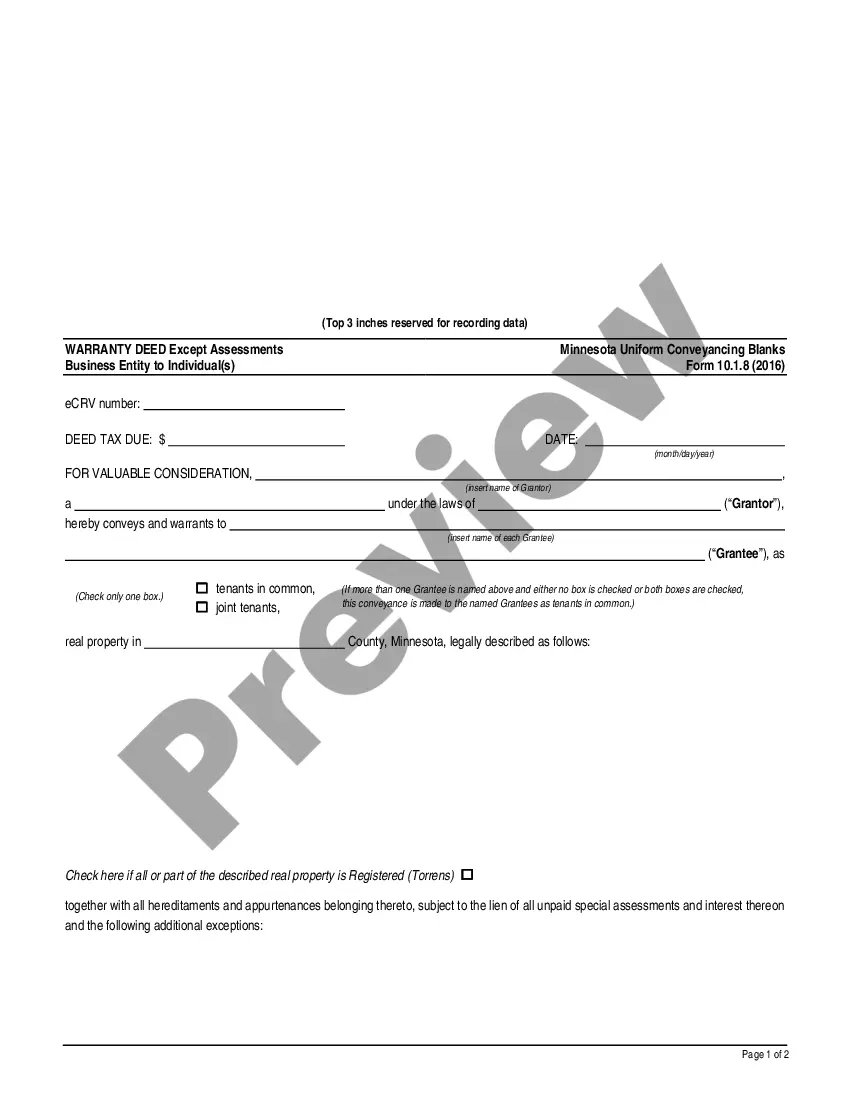

A Washington Deed of Trust with Due on Sale and Due Date. Is a deed of trust used to secure a loan in Washington state. This type of deed is often used to purchase real estate, such as residential or commercial property. It is a three-party agreement between the borrower (trust or), the lender (beneficiary), and the trustee, which is usually a title or escrow company. The deed of trust provides the lender with a lien on the property in case the borrower defaults on the loan. The due on sale clause of the deed of trust states that the loan must be paid in full when the property is sold or transferred. The due date is the date on which the loan must be paid in full, or when the borrower defaults on the loan. The different types of Washington Deed of Trust with Due on Sale and Due Date. Include: 1. Revocable Deed of Trust with Due on Sale and Due Date. 2. Irrevocable Deed of Trust with Due on Sale and Due Date. 3. Non-Judicial Deed of Trust with Due on Sale and Due Date. 4. Judicial Deed of Trust with Due on Sale and Due Date. 5. FHA Deed of Trust with Due on Sale and Due Date. 6. VA Deed of Trust with Due on Sale and Due Date.

