Washington Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

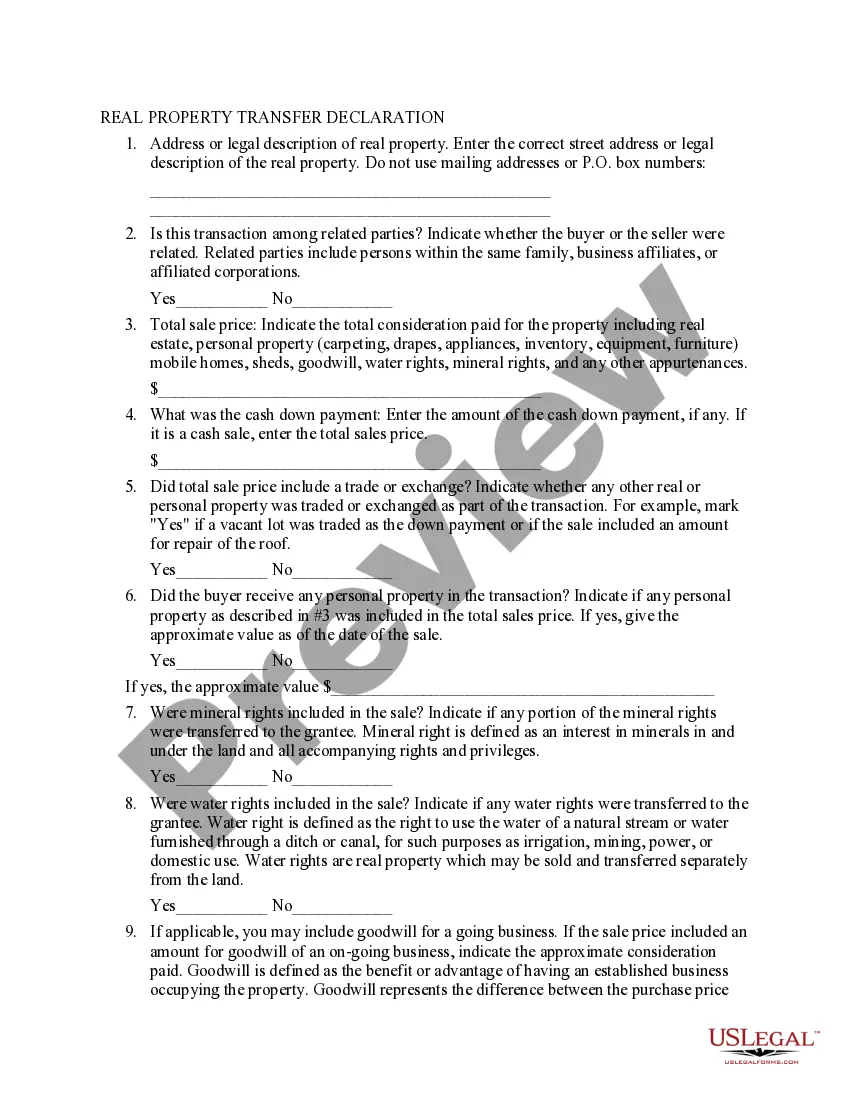

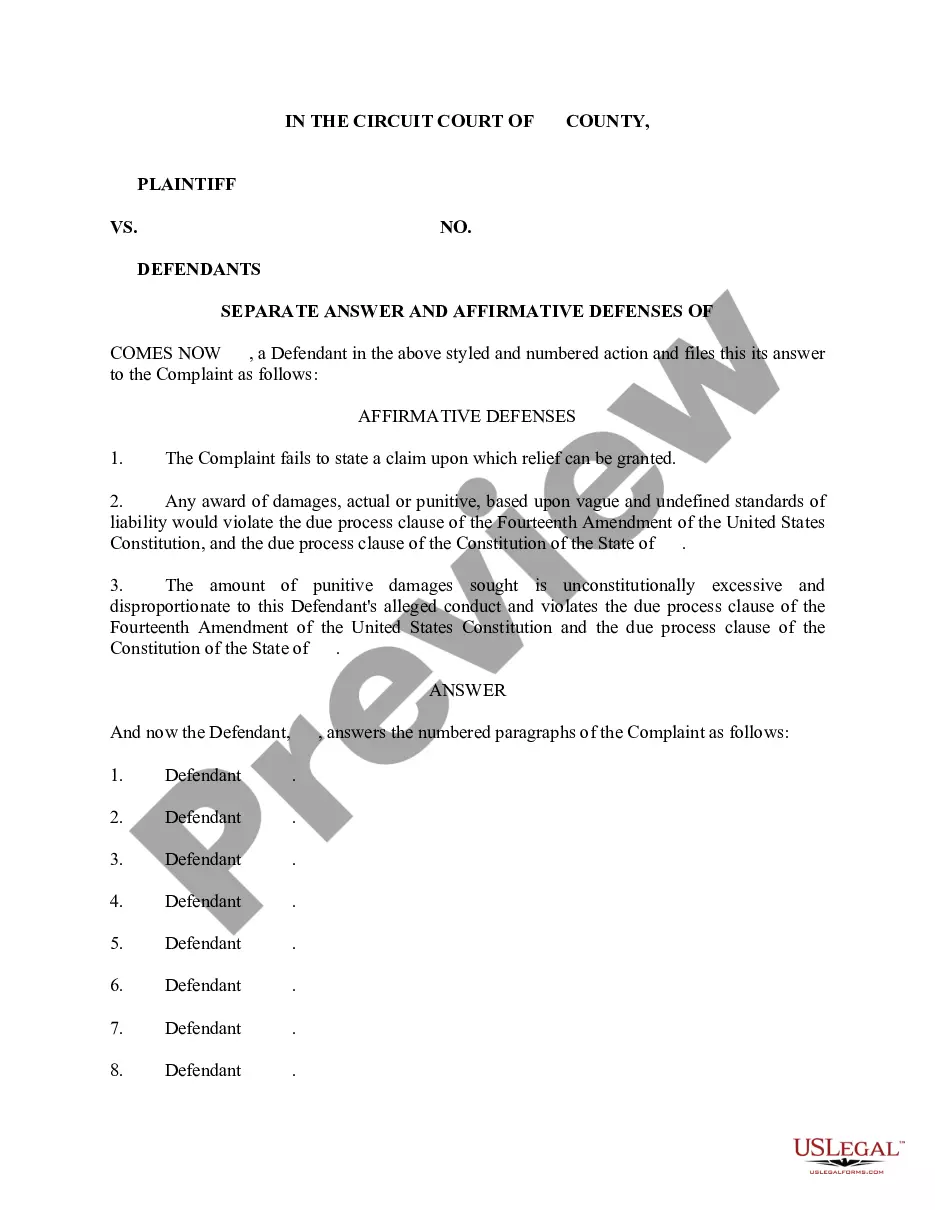

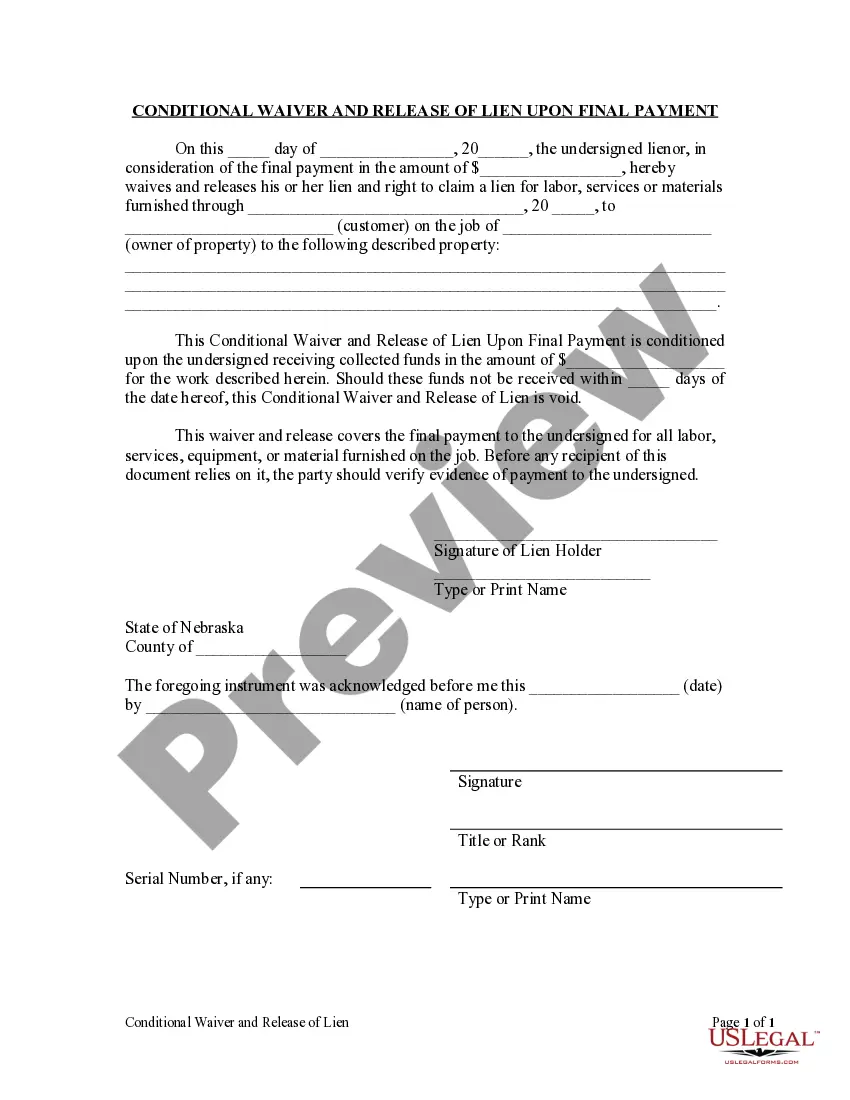

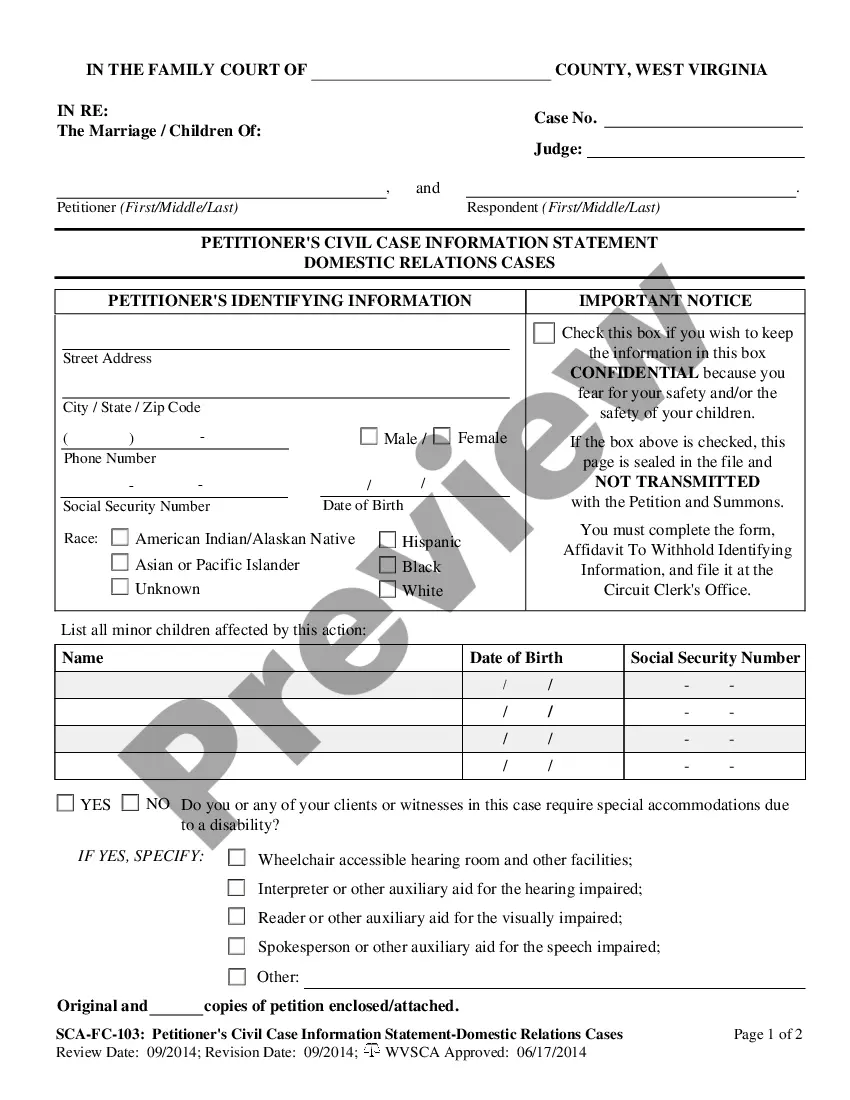

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

If you have to total, down load, or print out authorized record templates, use US Legal Forms, the greatest selection of authorized kinds, that can be found on-line. Use the site`s simple and easy handy research to obtain the files you will need. Numerous templates for company and person functions are sorted by groups and says, or search phrases. Use US Legal Forms to obtain the Washington Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage in just a few click throughs.

When you are presently a US Legal Forms client, log in for your accounts and then click the Down load button to get the Washington Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage. You can also access kinds you earlier acquired in the My Forms tab of your respective accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for your right metropolis/land.

