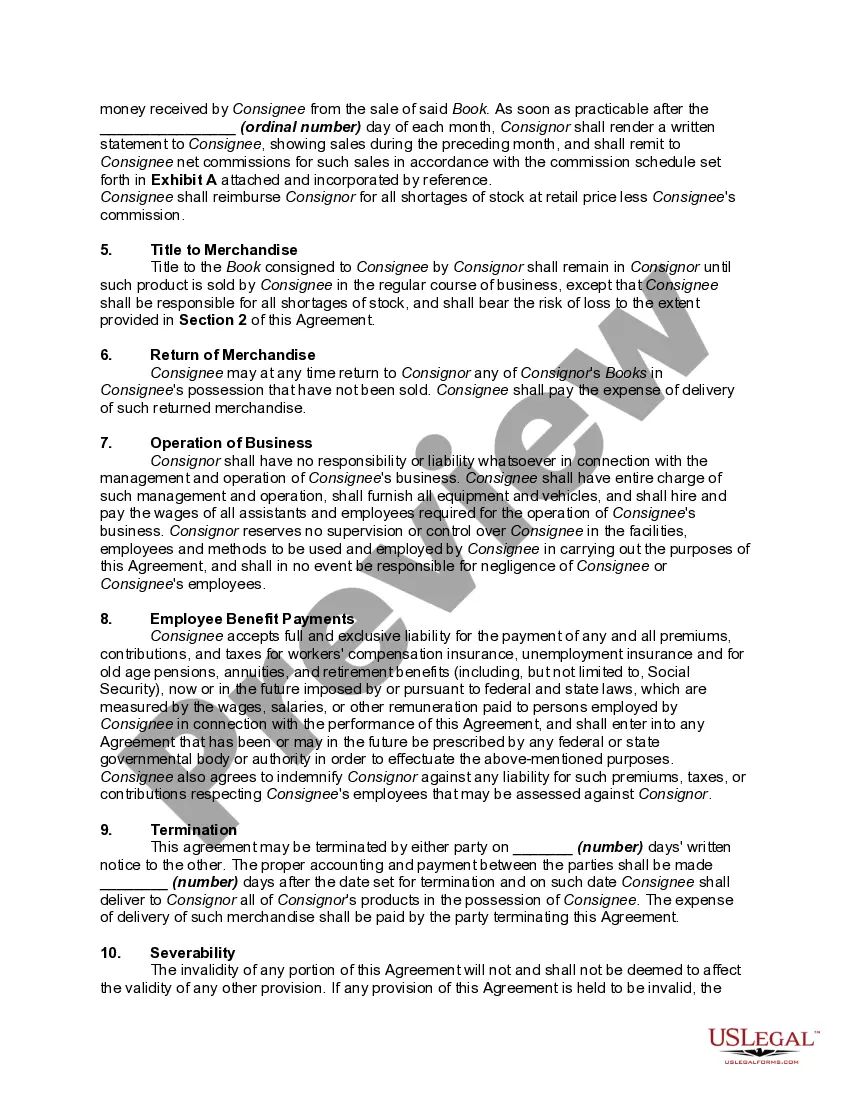

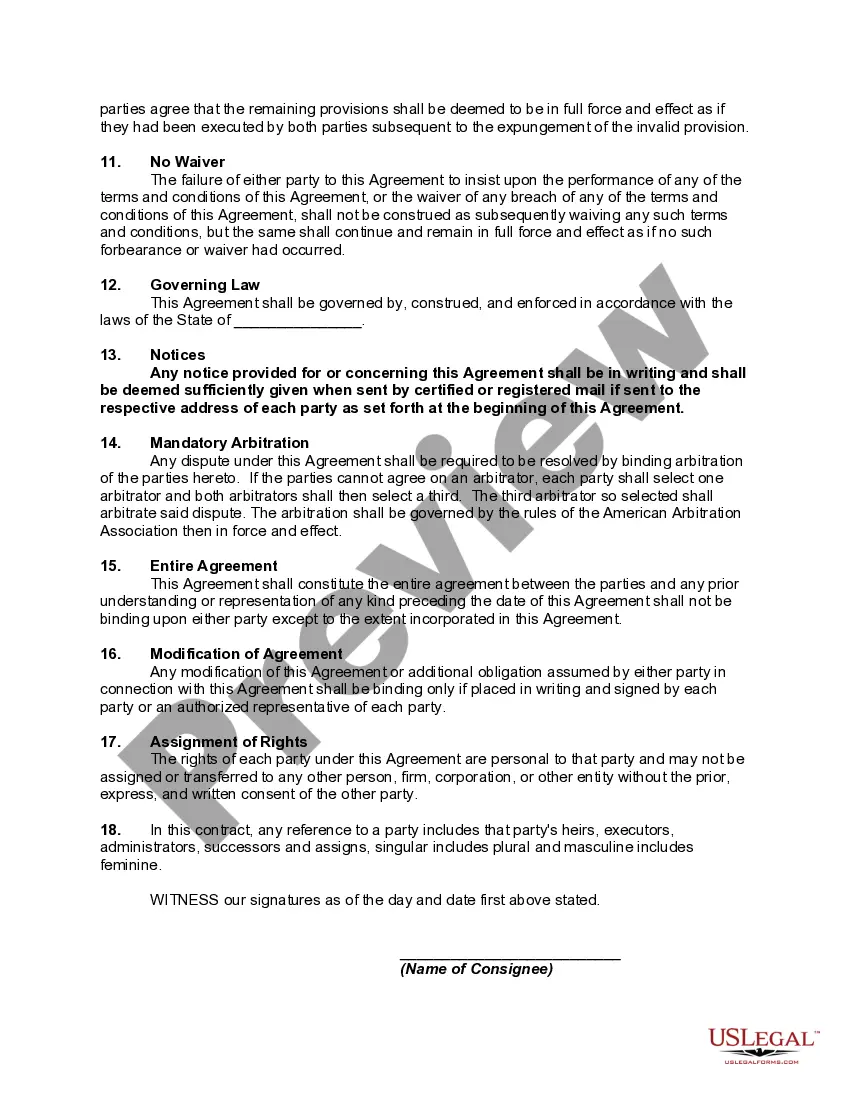

A consignment is an agreement made when goods are delivered to an agent or customer when an actual purchase has not been made, obliging the consignee to pay the consignor for the goods when sold. This consignment involves the sale of a book. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Contract for Sale of Book on Consignment

Description

How to fill out Contract For Sale Of Book On Consignment?

Selecting the appropriate legal document web template can be a challenge. Clearly, there are numerous templates accessible online, but how can you locate the legal form you seek.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Washington Contract for Sale of Book on Consignment, which can be utilized for both business and personal requirements.

All of the forms are reviewed by experts and comply with federal and state regulations.

Once you are convinced the form is correct, click the Purchase now button to obtain the form. Choose the pricing plan you wish and provide the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, modify, print, and sign the received Washington Contract for Sale of Book on Consignment. US Legal Forms is the largest collection of legal documents from which you can access numerous document templates. Use the service to download properly drafted files that adhere to state specifications.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Washington Contract for Sale of Book on Consignment.

- Use your account to view the legal forms you have purchased previously.

- Visit the My documents tab in your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for the city/region. You can review the form using the Review button and check the form details to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search area to find the appropriate form.

Form popularity

FAQ

The two types of consignments are physical consignment and financial consignment. With physical consignment, goods are not sold until someone purchases them, while financial consignment involves a seller receiving immediate payment for the goods even if they remain unsold. Understanding these types can help you create a tailored Washington Contract for Sale of Book on Consignment that fits your needs.

To set up a consignment agreement, first, identify the items you will sell and the terms of sale. You need to outline the responsibilities of both parties involved, including payment procedures and handling unsold items. A well-structured Washington Contract for Sale of Book on Consignment can serve as a guide, ensuring clear communication and accountability.

