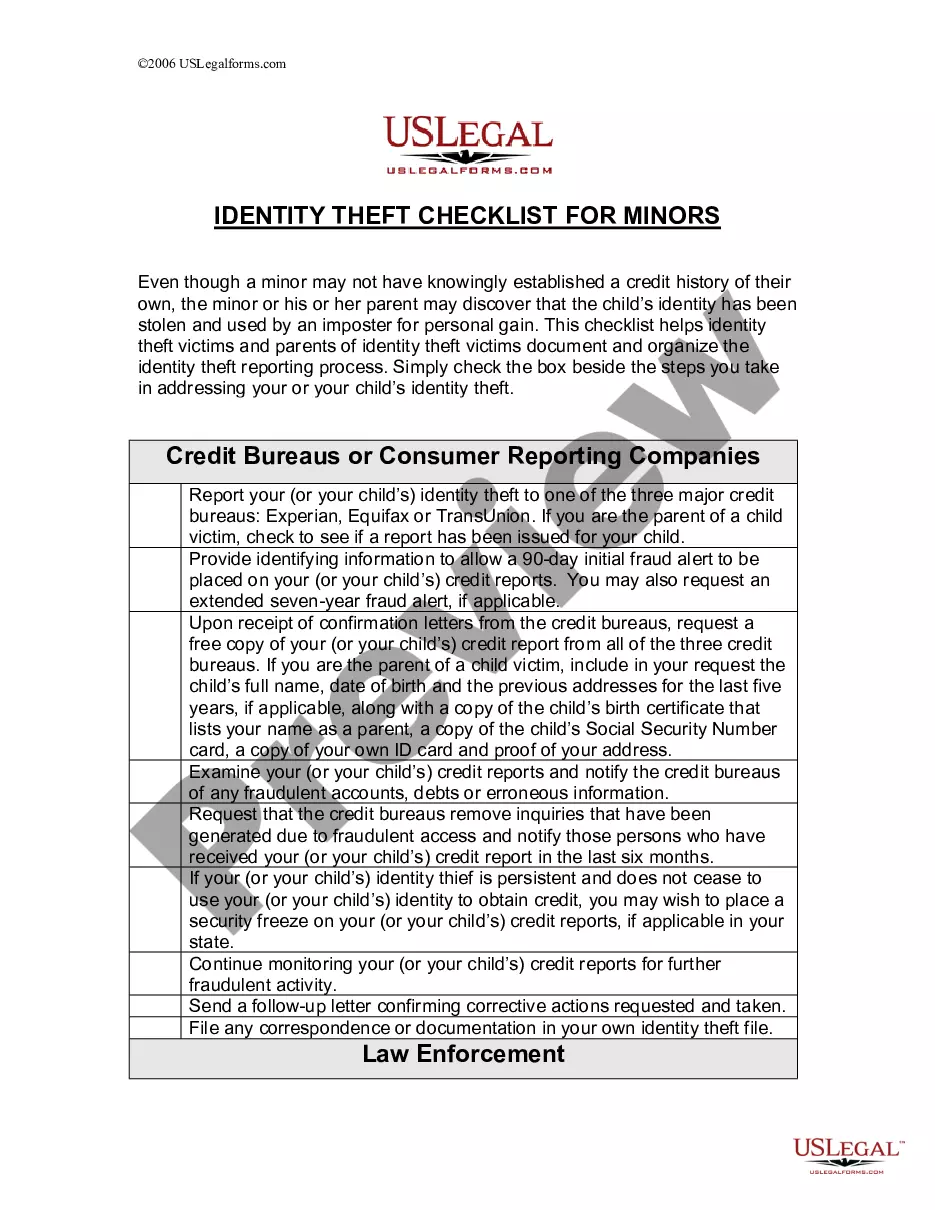

Washington Identity Theft Checklist for Minors

Description

How to fill out Identity Theft Checklist For Minors?

Selecting the appropriate legal document format can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms platform. The service provides a vast array of templates, including the Washington Identity Theft Checklist for Minors, which you can utilize for business and personal purposes. All documents are verified by experts and comply with federal and state regulations.

