This form is a simple Escrow Release, by which the parties to a transaction having previously hired an escrow agent to perform certain tasks release the agent from service following the completion of tasks and satisfaction of escrow agreement. Adapt to fit your circumstances.

Washington Escrow Release

Description

How to fill out Escrow Release?

Have you ever found yourself in a scenario where you need documentation for personal or business reasons repeatedly.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Washington Escrow Release, designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, enter the required information to create your account, and complete your purchase using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Washington Escrow Release template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct jurisdiction/state.

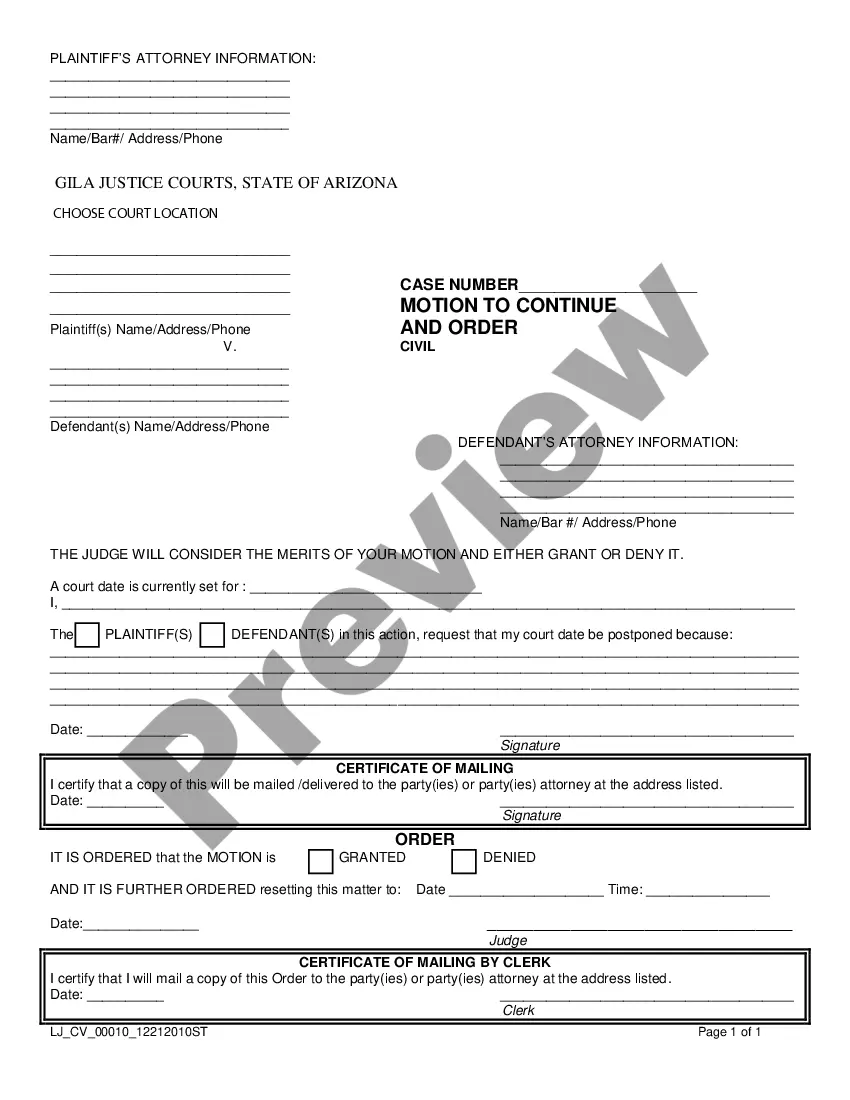

- Use the Preview button to view the form.

- Review the description to guarantee you have chosen the correct document.

- If the form does not meet your needs, utilize the Search feature to find the form that aligns with your requirements.

Form popularity

FAQ

The escrow process in Washington can vary based on the specifics of the transaction. On average, escrow periods can range from 30 to 60 days. But again, it varies. Typically, the home buyer and seller will agree on the escrow timeframe and closing date as part of the purchase agreement/contract.

The provision requires buyer to deliver earnest money within two days following mutual acceptance. Buyer must deliver within two days following mutual acceptance regardless of whether buyer is delivering to buyer's broker or to escrow.

There is no standard requirement amount for earnest money deposits in Washington State. It's really up to the seller and the buyer. Some sellers request a specific dollar amount, but most just wait and see what the buyer has to offer.

If the inspection reveals major flaws within the structure of the home, and the buyer is no longer comfortable continuing with the deal, the buyer can notify the seller in writing and expect a full refund of the earnest money deposit.

Washington state's escrow process is similar to other states where an escrow agent is used to complete the transaction. The escrow company will notify the seller's agent when the title has recorded, and the seller's agent will usually then deliver the keys to the buyer's agent or the buyer.

Escrow fees in Washington state are generally about 1-3% of the property's total purchase price. Endpoint offers one flat, low rate of $800 per side regardless of the price of the home.

Is escrow required in Washington state? Escrow is required in Washington state whenever buying and selling property. The title and escrow company ensures that a neutral third-party oversees and confirms the financial portion of the property transaction.

Open an Escrow Account.Await the Lender's Appraisal.Secure Financing.Approve the Seller Disclosures.Obtain the Home Inspection.Purchase Hazard Insurance.Title Report and Insurance.The Final Walk-Through.More items...

Escrow Closing Fee Many times you're required to pay two months of property taxes and mortgage insurance payments upfront at closing. And in Washington, the buyer and seller split escrow costs.