If you need to comprehensive, down load, or produce legal document layouts, use US Legal Forms, the most important collection of legal varieties, which can be found on the Internet. Take advantage of the site`s simple and practical lookup to obtain the papers you require. Different layouts for company and personal purposes are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the Washington Agreement Between Heirs and Third Party Claimant as to Division of Estate in just a number of mouse clicks.

If you are already a US Legal Forms client, log in in your bank account and click the Acquire button to have the Washington Agreement Between Heirs and Third Party Claimant as to Division of Estate. You may also gain access to varieties you previously saved in the My Forms tab of your own bank account.

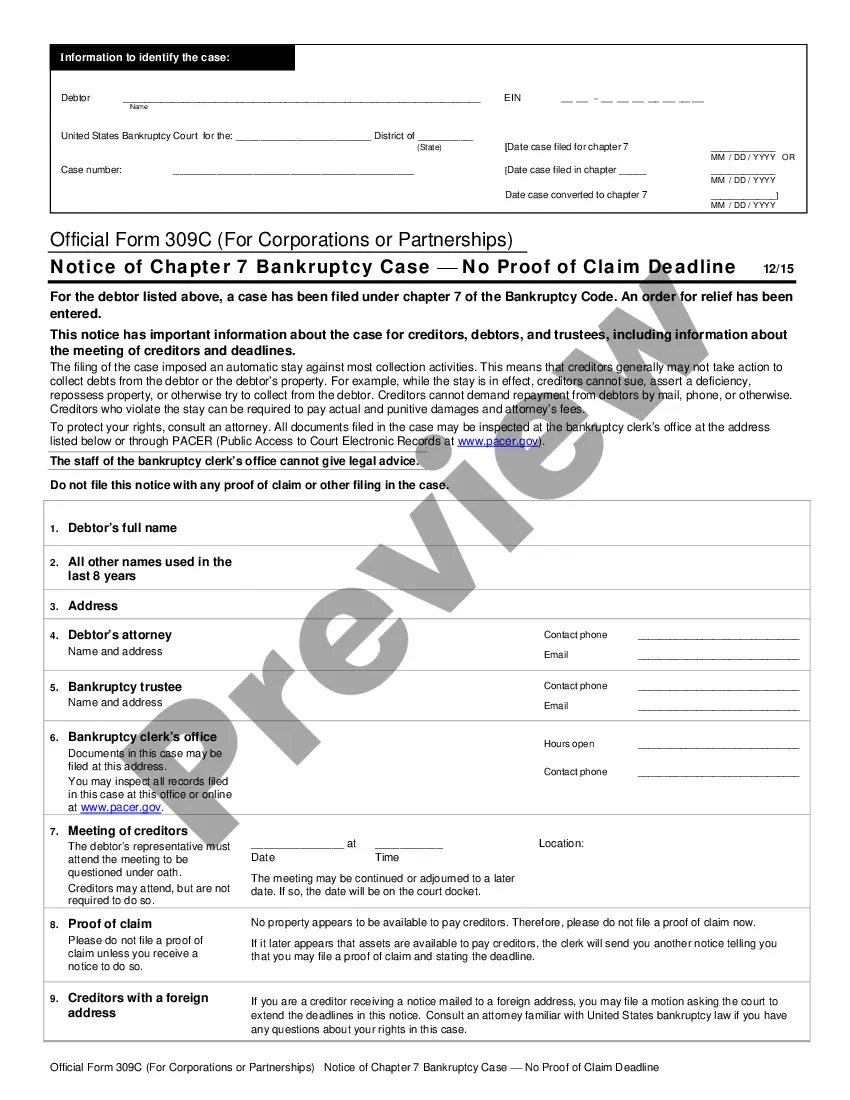

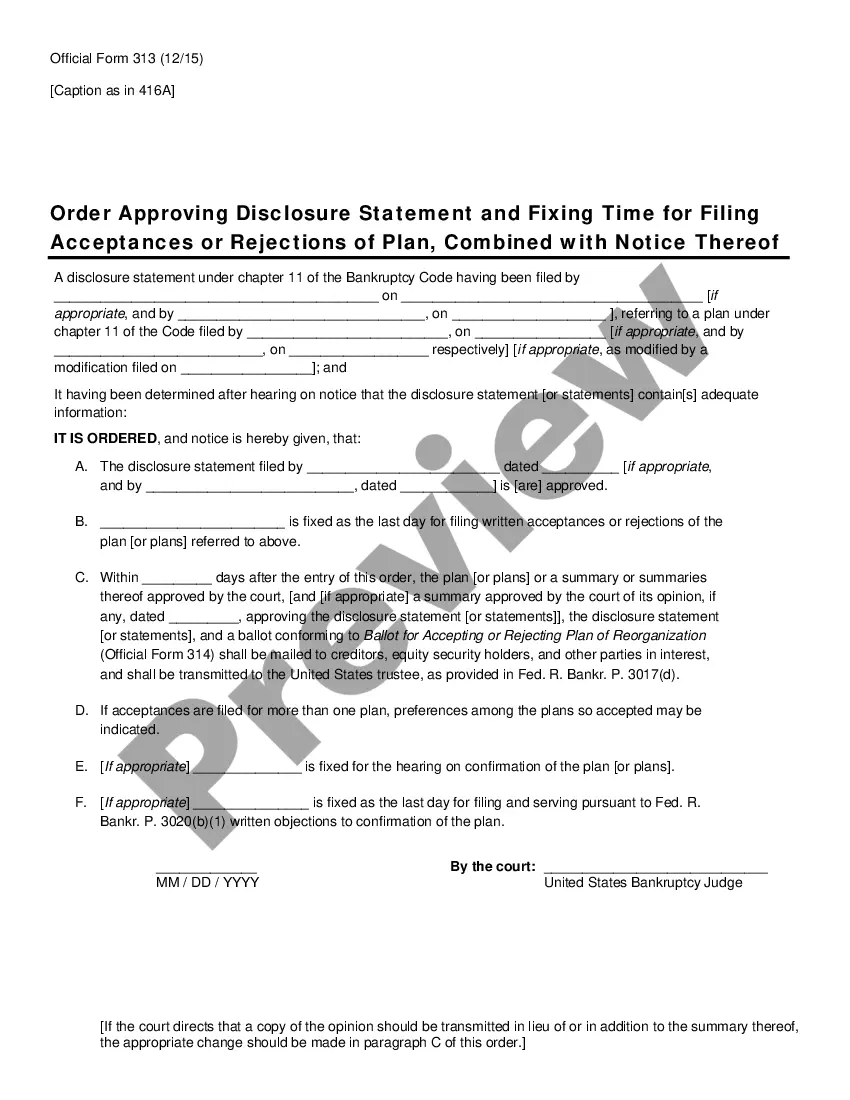

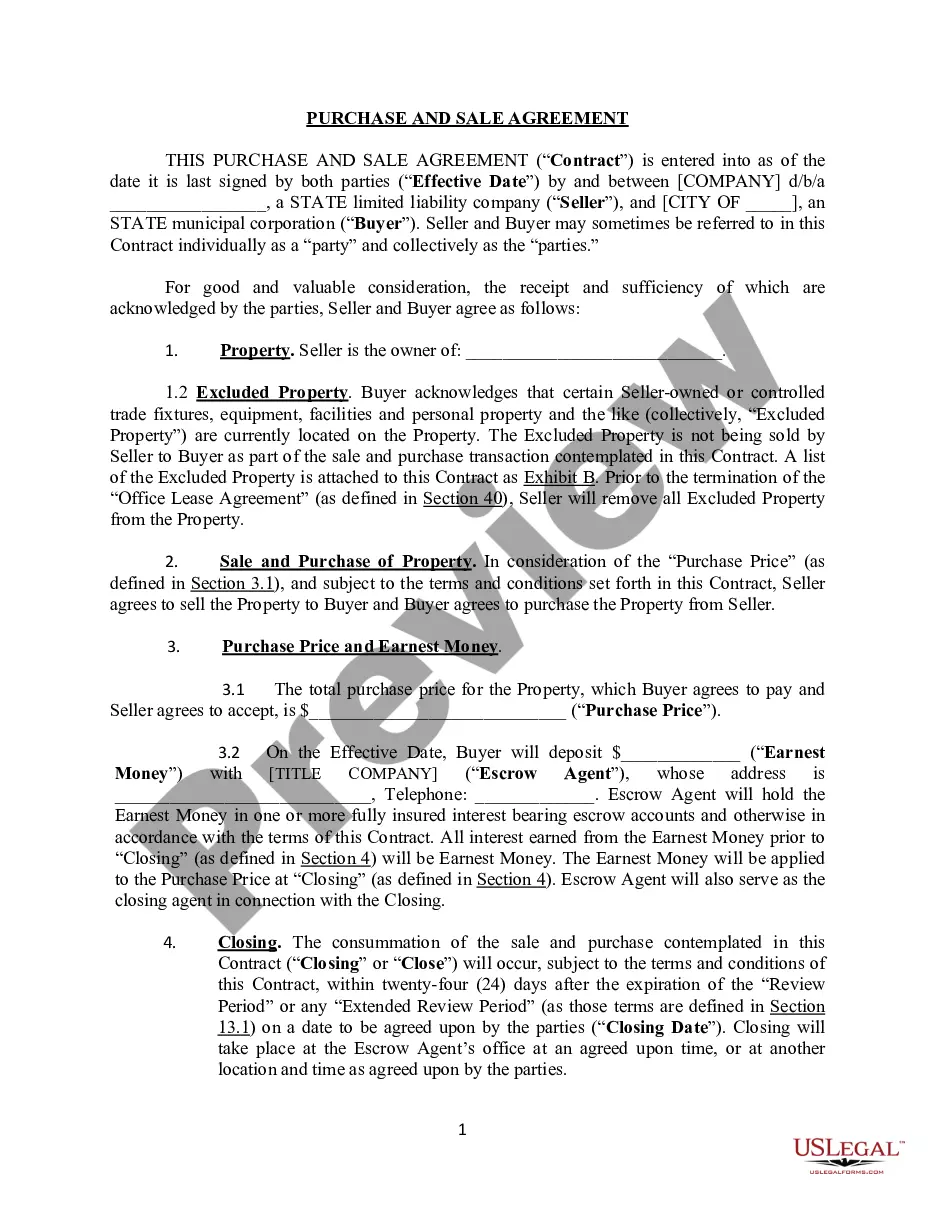

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for the correct town/region.

- Step 2. Use the Review option to look through the form`s content material. Never forget to read the explanation.

- Step 3. If you are unhappy with all the form, take advantage of the Search industry at the top of the monitor to locate other variations from the legal form design.

- Step 4. After you have discovered the form you require, click the Acquire now button. Choose the prices plan you like and add your accreditations to register to have an bank account.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Pick the structure from the legal form and down load it on your own system.

- Step 7. Full, edit and produce or indication the Washington Agreement Between Heirs and Third Party Claimant as to Division of Estate.

Every legal document design you buy is yours for a long time. You possess acces to each and every form you saved inside your acccount. Click on the My Forms portion and choose a form to produce or down load once again.

Contend and down load, and produce the Washington Agreement Between Heirs and Third Party Claimant as to Division of Estate with US Legal Forms. There are thousands of expert and status-specific varieties you may use for the company or personal demands.