If you are currently registered, Log Into your account and click the Download button to obtain the Washington Identity Theft Checklist for Minors. Use your account to view the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

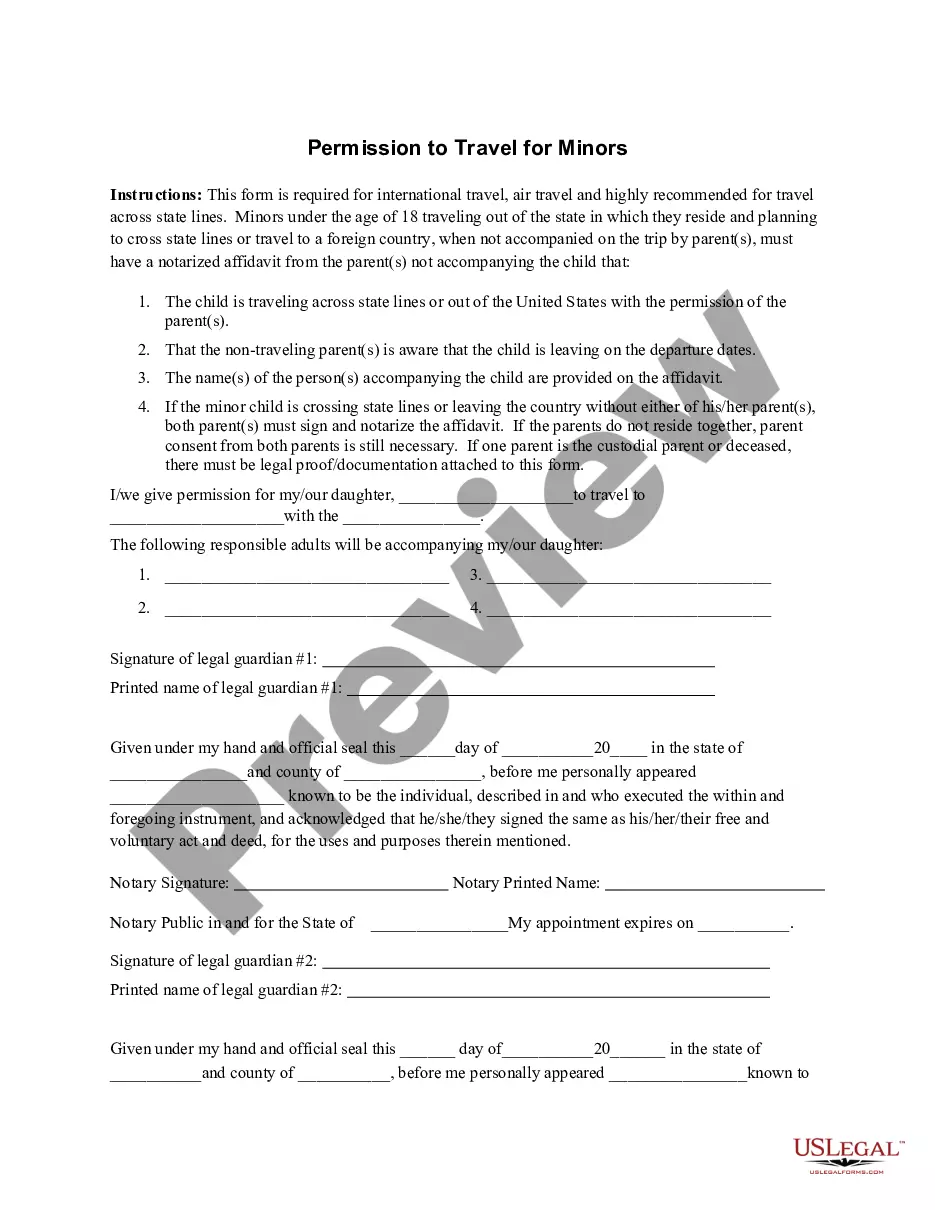

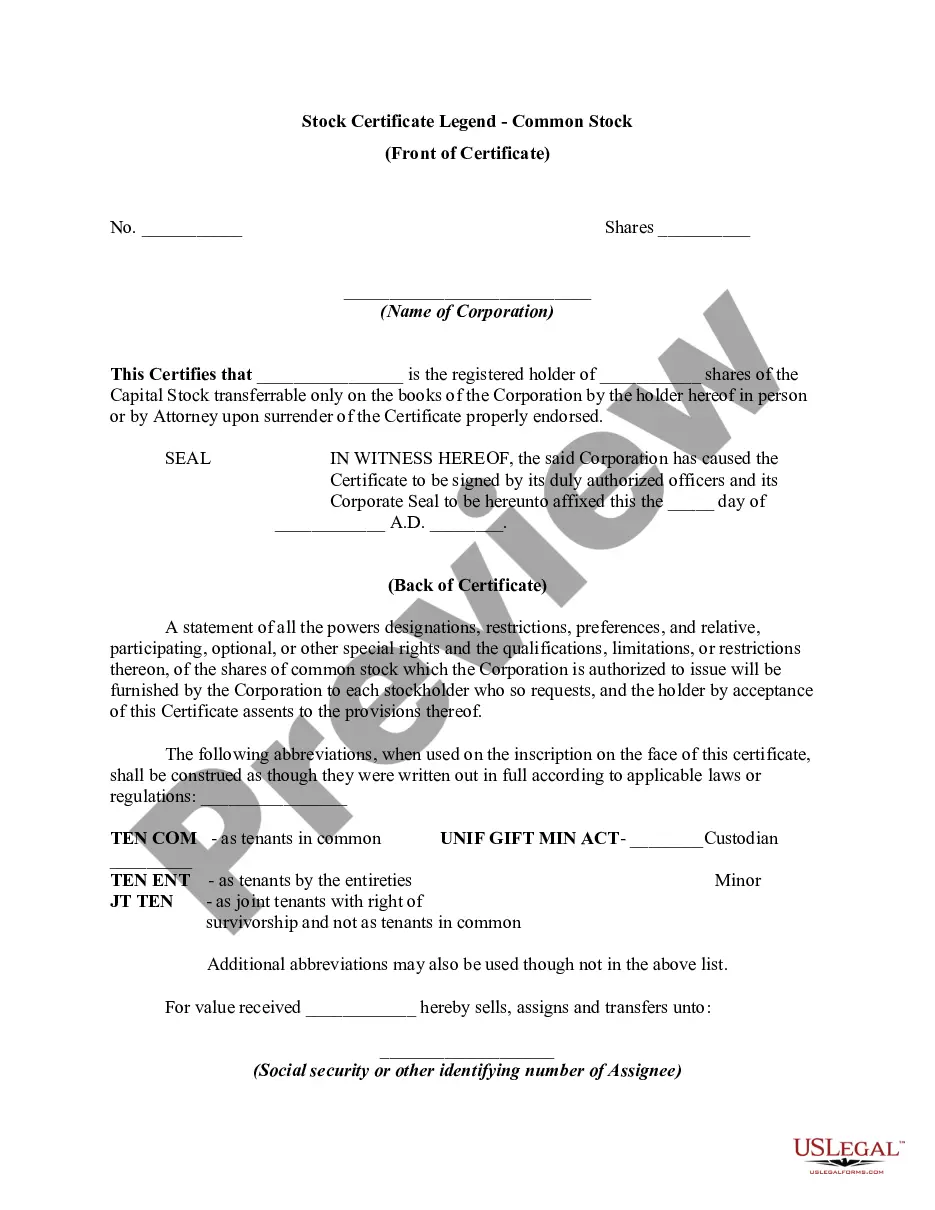

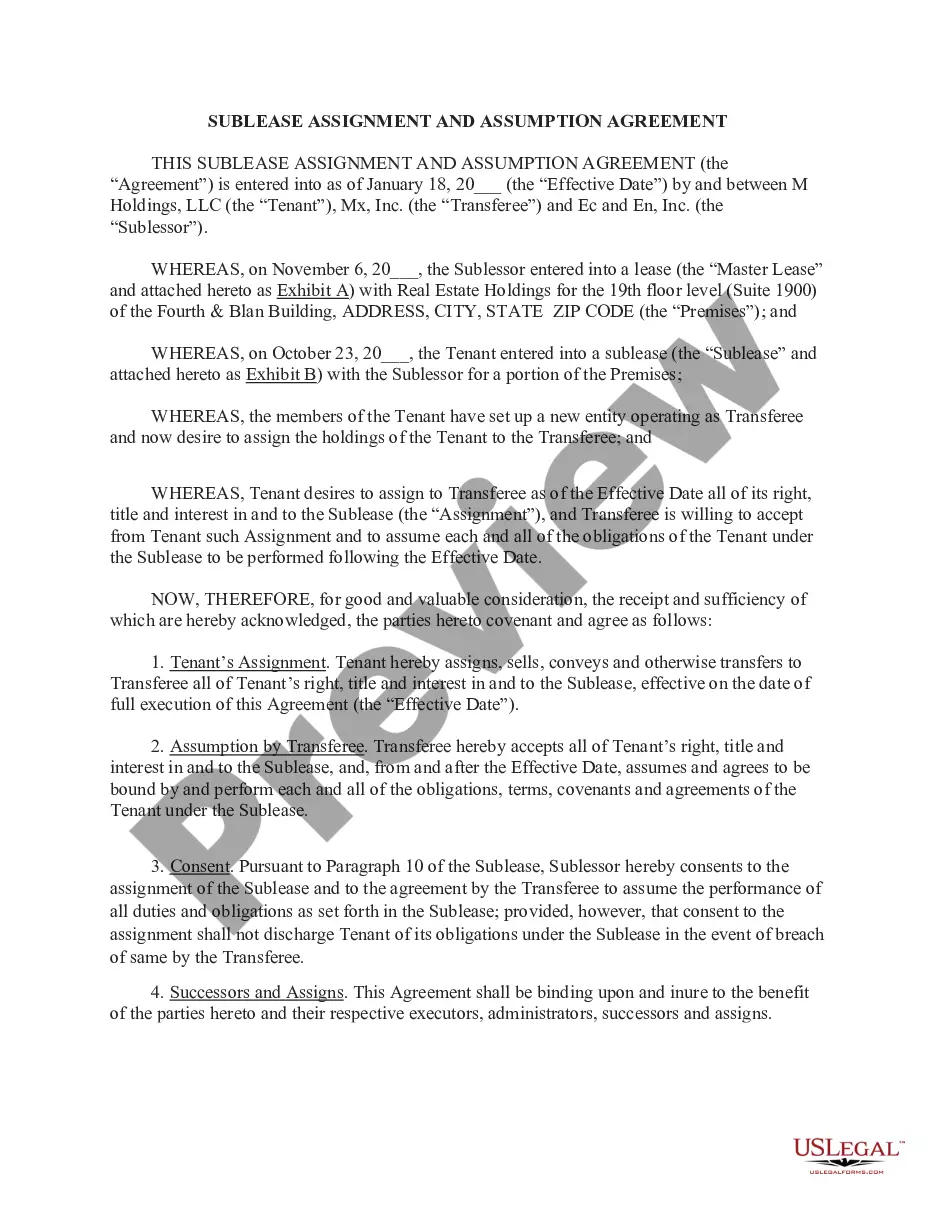

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure that you have selected the correct form for your region/county. You can review the document using the Review option and examine the form outline to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search field to find the correct document. Once you are confident the form is appropriate, click the Buy now option to acquire the form. Choose the pricing plan you want and enter the necessary information. Create your account and process the payment using your PayPal account or credit card. Select the file format and download the legal document template for your needs. Complete, edit, print, and sign the received Washington Identity Theft Checklist for Minors.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to obtain properly-crafted documents that meet state requirements.

- Navigate through the extensive library for your needed legal templates.

- Ensure compliance with legal standards through verified documents.

- Access a wide selection of templates for both personal and professional use.

- Simplify your legal document needs with convenient online access.

