Washington Checklist - Key Employee Life Insurance

Description

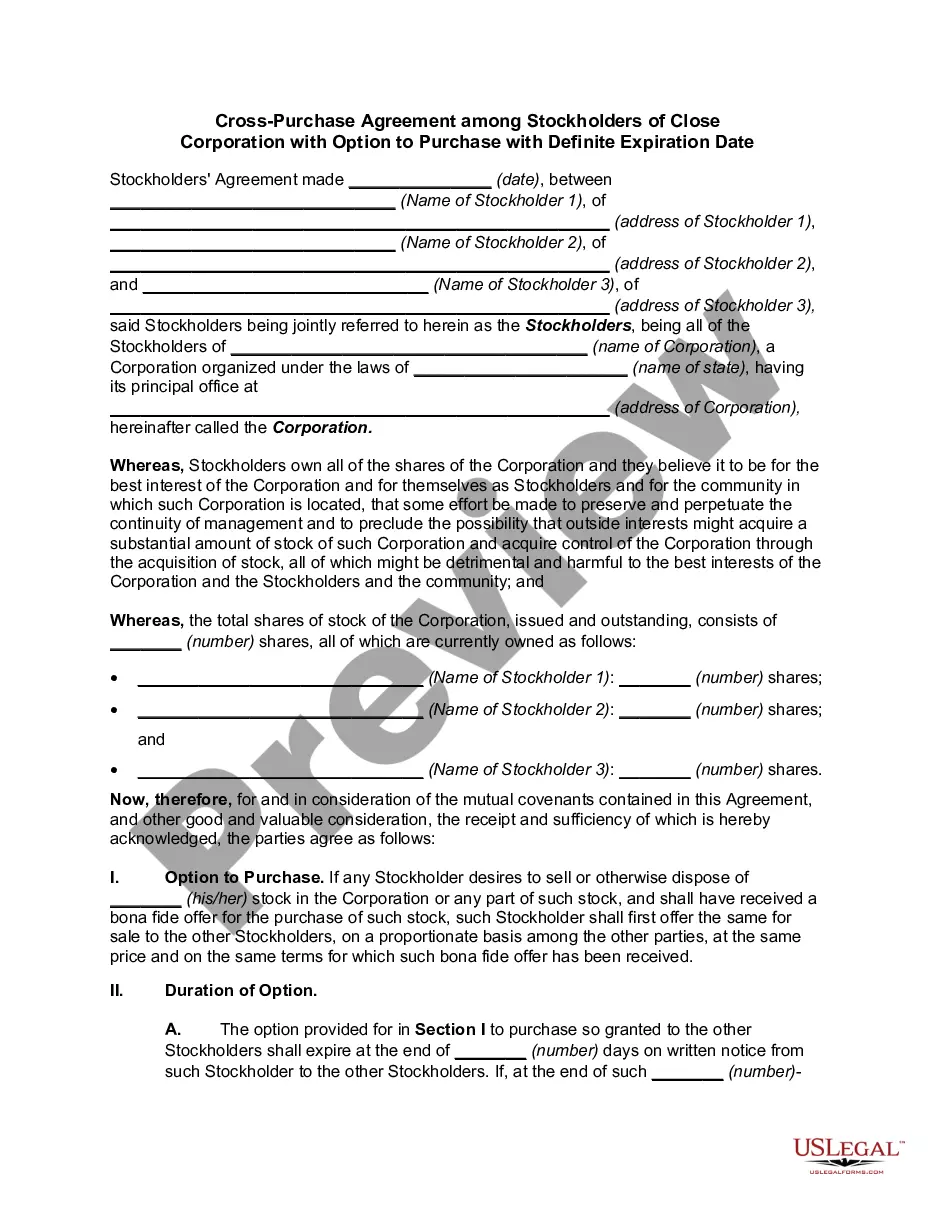

Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

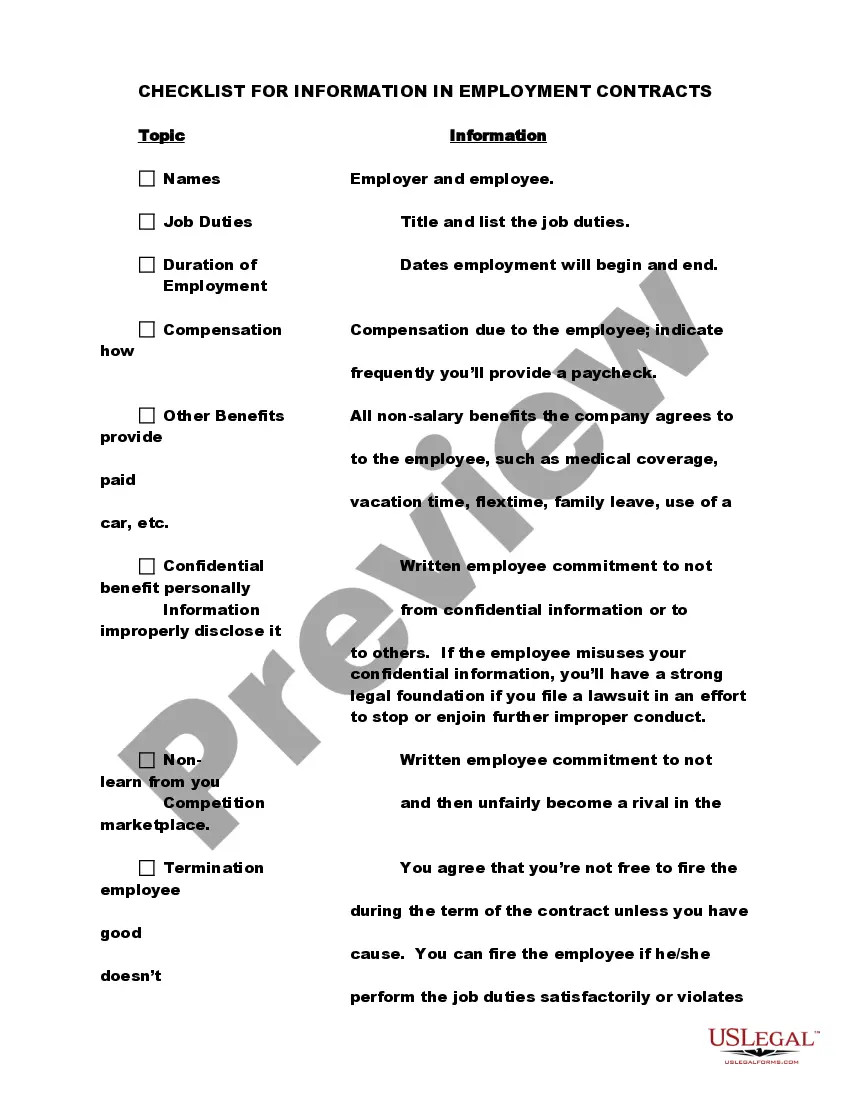

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

How to fill out Checklist - Key Employee Life Insurance?

You can spend effort online attempting to locate the authentic document format that meets the state and federal requirements you require.

US Legal Forms offers countless authentic templates that can be examined by experts.

You can obtain or print the Washington Checklist - Key Employee Life Insurance from the service.

To search for another version of the template, use the Search field to find the format that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Washington Checklist - Key Employee Life Insurance.

- Every authentic document format you receive is yours to keep indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If it's your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your chosen county/city.

- Check the form details to confirm you have selected the correct template.

Form popularity

FAQ

Typically, you should list individuals who are important to your financial stability and well-being as beneficiaries. This often includes family members like spouses, children, or trusted friends. It’s essential to name someone who would responsibly use the funds to meet their needs. Also, the Washington Checklist - Key Employee Life Insurance offers valuable guidance on making these decisions.

You may want to avoid naming minors or individuals who may not be financially responsible as beneficiaries. It's also wise to consider naming someone who is willing to manage the funds effectively and in accordance with your wishes. Additionally, if the relationship is estranged or strained, reconsider naming that person. The Washington Checklist - Key Employee Life Insurance highlights these considerations for your benefit.

To list someone as a beneficiary, access your life insurance policy documents. Clearly write their name, relationship to you, and any necessary personal details. If there are multiple beneficiaries, delineate percentages they will receive. This process would be easier with resources like the Washington Checklist - Key Employee Life Insurance.

Completing a life insurance claim form requires you to provide specific details related to the deceased’s policy. Begin by including the policy number, the insured's name, and the date of death. Next, ensure you attach any required documentation, such as the death certificate. Using tools like the Washington Checklist - Key Employee Life Insurance can help streamline this form-filling process.

