Washington Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive array of legal document templates that you can download or create.

By using the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can discover the latest versions of forms such as the Washington Application for S Corporation Status - Corporate Resolutions Forms in just minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you wish and enter your information to register for an account.

- If you already have a membership, Log In and access the Washington Application for S Corporation Status - Corporate Resolutions Forms from the US Legal Forms library.

- The Download button will be displayed on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Make sure to choose the correct form for your city/state.

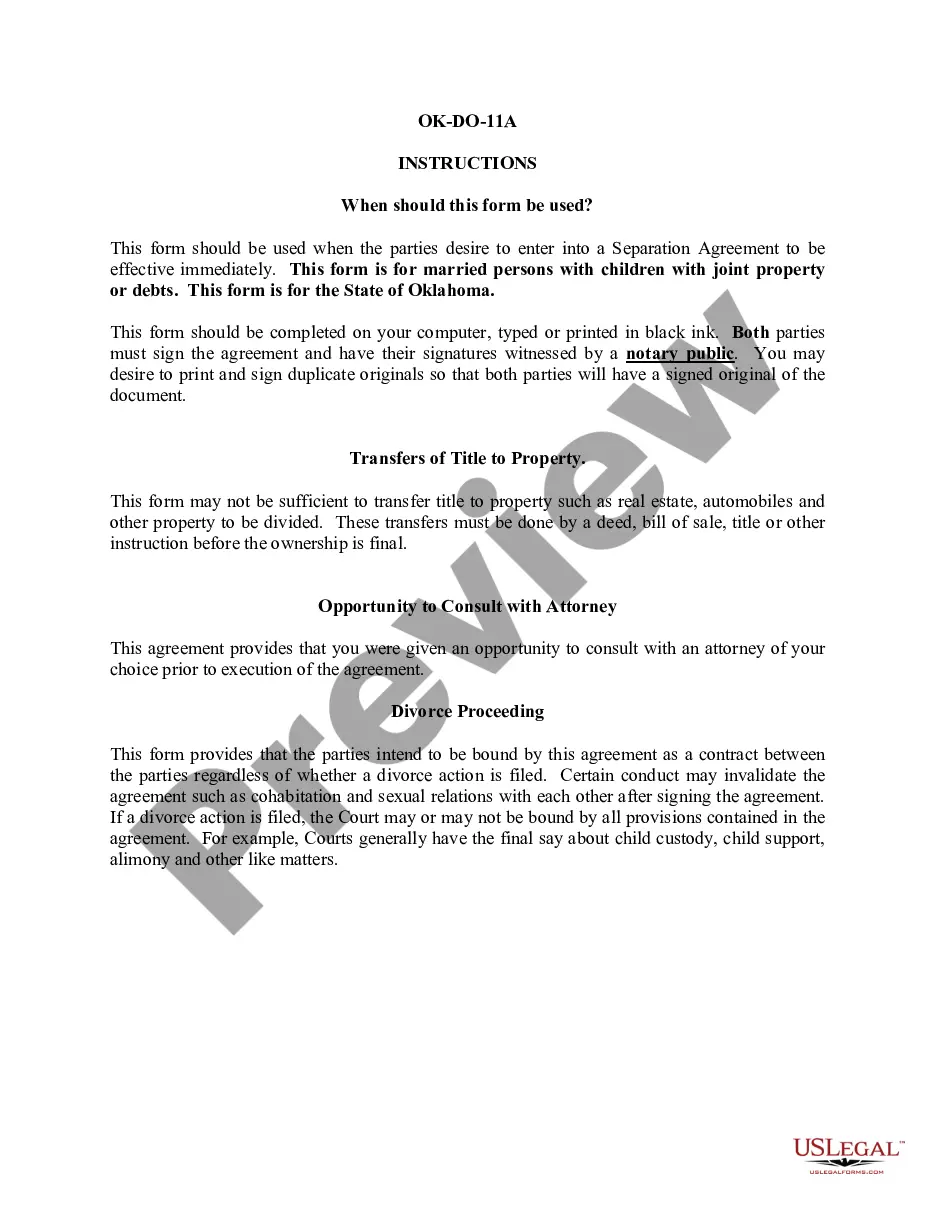

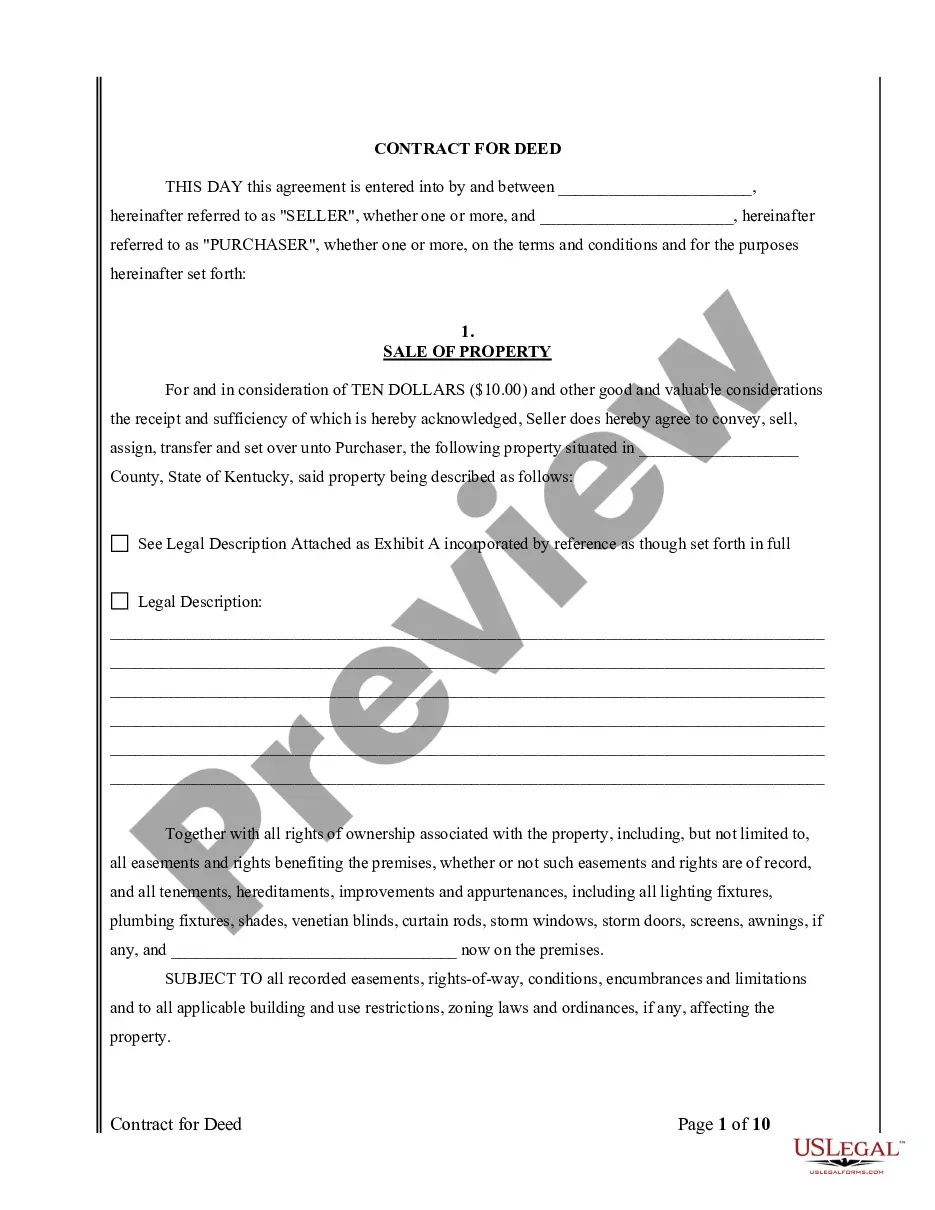

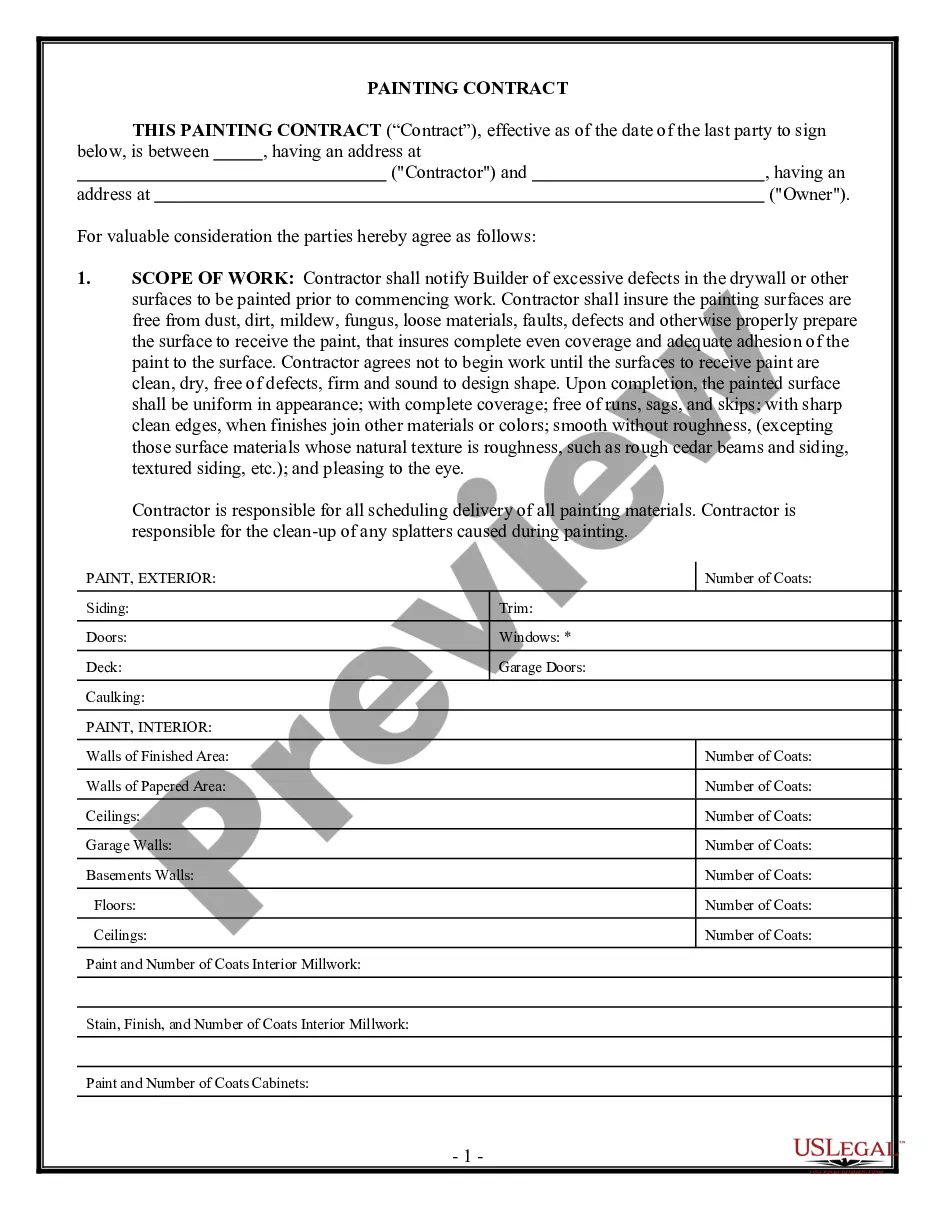

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Forming an S Corp in Washington state involves several important steps. Start by selecting a name that is distinguishable from other entities registered in the state. After that, file your Articles of Incorporation with the state, and do not forget to submit IRS Form 2553 to obtain S Corporation status. To ease your journey, US Legal Forms offers various templates and Corporate Resolutions Forms tailored to help you ensure that your formation process is both accurate and efficient.

While it is not mandatory to hire an accountant when setting up an S Corp, having one can make the process smoother. An accountant can guide you through the complex tax implications and ensure you meet all legal requirements. They can also assist in preparing the necessary paperwork, including your application for S Corporation status. Using US Legal Forms can further streamline your setup and provide you with Corporate Resolutions Forms to maintain compliance.

