Washington Subscription Agreement

Description

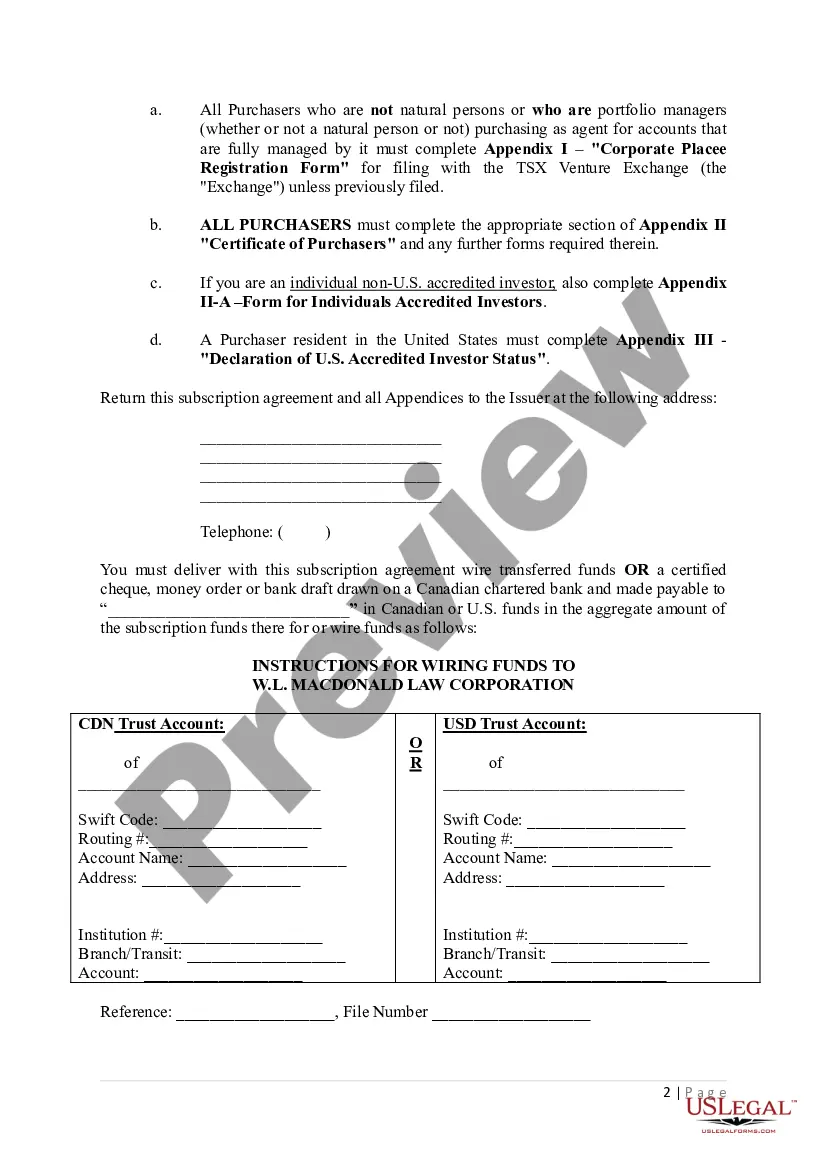

How to fill out Subscription Agreement?

US Legal Forms - one of many greatest libraries of legitimate forms in the States - provides a variety of legitimate papers templates you can obtain or printing. Making use of the website, you will get 1000s of forms for organization and specific uses, categorized by categories, says, or keywords.You will discover the most recent variations of forms like the Washington Subscription Agreement in seconds.

If you already possess a subscription, log in and obtain Washington Subscription Agreement from your US Legal Forms catalogue. The Down load key can look on every single develop you see. You gain access to all earlier delivered electronically forms inside the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed here are straightforward directions to obtain started off:

- Make sure you have selected the proper develop for your area/state. Click the Preview key to review the form`s articles. Look at the develop explanation to ensure that you have chosen the correct develop.

- In case the develop does not fit your needs, use the Research area on top of the display to find the one that does.

- In case you are satisfied with the form, affirm your choice by visiting the Buy now key. Then, opt for the rates strategy you prefer and give your references to sign up to have an profile.

- Process the deal. Utilize your bank card or PayPal profile to perform the deal.

- Pick the formatting and obtain the form on the product.

- Make modifications. Fill out, change and printing and indication the delivered electronically Washington Subscription Agreement.

Each and every design you included in your money lacks an expiration particular date which is your own permanently. So, if you wish to obtain or printing one more version, just visit the My Forms section and then click about the develop you will need.

Obtain access to the Washington Subscription Agreement with US Legal Forms, probably the most extensive catalogue of legitimate papers templates. Use 1000s of expert and status-distinct templates that meet up with your organization or specific needs and needs.