Washington Deed of Trust with Due on Sale and Due Date

Description

How to fill out Washington Deed Of Trust With Due On Sale And Due Date?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to prepare Washington Deed of Trust with Due on Sale and Due Date, our service is the perfect place to download it.

Getting your Washington Deed of Trust with Due on Sale and Due Date from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Washington Deed of Trust with Due on Sale and Due Date and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

In Washington, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense.

IF YOU DO NOT RESPOND within thirty days, a notice of default may be issued and you may lose your home in foreclosure. IF YOU DO RESPOND within thirty days of the date of this letter, you will have an additional sixty days to meet with your lender before a notice of default may be issued.

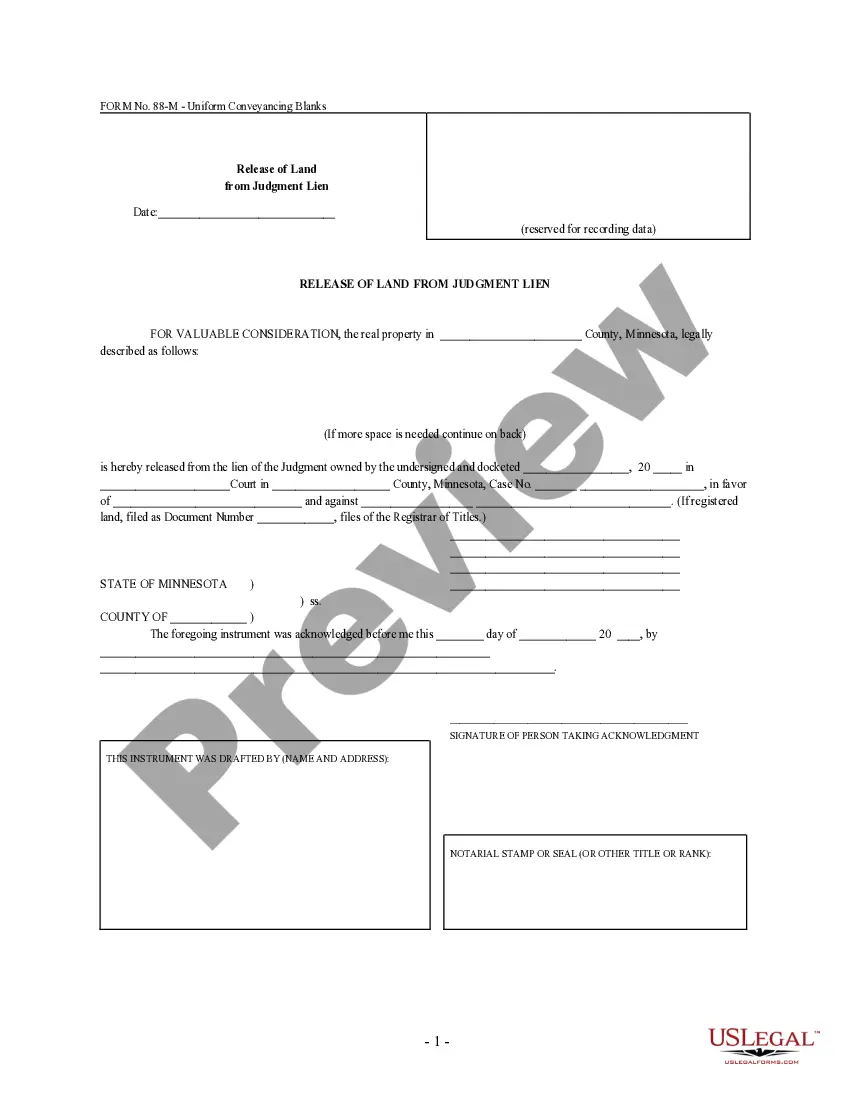

RCW 61.24. 127: Failure to bring civil action to enjoin foreclosure?Not a waiver of claims.