Form popularity

FAQ

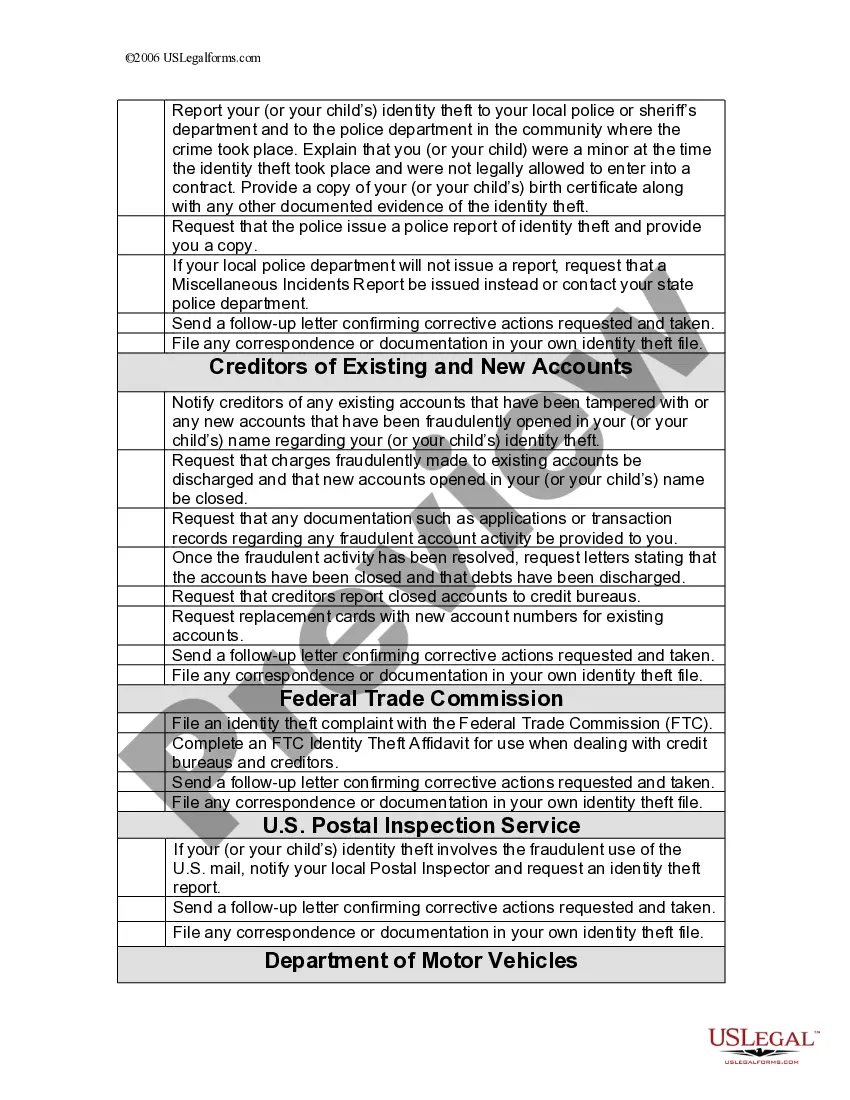

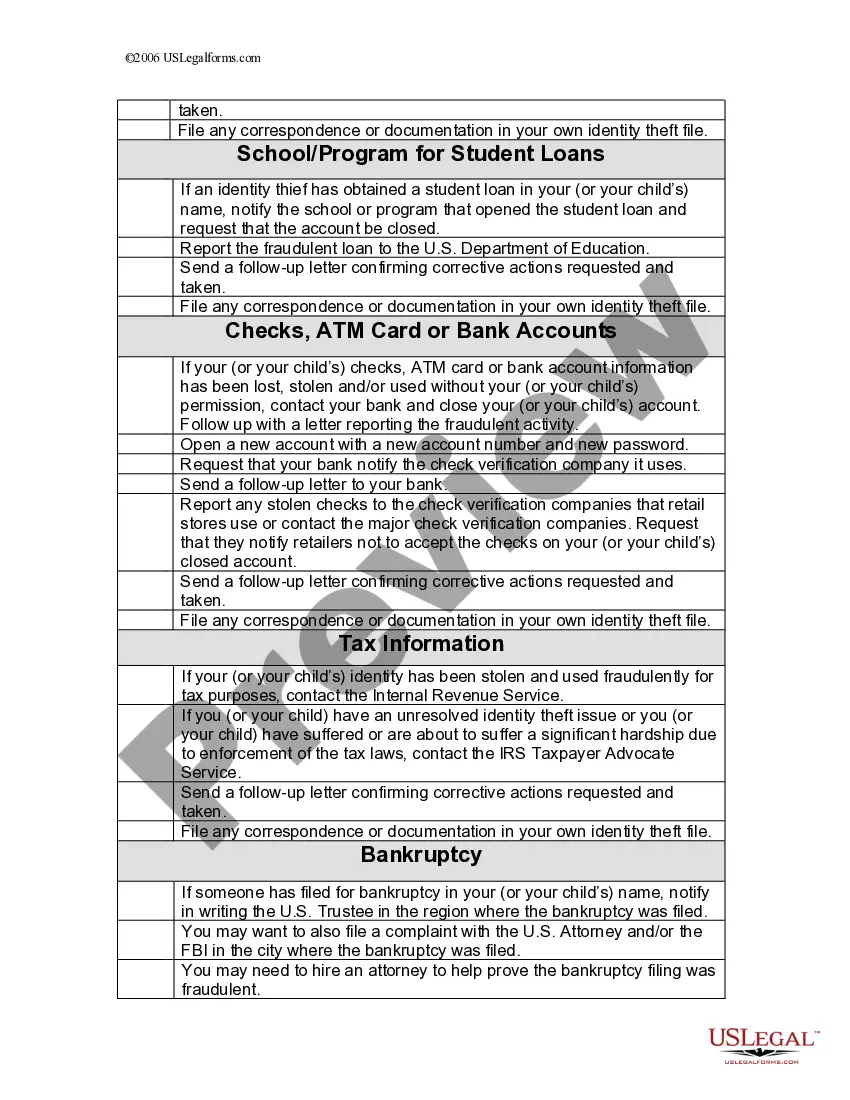

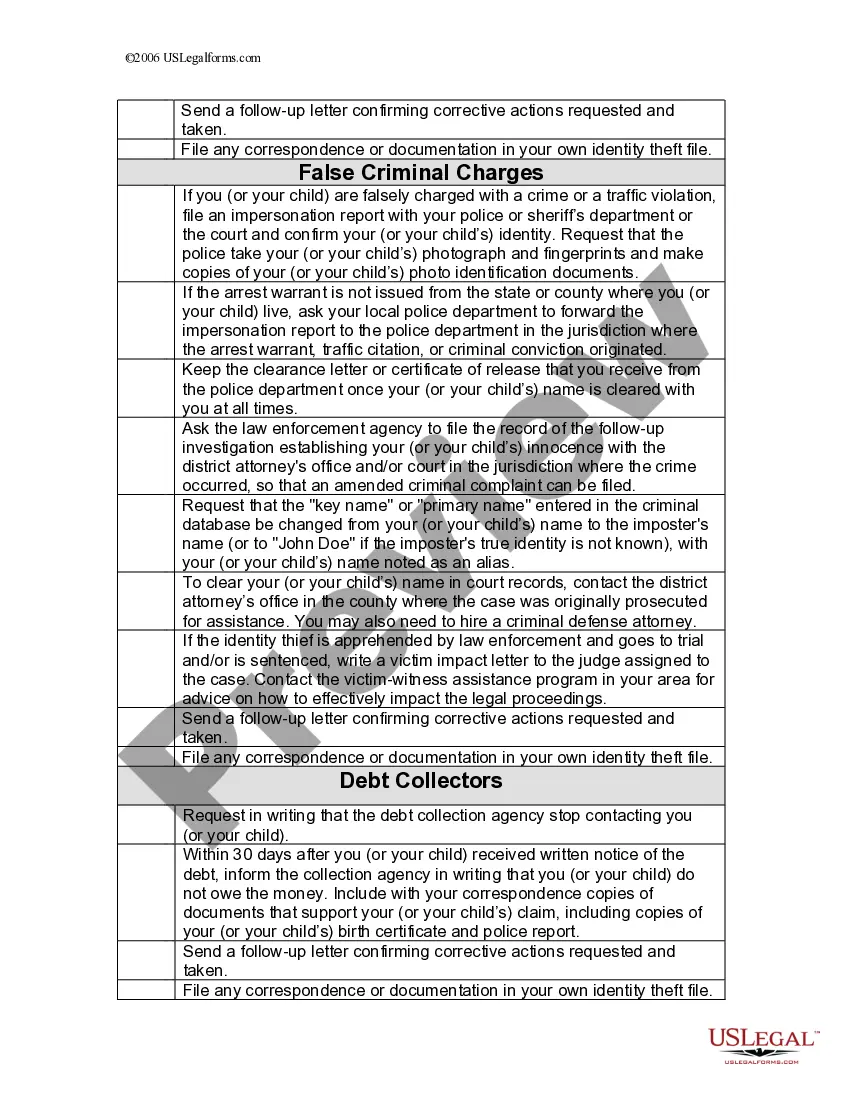