Form popularity

FAQ

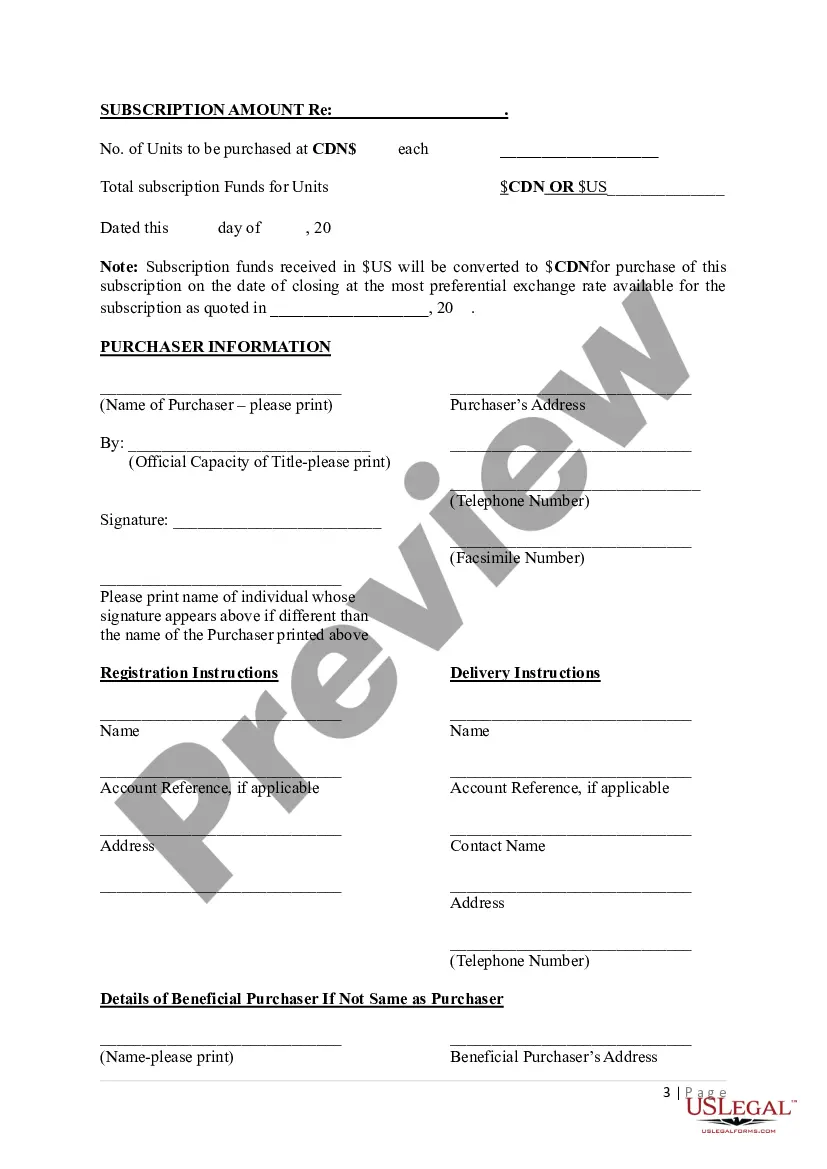

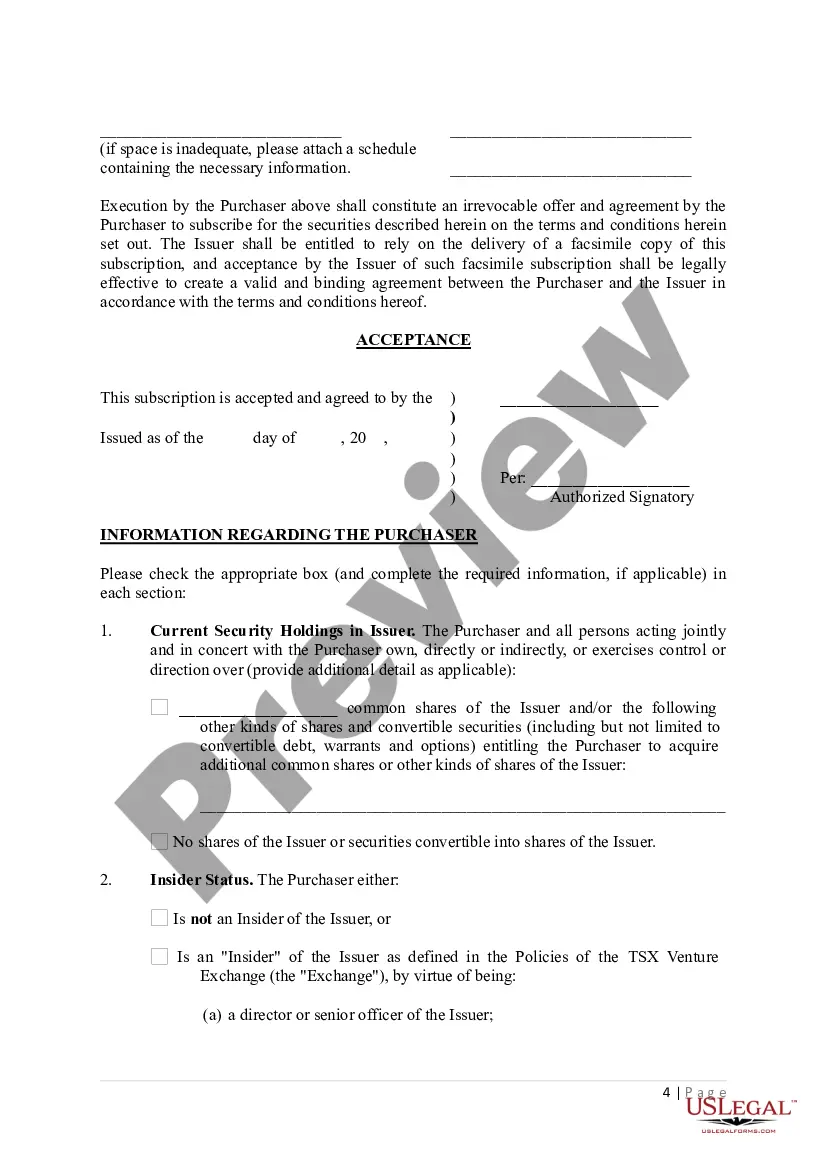

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

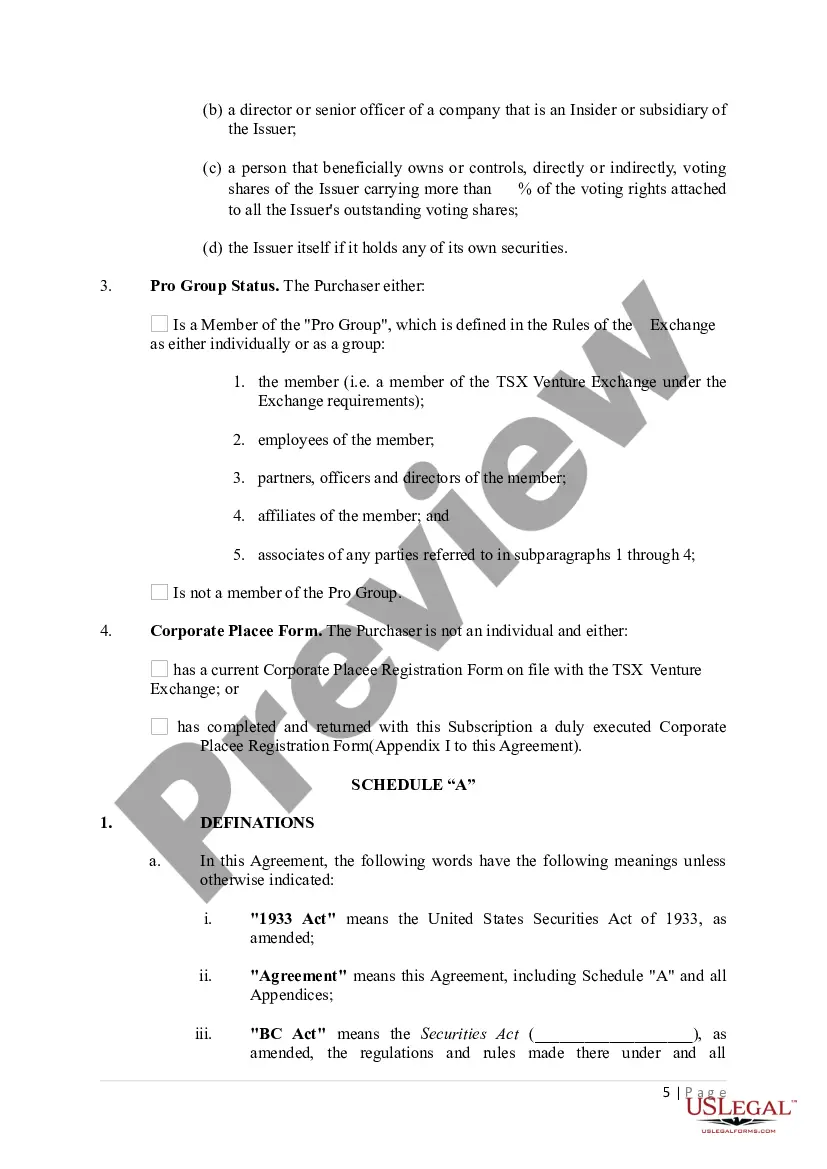

A limited partnership is when private investors or partners own the company. Under the subscription agreement, the terms are set for the company to sell a certain number of shares in return for a predetermined amount from the private investor.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares. Sample Share Subscription Agreement - WVU College of Law wvu.edu ? files ? sample-ssa-clean-versi... wvu.edu ? files ? sample-ssa-clean-versi...

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer. Subscription Agreement overview - CrowdStreet crowdstreet.com ? knowledge ? subscription... crowdstreet.com ? knowledge ? subscription...

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses. Subscription Agreement - Overview, How It Works, Regulation corporatefinanceinstitute.com ? resources ? equities corporatefinanceinstitute.com ? resources ? equities

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement. The importance of an LLC Operating Agreement - Propel(x) propelx.com ? blog ? llc-operating-agreement propelx.com ? blog ? llc-operating-agreement