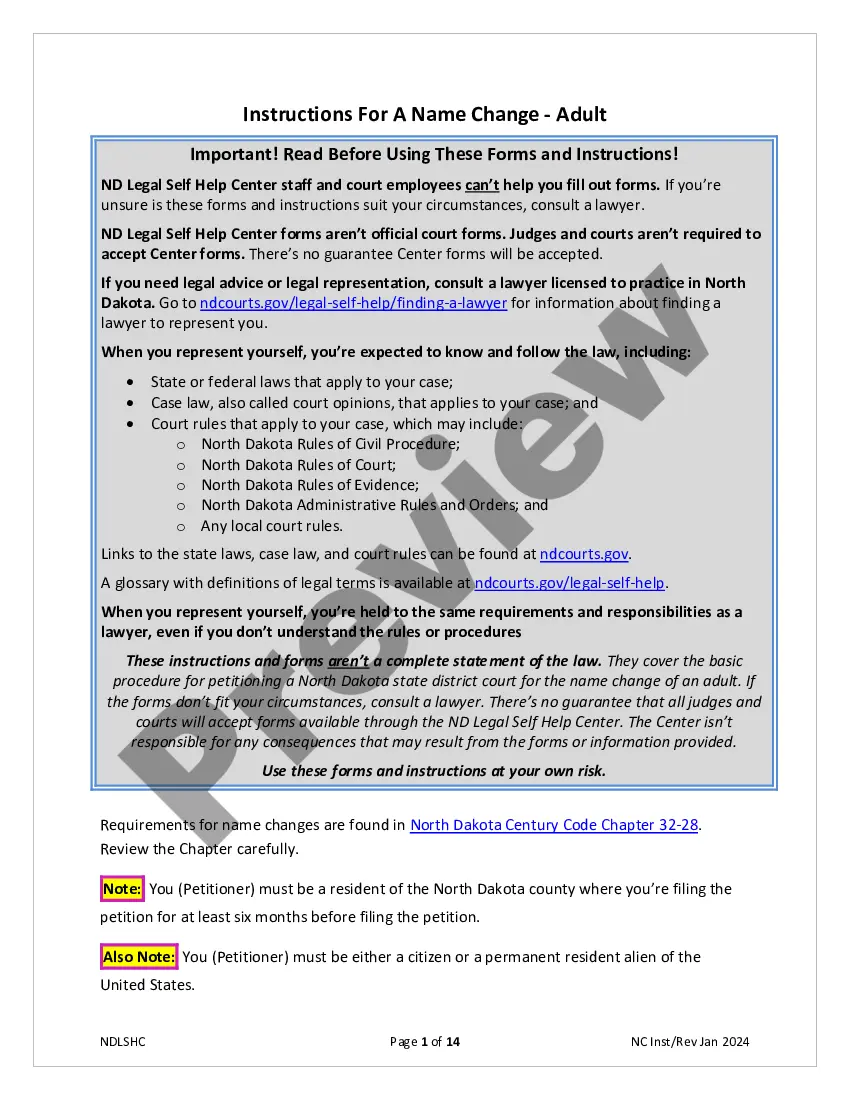

Washington Elimination of the Class A Preferred Stock

Description

How to fill out Elimination Of The Class A Preferred Stock?

US Legal Forms - one of several largest libraries of legitimate forms in the States - provides a variety of legitimate record layouts you can obtain or printing. While using web site, you may get a huge number of forms for business and person purposes, sorted by classes, says, or key phrases.You will discover the most recent versions of forms like the Washington Elimination of the Class A Preferred Stock in seconds.

If you already have a monthly subscription, log in and obtain Washington Elimination of the Class A Preferred Stock from the US Legal Forms catalogue. The Down load option will show up on each and every type you see. You have accessibility to all in the past delivered electronically forms from the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, here are straightforward guidelines to help you get started out:

- Make sure you have picked the right type for the town/county. Select the Review option to check the form`s content material. Browse the type information to actually have chosen the proper type.

- If the type does not match your needs, make use of the Search discipline on top of the monitor to discover the one that does.

- Should you be content with the shape, verify your choice by clicking on the Purchase now option. Then, pick the costs strategy you prefer and give your accreditations to sign up for an accounts.

- Method the financial transaction. Use your credit card or PayPal accounts to finish the financial transaction.

- Find the format and obtain the shape on your product.

- Make modifications. Fill out, modify and printing and indication the delivered electronically Washington Elimination of the Class A Preferred Stock.

Each format you included in your account lacks an expiry day and is your own property permanently. So, in order to obtain or printing another duplicate, just go to the My Forms section and then click on the type you want.

Get access to the Washington Elimination of the Class A Preferred Stock with US Legal Forms, by far the most extensive catalogue of legitimate record layouts. Use a huge number of professional and condition-specific layouts that satisfy your company or person requirements and needs.

Form popularity

FAQ

Preferred stock dividend payments are not fixed and can change or be stopped. However, these payments are often taxed at a lower rate than bond interest. In addition, bonds often have a term that mature after a certain amount of time. There is theoretically no "end date" to preferred stock.

Preferred stock are shares issued from a company that have priority in receiving dividends and other benefits over common stock. The exact benefits offered by a preferred stock may vary, but all have some form of priority over common stockholders.

Depending on the specifics of the merger, investors may have their shares cashed-out, or exchanged for shares of the new company. Prices of stocks may increase or decrease, often depending on if they're shares of the target or acquiring company.

Preferred Stock is different from Common Stock in that it offers distinct advantages that are not given to Common Stock shareholders. In addition, Preferred Stock is not standardized. You can issue different classes of Preferred Stock, each with their own unique benefits.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

Preferred shares typically get converted to common shares when a start-up has an IPO or when another company acquires the start-up. So there should be enough common shares available to allow the preferred shareholders to convert their shares.

Holders of preferred shares are also repaid first in the event that the company has to liquidate its assets, such as in a merger or acquisition or a ?solvency event? like bankruptcy. However, unlike common stock, they don't usually come with voting rights.