Washington HVAC Service Contract - Self-Employed

Description

How to fill out HVAC Service Contract - Self-Employed?

Have you ever been in a situation where you require documents for potential organization or specific tasks almost every day.

There are numerous legal document templates available online, but it’s not easy to find ones you can rely on.

US Legal Forms offers a vast array of form templates, such as the Washington HVAC Service Contract - Self-Employed, which are designed to meet both state and federal requirements.

Once you find the suitable form, click Get now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and process the payment using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- After logging in, you can download the Washington HVAC Service Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

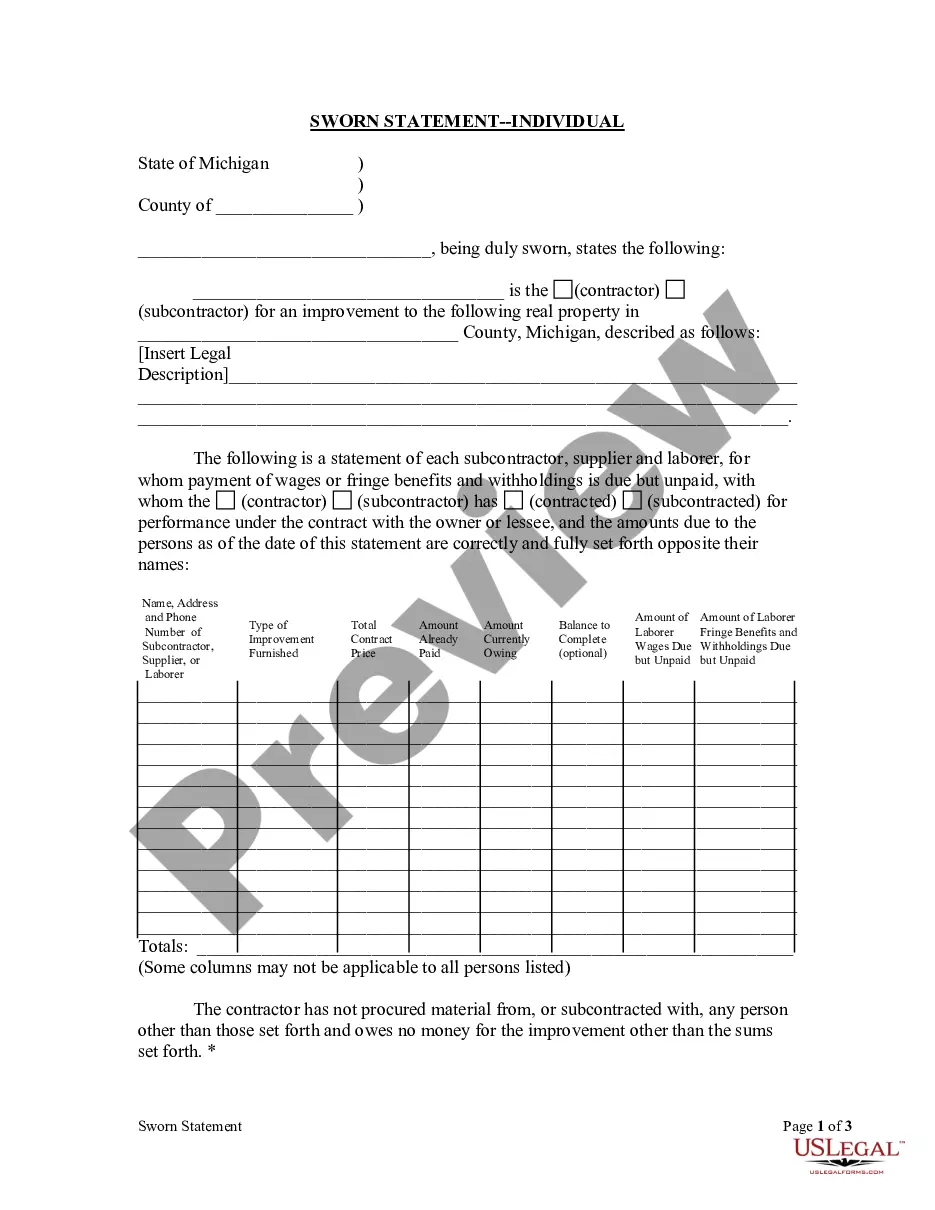

- Use the Preview button to review the document.

- Check the description to verify you have selected the right form.

- If the form is not what you’re looking for, utilize the Search field to locate the form that fits your requirements.

Form popularity

FAQ

Yes, independent contractors in Washington, including those offering HVAC services, must obtain a business license. This license legitimizes your work and allows you to build trust with clients. By acquiring a Washington HVAC Service Contract - Self-Employed, you can find guidance on maintaining compliance with local laws. Don't overlook this important step to ensure your services are recognized and respected in the market.

You need a business license in Washington as soon as you begin conducting business activities. This requirement applies whether you are providing services like HVAC work or selling products. If you are planning to enter into a Washington HVAC Service Contract - Self-Employed, securing your license beforehand can help avoid potential legal issues down the line. So, act promptly to protect your business interests.

Yes, as a self-employed individual in Washington, you will need a business license to operate legally. A Washington HVAC Service Contract - Self-Employed can help you navigate the licensing requirements, ensuring you meet all necessary regulations. Moreover, having a license demonstrates professionalism and can enhance your credibility with clients. Therefore, it’s wise to secure your business license to establish a solid foundation for your HVAC services.

Being self-employed means you run your own business, whereas being contracted usually refers to working under specific terms for another company. A Washington HVAC Service Contract - Self-Employed outlines your independent work, while a contract with a company may dictate your projects and deadlines. Understanding these distinctions can help you navigate your career options more effectively.

Yes, registering your business as an independent contractor is important in Washington state. You should obtain the necessary licenses and permits to operate legally. Moreover, utilizing a Washington HVAC Service Contract - Self-Employed can help in establishing a professional presence. Registration enhances your credibility and allows you to market your services effectively.

Yes, having a contract is crucial when you are self-employed. A Washington HVAC Service Contract - Self-Employed defines the service terms you provide, including payment, scope of work, and timelines. It protects both you and your client, reducing the risk of misinterpretation or disputes. Secure your contracts for peace of mind in your business dealings.

While freelancing without a contract is possible, it is not advisable. A Washington HVAC Service Contract - Self-Employed helps solidify your freelance agreements and ensures you and your clients are on the same page. Without it, you risk miscommunications and potential work disagreements. Always protect your interests with well-documented contracts.

Not having a contract can lead to several issues, especially in the HVAC industry. A Washington HVAC Service Contract - Self-Employed clarifies expectations, ensuring both parties understand their obligations. Without a contract, you may face challenges in payment disputes or job requirements, creating potential complications down the road. It is always best to have clear agreements in place.

Becoming an independent contractor in Washington state involves several steps. Start by obtaining your business license, and if you're offering services like HVAC, consider using a Washington HVAC Service Contract - Self-Employed to formalize your agreements. Register your business with the Washington Secretary of State and ensure you meet any local regulations. Lastly, promote your services to attract potential clients.

Yes, you can technically work as a 1099 employee without a formal contract. However, having a Washington HVAC Service Contract - Self-Employed is beneficial for defining the terms of your working relationship. It protects you by outlining expectations, payments, and responsibilities. Without it, misunderstandings may arise, leading to disputes.