The Washington Agreement for Auditing Services between an Accounting Firm and a Municipality is a formal contract that outlines the terms and conditions for providing auditing services to a local government entity within the state of Washington. This agreement serves to ensure financial transparency, accuracy, and compliance with regulatory guidelines. Keywords: Washington Agreement, Auditing Services, Accounting Firm, Municipality, local government, financial transparency, accuracy, compliance, regulatory guidelines. The Washington Agreement for Auditing Services between an Accounting Firm and a Municipality is categorized into various types based on the scope and duration of the engagement. Some common types of these agreements are: 1. Comprehensive Audit Agreement: This type of agreement covers a thorough examination of the municipality's financial records, encompassing all major areas such as revenue, expenditure, assets, liabilities, and budgetary compliance. It details the specific audit procedures, timelines, and reporting requirements. 2. Limited Scope Audit Agreement: This agreement focuses on a particular aspect or area of the municipality's financial operations that require special attention or scrutiny. It may involve conducting an audit specifically for grants and contracts, internal control systems, or specific funds within the municipality. 3. Performance Audit Agreement: A performance audit determines whether the municipality's programs, activities, or operations are conducted efficiently, effectively, and in compliance with applicable laws and regulations. This agreement outlines the scope, objectives, and methodologies for conducting such an audit, which may involve reviewing specific programs or evaluating the overall performance of the municipality. 4. Compliance Audit Agreement: A compliance audit ensures that the municipality adheres to legal and regulatory requirements. It examines whether the municipality is complying with laws, regulations, and internal policies concerning fiscal matters, ethics, and legal obligations. This agreement specifies the areas to be audited, the reporting requirements, and the deliverables expected from the accounting firm. 5. Financial Statement Audit Agreement: This agreement primarily focuses on the examination of the municipality's financial statements to ensure their accuracy, completeness, and compliance with Generally Accepted Accounting Principles (GAAP) or other relevant accounting standards. It details the audit procedures, timelines, and the responsibilities of both the accounting firm and the municipality in preparing financial statements. These Washington Agreement for Auditing Services enable municipalities to engage the services of qualified accounting firms to enhance financial accountability, improve governance, and ensure compliance with legal and regulatory requirements. By collaborating with experienced auditors, municipalities can ensure the integrity and reliability of their financial processes and safeguard public funds.

Washington Agreement for Auditing Services between Accounting Firm and Municipality