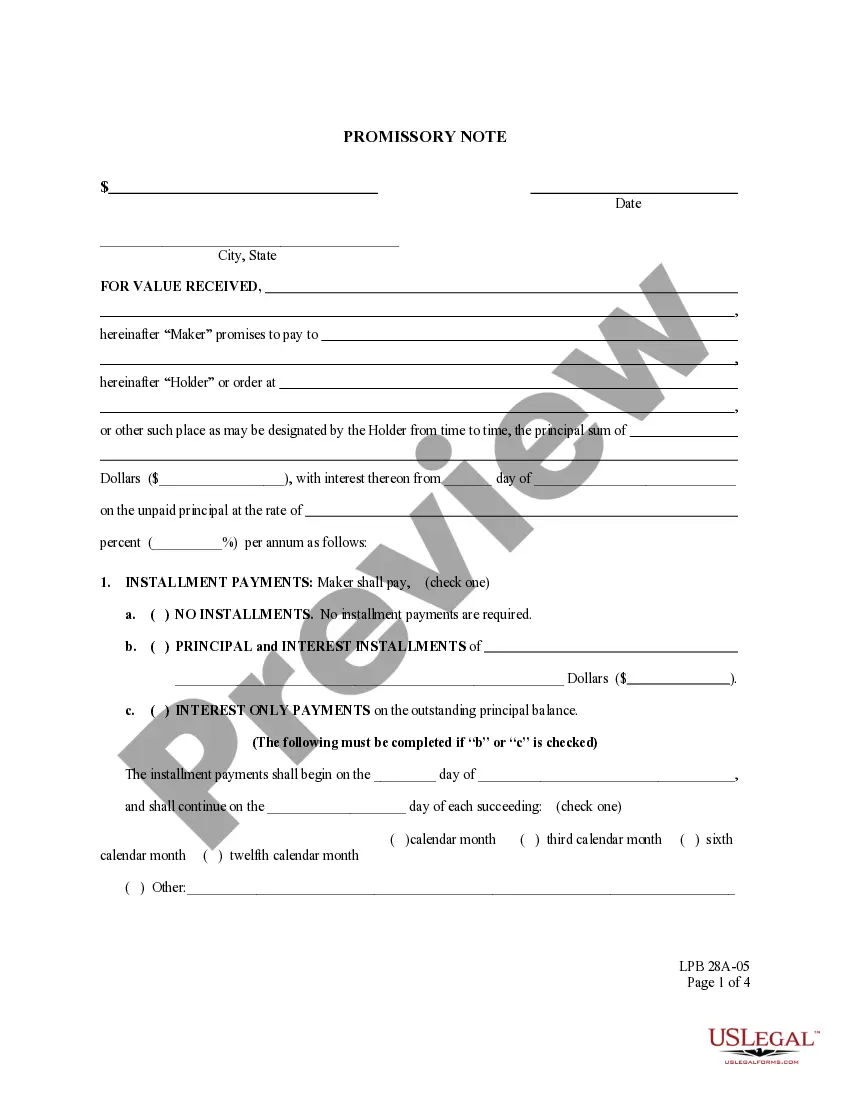

Promissory notes and deeds of trust are subject to Washington's six-year statute of limitations.

Except as provided in this chapter, a deed of trust is subject to all laws relating to mortgages on real property. A deed conveying real property to a trustee in trust to secure the performance of an obligation of the grantor or another to the beneficiary may be foreclosed by trustee's sale.

This Notice tells you the date, time, and place your home will be sold. The Notice of Trustee Sale must be mailed to you at least 20 days before the day they plan to sell your home. The notice must also be posted on your property.

RCW 61.24. 033: Model language for initial contact letter used by beneficiaries?Rules.