Washington Prenuptial Premarital Agreement with Financial Statements

Definition and meaning

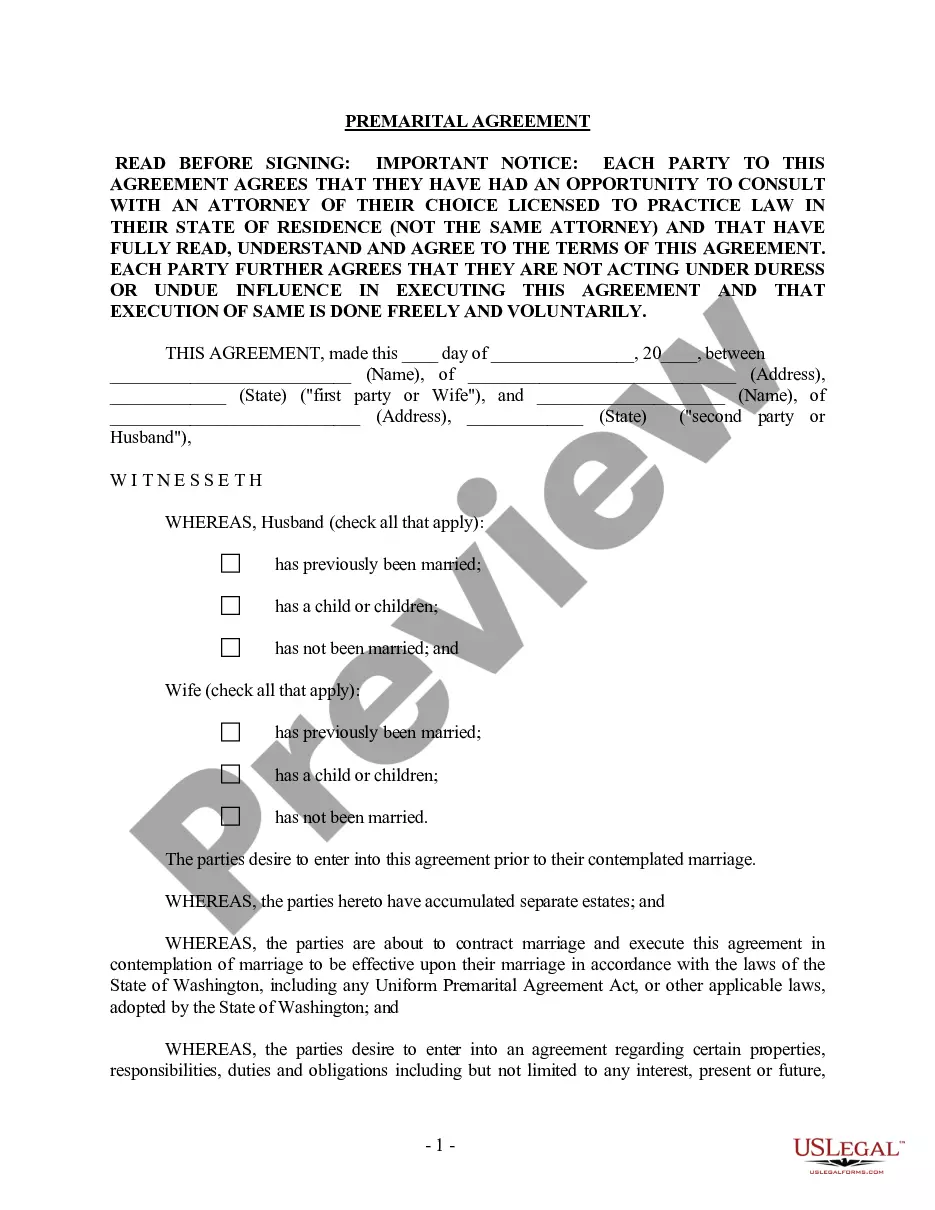

A Washington Prenuptial Premarital Agreement with Financial Statements is a legal document created by two people who plan to marry. This agreement outlines the distribution of assets, debts, and financial responsibilities in the event of divorce, separation, or death.

