Washington Online Advertising Agreement for Website Hosted Ads

Description

How to fill out Online Advertising Agreement For Website Hosted Ads?

Locating the appropriate legitimate document template can be challenging.

Clearly, there are numerous formats available online, but how can you identify the correct one you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Washington Online Advertising Agreement for Website Hosted Ads, suitable for both business and personal use.

You can preview the form using the Preview option and review the form details to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Washington Online Advertising Agreement for Website Hosted Ads.

- Use your account to search for the legal documents you have previously acquired.

- Visit the My documents section of your account to obtain another copy of the document you need.

- For new users of US Legal Forms, here are some simple steps you should follow.

- First, ensure you have selected the correct form for your location/state.

Form popularity

FAQ

Choosing the best website for advertising depends on your target audience and advertising goals, but platforms like Google Ads and Facebook Ads are often recommended for their extensive reach. However, if you're specifically focusing on a Washington Online Advertising Agreement for Website Hosted Ads, consider using niche websites that align closely with your product or service. This targeted approach can yield better engagement and return on investment. Additionally, using a platform like uslegalforms can help you draft the necessary agreements to ensure smooth collaborations with advertising websites.

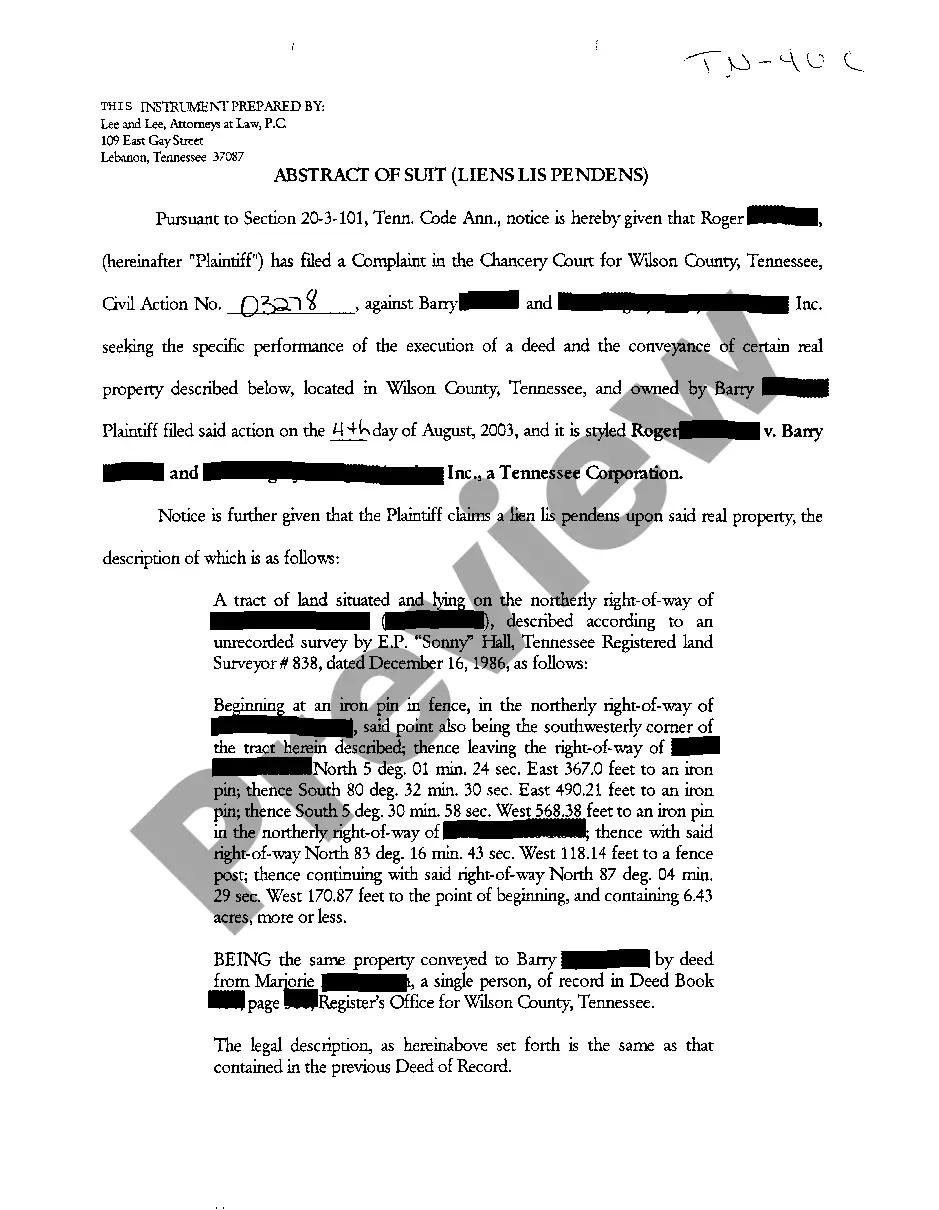

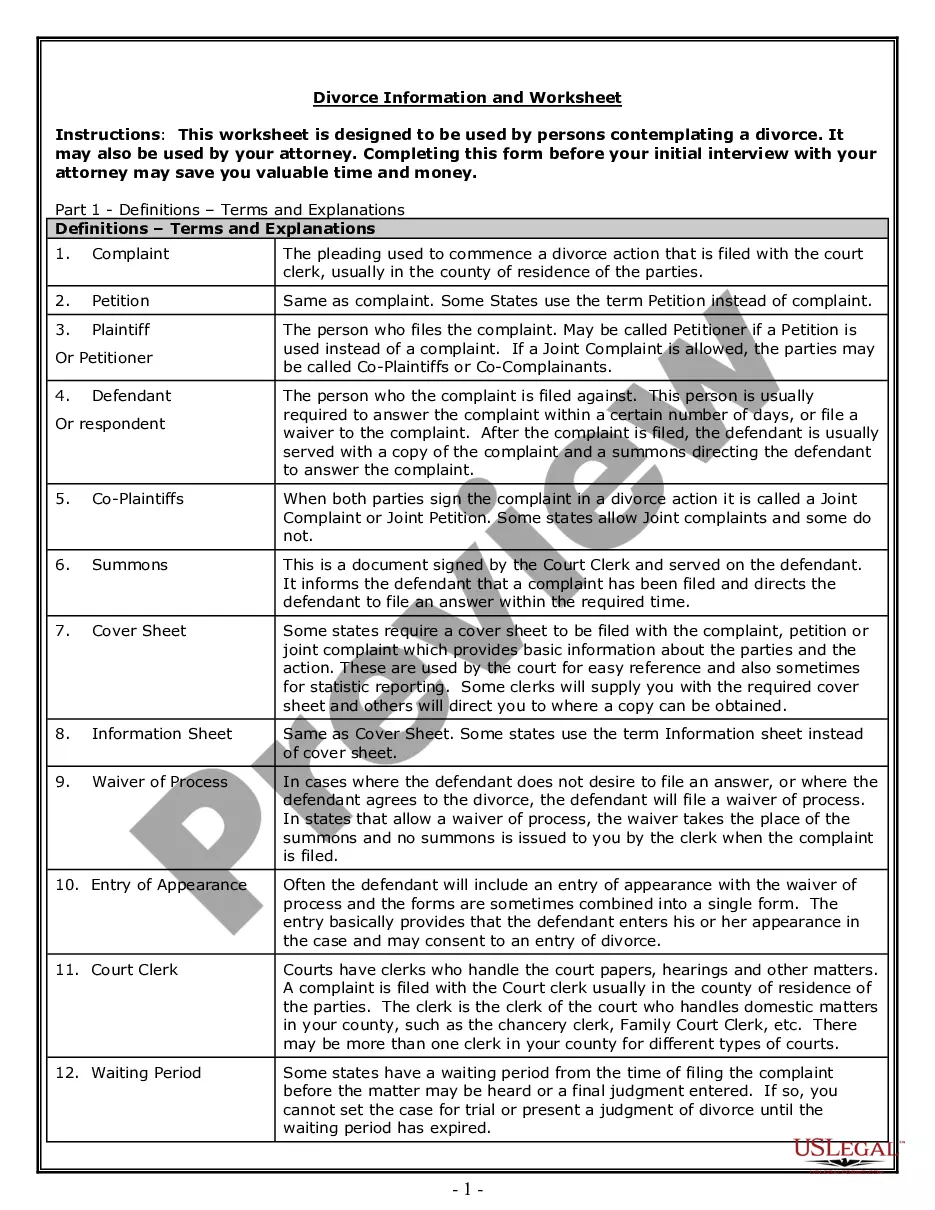

There are various types of agreements that one might encounter in the realm of advertising, including verbal agreements, written contracts, implied agreements, and mutual consent agreements. Each type serves a different purpose and covers different aspects of the relationship between advertisers and platforms. When it comes to a Washington Online Advertising Agreement for Website Hosted Ads, a written contract is preferable as it provides stability and clarity for both parties involved. Ensuring that all details are documented can significantly reduce future disputes and enhance cooperation.

The main purpose of a Washington Online Advertising Agreement for Website Hosted Ads is to clearly outline the terms and conditions under which advertising takes place. This agreement helps to protect both the advertiser and the website host by establishing expectations, responsibilities, and rights. By having a well-defined agreement, parties can avoid misunderstandings and potential conflicts. Overall, this agreement serves as a crucial tool in fostering a successful advertising relationship.

Yes, in Washington state, advertising services are generally subject to sales tax. This applies to a range of advertising services, including those marketed through online platforms. When entering into a Washington Online Advertising Agreement for Website Hosted Ads, always confirm the specific tax treatment of your advertising services to avoid surprises down the line.

