Washington Demand for Collateral by Creditor

Description

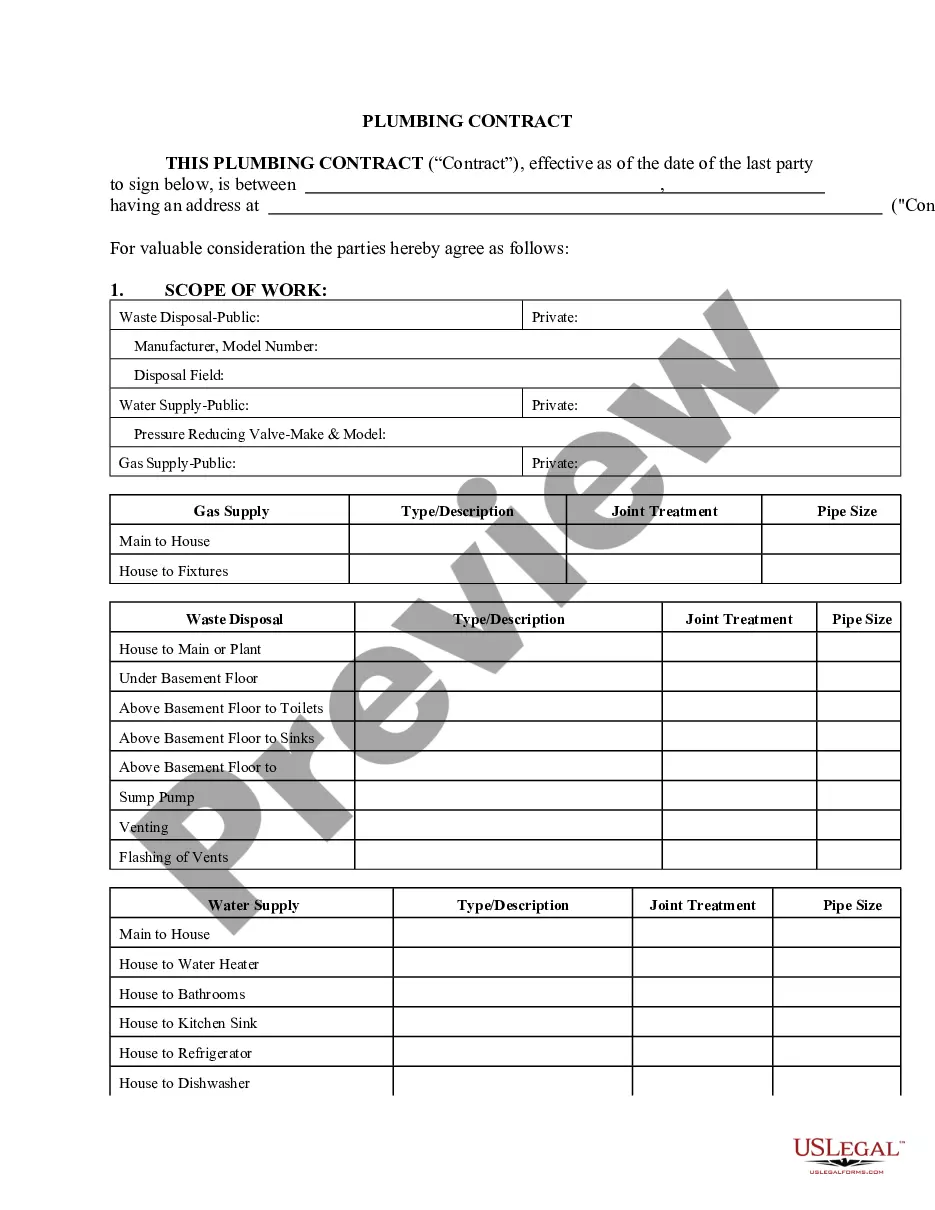

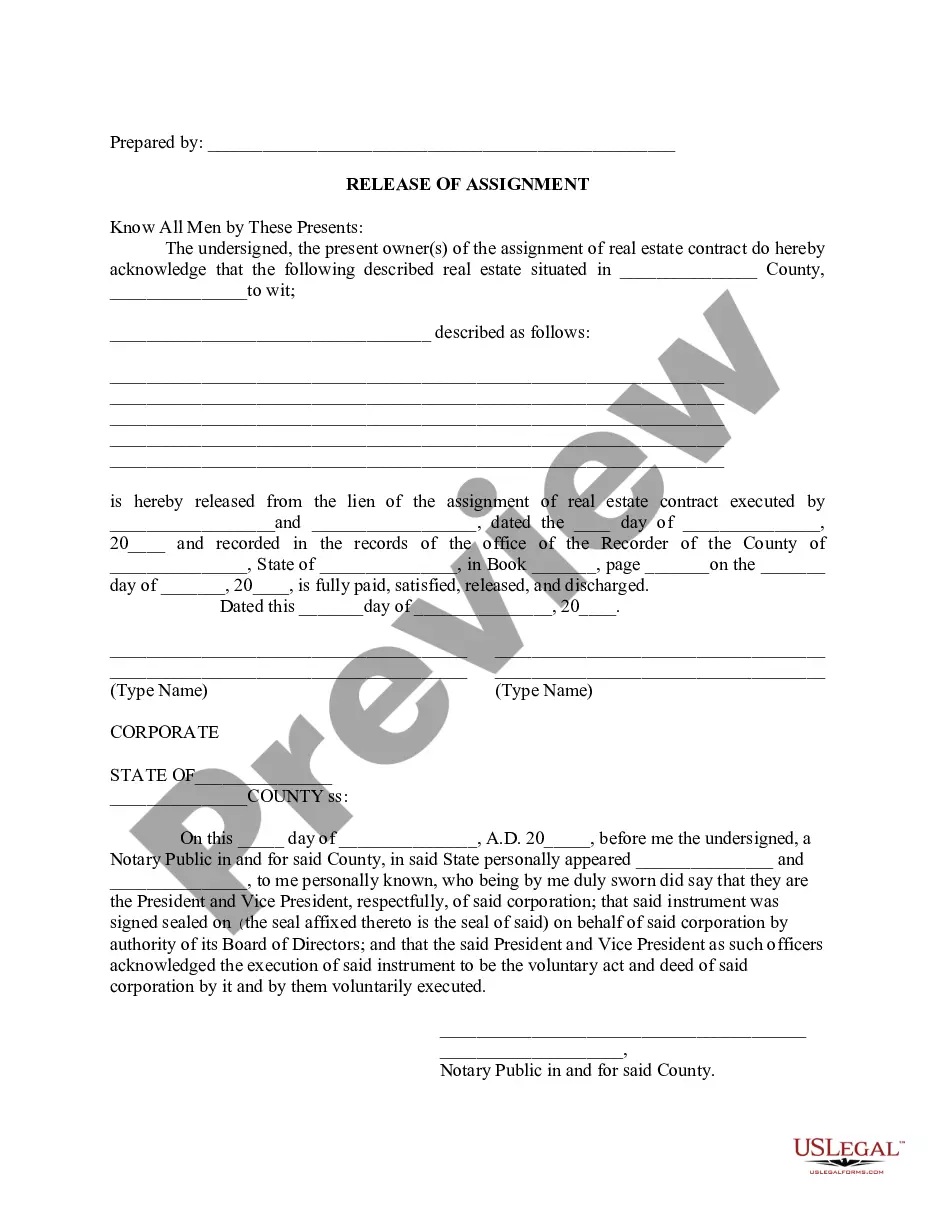

How to fill out Demand For Collateral By Creditor?

You can waste hours online trying to locate the legal document template that meets the state and federal standards you need.

US Legal Forms provides a vast array of legal forms that are vetted by professionals.

You can readily download or print the Washington Demand for Collateral by Creditor from the service.

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Washington Demand for Collateral by Creditor.

- Every legal document template you purchase is your own forever.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your chosen county/city.

- Read the form description to ensure you have picked the right form.

Form popularity

FAQ

Yes, in a Washington Demand for Collateral by Creditor situation, the debtor retains certain rights over the collateral. These rights can include the ability to use the collateral until the debt is resolved. However, the creditor's interest must be respected, and the debtor cannot sell or further encumber the collateral without the creditor's permission. Understanding these rights can help both parties navigate their obligations and avoid conflicts.

A creditor's right to use collateral to recover a debt is referred to as a security interest. This concept underlies the Washington Demand for Collateral by Creditor, allowing creditors to claim collateral in the event of borrower default. This right ensures that creditors have a means of safeguarding their financial interests while also promoting responsible lending practices. Thus, it serves as an essential tool in securing repayment.

The process of making a security interest in collateral enforceable typically involves creating a security agreement between the creditor and the borrower. This agreement outlines the terms under which the creditor can claim the collateral if the borrower fails to repay the debt. Once the agreement is executed, the creditor may also need to perfect their interest through filing a financing statement with the appropriate authorities. This step is crucial to establish the creditor's rights under the Washington Demand for Collateral by Creditor framework.

The right of a secured creditor includes the ability to take possession of the collateral upon a debtor's default. They can sell the collateral to recover the owed amount and, in certain cases, pursue further legal avenues for deficiencies. Knowing your rights as a secured creditor is crucial, and resources such as the Washington Demand for Collateral by Creditor can provide clarity on these legal entitlements.

