Washington Proposal Approval of Nonqualified Stock Option Plan

Description

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

Choosing the best legal file format can be a have difficulties. Obviously, there are plenty of web templates accessible on the Internet, but how will you obtain the legal kind you want? Utilize the US Legal Forms internet site. The assistance delivers a huge number of web templates, including the Washington Proposal Approval of Nonqualified Stock Option Plan, which can be used for enterprise and private demands. All of the forms are examined by experts and meet state and federal needs.

If you are previously signed up, log in to your profile and click on the Obtain key to get the Washington Proposal Approval of Nonqualified Stock Option Plan. Utilize your profile to appear from the legal forms you possess bought in the past. Check out the My Forms tab of your profile and acquire another copy from the file you want.

If you are a brand new user of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

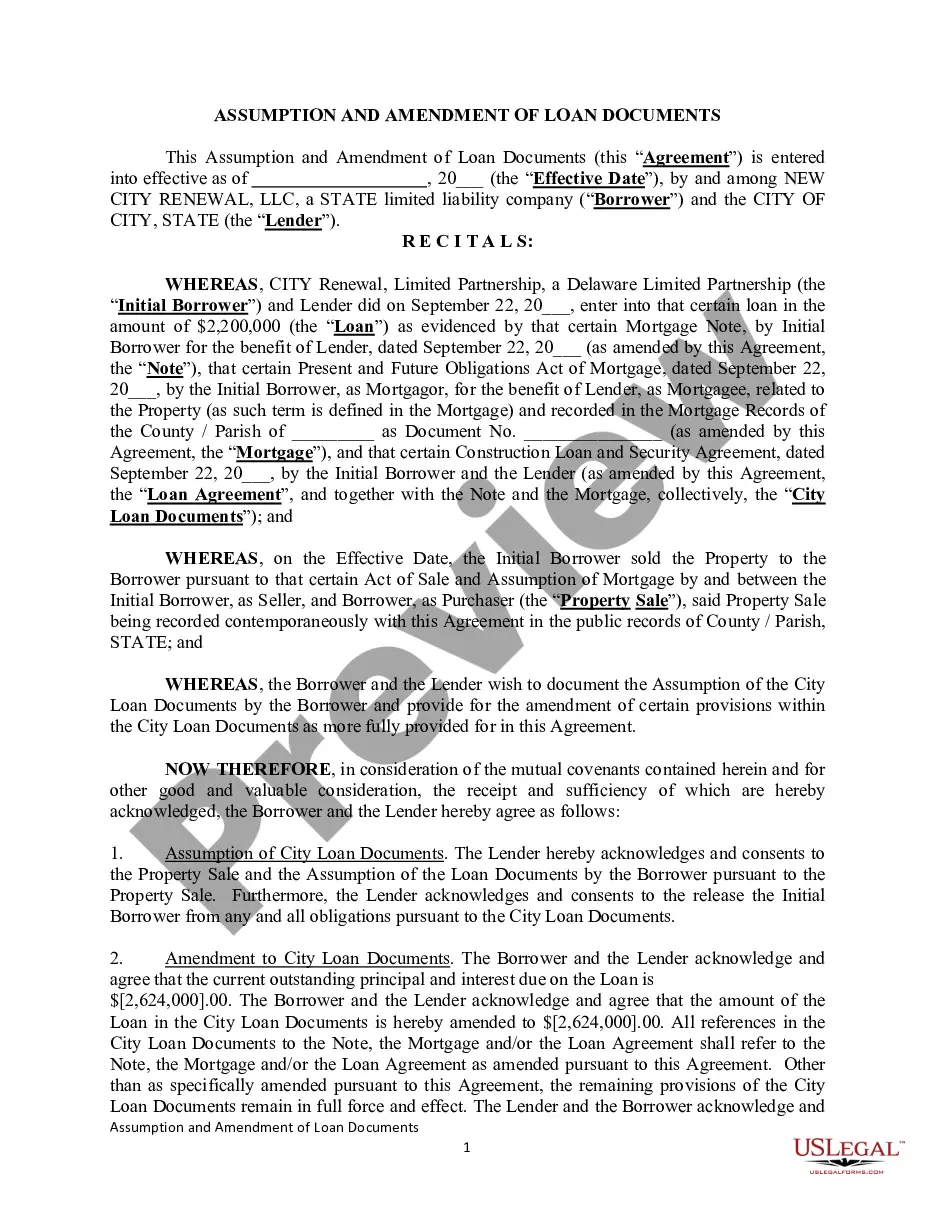

- Very first, ensure you have chosen the appropriate kind for your metropolis/area. It is possible to look through the form while using Review key and look at the form description to guarantee this is basically the best for you.

- If the kind is not going to meet your preferences, make use of the Seach discipline to get the appropriate kind.

- When you are positive that the form is acceptable, go through the Purchase now key to get the kind.

- Pick the costs strategy you desire and enter in the needed info. Make your profile and pay money for your order with your PayPal profile or charge card.

- Choose the data file file format and down load the legal file format to your device.

- Full, change and print out and indicator the received Washington Proposal Approval of Nonqualified Stock Option Plan.

US Legal Forms is the greatest catalogue of legal forms where you can find different file web templates. Utilize the company to down load professionally-manufactured papers that adhere to status needs.

Form popularity

FAQ

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase. Your strike price.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

To qualify, ESPPs generally have to be available to all full-time employees with a certain amount of time vested in the job. Participants may need to hold their shares for at least one year after the purchase date and two years after the grant date to take advantage of the long-term capital gains rate.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Employee Stock Purchase Plan: Qualified or Non-qualified This means that there is more flexibility in how a non-qualified plan can be designed, but a qualified plan is treated more favorably on taxation as there's no taxable event when shares are purchased.

Incentive Stock Options (ISO) are one example of a qualified stock option plan. With ISO plans, there is no tax due at the time the option is granted and no tax due at the time the option is exercised. Instead, the tax on the option is deferred until the time you sell the stock.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.