To fill out a beneficiary for life insurance, you should start by gathering the necessary information about the person you wish to designate. Include their full name, date of birth, and relationship to you. It's important to specify whether they are a primary or contingent beneficiary. Utilizing the Washington Checklist - Key Employee Life Insurance can guide you through this process smoothly.

Life insurance is taken out on a key employee to ensure business continuity in the face of an unexpected loss. This financial cushion allows a company to manage debts, cover operational costs, and find a suitable replacement without financial strain. Furthermore, this insurance reassures stakeholders about the business's resilience despite personnel changes. Explore the Washington Checklist - Key Employee Life Insurance to realize the full benefits and secure your business's future.

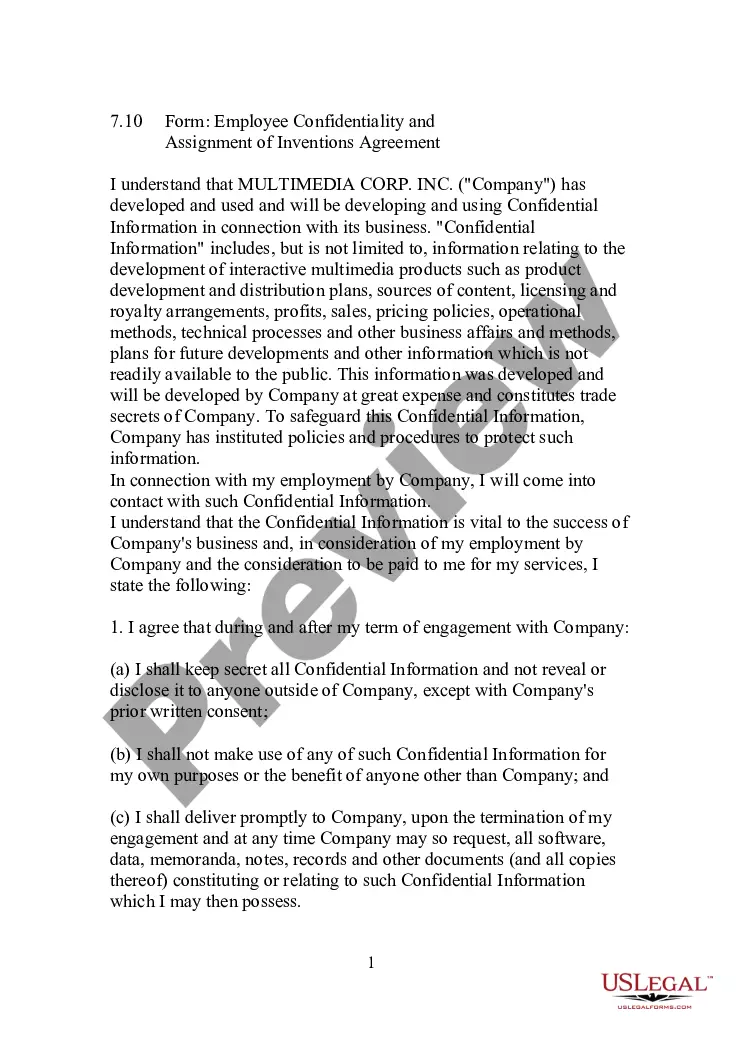

Key employee life insurance is a coverage designed for companies to protect themselves against the loss of an important employee. This type of insurance ensures that the business can sustain itself financially while dealing with the consequences of losing a critical member of the team. By securing this insurance, businesses can focus on growth and stability without the looming fear of financial instability caused by sudden employee loss. The Washington Checklist - Key Employee Life Insurance can help you understand the specifics.

A key employee life insurance policy is a type of insurance that provides financial coverage for a business in the event of an essential employee’s death. The company pays the premiums, and upon the employee's passing, the business receives a payout to help cover the financial impact of their loss. This coverage often helps with recruitment, training new hires, and maintaining stability during transitions. Reviewing the Washington Checklist - Key Employee Life Insurance can guide you in choosing the right policy.

A business may use a key person life insurance policy to safeguard against the financial impact of losing a critical employee. This policy provides funds that can help cover lost revenue and hire a replacement. Utilizing a Washington Checklist - Key Employee Life Insurance ensures that your business is well-prepared for any unforeseen circumstances.

In Washington state, life insurance payouts are generally not subject to income tax. However, estate taxes may apply depending on the overall estate value if the insured's estate exceeds a certain threshold. Understanding these nuances through resources like the Washington Checklist - Key Employee Life Insurance can help you plan effectively.