Washington Framing Contract for Contractor

What this document covers

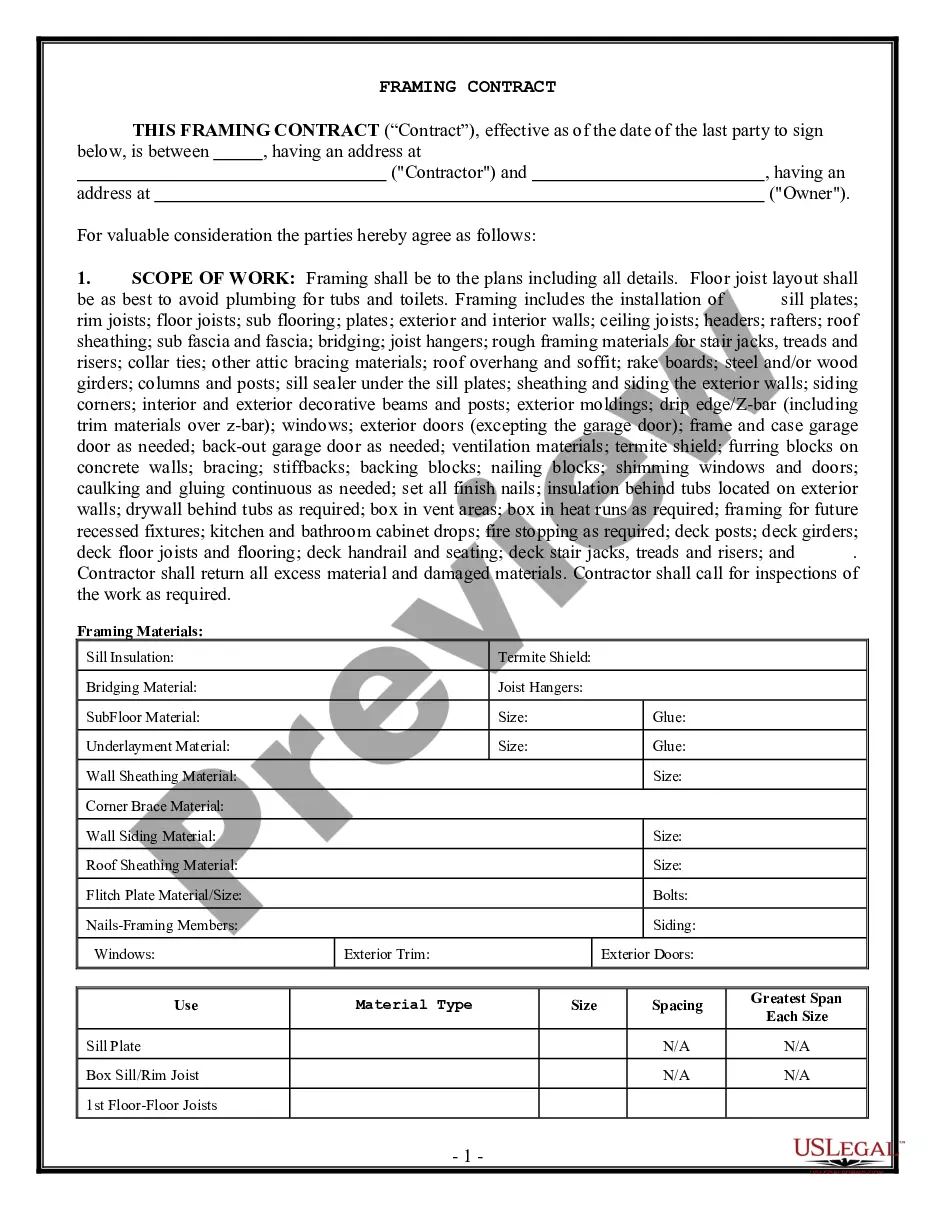

The Framing Contract for Contractor is a legal document used between framing contractors and property owners. This contract outlines the terms of engagement for a construction project, including payment arrangements, change orders, and responsibilities regarding permits and insurance. Unlike other construction contracts, this form is specifically tailored to comply with the laws of the State of Washington, ensuring legal validity and protection for both parties involved.

Main sections of this form

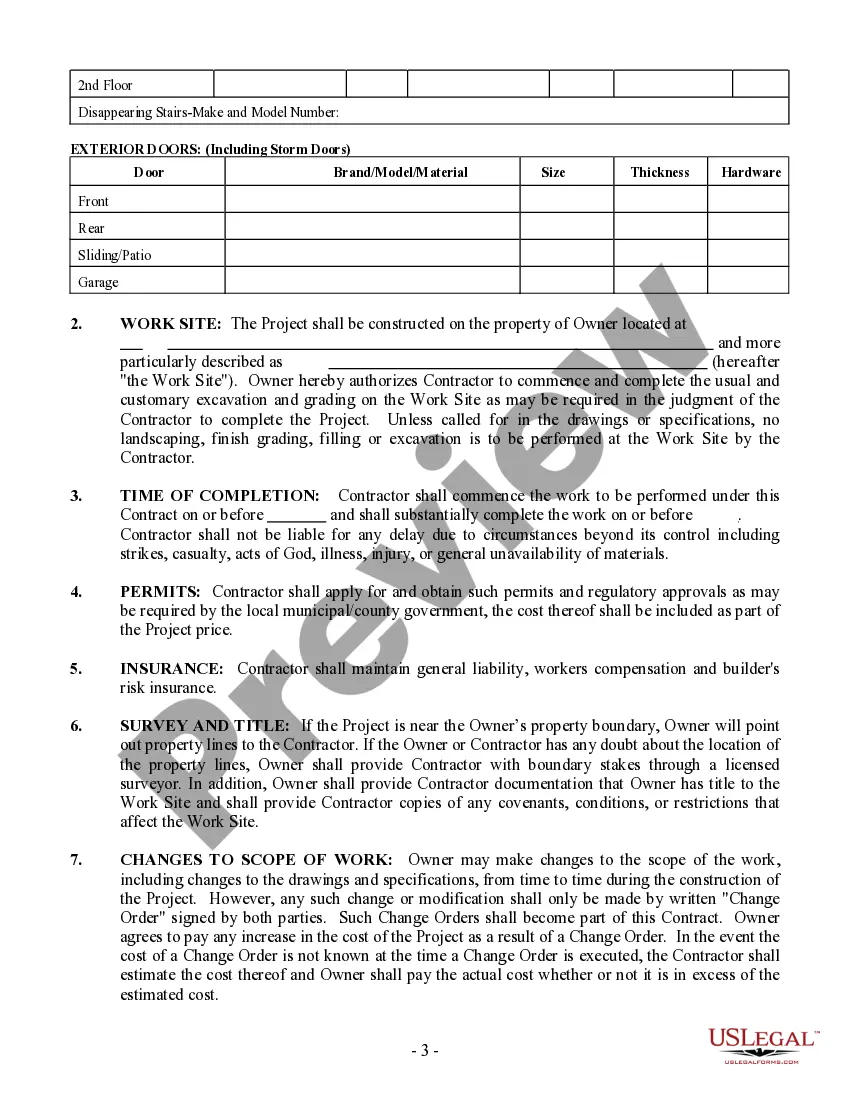

- Permits: Contractor must apply for and secure necessary local permits as part of the project cost.

- Insurance: Requires the contractor to maintain specific insurance types, including general liability and workers' compensation.