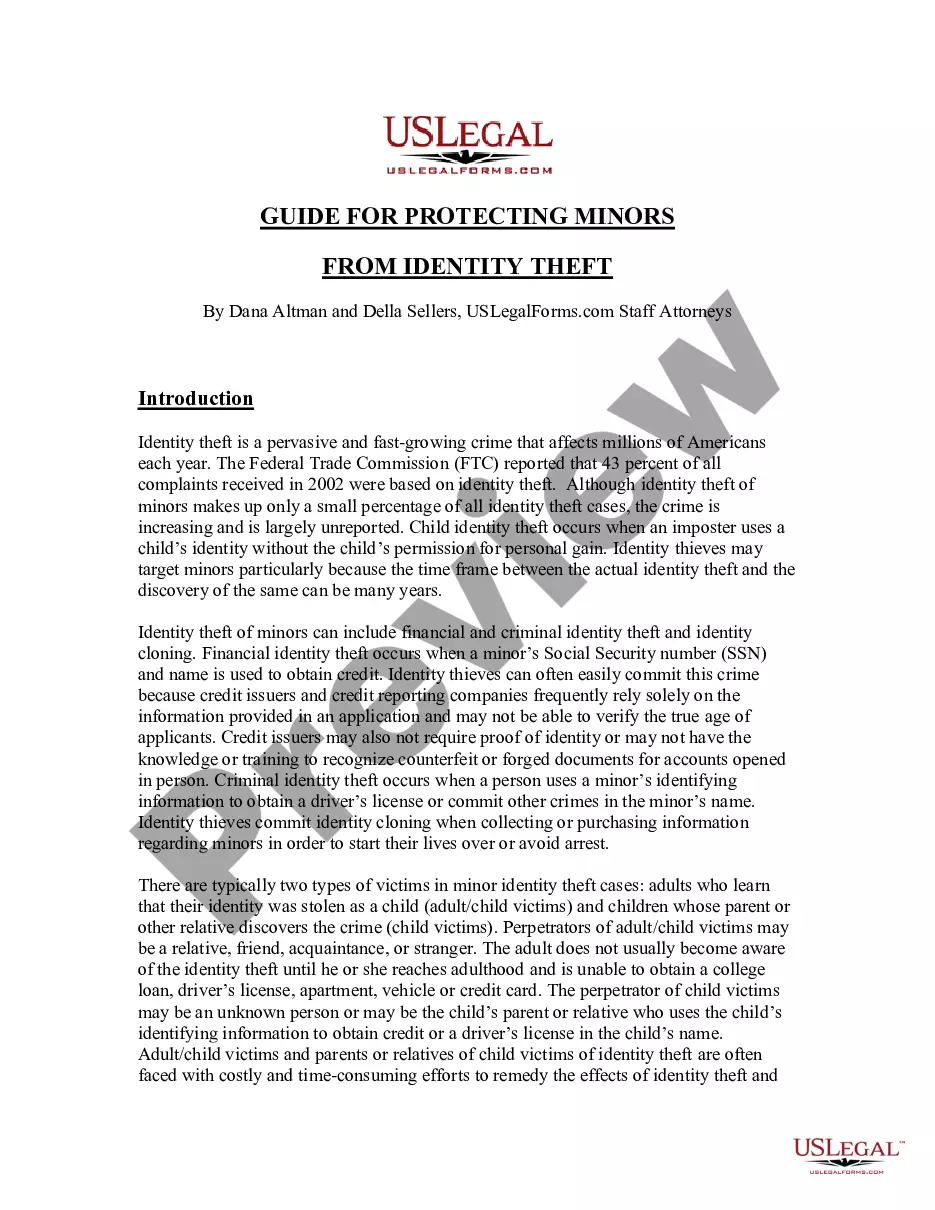

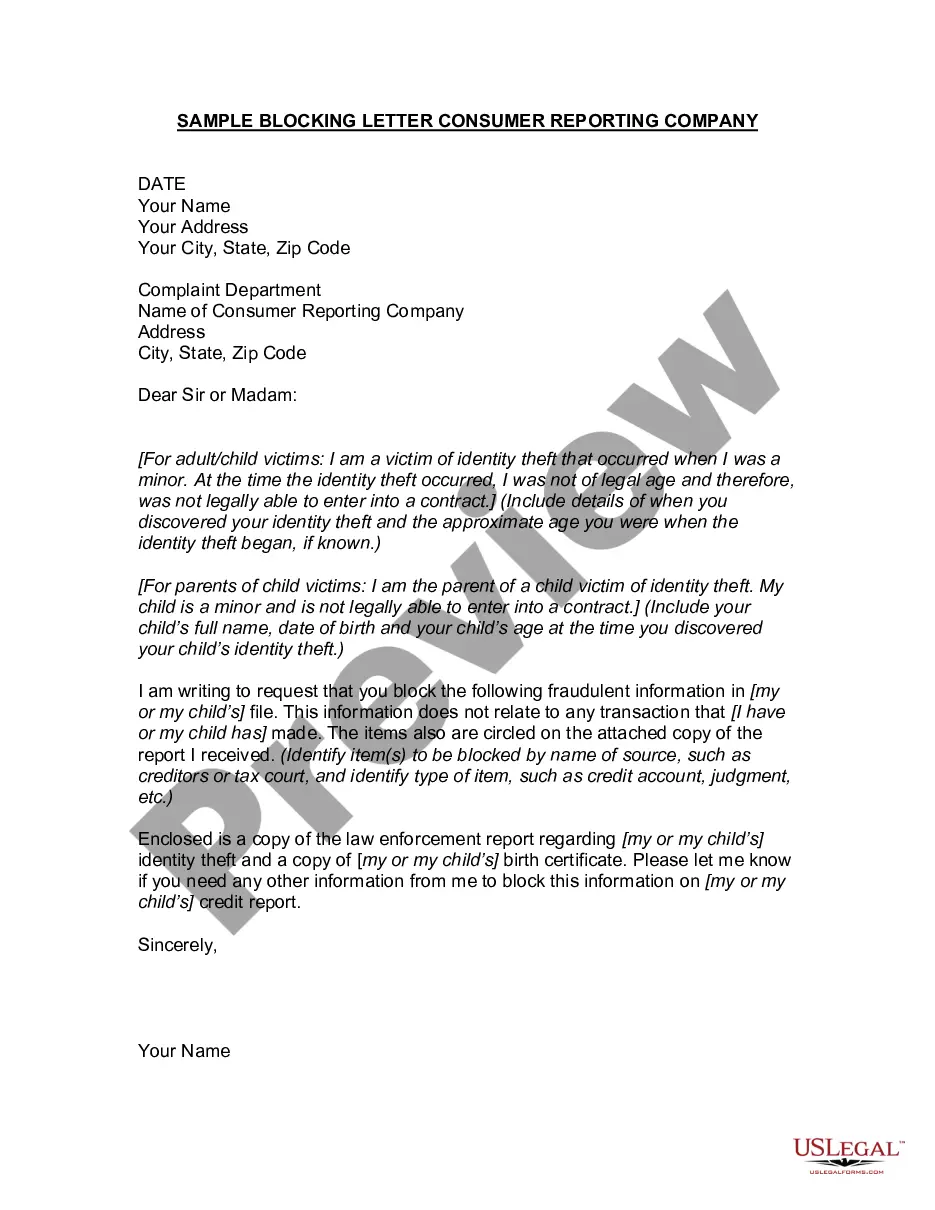

If your child's identity has been stolen, here are some steps you can take: Contact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan. Contact your local law enforcement and get a police report. Contact the fraud departments of companies where accounts were opened in your child's name.

