Washington Guaranty with Pledged Collateral

Description

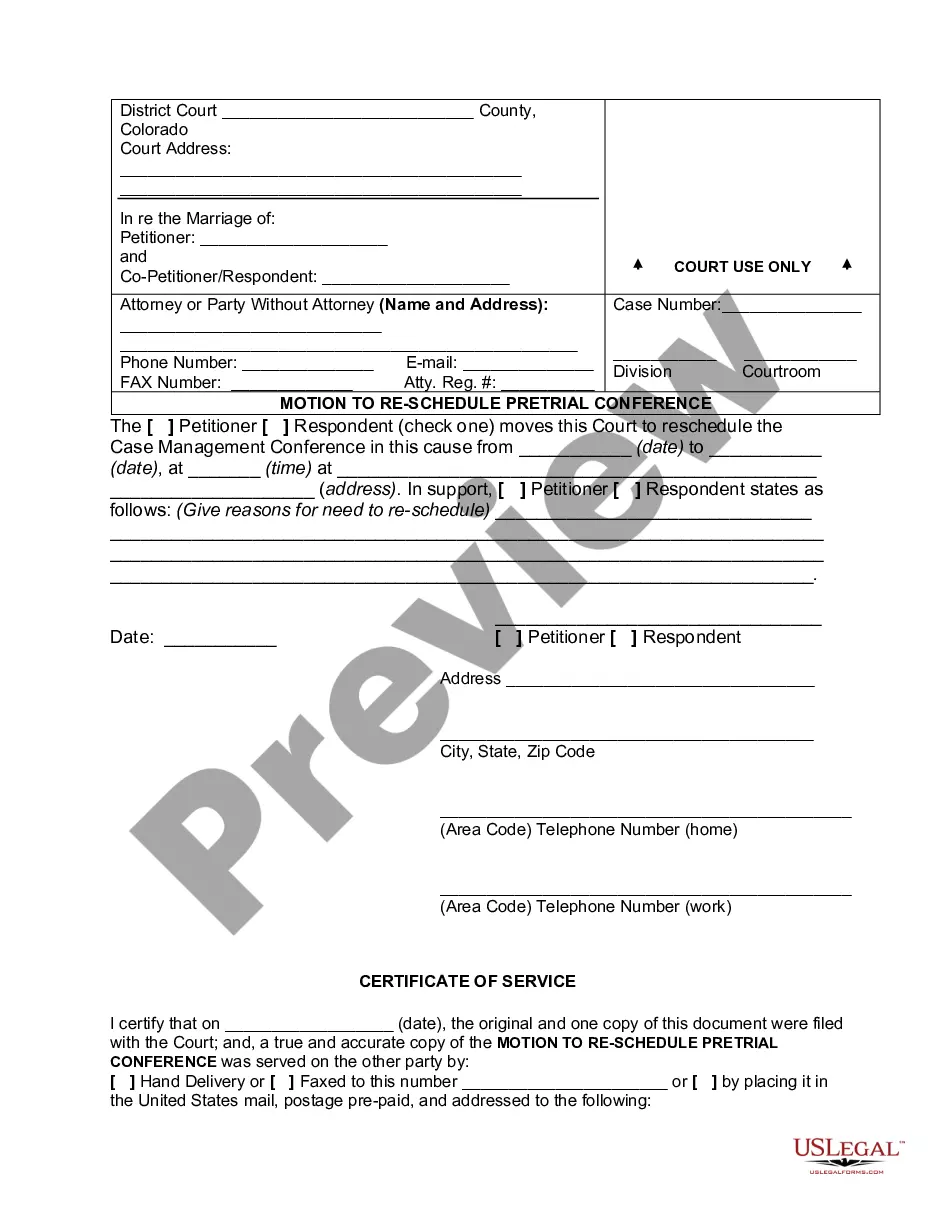

How to fill out Guaranty With Pledged Collateral?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or create.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Washington Guaranty with Pledged Collateral in moments.

If the form does not meet your requirements, use the Search field at the top of the screen to discover one that does.

Once you are satisfied with the form, affirm your choice by clicking the Acquire now button. Then, choose the payment plan you prefer and provide your credentials to register for the account.

- If you already have a subscription, Log In and download Washington Guaranty with Pledged Collateral from the US Legal Forms repository.

- The Download button will present itself on every form you examine.

- You have access to all previously saved forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you begin.

- Ensure you have chosen the correct form for the city/area.

- Select the Review button to inspect the form's content.

Form popularity

FAQ

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

Stock-Secured LoansWith a stock-based loan, you pledge shares of stock as collateral against the repayment of the loan. Typically you do not make payments until the loan is due in two to three years and any dividends paid on the shares go toward the interest and principal of the loan.

Because liquid, public stock is an acceptable form of collateral, it can easily be used for both business and personal loan guarantees against the unlikely event of default. A founding shareholder of a public company may wish to secure a large, personal loan against the value of the public stock.

Collateral, a borrower's pledge to a lender of something specific that is used to secure the repayment of a loan (see credit). The collateral is pledged when the loan contract is signed and serves as protection for the lender.

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Collateral documents include any documents granting a security interest in collateral by the borrower, parent or subsidiary in favor of the lender and all other documents required to be executed or delivered pursuant to those documents. Collateral documents do not include guaranties.

To pledge assets as collateral (or Pledging) is the act of offering assets as collateral to secure loans. Assets pledged can be in the form of security holdings and act as assurance for recovering the borrowed amount should a borrower fail to pay up.

In the holdings table, hover the cursor on the stock you want to pledge and click on 'options' and select pledge for margins . Once you do, you will get a pop-up, which will show how much margins you will be eligible for. The cost of pledging will be 20b930 + GST per scrip irrespective of the quantity pledged.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.