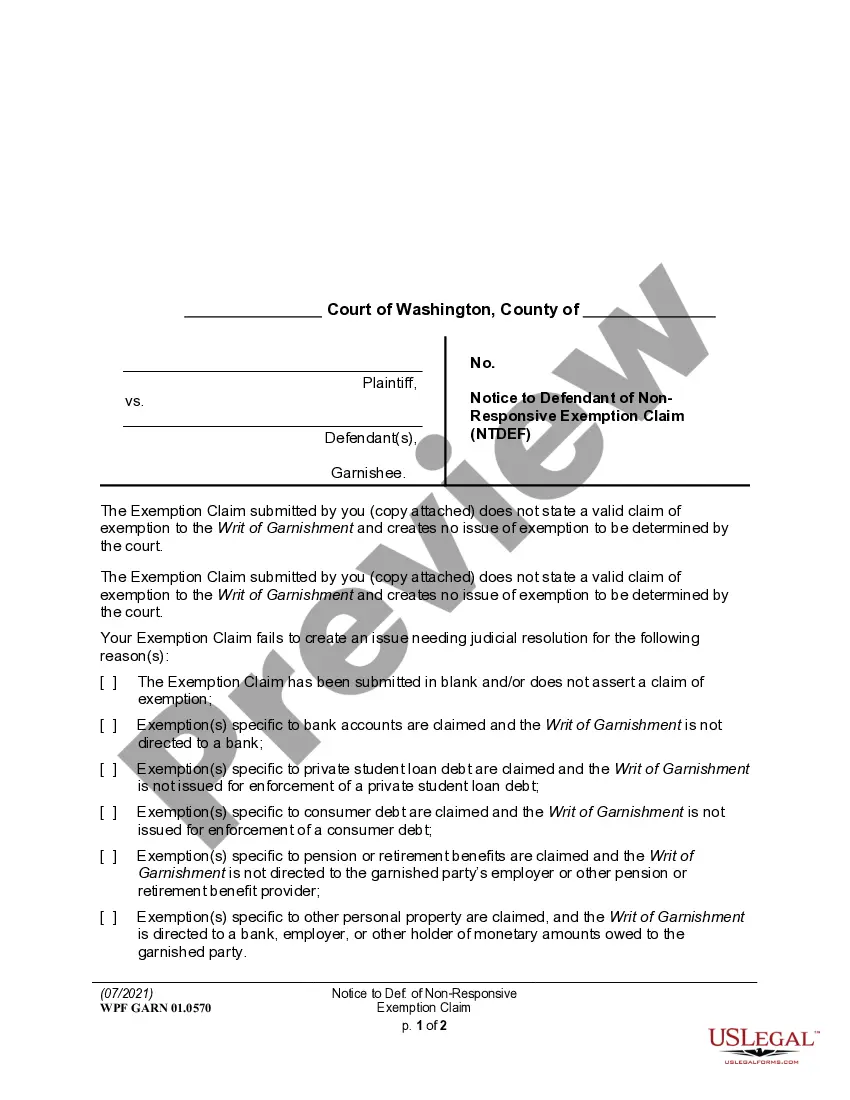

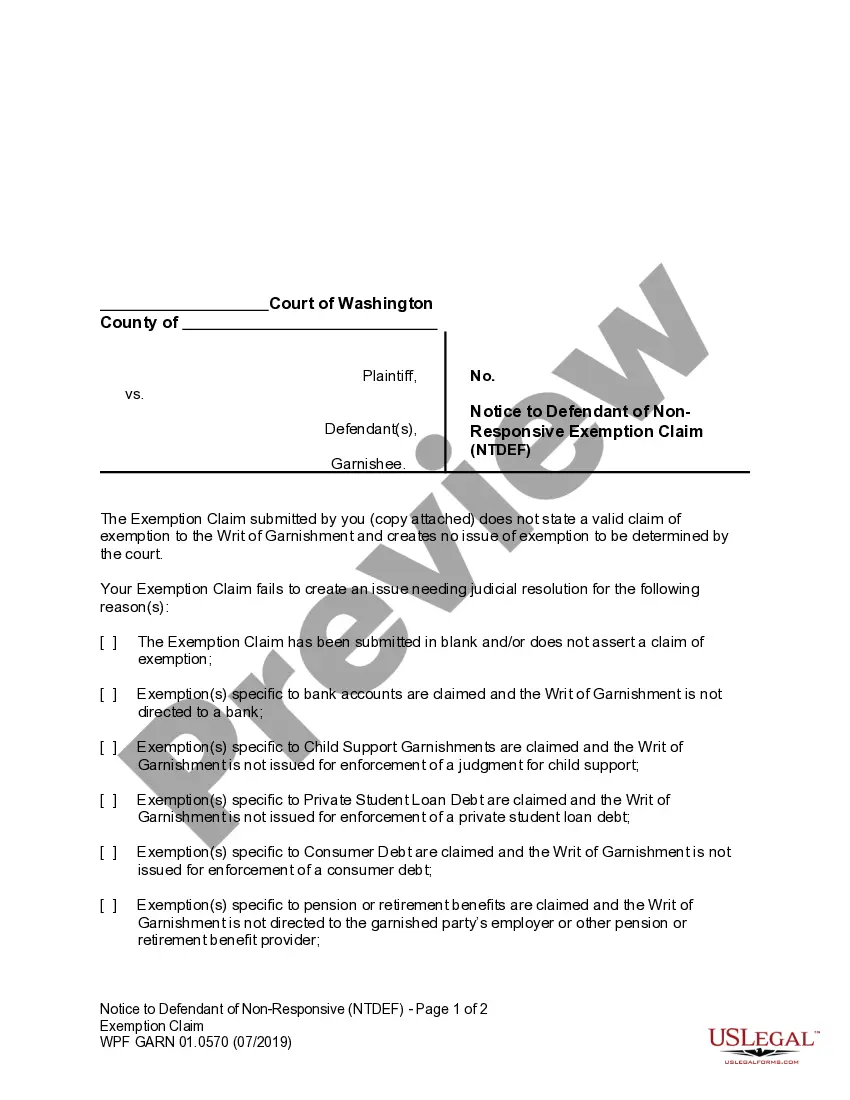

Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim is a document that is issued by the court to a defendant who has failed to timely respond to a claim of exemption or has failed to provide sufficient evidence in support of their claim. It is used to inform the defendant that they are in default and that the court may rule in favor of the creditor. The Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim is typically served via certified mail. There are two types of Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim: 1) Notice to Debtor of Non-Responsive Exemption Claim and 2) Notice to Creditor of Non-Responsive Exemption Claim. These notices are used in the context of garnishment procedures in Washington State.

Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim

Description

How to fill out Washington Note On Usage: Notice To Defendant Of Non-Responsive Exemption Claim?

If you’re looking for a way to properly complete the Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to acquire the ready-to-use Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim:

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Washington Note on Usage: Notice to Defendant of Non-Responsive Exemption Claim and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

Washington Wage Garnishment Process. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. This is true for wage and bank account garnishments. This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint.

A Writ of Garnishment is a court order directing an employer or a bank or someone else who has money belonging to the defendant to withhold the money you are owed and pay the money to you instead of the defendant.

In Washington, creditors can garnish 25% of your take-home pay. Even if you have a higher income and will need to file a Chapter 13 repayment plan, that is much better than being garnished. In most situations, a garnishment means things have really spun out of control. Only one creditor can garnish at a time.

Wage garnishments are taken out of your disposable income, which is the amount left in your paycheck after mandatory deductions are taken out. Also, creditors can never garnish your check for more than the judgment amount. The judgment amount will include the past-due debt, court costs, fees, and interest.

After 60 days, the judgment creditor's attorney will serve a ?Second Answer.? In response to the Second Answer, the employer must tell the judgment creditor how much was actually withheld during the 60-day period during which the garnishment was effective.

Stopping Wage Garnishment in Washington. There are some options for protecting your wages from garnishment, such as by objecting to a writ of garnishment or filing an exemption claim with the court. You can also stop most wage garnishments by filing for bankruptcy. In most cases, the sooner you can do this, the better.

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments.