Washington Subrogation Agreement between Insurer and Insured

Description

How to fill out Subrogation Agreement Between Insurer And Insured?

US Legal Forms - one of the largest libraries of authorized varieties in the United States - delivers a wide array of authorized file themes you can download or print. Utilizing the site, you will get thousands of varieties for enterprise and specific uses, sorted by types, suggests, or key phrases.You will discover the most recent variations of varieties like the Washington Subrogation Agreement between Insurer and Insured in seconds.

If you have a registration, log in and download Washington Subrogation Agreement between Insurer and Insured from your US Legal Forms library. The Obtain key will show up on every single develop you look at. You have accessibility to all in the past downloaded varieties from the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed here are easy recommendations to obtain began:

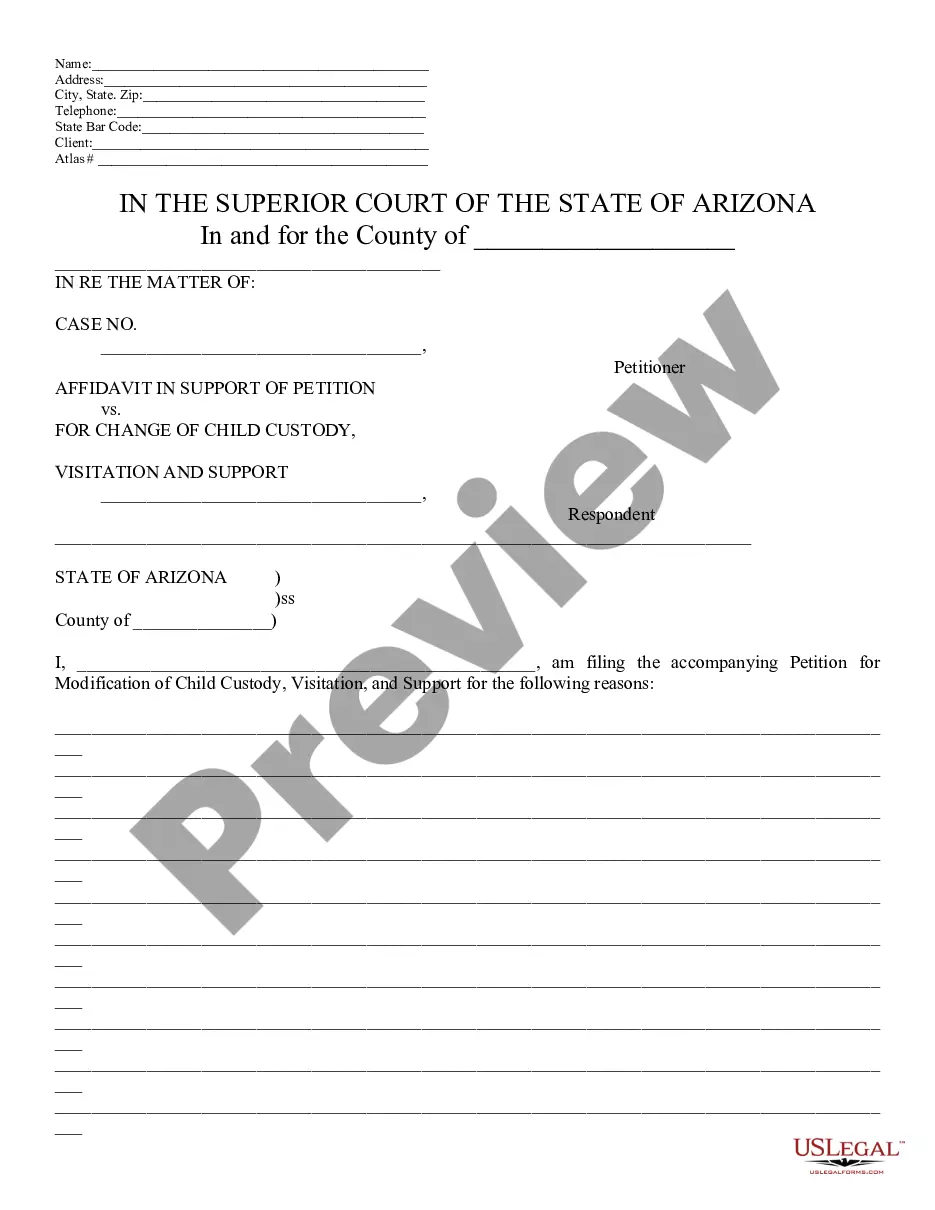

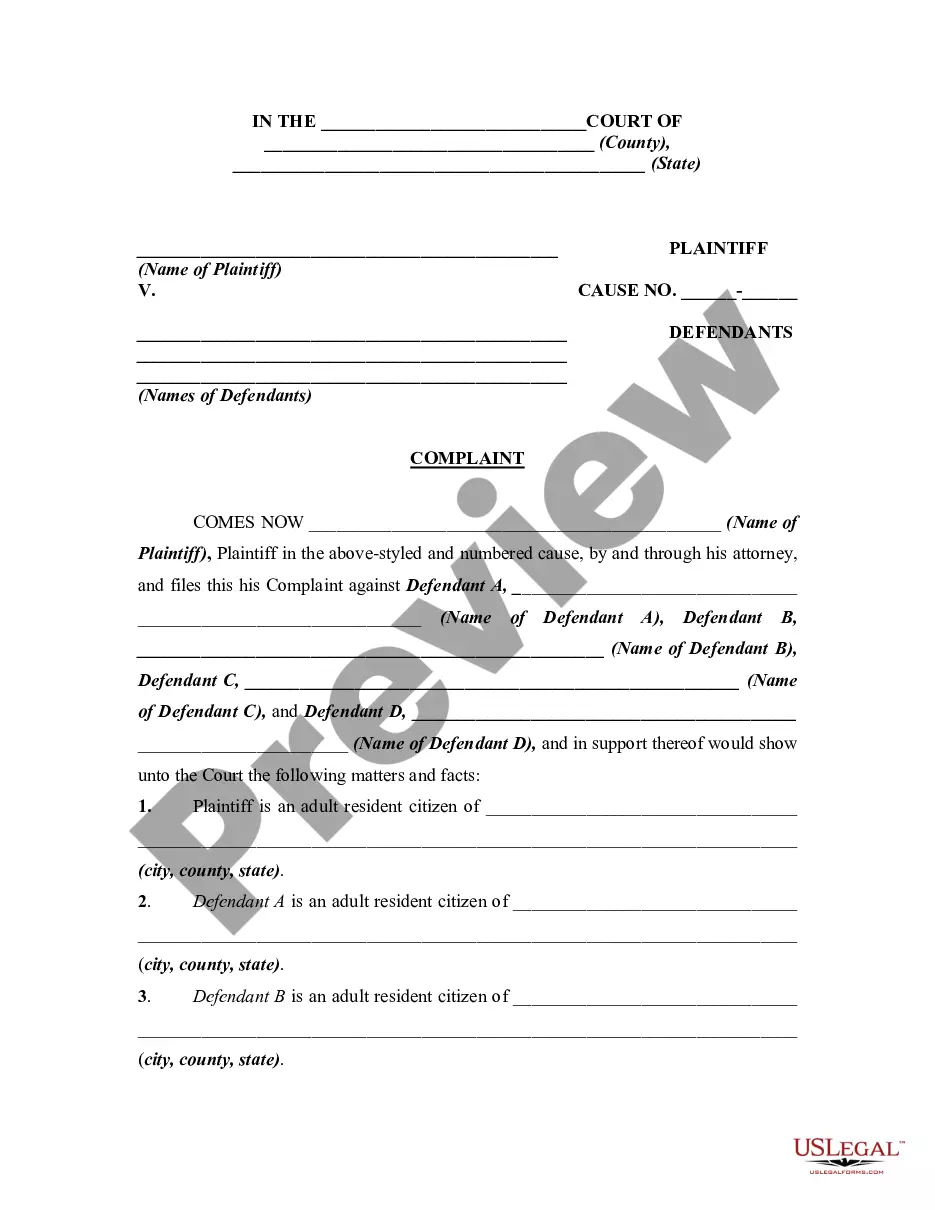

- Make sure you have selected the proper develop for the metropolis/region. Select the Preview key to examine the form`s information. Browse the develop description to actually have chosen the correct develop.

- When the develop doesn`t match your demands, use the Search discipline towards the top of the monitor to obtain the one that does.

- In case you are satisfied with the form, validate your choice by visiting the Buy now key. Then, choose the rates plan you prefer and give your references to register for an profile.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the formatting and download the form on your system.

- Make modifications. Fill out, revise and print and indicator the downloaded Washington Subrogation Agreement between Insurer and Insured.

Each and every web template you included in your account does not have an expiry time and is also yours for a long time. So, if you wish to download or print an additional duplicate, just proceed to the My Forms segment and then click about the develop you want.

Get access to the Washington Subrogation Agreement between Insurer and Insured with US Legal Forms, one of the most considerable library of authorized file themes. Use thousands of specialist and state-certain themes that meet your organization or specific demands and demands.

Form popularity

FAQ

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

The rule of subrogation known as the ?Sutton Rule? states that a tenant and landlord are automatically considered ?co-insureds? under a fire insurance policy as a matter of law and, therefore, the insurer of the landlord who pays for the fire damage caused by the negligence of a tenant may not sue the tenant in ...

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.