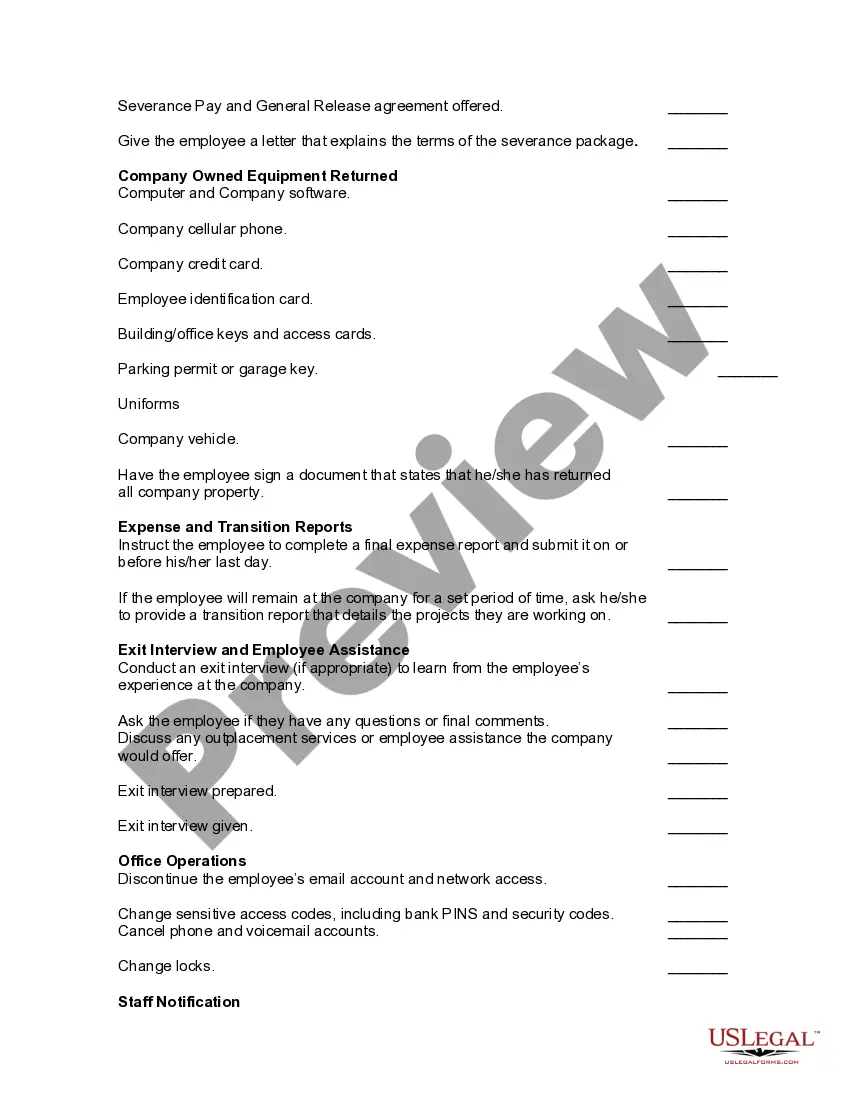

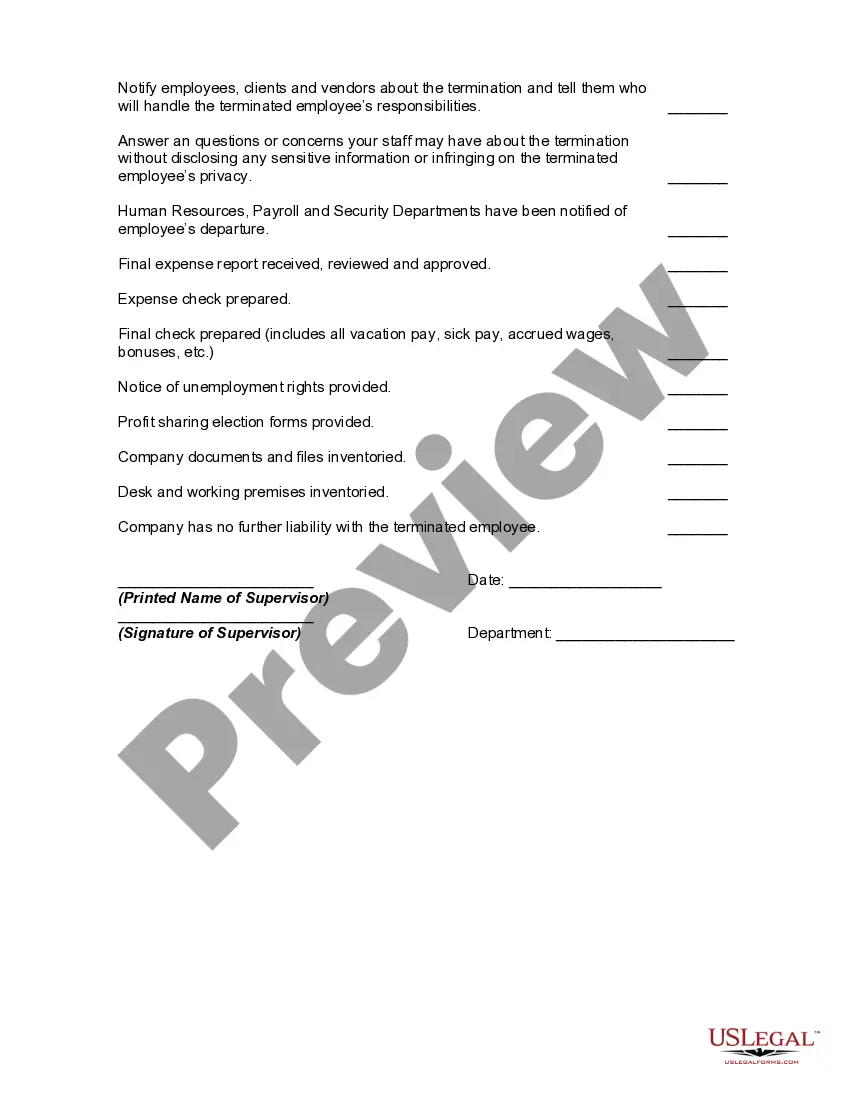

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Washington Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

Are you presently in a location where you frequently require documents for either business or specific needs almost every day.

There are numerous authentic document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template forms, such as the Washington Worksheet - Termination of Employment, which are designed to comply with federal and state regulations.

Once you locate the correct form, simply click Buy now.

Select the pricing plan you prefer, fill in the required details to process your payment, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Washington Worksheet - Termination of Employment template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to view the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn't what you're looking for, utilize the Search field to find a form that fits your needs.

Form popularity

FAQ

Your employer is not required to keep you on as an employee when you give 2 weeks notice. Washington state is an at-will employment state, which you may have heard about.

Wrongful termination is a legal phrase that means that an employer fired an employee and broke a law in the process.

Are termination letters required? Most companies are not required by law to give employees letters of termination. The exceptions are those located in Arizona, California, Illinois and New Jersey. Most employers, however, do provide termination letters as a professional courtesy and a legal record.

Employment Security (ES) Reference NumberYou can find your ES Reference Number online or on the Tax Rate Notice mailed by the WA State Employment Security Department.If you're unsure, contact the agency at (855) 829-9243.

If you have employees working in Washington, you likely must pay unemployment taxes on their wages in this state. Tax reports or tax and wage reports are due quarterly. Liable employers must submit a tax report every quarter, even if there are no paid employees that quarter and/or taxes are unable to be paid.

You'll essentially need two kinds of paperwork: documents you need to gather before you actually fire the person (such as their hours worked and paid-time-off balances due), and documents you'll need to bring to the termination meeting itself such as a severance agreement or their final paycheck.

The UI tax funds unemployment compensation programs for eligible employees. In Washington, state UI tax is one of the primary taxes that employers must pay.

Officers who provide services in Washington are automatically exempt from unemployment insurance unless the employer specifically requests to cover them. The law applies only to corporations. This law took effect December 29, 2013. 2.

Q. Is it legal for a worker to be fired from their job without any notice? A. The law does not require employers to give a worker notice before terminating their job.

Businesses may fire any employee at any time, for any or no reason, as long as they are not violating any employee protection laws. However, workers may request the reason for discharge by sending a written request to the business for a signed written statement of the reason for discharge and the effective date.