- Step 2. Make use of the Review option to examine the form`s content material. Do not neglect to read the information.

- Step 3. When you are not happy using the develop, utilize the Search area near the top of the monitor to discover other models of the authorized develop format.

- Step 4. Once you have discovered the form you will need, select the Acquire now button. Pick the pricing strategy you choose and put your qualifications to sign up for an accounts.

- Step 5. Approach the deal. You should use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Choose the formatting of the authorized develop and down load it on the product.

- Step 7. Comprehensive, revise and print out or indicator the Washington Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

Every single authorized record format you acquire is the one you have forever. You have acces to every develop you acquired inside your acccount. Click on the My Forms section and select a develop to print out or down load yet again.

Contend and down load, and print out the Washington Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage with US Legal Forms. There are millions of skilled and condition-distinct kinds you may use for the company or person requires.

Form popularity

FAQ

California law generally prohibits a deficiency judgment following the short sale of a residential property with no more than four units. Junior lienholders are also prohibited from pursuing a deficiency judgment if they agree to the short sale and they receive proceeds as agreed. (Cal. Code Civ.

If a foreclosure is nonjudicial, the foreclosing lender must file a lawsuit following the foreclosure to get a deficiency judgment. On the other hand, with a judicial foreclosure, most states allow the lender to seek a deficiency judgment as part of the underlying foreclosure lawsuit.

In a judicial foreclosure, the lender can get a deficiency judgment to collect any money they're owed after the sale. In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder.

In return for the lender having the power to sell the property, the Power of Sale clause protects the borrower by stating that when the lender sells the property, the lender may not hold the borrower liable for any cost not covered by the sale unless the lender is able to obtain a deficiency judgment in their favor, ...

In California, if you owe money secured with a purchase money mortgage or deed of trust (e.g. the money was used to purchase the dwelling) the holder of the Deed of Trust or Mortgage is prohibited from seeking to collect on the Note any sums more than it recovers from foreclosure even if the sums from foreclosure are ...

Primary tabs. Deficiency judgment is money awarded to creditors when assets securing a loan do not cover the debt owed by a debtor. When a debtor becomes insolvent, a creditor can repossess the asset securing the loan, and then sell the asset to recover the debt.

Some states, including Washington, have anti-deficiency laws that prohibit deficiency judgments in some circumstances.