Washington Agreement to Provide Part-Time Custodial Services to a Church

Description

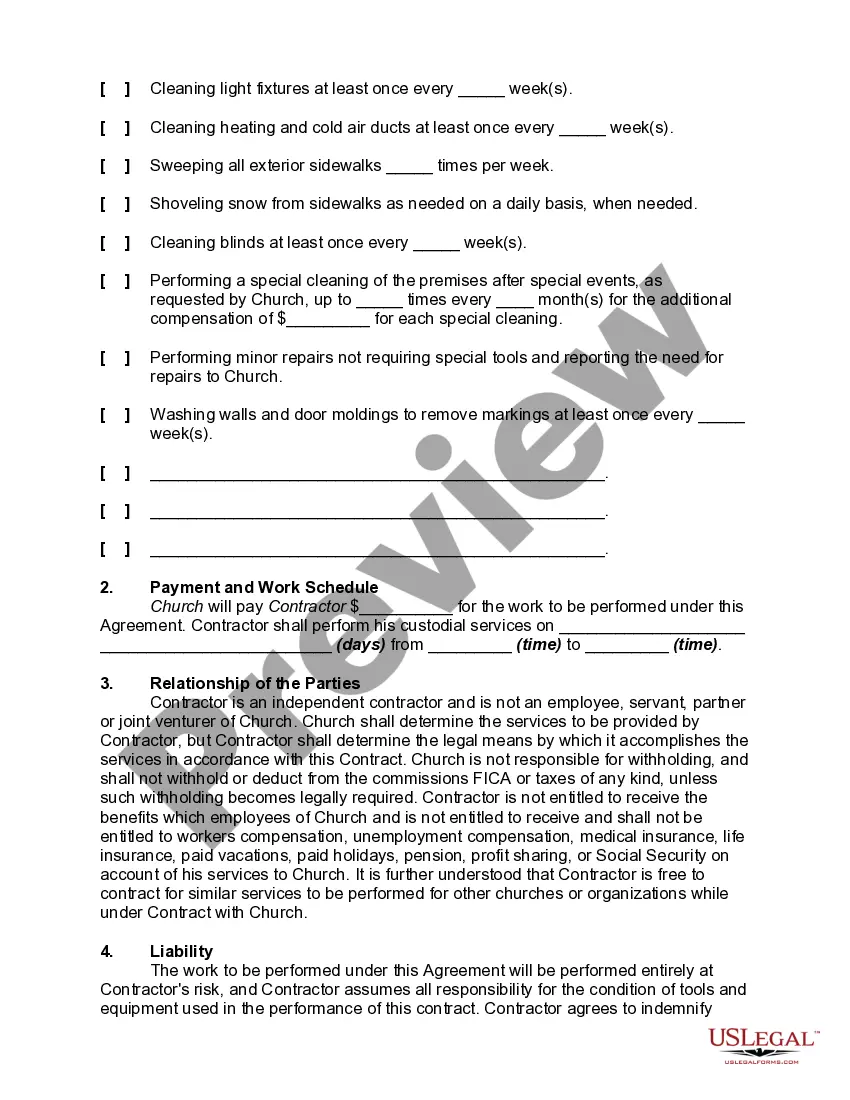

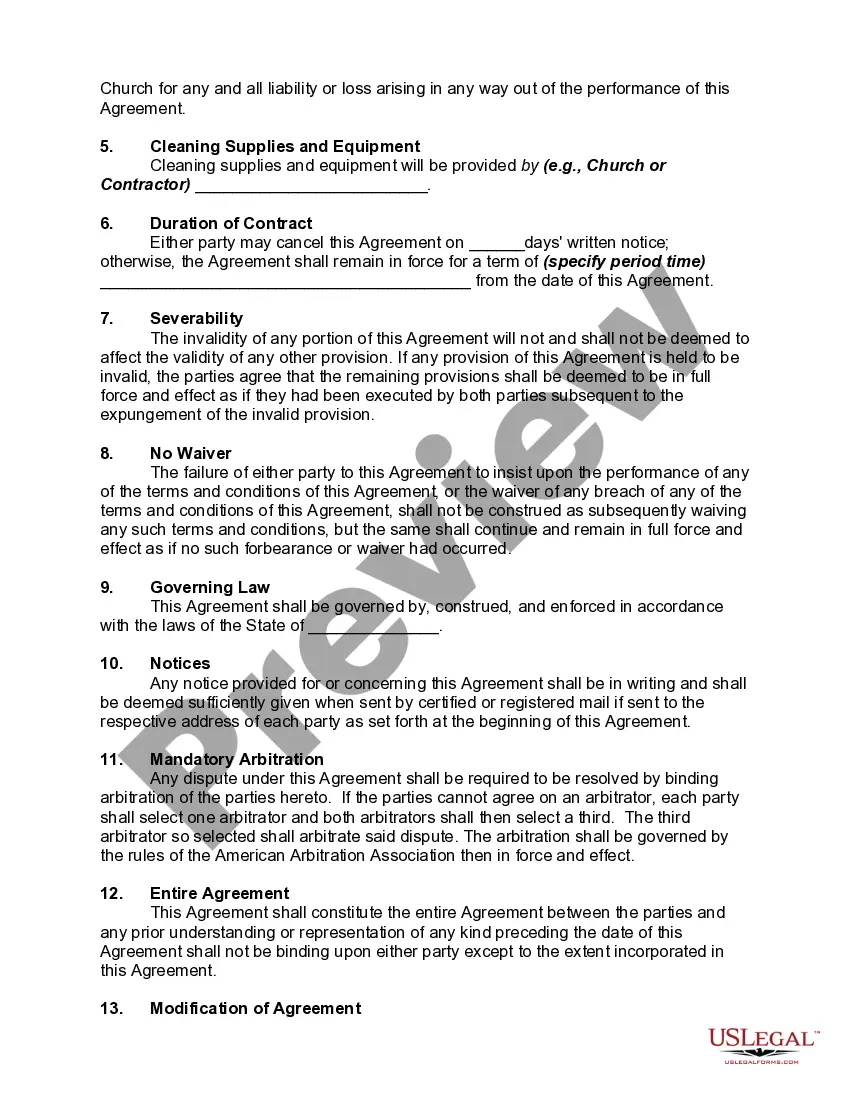

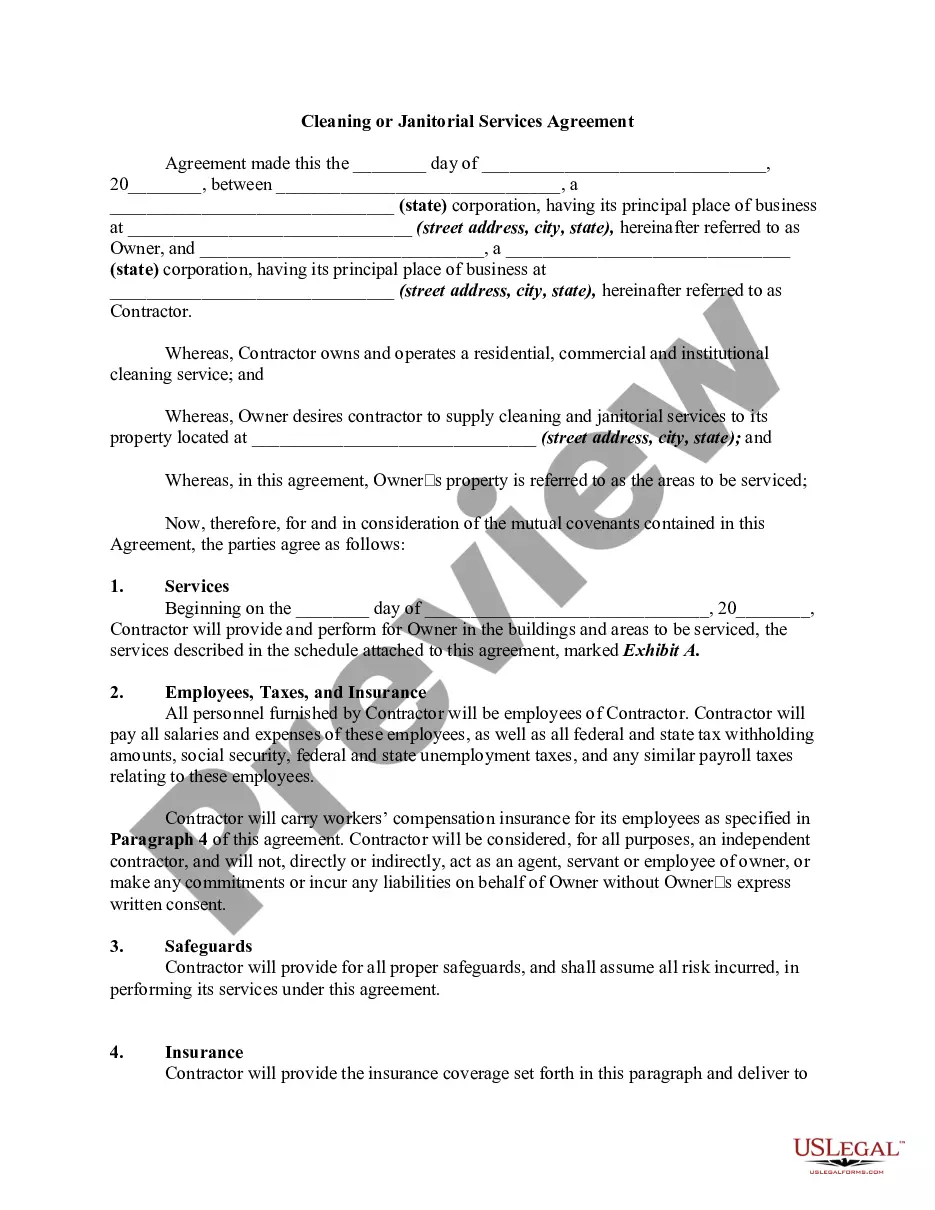

How to fill out Agreement To Provide Part-Time Custodial Services To A Church?

US Legal Forms - one of the most prominent collections of legal templates in the United States - provides an extensive array of legal document formats available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the most recent versions of forms such as the Washington Agreement to Provide Part-Time Custodial Services to a Church in no time.

Check the form description to confirm that you have selected the right document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you have a monthly subscription, Log In to download the Washington Agreement to Provide Part-Time Custodial Services to a Church from the US Legal Forms library.

- The Download option will appear on every document you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the form’s details.

Form popularity

