Washington Sample Letter for Request for Tax Clearance Letter

Description

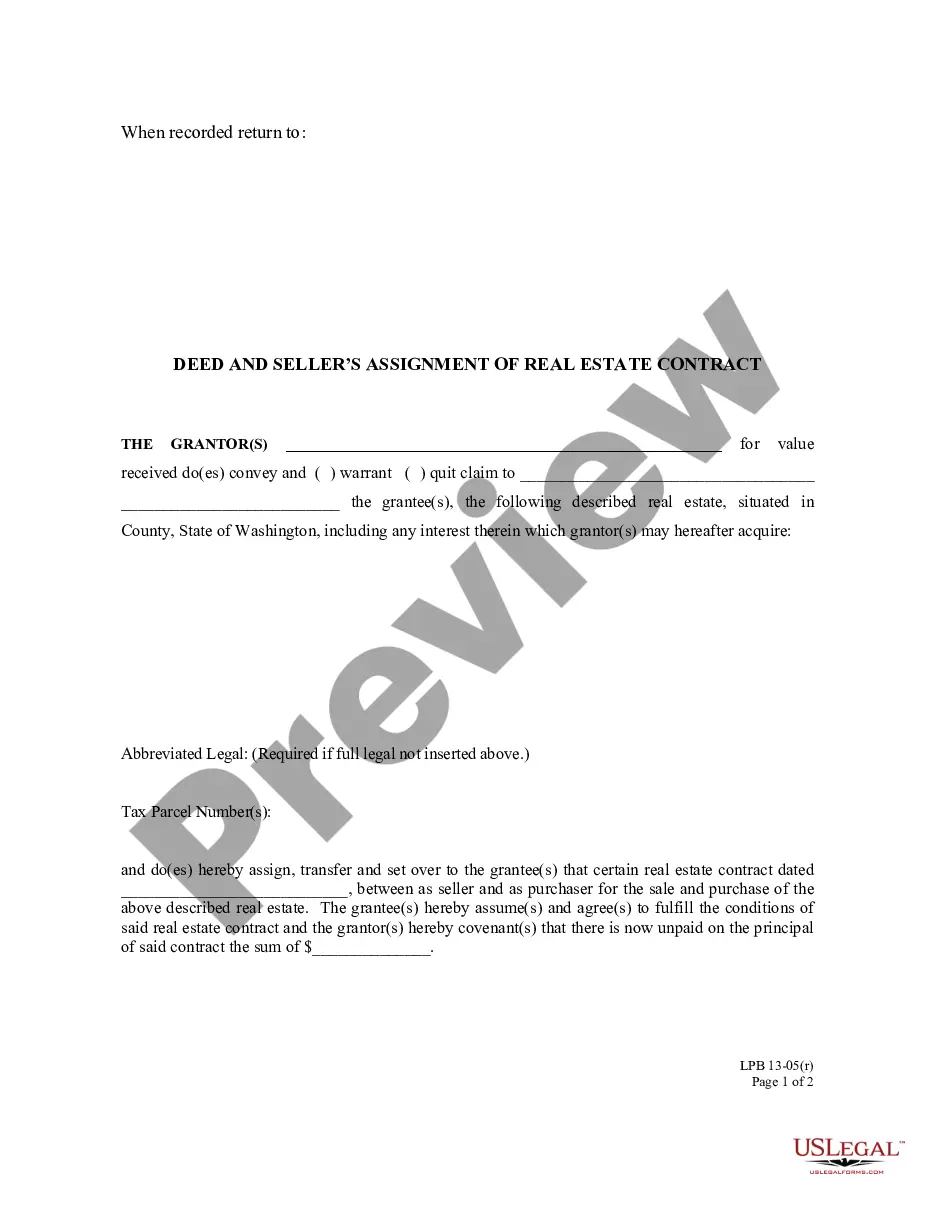

How to fill out Sample Letter For Request For Tax Clearance Letter?

US Legal Forms - one of the largest collections of valid forms in the United States - provides a broad selection of valid document templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Washington Sample Letter for Request for Tax Clearance Letter in moments.

If you have a subscription, Log In and download the Washington Sample Letter for Request for Tax Clearance Letter from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Washington Sample Letter for Request for Tax Clearance Letter. Every template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Washington Sample Letter for Request for Tax Clearance Letter with US Legal Forms, the most extensive library of valid document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Make sure you have selected the correct form for your city/region.

- Click on the Preview button to review the form’s details.

- Check the form summary to confirm that you have selected the correct form.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Download now button.

- Then, choose the payment plan you prefer and provide your information to create an account.

Form popularity

FAQ

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

Individuals and businesses that are expecting a tax refund can expect IRS-certified mail if there is a discrepancy in the return. This discrepancy could be a smaller or larger refund than anticipated, though it's important to compare any new refund amounts with the original tax return.

How to apply for a Tax Clearance? To do this, the employer (usually HR Department) needs to complete one of the following forms: Form CP21 (if you are leaving the country) Form CP22A (for retirement, resignation or termination of employment if you work in the private sector)

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

What is a Revenue Clearance Certificate? A Revenue Clearance Certificate is required to dissolve a corporation registered to do business in Washington State.

A tax status letter provides details regarding liabilities, credits, or other outstanding issues for a specific taxpayer. This letter is not a verification of correct reporting. It is a snap shot in time of a taxpayer's account and includes: Closed date or non-reporter status (if applicable)

If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt. If you do not pay the agency, the debt then goes to Treasury and we send you a letter about that debt.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.