Washington Sample Letter for Corporation Taxes

Description

How to fill out Sample Letter For Corporation Taxes?

Have you been in a place in which you will need files for sometimes enterprise or person reasons nearly every day? There are plenty of authorized document web templates available on the net, but discovering kinds you can rely isn`t simple. US Legal Forms delivers thousands of develop web templates, like the Washington Sample Letter for Corporation Taxes, that happen to be written in order to meet federal and state needs.

When you are previously familiar with US Legal Forms website and possess a merchant account, merely log in. Following that, you can obtain the Washington Sample Letter for Corporation Taxes design.

If you do not have an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for the right metropolis/region.

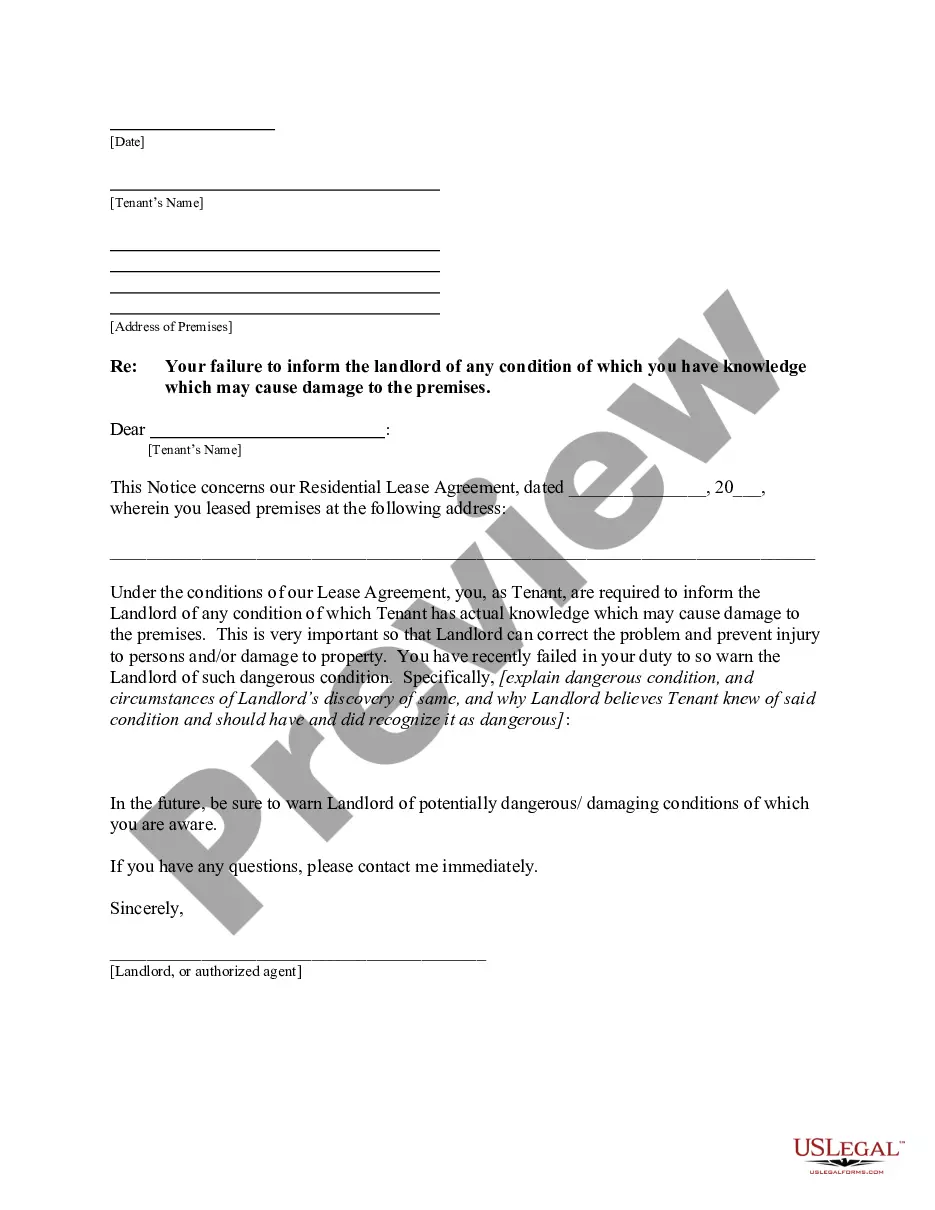

- Take advantage of the Review button to examine the form.

- Look at the description to ensure that you have chosen the right develop.

- If the develop isn`t what you are seeking, use the Search area to obtain the develop that suits you and needs.

- If you find the right develop, simply click Acquire now.

- Choose the prices strategy you would like, fill in the desired information and facts to generate your account, and buy the transaction with your PayPal or charge card.

- Select a hassle-free data file formatting and obtain your version.

Locate every one of the document web templates you have bought in the My Forms food list. You can obtain a additional version of Washington Sample Letter for Corporation Taxes anytime, if needed. Just click on the needed develop to obtain or produce the document design.

Use US Legal Forms, one of the most substantial assortment of authorized forms, to conserve time and steer clear of mistakes. The assistance delivers appropriately made authorized document web templates which can be used for a range of reasons. Generate a merchant account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Introduction to S Corp in Washington A Washington S corporation doesn't pay income taxes. Even if a corporation with more than one shareholder has to file tax returns, the owners have to include their share of the income or loss on their own tax returns, just like with LLCs or partnerships.

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

Income tax forms: The State of Washington does not have a personal or corporate Income Tax.

Washington does not have a personal income tax, so that's one tax return you won't need to file. Just use 1040.com to file your federal return, and any returns you need to file for states that do have an income tax.

Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. The business's gross receipts determine the amount of tax they are required to pay.

A tax status letter provides details regarding liabilities, credits, or other outstanding issues for a specific taxpayer. This letter is not a verification of correct reporting. It is a snap shot in time of a taxpayer's account and includes: Closed date or non-reporter status (if applicable)

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Active non-reporting status means you are actively doing business in Washington, but you are not required to file tax returns.