Washington Midwife Agreement - Self-Employed Independent Contractor

Description

How to fill out Midwife Agreement - Self-Employed Independent Contractor?

Are you presently inside a place where you will need paperwork for possibly company or person purposes virtually every time? There are a variety of authorized file themes available on the Internet, but discovering versions you can rely on isn`t straightforward. US Legal Forms gives thousands of develop themes, much like the Washington Midwife Agreement - Self-Employed Independent Contractor, which can be written in order to meet state and federal demands.

In case you are previously familiar with US Legal Forms web site and also have a free account, merely log in. Afterward, you are able to acquire the Washington Midwife Agreement - Self-Employed Independent Contractor template.

Unless you offer an profile and wish to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for the correct town/state.

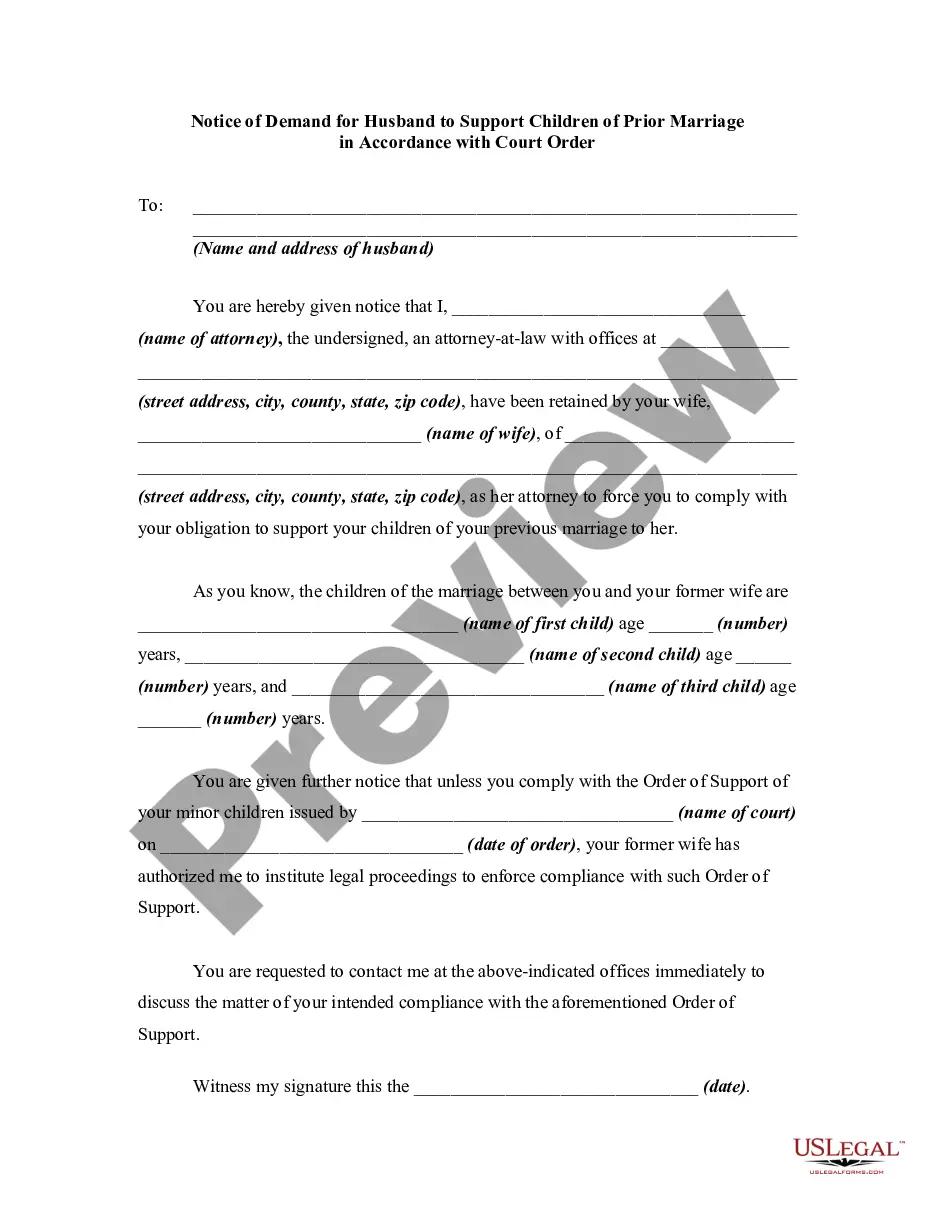

- Utilize the Review option to examine the form.

- Look at the explanation to ensure that you have selected the appropriate develop.

- If the develop isn`t what you are seeking, use the Lookup discipline to discover the develop that fits your needs and demands.

- Whenever you obtain the correct develop, click on Purchase now.

- Select the costs program you need, submit the necessary information and facts to create your money, and pay for the transaction with your PayPal or charge card.

- Pick a handy paper structure and acquire your version.

Discover every one of the file themes you might have purchased in the My Forms food list. You can aquire a additional version of Washington Midwife Agreement - Self-Employed Independent Contractor at any time, if necessary. Just click the essential develop to acquire or printing the file template.

Use US Legal Forms, the most considerable assortment of authorized types, to save lots of some time and prevent blunders. The assistance gives expertly manufactured authorized file themes which you can use for a selection of purposes. Create a free account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

As a contractor, this is most likely you. This means that you run your own business as an individual and you are self-employed. Being a sole trader gives you both complete control and responsibility. Your business assets and liabilities are not separate from your personal ones.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

You need a license if you meet one or more of the following criteria: Your business requires city and state endorsements. You are doing business using a name other than your full name legal name. You plan to hire employees within the next 90 days.

Must pass 1 of the following 2 options: The individual:Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.Has a principal place of business that is eligible for a business deduction for IRS purposes.

Do Independent Contractors Need A Business License In Washington State? If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

As an independent contractor, you are engaged in business in Washington. You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following: You are required to collect sales tax. Your gross income equals $12,000 or more per year.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.