Washington Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

If you need to thorough, obtain, or produce authentic document templates, utilize US Legal Forms, the foremost repository of legal forms available online.

Take advantage of the site’s easy and user-friendly search to locate the documents you require.

A range of templates for business and personal uses are organized by categories and regions, or keywords.

Step 4. Once you have found the form you want, choose the Acquire now button. Select your preferred payment plan and enter your information to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Washington Pledge of Shares of Stock with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to secure the Washington Pledge of Shares of Stock.

- You may also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/country.

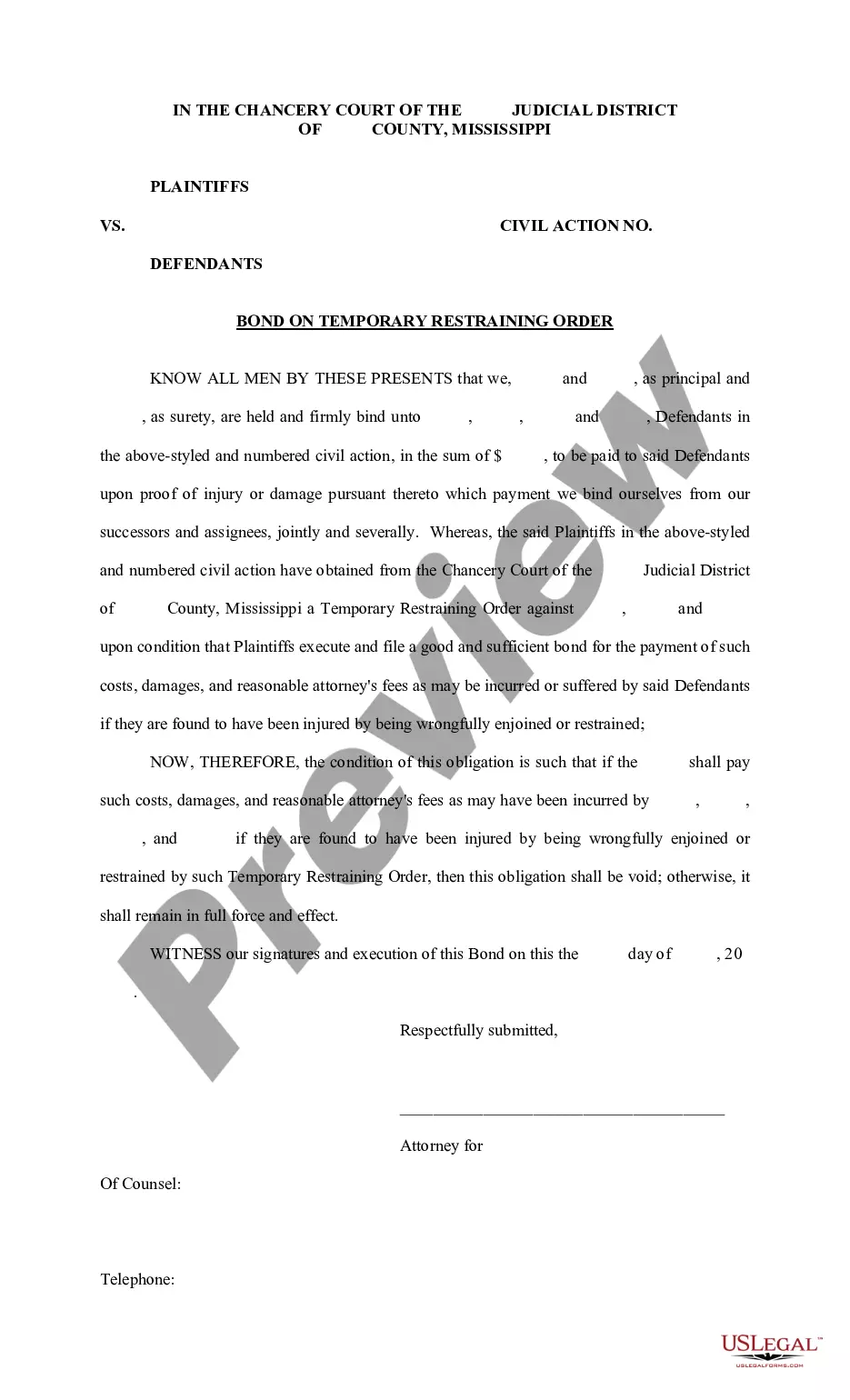

- Step 2. Use the Preview option to review the form’s contents. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other types within the legal form category.

Form popularity

FAQ

You can pledge shares through various financial institutions, including banks and credit unions. Additionally, online platforms like US Legal Forms offer resources to create a Washington Pledge of Shares of Stock agreement and guide you through the process. It’s advisable to explore different lenders to find the best terms for your pledge. Be sure to choose one that aligns with your financial goals and requirements.

Invoking a Washington Pledge of Shares of Stock involves the lender taking control of the shares as specified in the pledge agreement due to a borrower’s default. Lenders typically follow a legal process to ensure fairness and transparency. It is crucial to understand the steps outlined in your agreement to avoid misunderstandings.

Yes, as the shareholder, you continue to receive dividends from your pledged shares during the Washington Pledge of Shares of Stock. Your obligation to the lender does not change your rights as a stockholder. However, check your specific agreement, as some clauses may impact dividend payments.

The interest rate for a Washington Pledge of Shares of Stock can vary based on several factors, including market conditions, lender policies, and your creditworthiness. Typically, these rates may be lower than unsecured loans due to the collateral aspect. It is wise to compare offers from multiple lenders to find the best rate.

The pledge of shares clause in a contract outlines the terms under which the shares are pledged as collateral. This clause details the rights and obligations of both parties involved in the Washington Pledge of Shares of Stock. It ensures transparency and legal protection, minimizing disputes during the pledge period.

When you engage in a Washington Pledge of Shares of Stock, you can still buy additional shares. However, it is essential to ensure that the pledged shares do not restrict your ability to make further investments. Always review the terms of your pledge agreement to understand any limitations.

To perfect a stock pledge, you need to take legal steps to establish priority over the shares you've pledged. This typically involves notifying the stockholder and filing the pledge agreement with the appropriate authority. Ensuring compliance with local laws is important, and the Washington Pledge of Shares of Stock process can guide you through these requirements effectively.

The time required to complete a Washington Pledge of Shares of Stock can vary, but most straightforward pledges can be finalized within a few days. Factors influencing this timeframe include the complexity of the share structure and how quickly all parties can review and sign the documents. Using uslegalforms can streamline this process and provide you with ready-to-use templates.

Pledging your shares involves a few key steps. First, you need to draft a Washington Pledge of Shares of Stock agreement, which specifies the details of the shares and the terms of the pledge. Next, submit this agreement to the entity holding your stock, and ensure that all stakeholders sign and acknowledge the pledge.

To initiate the Washington Pledge of Shares of Stock, you will need to fill out a pledge agreement that outlines the terms and conditions of the pledge. After completing the agreement, you should notify the legal entity holding the stock of your intention to pledge. Finally, ensure that all necessary parties sign the document, making it enforceable and official.