Washington Gutter Services Contract - Self-Employed

Description

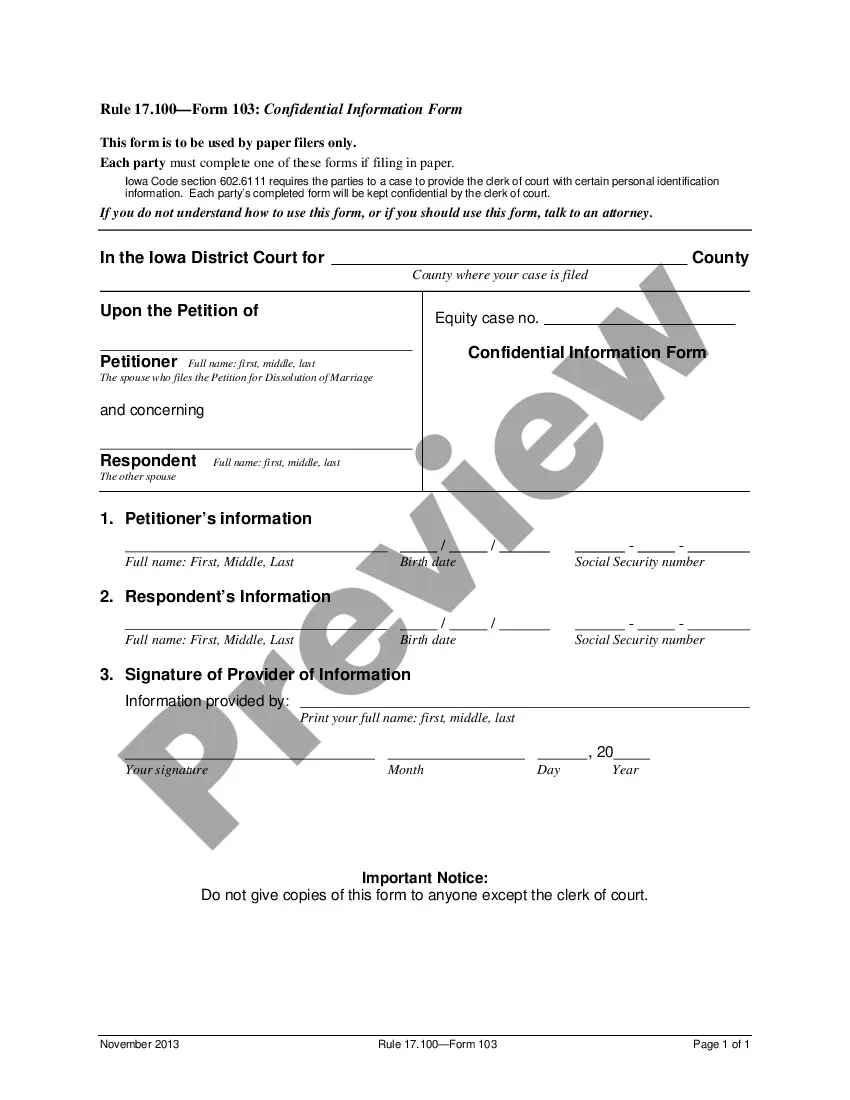

How to fill out Gutter Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast selection of legal form templates that you can download or print. By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Washington Gutter Services Contract - Self-Employed in moments. If you have a membership, Log In and download the Washington Gutter Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab of your account.

If you're using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's details. Check the form summary to confirm you have selected the right one. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your credentials to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Washington Gutter Services Contract - Self-Employed.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every template you added to your account has no expiration date and is yours permanently.

- If you wish to download or print another copy, simply go to the My documents section and click on the form you want.

- Access the Washington Gutter Services Contract - Self-Employed with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The basic requirement of being an independent contractor is to have a written agreement that stipulates the terms of your work, such as the Washington Gutter Services Contract - Self-Employed. This agreement outlines the expectations from both parties, ensuring clarity on payment, project scope, and deadlines. Additionally, you must operate your own business, meaning you manage your tools, supplies, and services. Properly understanding these requirements makes it easier to navigate your path as a successful independent contractor.

To establish yourself as an independent contractor under a Washington Gutter Services Contract - Self-Employed, begin by registering your business name in Washington state. Next, obtain any necessary permits and licenses relevant to your business type. It is also essential to create a robust portfolio showcasing your skills and previous work, which will instill confidence in potential clients. Additionally, consider using the US Legal Forms platform to access templates and guides that facilitate the formalization of your independent contractor status.

The 7 minute rule in Washington state refers to the guideline that independent contractors, such as those working under a Washington Gutter Services Contract - Self-Employed, should spend at least seven minutes on each task for it to be considered a billable hour. This rule helps in structuring work hours effectively and ensuring proper compensation. Understanding this principle can assist independent contractors in planning their schedules and maximizing their earnings. By adhering to this rule, you can establish better contracts and work relationships.

Writing an independent contractor agreement starts with defining the scope of work and payment terms. It's essential to include details such as project deadlines, responsibilities, and legal considerations. Using a template for a Washington Gutter Services Contract - Self-Employed can streamline this process and ensure that all important elements are covered, protecting both you and your clients.

The responsibility for cleaning gutters typically falls on the property owner unless otherwise stated in a service agreement. If you are providing gutter services as an independent contractor, you should clearly outline your responsibilities in a Washington Gutter Services Contract - Self-Employed. This contract will define the scope of work and ensure both parties understand their commitments.

To be an independent contractor in Washington state, you need to have a valid business registration and any relevant licenses. It's crucial to maintain accurate financial records and understand your tax obligations. Additionally, drafting a solid Washington Gutter Services Contract - Self-Employed will help ensure clarity in your working relationships with clients.

In Washington state, an employee works under an employer's control and often receives benefits, while an independent contractor operates independently and typically has more flexibility. An independent contractor is responsible for their own taxes and expenses, making a Washington Gutter Services Contract - Self-Employed essential for clarifying roles and responsibilities. Understanding these distinctions can help you choose the right employment model for your situation.

To become an independent contractor in Washington state, you need to register your business with the Washington Secretary of State. It's essential to obtain any necessary licenses or permits specific to your industry. Additionally, consider drafting a Washington Gutter Services Contract - Self-Employed to outline your responsibilities and establish terms with your clients.

In Washington state, independent contractors are generally not required to carry workers' compensation insurance. However, if you are working under the Washington Gutter Services Contract - Self-Employed and hire subcontractors, you may want to consider coverage to protect yourself. It’s always wise to consult a legal professional about your obligations, as regulations can change and vary by situation.

When filling out an independent contractor agreement, begin with the title and parties involved. Clearly outline the scope of work associated with the Washington Gutter Services Contract - Self-Employed, including deadlines and payment terms. Remember to include a clause for dispute resolution and any additional terms specific to your working relationship, ensuring both parties understand their rights and responsibilities.