Washington Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

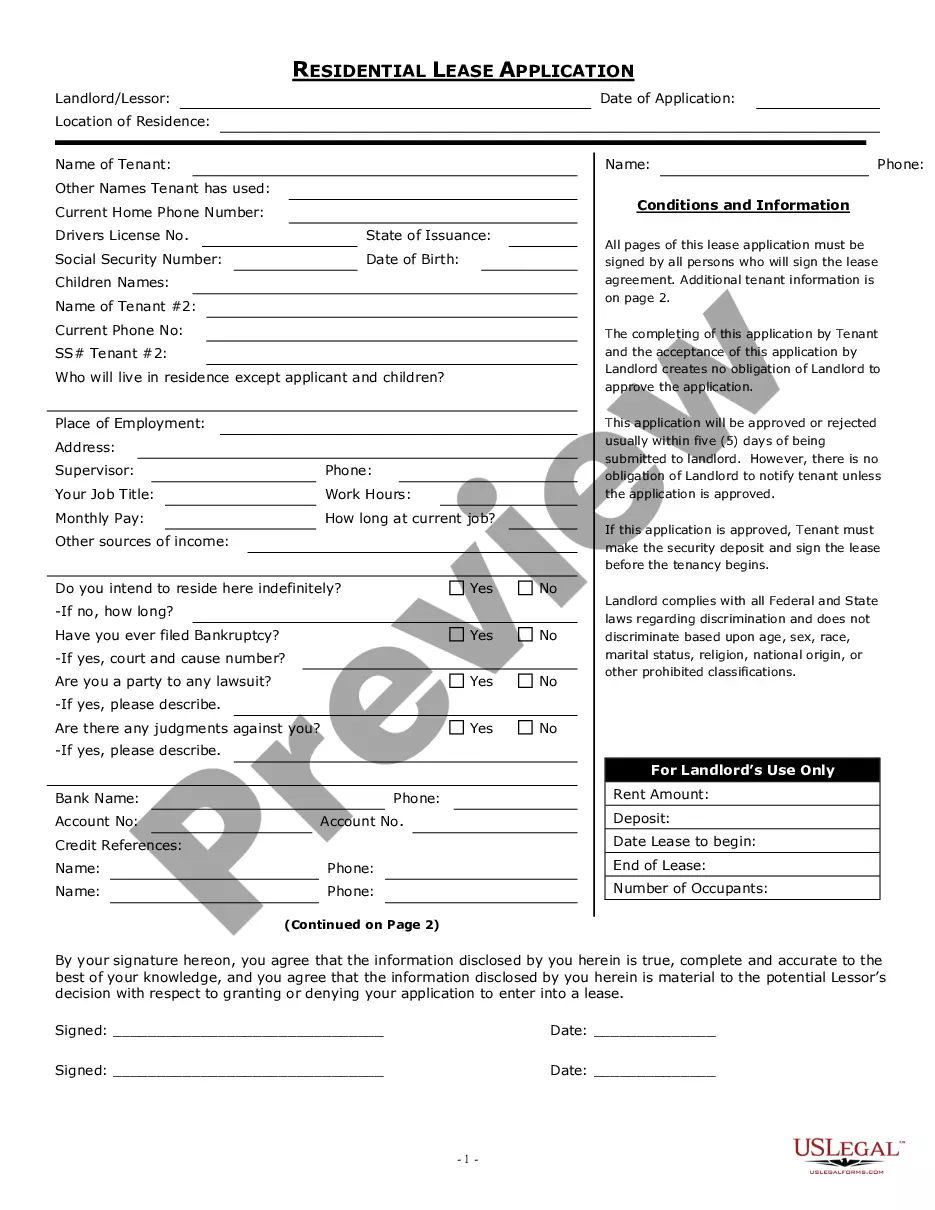

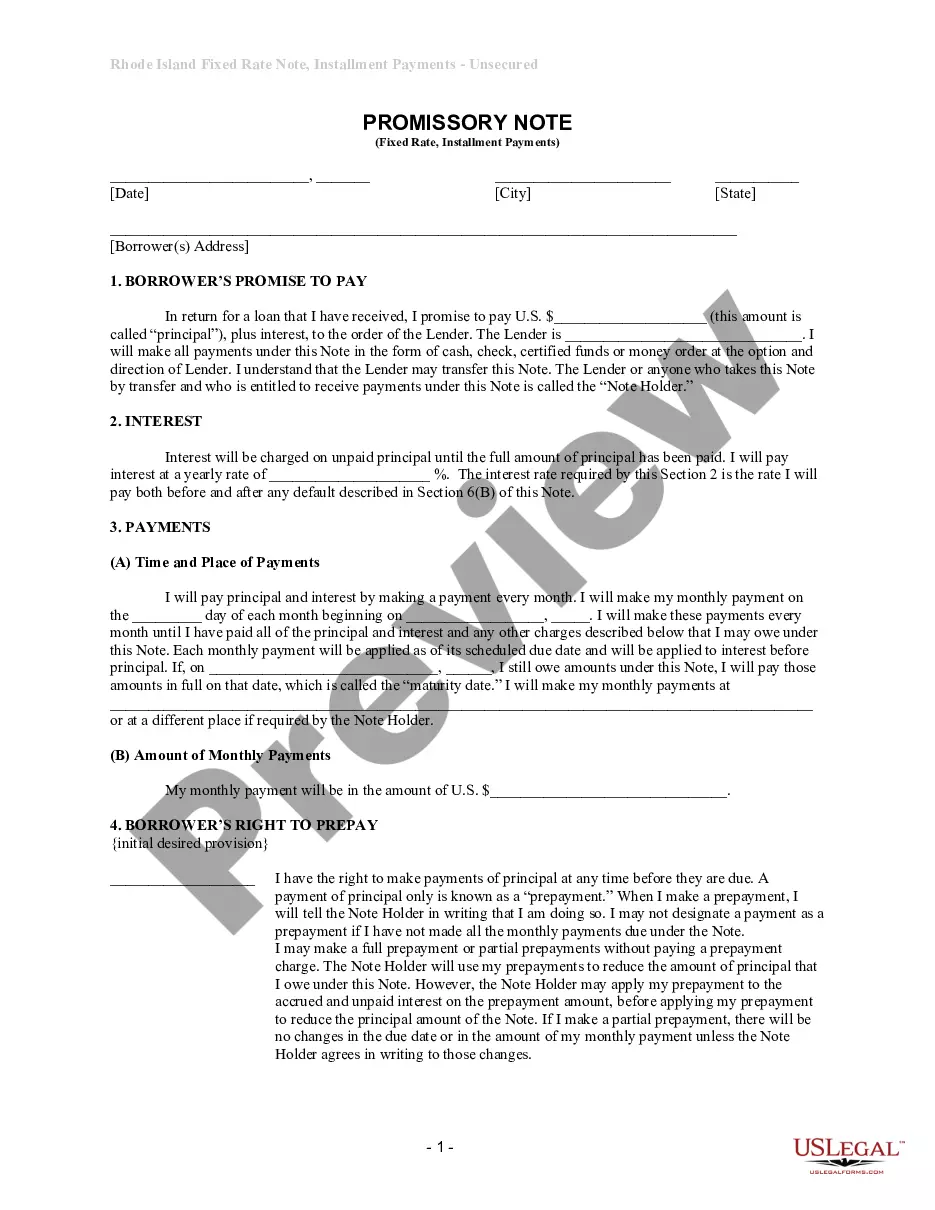

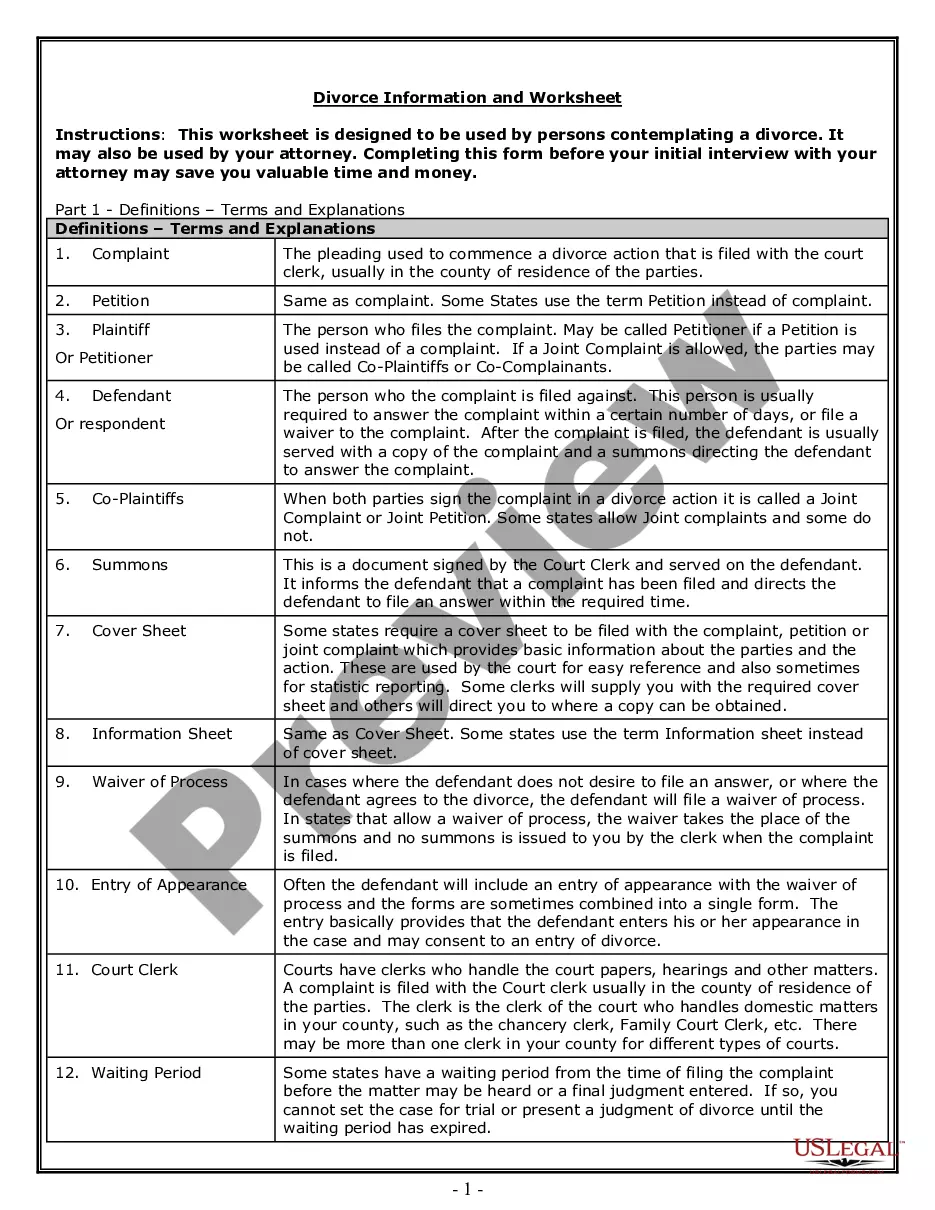

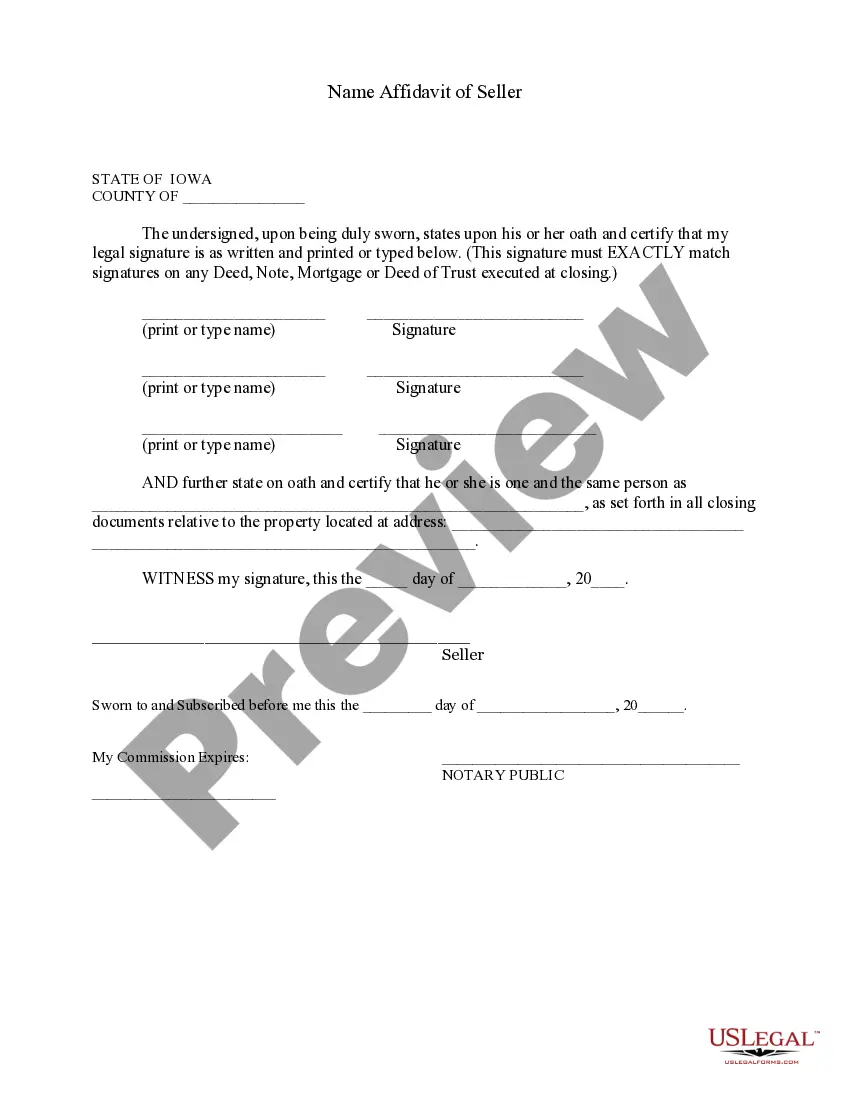

You can spend hours on the web attempting to find the legitimate file design that fits the federal and state specifications you require. US Legal Forms supplies 1000s of legitimate types that are reviewed by experts. You can easily acquire or print out the Washington Proposal to decrease authorized common and preferred stock from your services.

If you have a US Legal Forms account, you are able to log in and then click the Acquire switch. Following that, you are able to comprehensive, edit, print out, or indicator the Washington Proposal to decrease authorized common and preferred stock. Each legitimate file design you get is the one you have eternally. To get an additional version of the purchased develop, check out the My Forms tab and then click the related switch.

