Washington Financing Statement

Description

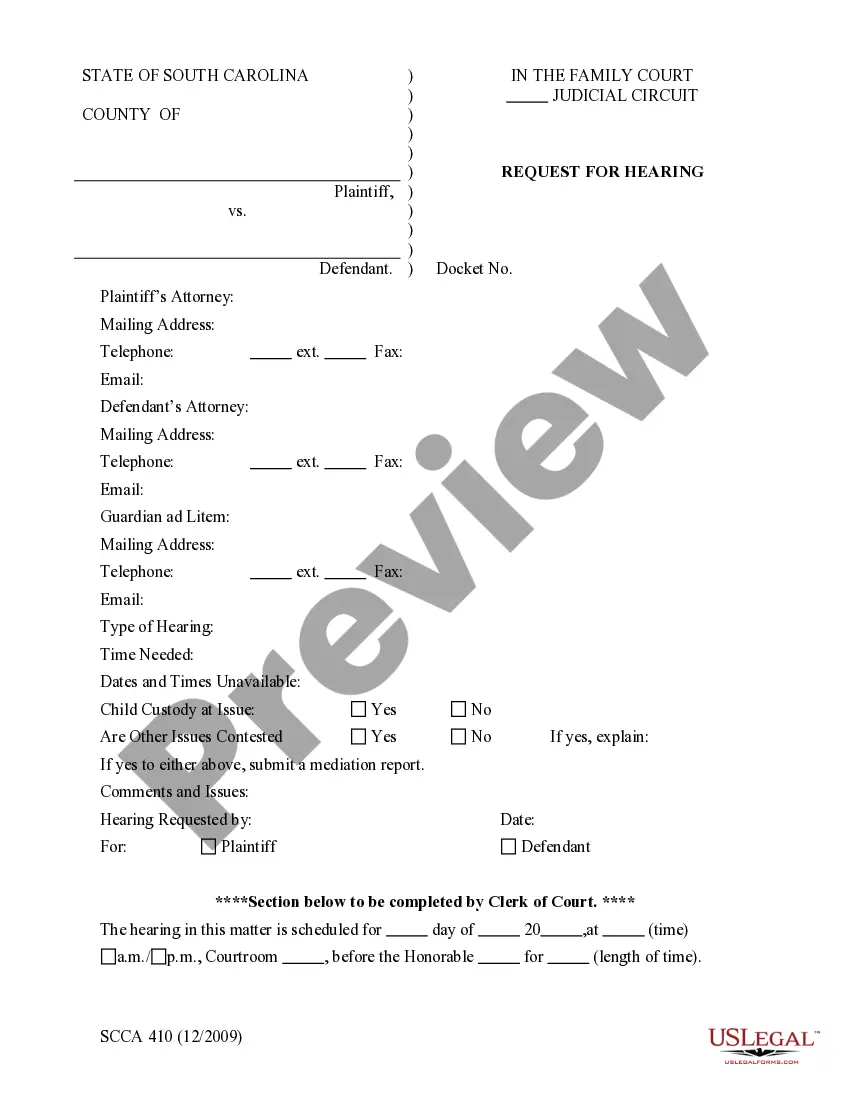

How to fill out Financing Statement?

If you wish to thoroughly download or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available on the web.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

Various templates for businesses and personal needs are categorized by type and relevance or keywords.

Step 4. After locating the desired form, click the Get now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to complete the payment.

- Use US Legal Forms to obtain the Washington Financing Statement with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to retrieve the Washington Financing Statement.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Verify that you have chosen the form for the correct city/region.

- Step 2. Use the Preview option to view the form’s specifics. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The IRS may file a UCC to secure interests for unpaid taxes. When an individual or business owes substantial tax debts, the IRS can file a Washington Financing Statement to report its claim. This action helps the IRS establish its priority in collecting debts owed by the taxpayer. Understanding this can help you navigate potential issues with tax compliance and financial planning.

1 financing statement establishes a secured party’s interest in the collateral described in the document. In essence, it signals to other creditors that a Washington Financing Statement has been filed. This step is important for defining the legal rights of a lender against a borrower. It protects lenders by putting others on notice about their claim to the borrower's property.

You can file a financing statement with the Secretary of State's office in Washington. This office handles all UCC filings, including Washington Financing Statements. It's vital to follow the specific guidelines provided by the office to ensure proper filing. Additionally, consider using platforms like uslegalforms to simplify the process and ensure all your documents are filled correctly.

A UCC filing can have both positive and negative implications, depending on your situation. On one hand, it could be evidence of financial support through loans or credit, while on the other, it signifies that creditors have a claim on your assets. If you are aware of and comfortable with your financial obligations, a UCC filing can be manageable. However, if you find an unexpected UCC filing against you, it’s wise to address it promptly.

A financing statement is a legal document that signifies a lender's interest in a borrower's personal property. In the context of a Washington Financing Statement, it acts as public notice of the lender's claim to certain assets. This document is essential for establishing priorities among creditors in case of default. It helps others know that there are existing financial interests in the specified collateral.

Filing a UCC-3 financing statement serves to amend or terminate a previously filed Washington Financing Statement. This could involve updating information on the secured party, debtor, or even the collateral listed. This process is vital for maintaining the accuracy of public records, ensuring that all parties have the correct details. Keeping this updated can protect your interests and help avoid potential disputes.

You may have received a UCC statement because a creditor has filed a Washington Financing Statement against you. This indicates a security interest in your assets or property. Essentially, this document serves to inform you and any potential lenders about outstanding debts. It's important to review this document to understand your financial obligations.

A financing statement must include several key components: the names of the debtor and secured party, contact information, and a description of the collateral covered. When preparing a Washington Financing Statement, accuracy is paramount to ensure that the security interest is validly perfected. Utilizing a trusted platform like uslegalforms can simplify this process, guiding you through each necessary detail.

For a Washington Financing Statement to be valid, it must include the debtor's name, the secured party's name, and a description of the collateral. Additionally, the form must be signed by the secured party or their representative. Failing to meet these minimum requirements can result in the statement being deemed ineffective.

To properly fill out a UCC-1 form, begin by clearly identifying the debtor and secured party with accurate names and addresses. Next, provide a detailed description of the collateral associated with the Washington Financing Statement. It is essential to follow formatting guidelines and review all entries for accuracy to ensure compliance.