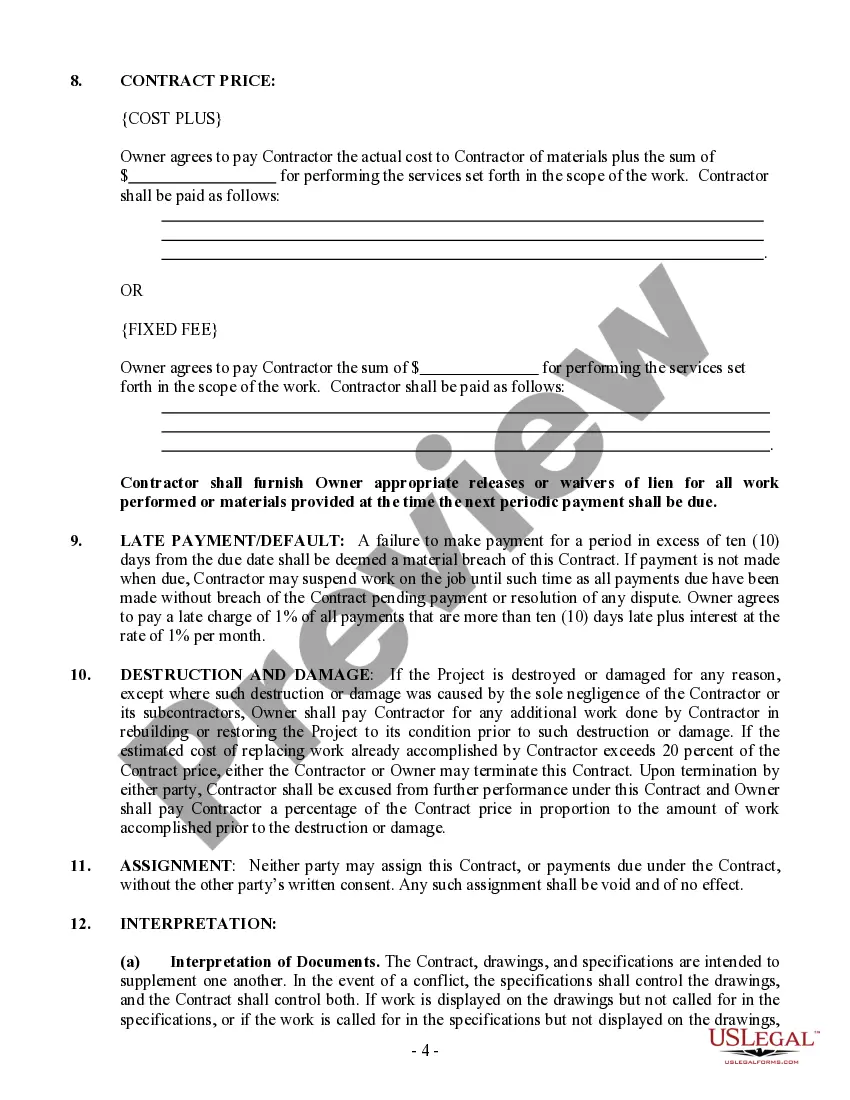

- Changes to scope of work: Outlines the procedure for making alterations to the project, requiring written change orders.

- Destruction and damage: Details the responsibilities if the project is damaged, including payment for rebuilding work.

- Assignment: Specifies that neither party can assign the contract without written consent from the other party.

- Governing law: States that the contract will be governed by the laws of the State of Washington.

Common use cases

This form should be used when a property owner engages a framing contractor for construction or renovation work. It is essential in situations where there are specific payment arrangements, project changes, or need for legal clarity on responsibilities regarding permits and insurance. This contract is particularly important for projects located in Washington State to ensure compliance with local regulations.

Who can use this document

- Property owners looking to hire a framing contractor for construction projects.

- Framing contractors seeking a standard legal agreement with property owners.

- Both parties needing a clear understanding of project terms, responsibilities, and liabilities.

Completing this form step by step

- Identify the parties involved: Clearly state the names and addresses of the contractor and the property owner.