Yes, website hosting services are considered taxable in Washington state. This includes the provision of server space for host websites or applications. As you create your Washington Online Advertising Agreement for Website Hosted Ads, factor in the sales tax obligations that may arise from hosting services to maintain compliance.

Sales tax in Washington applies to tangible personal property and certain specified services. This includes retail sales, repairs, and installation services involving physical goods. When managing online ads or crafting a Washington Online Advertising Agreement for Website Hosted Ads, consider how your services interface with the product sales tax regulations to ensure compliance.

Several services are not subject to sales tax in Washington, including some professional services like legal and accounting. Additionally, personal services and certain educational services may also be exempt. When drafting a Washington Online Advertising Agreement for Website Hosted Ads, it’s crucial to classify your services accurately to avoid unnecessary tax obligations.

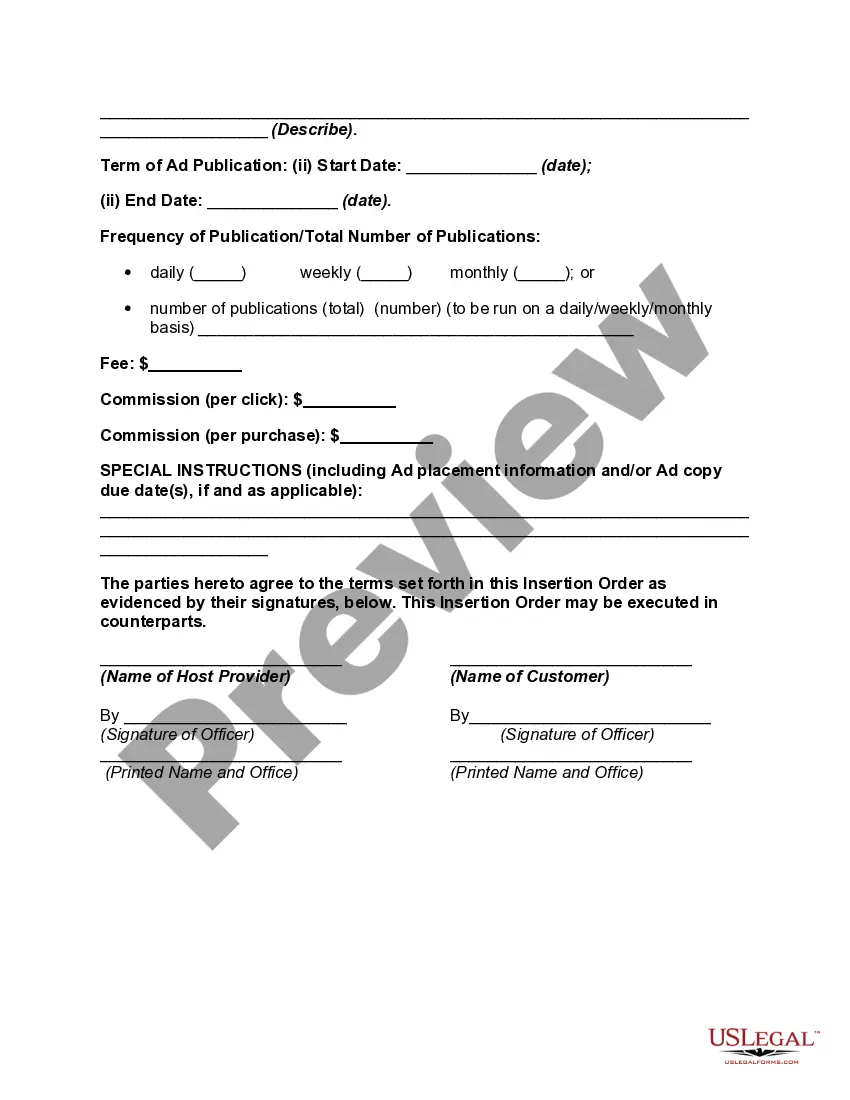

Writing an advertising contract involves several key steps. Start by clearly defining the terms of the agreement, including the services offered, payment structure, and duration of the contract. Using a platform like USLegalForms can simplify this process, especially when crafting a Washington Online Advertising Agreement for Website Hosted Ads, to ensure all legal aspects are covered.

Digital media in Washington is generally considered taxable. This includes items like digital downloads and online subscriptions. However, when you create a Washington Online Advertising Agreement for Website Hosted Ads, consider carefully how your services are structured, as different components may have different tax implications.

In Washington, certain items and services are exempt from sales tax, which can include food and some medical supplies. Additionally, nonprofits and government entities can benefit from sales tax exemptions. If you are engaging in an online advertising agreement for website hosted ads, be sure to clarify your tax obligations, as they may differ based on the specific services provided.