FAQ

The Child and Dependent Care Credit is a federal tax benefit that helps families pay expenses for child care needed to work or to look for work. The credit also is available to families that must pay for the care of an incapacitated spouse or an adult dependent.

Calculating the Child and Dependent Care Credit until 2020 The maximum amount of qualified expenses you're allowed to calculate the credit is: $3,000 for one qualifying person. $6,000 for two or more qualifying persons.

A Dependent Care Flexible Spending Account (DCFSA) is a pretax benefit that allows reimbursement for qualified dependent care expenses. Qualified expenses include care for a dependent child under the age of 13 and/or care for your spouse or adult dependent who is physically or mentally unable to care for themselves.

To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person.

The IRS goes about verifying a provider's income by evaluating contracts, sign-in sheets, child attendance records, bank deposit records and other income statements. Generally, the actual method the IRS uses to verify a child-care provider's income is determined on a case-by-case basis.

To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person.

For 2021 only, the total expenses that you may use to calculate the credit may not be more than $8,000 (for one qualifying individual) or $16,000 (for two or more qualifying individuals).

The IRS goes about verifying a provider's income by evaluating contracts, sign-in sheets, child attendance records, bank deposit records and other income statements. Generally, the actual method the IRS uses to verify a child-care provider's income is determined on a case-by-case basis.

Child care expenses means amounts paid by the family for the care of minors under 13 years of age where such care is necessary to enable a family member to be employed or for a household member to further his/her education.

The Child and Dependent Care Credit can be worth from 20% to 35% of some or all of the dependent care expenses you paid. The percentage you use depends on your income. If your income is below $15,000, you will qualify for the full 35%.