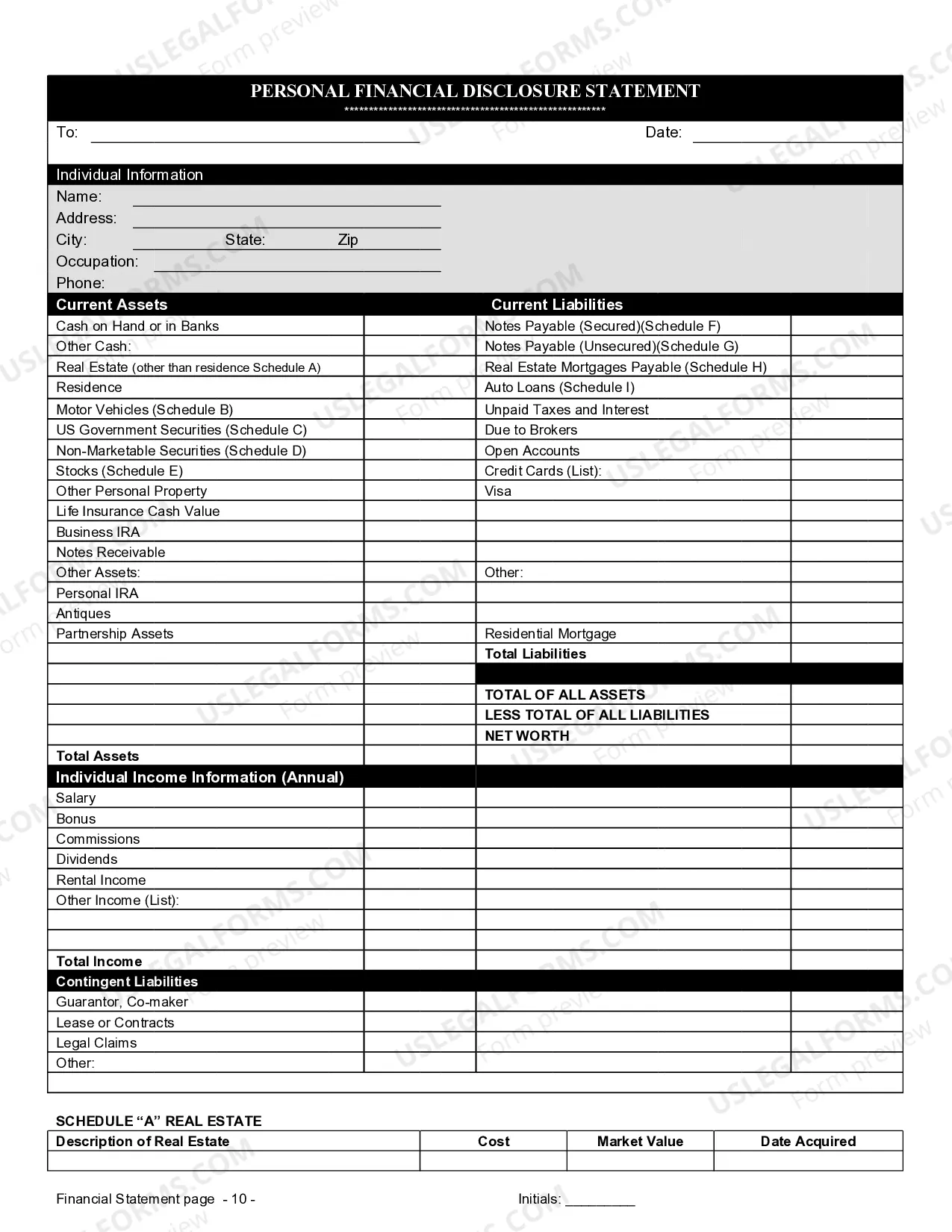

The financial statements included provide a clear view of each party's assets and liabilities, ensuring transparency in financial matters. This form is important because it helps to define personal property rights and financial obligations before marriage.

Key components of the form

This prenuptial agreement typically includes several key components:

- Identification of Parties: Names and addresses of both individuals.

- Disclosure of Financial Information: Complete financial statements detailing assets, liabilities, income, and expenses.

- Property Rights: Explicit statements regarding the ownership and management of property during the marriage.

- Spousal Support: Provisions regarding alimony, if any.

- Dispute Resolution: Details on how disputes will be handled if they arise.

Including these components ensures that both parties have a mutual understanding of their financial situation and rights.

Who should use this form

Any couple planning to marry may consider using a Washington Prenuptial Premarital Agreement with Financial Statements. It is especially beneficial for:

- Individuals with substantial assets or debts.

- Those entering a second marriage or later in life, possibly with children from previous relationships.

- Couples who want to clarify financial responsibilities and property ownership.

This agreement can provide peace of mind, ensuring that both parties' financial interests are protected.

Legal use and context

Prenuptial agreements are recognized in the State of Washington under the Uniform Premarital Agreement Act. For the agreement to be enforceable, it must meet specific legal requirements:

- Both parties must voluntarily enter into the agreement.

- There must be a full disclosure of assets and liabilities.

- The agreement should be in writing and signed by both parties.

Understanding the legal context helps ensure that the agreement holds weight in court if disputes arise.

Benefits of using this form online

Utilizing an online platform to complete a Washington Prenuptial Premarital Agreement with Financial Statements offers several advantages:

- Convenience: Access the form at any time and complete it at your own pace.

- Guidance: Online services often provide step-by-step instructions and explanations.

- Legal Validation: Many online resources ensure that the document complies with current laws, reducing the risk of errors.

- Cost-effective: Often less expensive than hiring an attorney for drafting.

These benefits promote a smoother process in preparing this vital legal document.

Common mistakes to avoid when using this form

When completing a prenuptial agreement, it is essential to avoid several common pitfalls:

- Not fully disclosing all assets and liabilities, which can lead to disputes later.

- Failing to have both parties consult with independent legal counsel.

- Not updating the agreement as circumstances change, such as the acquisition of new assets.

- Overlooking the need for notarization or witnessing, which can invalidate the agreement.

Avoiding these mistakes can help ensure the agreement is enforceable and effective.

Form popularity

FAQ

The purpose of a prenup is to opt out of certain provisions that the couple would otherwise be entering into under the laws of their state, Wasser said. You design a couple's own contract for how they want their money to be treated if they are to divorce in the future.

The average cost of a prenup ranges from about $1,200 for low-cost, simple agreements to $10,000 for more complicated situations.

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

Typically, prenups cost around $2,500, but can cost more if you spend a while haggling out various issues.

To ensure that a prenuptial agreement is fully enforceable in the Washington courts, the following requirements must be met: The agreement must be in writing.If there is no marriage, the agreement is unenforceable. The agreement should contain a list of the parties' assets, liabilities, and income.

A prenuptial agreement does not have to be notarized to be valid. Often, they are notarized, so there is no question that it was actually signed by the parties. Assuming, that neither of you are contesting the validity of the agreement it should be legally viable.

A prenup can also be overturned if one or both parties change their mind after initially signing the agreement. They may decide at that time to sign a new agreement suspending the prenup.

A good prenuptial agreement should be fair. It should be entered into between two consenting adults who know what they are doing. The agreement should be fair when it is signed and entered into, and also fair when it is be enforced, whether in the event of a divorce or death.