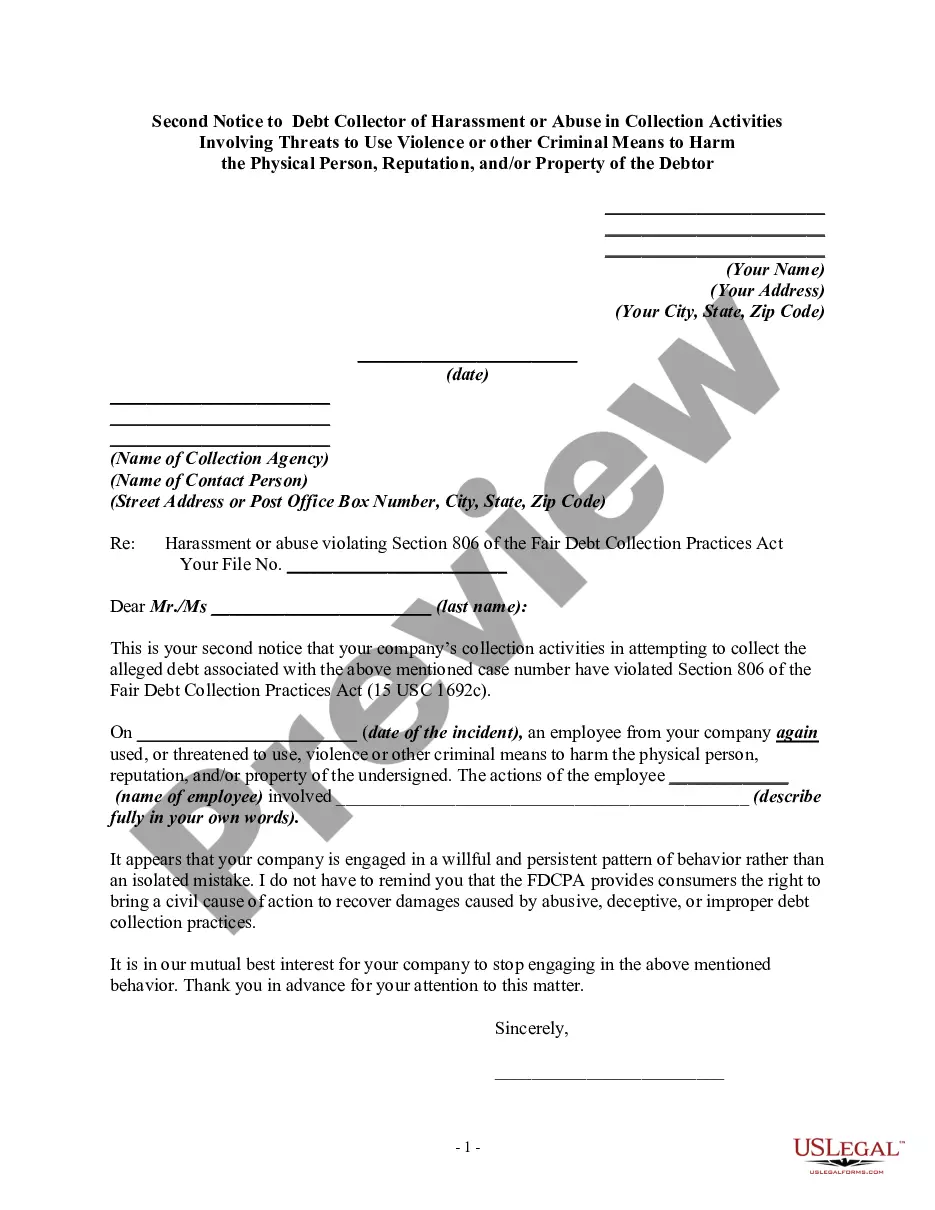

This form is a follow-up letter containing a warning that the debt collector's continued violation of the Fair Debt Collection Practices Act may result in a law suit being filed against the debt collector.

Washington Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

How to fill out Second Notice To Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Selecting the appropriate valid document template can be somewhat challenging. Naturally, there is a multitude of templates available online, but how can you find the correct document you require? Utilize the US Legal Forms website. This service offers thousands of templates, such as the Washington Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor, which you can use for both business and personal needs. All templates are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and select the Download button to obtain the Washington Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor. Use your account to view the legal documents you have purchased previously. Visit the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should take: First, ensure you have selected the correct document for your state/region. You can browse the form using the Review option and read the form description to confirm it is suitable for you. If the document does not meet your expectations, use the Search field to find the correct form. Once you are certain the form is appropriate, click on the Purchase now button to obtain the document. Choose the pricing plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Washington Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor.