Secured creditors typically do not need to file a proof of claim in bankruptcy, as their rights to collateral protect them. However, filing a proof of claim can be beneficial if they seek to recover additional amounts beyond the collateral's value. Being informed about the Washington Demand for Collateral by Creditor will guide you on whether filing is necessary in your specific situation.

A secured party creditor can take various actions to protect their interests. They can enforce their security agreement by seizing collateral in the event of default, and they may also sell that collateral to recover what is owed. Moreover, they can pursue legal actions to pursue deficiencies. Familiarity with the Washington Demand for Collateral by Creditor is vital for understanding these functions.

Yes, an unsecured creditor can become a secured creditor by obtaining a security interest in a debtor's asset. This typically involves having the debtor sign a security agreement that allows the creditor to claim specific collateral. It’s important for creditors to follow legal channels to perfect their interest, ensuring their enhanced protections. Resources about Washington Demand for Collateral by Creditor can assist in this transition.

Secured creditors hold exclusive rights to the collateral securing the debt. They can enforce their interest through repossession, sale of the collateral, and recovery of any deficiencies. Moreover, they have priority over unsecured creditors in bankruptcy situations. Understanding these rights through the lens of Washington Demand for Collateral by Creditor is essential for effective debt management.

Secured creditors have several remedies available to them if the debtor defaults. They can repossess the collateral specified in the security agreement and sell it to recover the owed amount. Additionally, they may seek a deficiency judgment if the sale does not cover the total debt. Utilizing resources on Washington Demand for Collateral by Creditor will help you understand how these remedies can be effectively executed.

A creditor is considered secured when they have a legal claim to specific collateral in case of default by the debtor. This claim arises from the security agreement, which gives the creditor rights over the debtor's asset. Secured creditors typically have a priority over unsecured creditors, ensuring they are compensated before other creditors in the event of liquidation. Navigating the Washington Demand for Collateral by Creditor can further elucidate this crucial distinction.