To make a consignment contract, begin by outlining the essential details including the parties involved, items consigned, and sales terms. Use a clear and accessible format, ensuring both sides understand their responsibilities. Platforms like US Legal Forms offer templates for the Washington Contract for Sale of Book on Consignment to help you create a professional and effective agreement.

A consignment contract works by allowing the consignee to sell goods on behalf of the consignor. The consignor remains the owner of the goods until they are sold, at which point the consignee earns a commission. This arrangement can maximize sales opportunities for authors, and the Washington Contract for Sale of Book on Consignment provides a solid foundation for these terms.

Yes, consignment sales must be reported to the IRS. Both the consignor and consignee have tax obligations based on the income generated from the sales. To ensure compliance, maintain clear records and consider consulting a tax professional familiar with consignment agreements, like those structured under the Washington Contract for Sale of Book on Consignment.

A contract for sale of goods on consignment is an agreement where the owner retains ownership of the goods until they are sold. The consignee sells the goods on behalf of the owner, receiving a commission on each sale. This arrangement allows authors to showcase and sell their books without upfront costs, utilizing the benefits of the Washington Contract for Sale of Book on Consignment.

When writing a consignment contract, start by clearly defining the parties involved and the items being consigned. Include terms related to duration, payment, and responsibilities. Utilize a reliable template, like those available on the US Legal Forms platform, to ensure your Washington Contract for Sale of Book on Consignment covers all necessary elements.

To terminate a consignment agreement, follow the terms outlined in the contract. Typically, you should provide written notice to the consignor or consignee, stating your intent to end the agreement. It is important to review the specifics of the Washington Contract for Sale of Book on Consignment, as different conditions may apply depending on the arrangement.

Certain vendors are exempt from 1099 reporting, including corporations and payments made for merchandise. If you're engaging with sellers under a Washington Contract for Sale of Book on Consignment, verify if they qualify for exemption. Also, payments to tax-exempt organizations do not require 1099s. For a comprehensive understanding, it's best to discuss your specific case with a tax advisor.

Yes, you can receive a 1099 for selling goods if your sales exceed the required thresholds. Under a Washington Contract for Sale of Book on Consignment, if you sell over $600 to a single buyer, the buyer must issue you a 1099 form. Accurate record-keeping is crucial in these instances to ensure tax compliance.