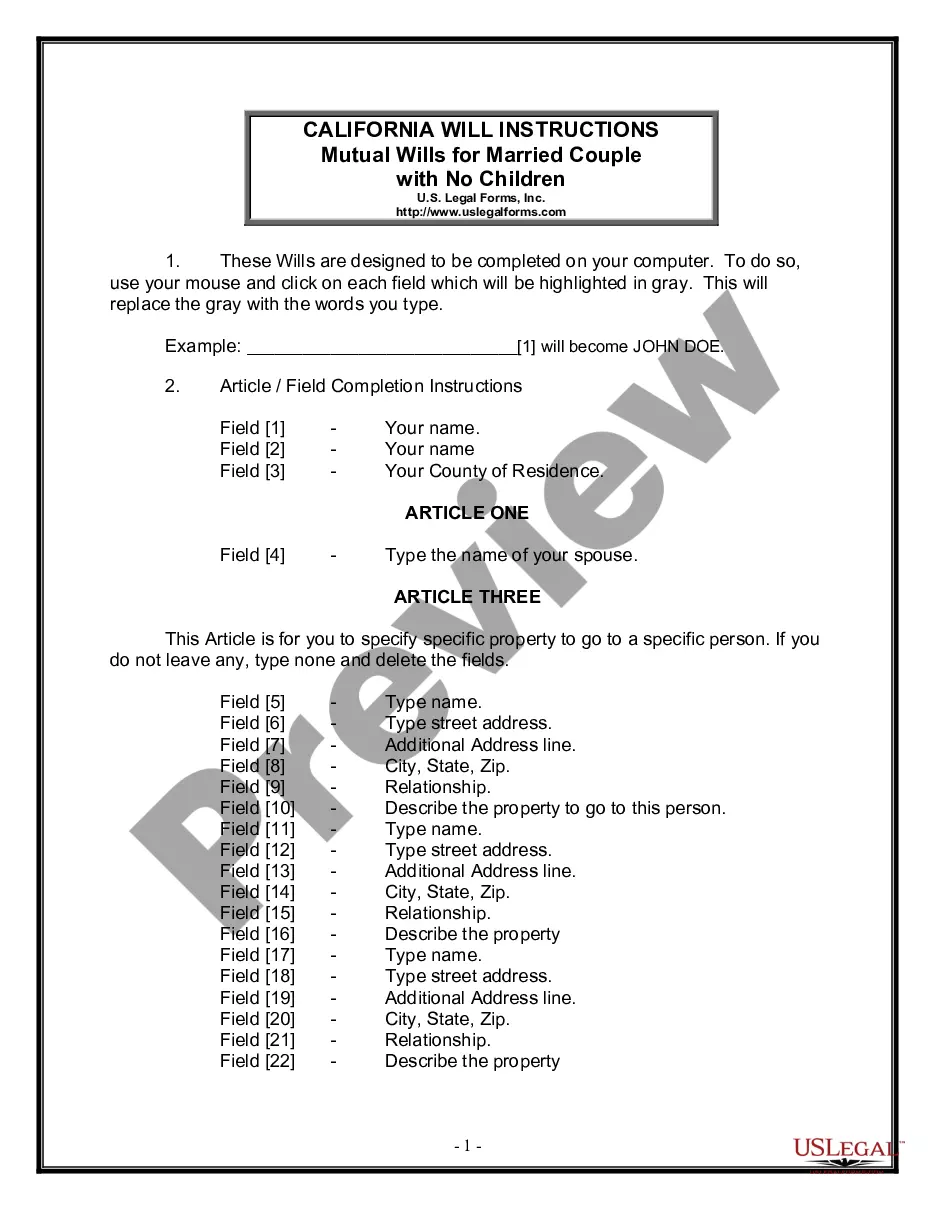

How to fill out Agreement For Sales Of Data Processing Equipment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print. Through the website, you can access thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can find the latest forms like the Washington Agreement for Sale of Data Processing Equipment in just moments.

If you already have a monthly subscription, Log In and download the Washington Agreement for Sale of Data Processing Equipment from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/region. Click the Preview button to review the form’s content. Check the form overview to confirm that you have chosen the proper form. If the form doesn’t meet your needs, utilize the Search area at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Washington Agreement for Sale of Data Processing Equipment. Each template you added to your account does not have an expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Washington Agreement for Sale of Data Processing Equipment with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

Through US Legal Forms, you can navigate a vast array of legal document templates tailored to various needs, whether for professional or personal use.

Make sure to choose the correct form for your location and review it thoroughly before proceeding with your purchase.

- US Legal Forms.

- legal documents.

- document templates.

- business purposes.

- individual purposes.

- Washington Agreement.

Form popularity

FAQ

Washington State imposes sales tax on a variety of services, including installation services and some labor related to tangible goods. However, specific categories of services may fall under exemptions provided by the Washington Agreement for Sales of Data Processing Equipment. Businesses need to discern which services are taxable to ensure compliance and limit tax exposure. Platforms like uslegalforms provide guidance tailored to your specific situations.

Software as a Service (SaaS) is generally taxable in Washington unless exempt under specific circumstances. Certain provisions within the Washington Agreement for Sales of Data Processing Equipment could provide exemptions for qualifying businesses. To navigate the complexities of SaaS taxation accurately, businesses should review their arrangements thoroughly. Using legal services like those from uslegalforms can aid in compliance.

The Washington State data center exemption offers significant sales tax benefits for eligible data center operations. This exemption, part of the Washington Agreement for Sales of Data Processing Equipment, can help businesses reduce their operating costs in technology and data processing. Eligibility often depends on investment levels and job creation. For a detailed understanding, consulting uslegalforms is advantageous.

In Washington State, various items and services are not subject to sales tax, including some professional services and certain digital goods. Exemptions can be found under the Washington Agreement for Sales of Data Processing Equipment, which help businesses avoid unnecessary tax burdens. Understanding these exemptions helps you manage costs effectively. You can rely on uslegalforms to examine specific exemptions relevant to your situation.

Data processing services can be taxable in Washington, depending on how the service is structured. Certain exemptions might apply under the Washington Agreement for Sales of Data Processing Equipment, which are crucial for businesses to utilize. Keeping abreast of these regulations can aid in tax planning and compliance. For tailored guidance, platforms like uslegalforms offer valuable support.

Information services in Washington are typically subject to sales tax. However, services specifically categorized under the Washington Agreement for Sales of Data Processing Equipment may qualify for exemptions. To ensure compliance and optimize tax obligations, consider researching the nuances of these categories. Resources like uslegalforms can provide clarity and assist in legal documentation.

Manufacturing equipment is generally subject to sales tax in Washington State. However, certain exemptions apply under the Washington Agreement for Sales of Data Processing Equipment. Understanding these exemptions can significantly reduce your tax liability. It is wise to consult legal resources or professionals familiar with Washington’s tax laws to navigate these complexities.

In Washington State, the taxation of software subscriptions depends on the nature of the service provided. If the software is delivered electronically and does not involve tangible personal property, it may be exempt from sales tax under the Washington Agreement for Sales of Data Processing Equipment. However, it’s crucial to evaluate each case based on the specific services offered. Consulting with a tax professional can help clarify your obligations.