Washington Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

If you require to obtain, download, or print sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's simple and convenient search to locate the documents you need.

A range of templates for commercial and specific purposes are organized by categories and states, or keywords.

Step 4. Once you locate the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to retrieve the Washington Affidavit of Lost Promissory Note with just a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click on the Acquire button to obtain the Washington Affidavit of Lost Promissory Note.

- You can also access forms you previously saved in the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to check the content of the form. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

Losing the original note or a copyThe original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

In order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized. However, these two steps can add a layer of protection particularly if the two parties do not know and trust each other.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

A Washington promissory note does not need to be notarized. To execute the note, the borrower should sign and date it. If there is a co-signer, the co-signer should also sign and date the document.

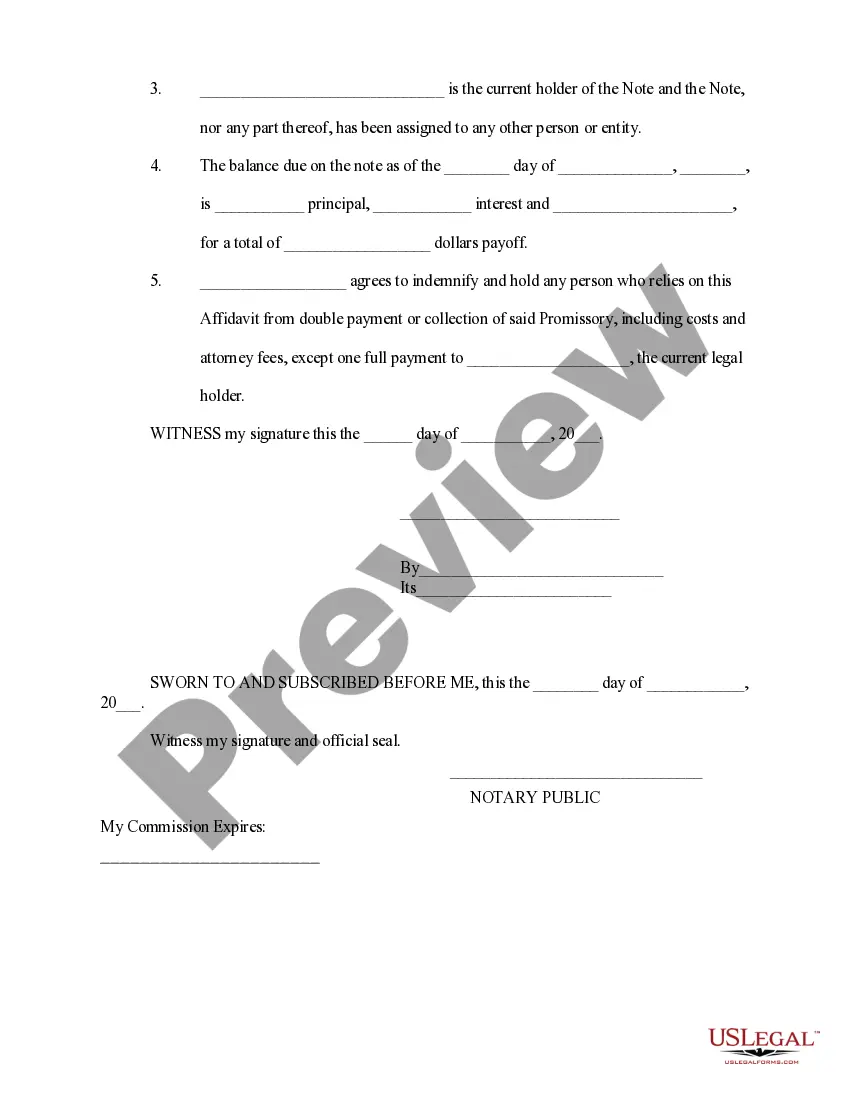

By Practical Law Finance. Maintained 2022 USA (National/Federal) A standard form of affidavit used when a promissory note has been delivered to a lender in a financing transaction and subsequently lost by that lender.

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.