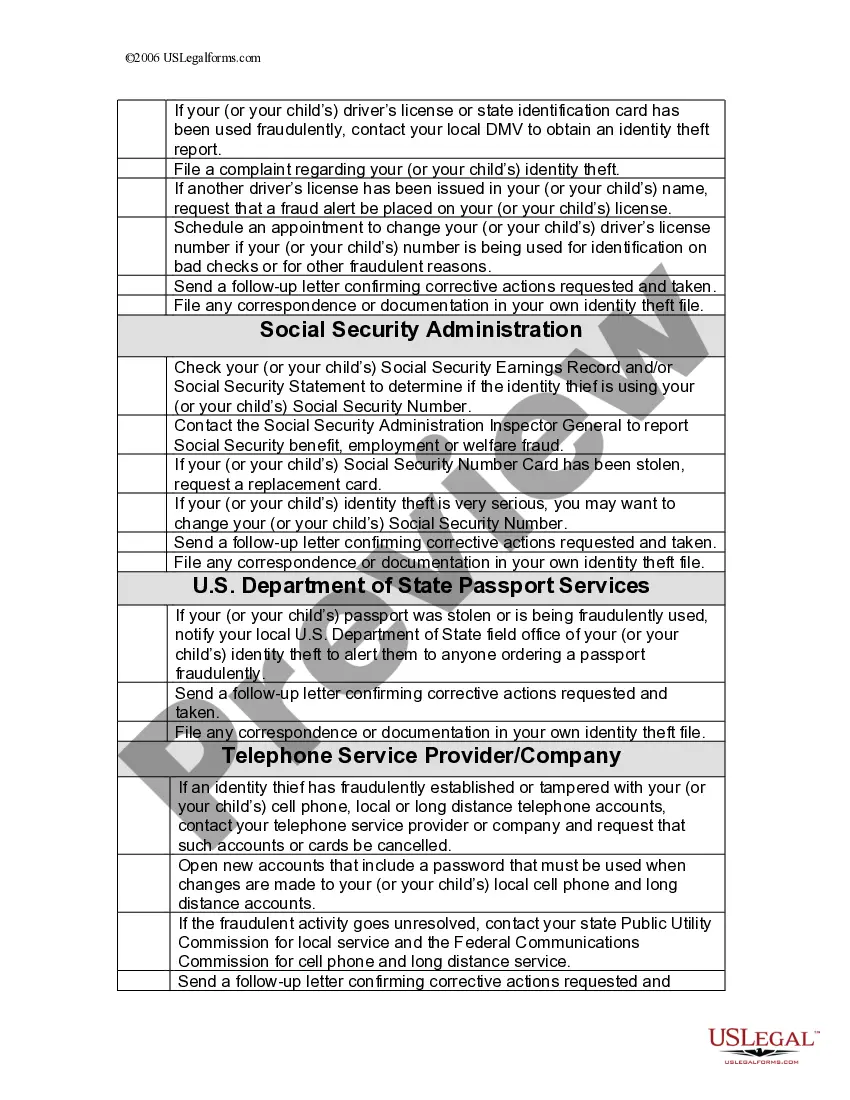

Since children can't get credit until they're at least 16 years old, initiating a security freeze is one of the best way to prevent identity theft. A security or credit freeze blocks access to your children's credit reports and denies all credit applications.

One of the best ways you can prevent someone from stealing your identity is to freeze your credit?and it may be a good idea to do the same for your children. Credit expert John Ulzheimer says children are easy targets because they have no credit history.

If you're at high risk of becoming a victim of identity theft, have already been a victim, or simply want professional monitoring and protection, an identity theft protection service could be worth the cost.

Are My Children at Risk Of Identity Theft? Highlights: Check your child's credit reports. Consider a free security freeze. Consider a credit monitoring product. Keep your child's documents in a safe place. Don't share your child's personal information unless it's absolutely necessary.

Warning Signs of Child Identity Theft Unexpected bills addressed to your child. Collection notices that arrive by mail or phone, targeting your child. Denial of government benefits for your child on the basis that they've already been paid to someone using your child's Social Security number.

? Change logins, passwords, and PINs for your accounts. You might have to contact these companies again after you have an Identity Theft Report. Step 2: Place a fraud alert and get your credit reports. ? To place a fraud alert, contact one of the three credit bureaus.

The average age of an identity fraud victim is 30-39 years old (FTC) In the US, the most common victims of identity theft are aged 30-39 years old. This is closely followed by those aged 40-49 years old. The least likely age group to fall victim to identity theft by raw numbers are 80+.