Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

You may spend several hours on the Internet attempting to locate the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can easily access or print the Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor from my service.

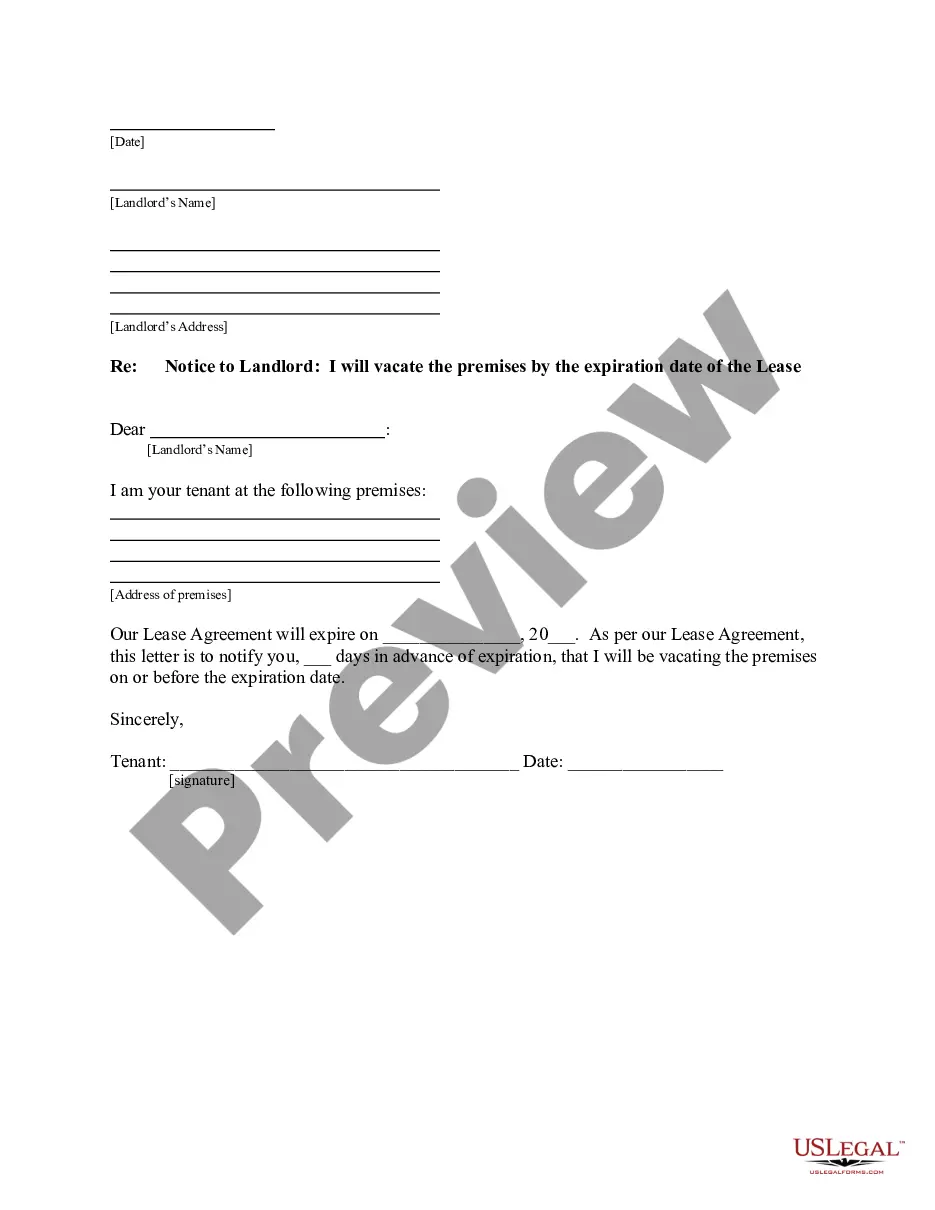

If available, use the Review button to examine the document format as well.

- If you already possess a US Legal Forms profile, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- Every legal document template you obtain is yours to keep permanently.

- To receive another copy of a purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have chosen the correct document template for your preferred region/city.

- Review the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

The percentage an independent contractor should earn often depends on the industry and the specific agreement with the client. Typically, commissions can range from 20% to 50% of sales, reflecting the unique services the contractor provides. By outlining this percentage clearly in a Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, both parties can manage expectations and foster a successful working relationship.

Determining an hourly rate as a 1099 contractor can vary greatly, depending on industry standards, experience, and the complexity of the work. It's essential to research and analyze competitors' rates to establish a fair and competitive figure. As part of a well-rounded Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, addressing your rate can ensure clarity and prevent disputes.

In Washington state, independent contractors generally do not need workers' compensation unless they opt to cover themselves. However, if the contractor has employees working under them, they must provide coverage. When creating a Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it is wise to address any workers' comp issues upfront to ensure compliance with state laws.

The 2 year contractor rule in Washington refers to the time frame in which a contractor must prove their independent status. After working as an independent contractor for two consecutive years, they can be more secure in maintaining their status without concerns of being misclassified as an employee. Understanding this rule can significantly impact the drafting of a Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

Yes, a sales rep can definitely be an independent contractor in Washington. This arrangement allows for greater flexibility and can often lead to higher earnings based on performance. When entering into a Washington Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it is important to clearly outline the terms and conditions to avoid any misunderstandings.

Writing an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment terms, and responsibilities of both parties. Next, you should outline the duration of the contract, along with confidentiality and termination clauses. Services like USLegalForms offer helpful templates, which can guide you through creating a comprehensive Washington employment agreement - percentage of sales - self-employed independent contractor.

Typically, the hiring party or the business that needs services drafts the independent contractor agreement. However, both parties should collaborate to ensure the agreement meets everyone’s needs and expectations. Utilizing services like USLegalForms can streamline this process by providing templates tailored for a Washington employment agreement - percentage of sales - self-employed independent contractor.

The best business structure for independent contractors largely depends on individual circumstances and preferences. Many choose to operate as a sole proprietorship, which is simple and easy to manage. Others may opt for forming an LLC, as it provides liability protection and can improve professionalism. Regardless of choice, consider consulting legal resources or platforms like USLegalForms for guidance in establishing a Washington employment agreement - percentage of sales - self-employed independent contractor.

The tax rate for self-employed individuals receiving 1099 forms is similarly structured at 15.3% for self-employment tax. This applies to your net earnings and forms a significant component of your overall tax liability. Understanding your responsibilities as a self-employed independent contractor can help you make informed decisions in your Washington Employment Agreement - Percentage of Sales.

The self-employment tax rate for independent contractors stands at 15.3%. This rate comprises a 12.4% Social Security tax and a 2.9% Medicare tax on your net earnings. As you navigate your Washington Employment Agreement - Percentage of Sales, it's crucial to factor this tax into your budgeting and financial strategies.