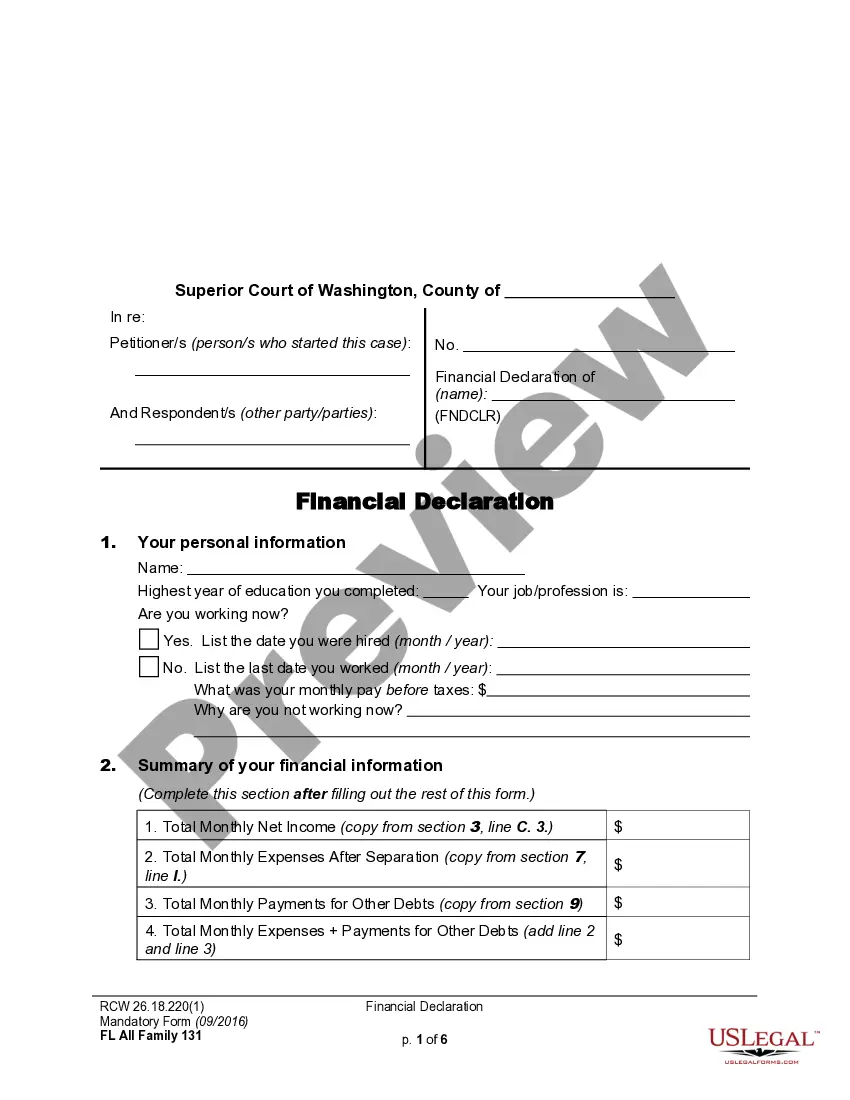

The Washington Financial Declaration is a document required by the Washington State Department of Revenue in order to file taxes. The Washington Financial Declaration is used to report income, deductions, and credits, and to calculate and declare an individual's or business's total tax liability. There are four different types of Washington Financial Declarations: Individual Declaration, Business Declaration, Nonresident Declaration, and Estate Declaration. The Individual Declaration is used to report income and expenses for individuals, while the Business Declaration is used to report income and expenses for businesses. The Nonresident Declaration is used to report income and expenses for nonresidents of Washington State, and the Estate Declaration is used to report income and expenses for deceased individuals.

Washington Financial Declaration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Financial Declaration?

If you’re looking for a way to appropriately prepare the Washington Financial Declaration without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of documentation you find on our online service is designed in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward guidelines on how to acquire the ready-to-use Washington Financial Declaration:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Washington Financial Declaration and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

The party may come for any reason that recognizes the authority of the court. Some states follow common law and do not consider a general appearance made when a party comes into court purely to challenge the court's personal jurisdiction over the defendant ? this is instead known as a special appearance.

An Entry of Appearance is a legal document that says that an attorney represents one party in a case. It is a representation to the court that an attorney represents one party or the other.

A financial declaration gives the court an overview of your monthly income and monthly expenses. Both parties need to file a sworn financial declaration (under penalty of perjury) whenever child support, maintenance, attorneys' fees, or any other financial issue needs to be determined.

Notice of Appearance. A Notice of Appearance does not need to be filed by an attorney appearing on behalf of a client; the act of using an ECF account to docket a pleading creates the attorney/party association within ECF and ensures that the attorney will receive electronic notice of all activity in that case.

Filling out a Financial Declaration for Divorce (Washington State) YouTube Start of suggested clip End of suggested clip And then your monthly expenses combined. With your payments. Here gross monthly income of otherMoreAnd then your monthly expenses combined. With your payments. Here gross monthly income of other party. This is where we tend to run into issues.

(4) No summons is necessary for a counterclaim or cross claim for any person who previously has been made a party. Counterclaims and cross claims against an existing party may be served as provided in rule 5.

The Notice of Appearance is a pleading that is filed with the Court, stating that the defendant is appearing on their own behalf or represented by an attorney. By filing and serving a Notice of Appearance, a Defendant becomes entitled to notice of all subsequent proceedings. RCW 4.28. 210.

Give your financial information to the court and to your spouse or domestic partner. This also explains when to use either this form or form FL-150. The court considers the information before making child support orders.