Description

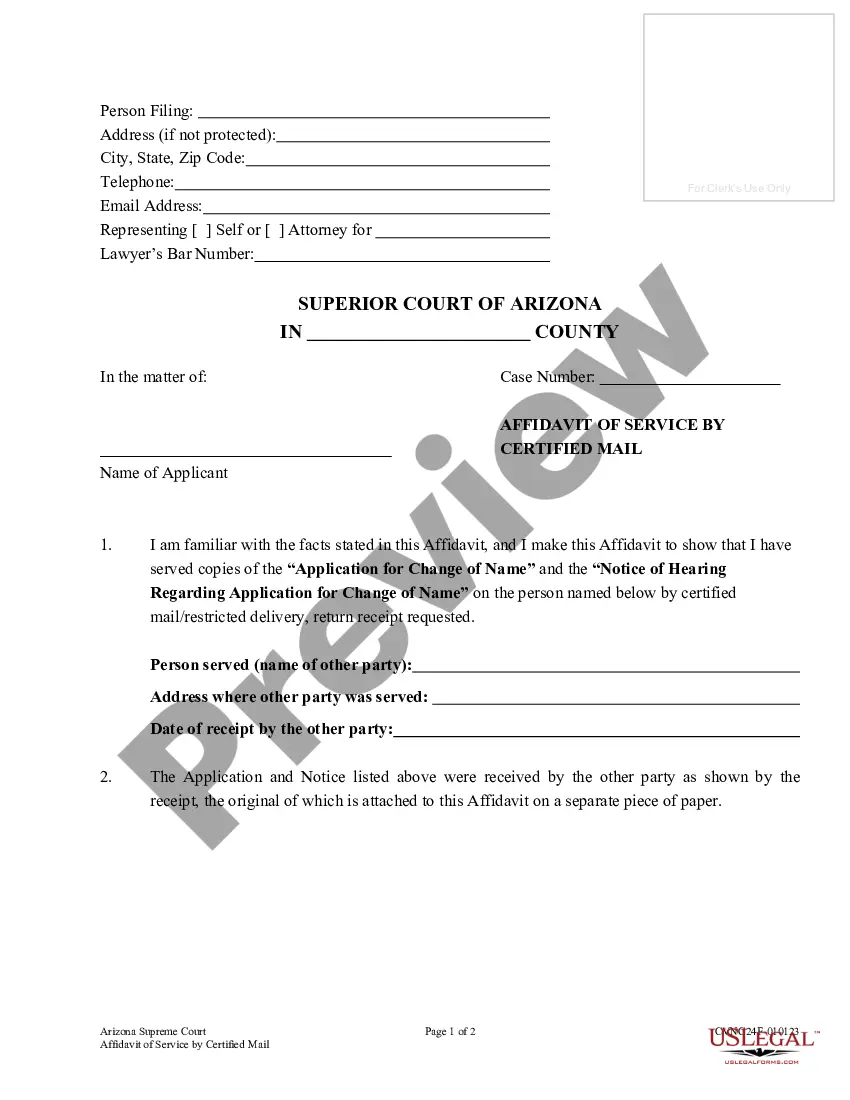

How to fill out Washington Agreement For Auditing Services Between Accounting Firm And Municipality?

US Legal Forms - among the most significant libraries of legitimate varieties in America - offers an array of legitimate record web templates you can down load or printing. While using internet site, you can find a huge number of varieties for organization and specific uses, sorted by categories, says, or search phrases.You can get the latest models of varieties just like the Washington Agreement for Auditing Services between Accounting Firm and Municipality in seconds.

If you already possess a registration, log in and down load Washington Agreement for Auditing Services between Accounting Firm and Municipality from your US Legal Forms library. The Down load key will show up on each and every form you view. You get access to all in the past saved varieties in the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, allow me to share easy instructions to obtain started out:

- Ensure you have selected the proper form for your town/state. Go through the Review key to examine the form`s content. Browse the form information to ensure that you have selected the correct form.

- When the form doesn`t fit your demands, take advantage of the Research industry on top of the display screen to discover the one that does.

- When you are happy with the shape, confirm your choice by clicking the Get now key. Then, select the pricing program you want and provide your references to sign up to have an profile.

- Approach the deal. Use your Visa or Mastercard or PayPal profile to accomplish the deal.

- Choose the format and down load the shape on the gadget.

- Make alterations. Fill up, edit and printing and signal the saved Washington Agreement for Auditing Services between Accounting Firm and Municipality.

Each template you put into your money lacks an expiration time and it is the one you have permanently. So, if you would like down load or printing one more copy, just go to the My Forms segment and click on around the form you require.

Obtain access to the Washington Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms, probably the most considerable library of legitimate record web templates. Use a huge number of professional and state-distinct web templates that fulfill your small business or specific needs and demands.

Form popularity

FAQ

Moreover, an audit is generally unnecessary for small nonprofits because they engage in a low number of financial transactions each year, and the veracity of their books can be checked in cheaper ways. There are two cheaper alternatives to a full-blown independent audit.

The PCAOB, which began operation in 2003, is charged with overseeing, regulating, inspecting and disciplining accounting firms in their roles as auditors of public companies. Guide to Public Company Auditing - IAS Plus iasplus.com ? aicpa ? 0905caqauditguide iasplus.com ? aicpa ? 0905caqauditguide

The Public Company Accounting Oversight Board The Sarbanes-Oxley Act of 2002 authorized the Public Company Accounting Oversight Board ("PCAOB") to establish auditing and related professional practice standards to be used by registered public accounting firms. Public Company Accounting Oversight Board; Notice of Filing ... SEC.gov ? rule-release SEC.gov ? rule-release

The Public Company Accounting Oversight Board (PCAOB) is a non-profit organization that regulates audits of publicly traded companies to minimize audit risk. The PCAOB was established at the same time as the Sarbanes-Oxley Act of 2002 to address the accounting scandals of the late 1990s.

Steps for conducting a financial audit Understand your goals. ... Decide what to include in your audit. ... Gather and organise your materials. ... Begin data analysis. ... Consider financial security. ... Examine tax reporting status. ... Compile a report.

The PCAOB The PCAOB is a nonprofit corporation established by Congress to oversee the audits of public companies in order to protect investors and further the public interest in the preparation of informative, accurate, and independent audit reports. About - PCAOB PCAOB ? about PCAOB ? about

Title I of the Sarbanes Oxley Act establishes the PCAOB as a nonprofit organization, that oversees the audits of public companies that are subject to the securities laws. The Sarbanes Oxley Act sarbanes-oxley-act.com sarbanes-oxley-act.com

Whether seeking an audit committee's permission to provide permissible tax services or other non-audit services to a public company audit client or when preparing to take a public company on as a new audit client, three important steps are: Describe, discuss, and document. Request, explain, and record.