Washington Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

You have the capability to dedicate time online trying to discover the legal document format that satisfies the federal and state regulations required for your needs. US Legal Forms offers thousands of legal documents that are assessed by experts.

It is easy to obtain or print the Washington Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction from my services.

If you possess a US Legal Forms account, you are able to Log In and click on the Obtain button. Afterwards, you can fill out, modify, print, or sign the Washington Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction.

Once you have identified the format you need, click Purchase now to proceed. Select the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to acquire the legal document. Select the format of the file and download it to your device. Make modifications to your document if required. You can fill out, edit, sign, and print the Washington Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- Every legal document you purchase is your personal asset indefinitely.

- To get another copy of the purchased form, navigate to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for your county/town of choice.

- Review the form details to make sure you have chosen the right document.

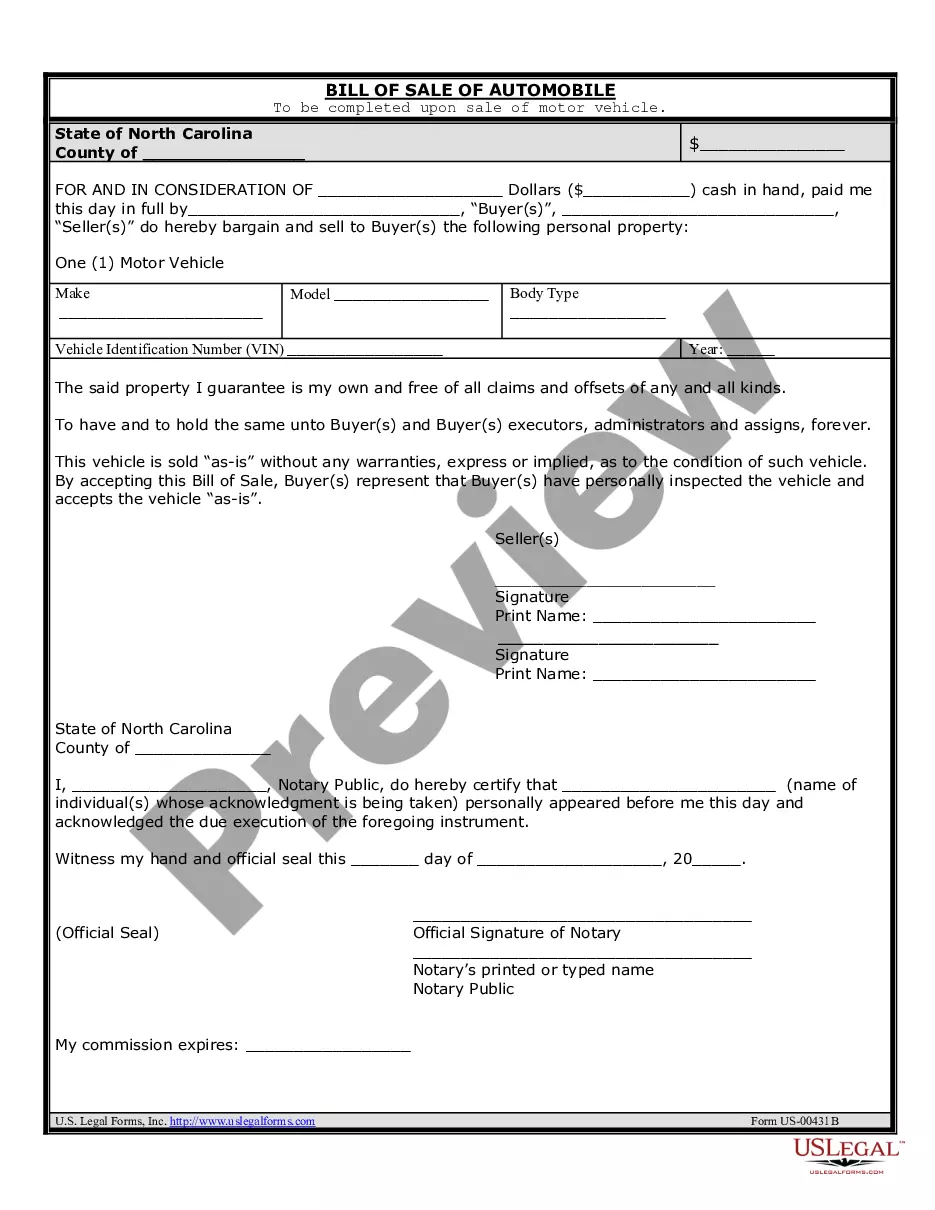

- If available, utilize the Preview button to inspect the document format simultaneously.

- To find another version of the document, use the Research field to locate the format that meets your requirements and specifications.

Form popularity

FAQ

Selling a company's assets in Washington involves preparing a comprehensive list of assets for sale. You must then determine the value and negotiate the terms with potential buyers. Utilizing a Bill of Sale for Personal Assets helps formalize the transaction and ensures all parties are clear on the terms.

When accounting for the sale of business assets, track the sale in your financial records. Record the revenue from the sale and adjust your asset accounts accordingly. A Bill of Sale for Personal Assets is crucial, as it provides a clear record of the transaction and helps in proper financial reporting.

What does sale of assets mean? When companies let go of some assets in exchange for needed cash or other forms of compensation, that is the sale of assets. It's important to note that this term only applies when a company is selling part of their assets and not when all of them are for sale.

When there is a gain on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

The sale of capital assets results in capital gain or loss. The sale of real property or depreciable property used in the business and held longer than 1 year results in gain or loss from a section 1231 transaction. The sale of inventory results in ordinary income or loss.

The following assets and liabilities are normally included in the sale:Working capital. Cash (but only the amount necessary to pay expenses for a reasonable period of time) Accounts receivable. Inventory. Work in progress. Prepaid expenses. Accounts payable. Wages payable.Furniture & fixtures.Equipment.Vehicles.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.