Washington Private Investigator Agreement - Self-Employed Independent Contractor

Description

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

You may spend countless hours online searching for the legal document template that complies with the state and federal regulations you desire.

US Legal Forms provides a vast array of legal forms that have been reviewed by professionals.

You can easily access or print the Washington Private Investigator Agreement - Self-Employed Independent Contractor from my service.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and hit the Acquire button.

- Then, you can complete, modify, print, or sign the Washington Private Investigator Agreement - Self-Employed Independent Contractor.

- Every legal document template you receive is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the state/region of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The process for obtaining a contractor's license can be relatively simple in states like California or Nevada, where the requirements are less complex. This accessibility allows more independent contractors to enter the field without heavy barriers. As a private investigator, knowing these ropes can greatly complement your understanding of the Washington Private Investigator Agreement - Self-Employed Independent Contractor.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

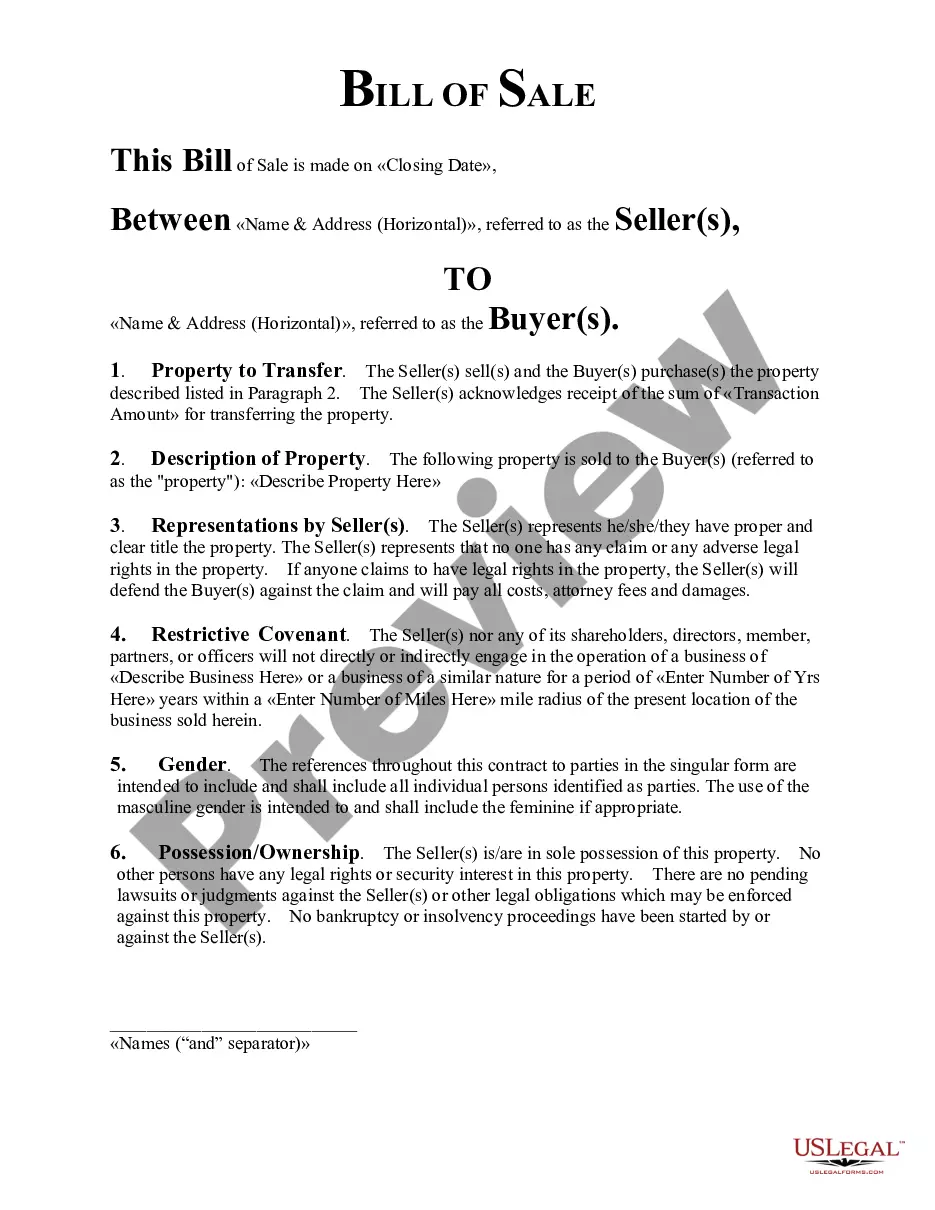

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.