US Legal Forms represents the largest repository of legal documents where you can find numerous template options. Take advantage of this service to obtain professionally crafted paperwork that adheres to state requirements.

- Confirm selection of the appropriate document for your state/region.

- Utilize the Review option to browse through the forms.

- Read the description of the form to check if it meets your needs.

- If needed, access the Search feature to find the correct document.

- Ensure you are confident about the form's appropriateness before purchase.

- Follow prompts to complete the transaction and download the document.

Form popularity

FAQ

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

Ask CFPBWho you're talking to (get the person's name)The name of the debt collection company they work for.The company's address and phone number.The name of the original creditor.The amount owed.How you can dispute the debt or ensure that the debt is yours.

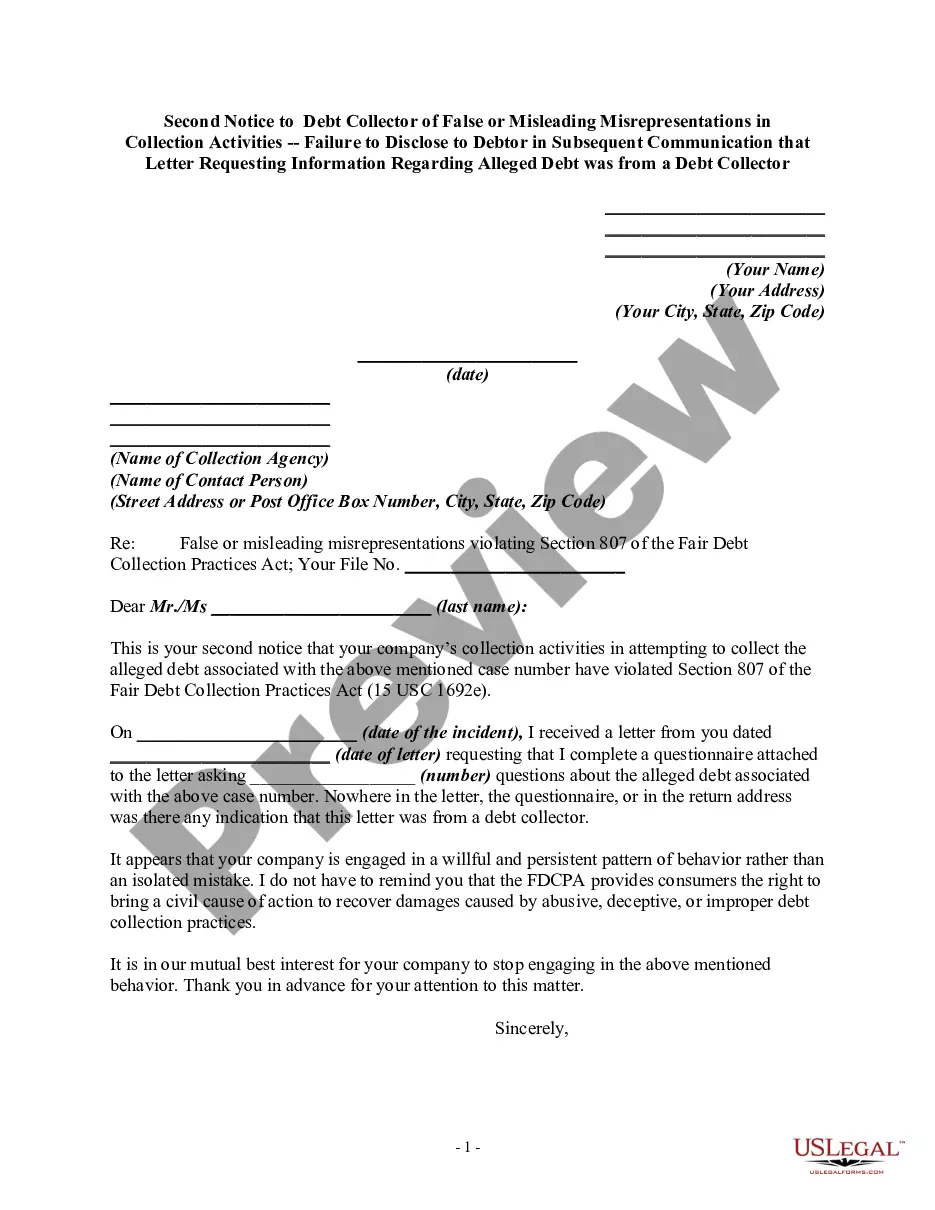

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

You're protected from harassing or abusive practicesThe Fair Debt Collection Practices Act prohibits debt collectors from using any harassing or abusive practices in an attempt to collect the debt. Harassment is more than just repeatedly asking you to pay money, says bankruptcy attorney Jay Fleischman.