Washington Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

Are you in a placement the place you need to have documents for possibly enterprise or person reasons just about every day? There are tons of lawful record layouts available on the Internet, but locating versions you can trust isn`t simple. US Legal Forms provides 1000s of develop layouts, much like the Washington Sample Letter for Note and Deed of Trust, that are written to fulfill federal and state needs.

When you are presently informed about US Legal Forms site and have an account, merely log in. Next, it is possible to obtain the Washington Sample Letter for Note and Deed of Trust template.

Should you not provide an account and wish to begin to use US Legal Forms, follow these steps:

- Discover the develop you need and ensure it is for that appropriate city/state.

- Use the Preview key to check the shape.

- Look at the description to ensure that you have selected the appropriate develop.

- When the develop isn`t what you`re searching for, use the Search discipline to find the develop that meets your requirements and needs.

- If you obtain the appropriate develop, click Get now.

- Choose the prices strategy you would like, fill in the necessary details to produce your money, and buy your order with your PayPal or Visa or Mastercard.

- Choose a convenient file file format and obtain your copy.

Find each of the record layouts you may have purchased in the My Forms food selection. You can get a more copy of Washington Sample Letter for Note and Deed of Trust at any time, if needed. Just click on the essential develop to obtain or print the record template.

Use US Legal Forms, one of the most considerable assortment of lawful forms, in order to save time as well as prevent mistakes. The services provides expertly made lawful record layouts which can be used for an array of reasons. Make an account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

An installment note is usually payable monthly and matures a later date. A demand note is due immediately upon its execution. Copper Creek addressed installment notes and is the focus here. Promissory notes and deeds of trust are subject to Washington's six-year statute of limitations.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

(1) The trustee of record shall reconvey all or any part of the property encumbered by the deed of trust to the person entitled thereto on written request of the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

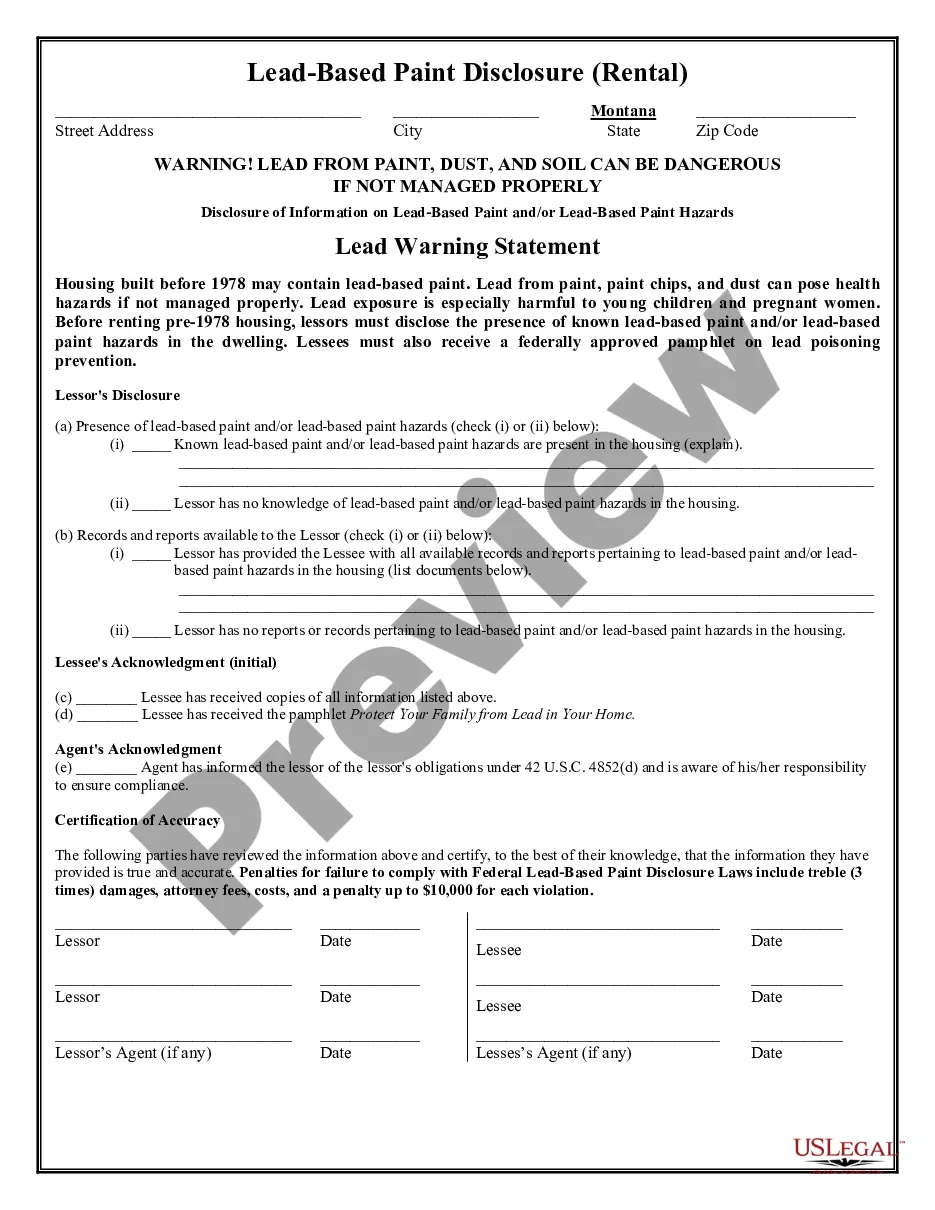

Deed of Trust and Promissory Note for Real Estate Located in Washington. A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender ing to terms defined in an attached promissory note.

In such event and upon written request of Beneficiary, Trustee shall sell the trust property, in ance with the Deed of Trust Act of the State of Washington, at public auction to the highest bidder. Any person except Trustee may bid at Trustee's sale.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.