Starting an S Corp in Washington state involves a few key steps. First, you must choose a unique name for your corporation that complies with state rules. Next, file Articles of Incorporation with the Washington Secretary of State, and subsequently, you can apply for S Corporation status through the IRS by submitting Form 2553. To simplify this process, you might consider using US Legal Forms, which offers comprehensive resources, including Corporate Resolutions Forms, designed to help you obtain S Corporation status efficiently.

Yes, you can set up an S Corporation yourself, but the process requires attention to detail. To achieve Washington Obtain S Corporation Status - Corporate Resolutions Forms, you will need to follow specific steps, such as filing necessary paperwork with the state and obtaining an Employer Identification Number (EIN). While it is possible to manage this on your own, using a platform like UsLegalForms can simplify the process and ensure that you meet all legal requirements efficiently. This way, you can focus on growing your business while we take care of the forms and documentation.

The primary difference between an LLC and an S Corp in Washington state lies in their taxation and structure. An LLC offers flexible management and is generally simpler to run, while an S Corp allows for specific tax benefits and is subject to more formalities. If you seek to minimize self-employment taxes, obtaining S Corporation status might be a more advantageous choice.

Filing for S Corporation status in Washington requires you to first form a regular corporation by filing Articles of Incorporation. Once your corporation is recognized, you must then file IRS Form 2553 to elect S Corporation status. Using Corporate Resolutions Forms can streamline this process, helping you ensure all details are managed efficiently.

To check the status of your LLC in Washington state, visit the Washington Secretary of State's online portal for business entities. You can enter your LLC's name or Unified Business Identifier to find detailed information about your business's status. This ensures you are informed and compliant as you pursue options like obtaining S Corporation status with the right Corporate Resolutions Forms.

Choosing between an LLC or a corporation depends on your business goals. An LLC offers flexible management and simpler tax treatment, while a corporation may provide limited liability and more options for attracting investors. If you plan to seek investment and consider S Corporation status, forming a corporation might offer more benefits in the long run.

Yes, you can start a corporation by yourself in Washington state. As a sole incorporator, you can officially establish your business by filing the necessary documentation. This enables you to manage your corporation and benefit from its liabilities while also preparing to obtain S Corporation status through specific forms.

To form a corporation in Washington state, you need to choose a unique name for your business that complies with state regulations. Next, prepare and file your Articles of Incorporation with the Washington Secretary of State. Additionally, you will want to create corporate bylaws and hold an initial board meeting. Remember, obtaining S Corporation status may involve specific steps, especially when using Corporate Resolutions Forms.