Washington Form of Convertible Promissory Note, Common Stock

Description

How to fill out Form Of Convertible Promissory Note, Common Stock?

Are you inside a placement in which you require papers for both business or personal purposes almost every day? There are plenty of legitimate record layouts available on the Internet, but locating kinds you can rely isn`t straightforward. US Legal Forms delivers a huge number of develop layouts, much like the Washington Form of Convertible Promissory Note, Common Stock, that happen to be written to satisfy federal and state demands.

Should you be already informed about US Legal Forms site and have a merchant account, basically log in. Next, it is possible to download the Washington Form of Convertible Promissory Note, Common Stock template.

Unless you come with an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you need and ensure it is for that proper area/state.

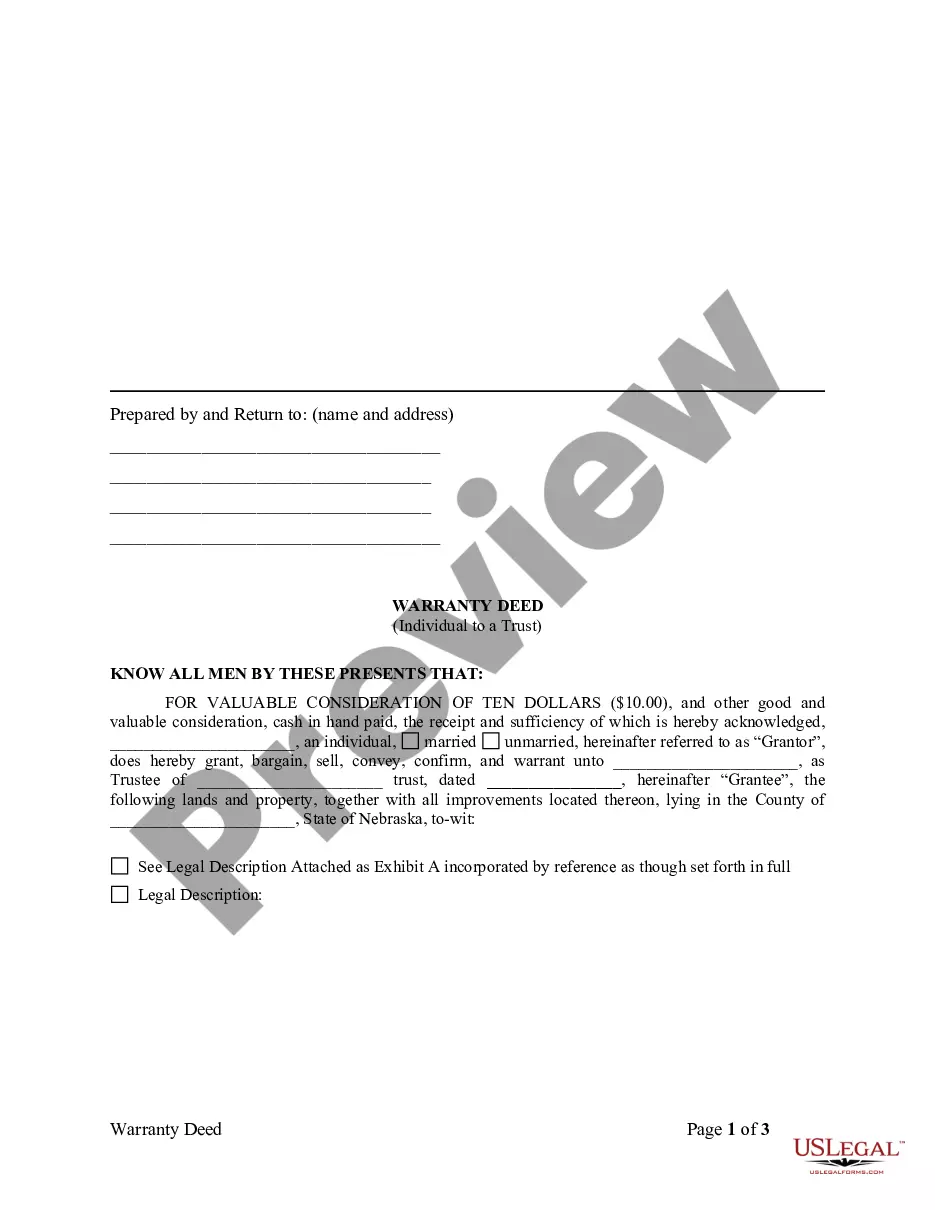

- Make use of the Preview option to analyze the form.

- Read the outline to actually have selected the appropriate develop.

- In the event the develop isn`t what you`re seeking, use the Look for field to get the develop that fits your needs and demands.

- If you find the proper develop, click on Acquire now.

- Pick the prices plan you need, complete the required details to generate your money, and pay money for an order utilizing your PayPal or credit card.

- Select a convenient document format and download your duplicate.

Discover each of the record layouts you have purchased in the My Forms menus. You can obtain a additional duplicate of Washington Form of Convertible Promissory Note, Common Stock any time, if possible. Just click the essential develop to download or print out the record template.

Use US Legal Forms, probably the most substantial collection of legitimate forms, to conserve time as well as prevent faults. The support delivers professionally created legitimate record layouts which you can use for a variety of purposes. Make a merchant account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Yes, you can issue convertible notes for LLCs, but this approach is rare. Transferring equity to the issuer of a convertible note once the convertible note matures is more complex in such cases, and the process must be laid out in the LLC's operating agreement. Convertible Notes Lawyers & Attorneys - Priori Legal priorilegal.com ? financing ? convertible-no... priorilegal.com ? financing ? convertible-no...

As noted above, convertible notes can be classified as all debt, all equity, or a mixture of both. To determine the appropriate classification, we need to consider the relevant definitions in IAS 32 Financial Instruments: Presentation.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable). What is a Convertible Promissory Note? - Nolo nolo.com ? legal-encyclopedia ? what-is-a-c... nolo.com ? legal-encyclopedia ? what-is-a-c...

Also known as convertible promissory notes, bridge notes, or convertible debt. Since convertible notes are securities, they must be registered, or qualify for an exemption from registration, under the Securities Act. Convertible Note | Practical Law - Westlaw westlaw.com ? document ? Convertib... westlaw.com ? document ? Convertib...

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section. How should convertible note financing be handled on the balance sheet? kruzeconsulting.com ? convertible-note-balance-s... kruzeconsulting.com ? convertible-note-balance-s...

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.

A convertible note is a short-term debt instrument that automatically turns into equity when a predetermined milestone or conversion event occurs. Essentially, a convertible note functions like a business loan that converts into equity instead of being repaid..