If you work with the US Legal Forms web site initially, adhere to the straightforward directions below:

- Initially, be sure that you have chosen the correct file design for that state/city that you pick. See the develop description to make sure you have chosen the proper develop. If available, take advantage of the Review switch to search from the file design also.

- If you wish to get an additional variation from the develop, take advantage of the Search industry to get the design that suits you and specifications.

- Once you have discovered the design you want, click Acquire now to proceed.

- Find the rates program you want, enter your references, and register for your account on US Legal Forms.

- Total the purchase. You may use your credit card or PayPal account to purchase the legitimate develop.

- Find the formatting from the file and acquire it to your product.

- Make modifications to your file if necessary. You can comprehensive, edit and indicator and print out Washington Proposal to decrease authorized common and preferred stock.

Acquire and print out 1000s of file layouts using the US Legal Forms site, which provides the most important collection of legitimate types. Use professional and express-distinct layouts to handle your small business or specific requires.

Form popularity

FAQ

The common shareholder does have the right to vote, receive a dividend, and to sell his shares.

Stakeholders have the right to, at any point, seek additional information from the management about any aspect of the company's business. They also have the right to weigh on significant matters through a vote.

The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

Purchasers of common stock are granted specific rights that may include the following: Voting at stockholder meetings. Selling or otherwise disposing of stock. Having the first opportunity to purchase additional shares of common stock issued by the corporation. Sharing dividends with other common stockholders.

A common shareholder is someone who has purchased at least one common share of a company. Common shareholders have a right to vote on corporate issues and are entitled to declared common dividends. Common shareholders are paid out last in the event of bankruptcy after debtholders and preferred shareholders.

Transfer of shares The company's articles of association (the company's set of rules) usually allow a shareholder ('the transferor') to transfer shares to someone else ('the transferee'). The transfer may be a sale or a gift of the shares. Sometimes the articles contain restrictions on transferring shares.

Reasons For Reducing Share Capital Commonly, it is carried out for one of the following purposes: To create distributable reserves ? for use towards payment of a dividend to shareholders or to finance a purchase of the company's own shares, where there are otherwise insufficient distributable profits.

Purchasers of common stock are granted specific rights that may include the following: Voting at stockholder meetings. Selling or otherwise disposing of stock. Having the first opportunity to purchase additional shares of common stock issued by the corporation. Sharing dividends with other common stockholders.