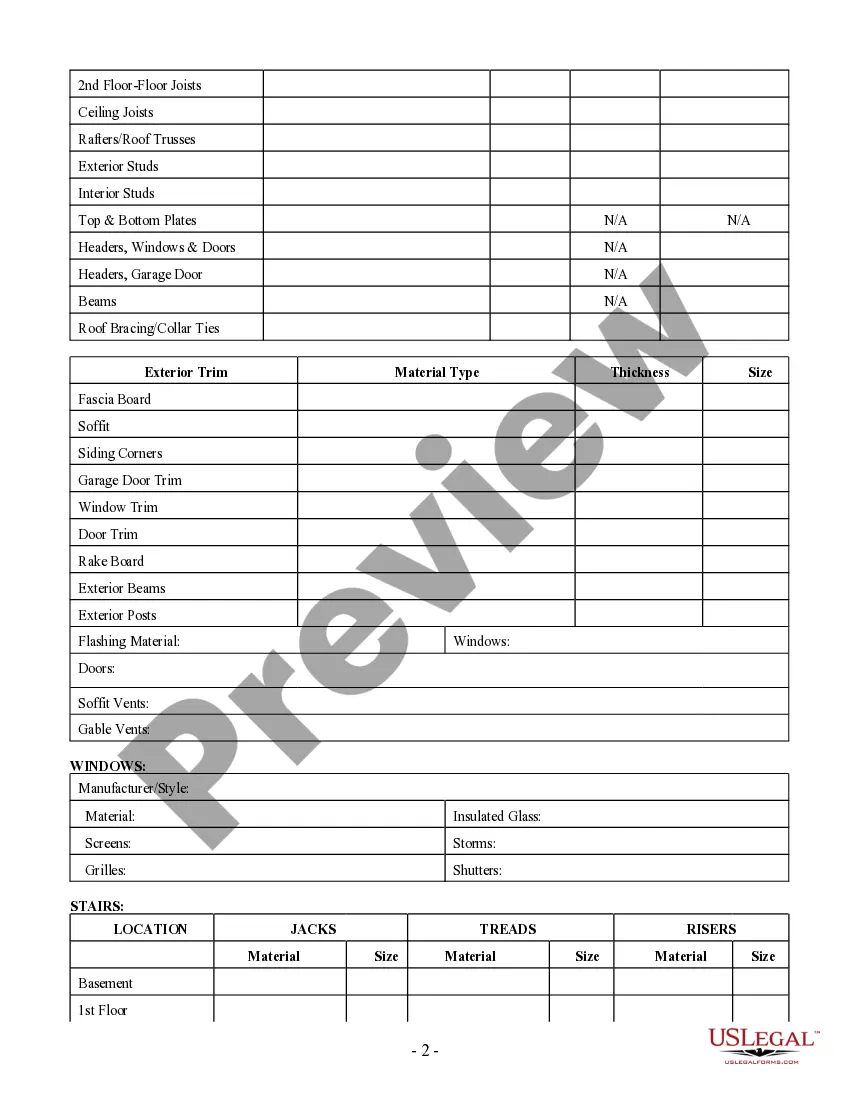

- Specify the project details: Describe the scope of work, including materials and timelines.

- Outline payment terms: Indicate whether the payment will be cost-plus or a fixed fee arrangement.

- Address insurance requirements: Confirm the types of insurance the contractor will maintain.

- Sign and date the agreement: Ensure that both parties sign the contract to make it legally binding.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not specifying all the terms of payment and scope, leading to misunderstandings.

- Failing to include necessary permits in the cost of the project.

- Neglecting to document changes in writing through a change order.

- Overlooking insurance responsibilities which can lead to liability issues.

Why use this form online

- Convenient access to a legally vetted contract, avoiding the need to draft one from scratch.

- Editability allows customization to meet specific project needs.

- Reliable source of legal forms drafted by licensed attorneys, ensuring compliance and protection.

Looking for another form?

Form popularity

FAQ

If the contractor requests a large sum of money before work has begun, Mozen says you should ask specifically what types of work or materials those payments are covering.Contractors sometimes have other motives, other than purchasing materials, when they ask for large amounts of money in advance, Fowler says.

Step 1: File Suit. Unfortunately, there is no simple claim process. Step 2: Serve L&I. Under RCW 18.27. Step 3: Show the Surety. This step is not mandatory, but extremely helpful. Step 4: Obtain Judgment. Step 5: Collect Disbursed Funds.

Excise tax reporting: Gross receipts from prime contracting on a custom construction job are taxable under the Retailing B&O tax classification and are subject to retail sales tax unless a specific exemption applies.

Avoid companies that require an upfront deposit of more than 10 percent. Try to include language in the contract that holds back a percentage of the total price, called a retainage, until you're sure the work was done well. A 10 percent retainage is common for residential remodeling work.

A: It's not uncommon for contractors to ask for a down payment up front to secure your spot on their schedule or purchase some of the job materials in advance. Asking for more than half of the project cost up front, though, is a big red flag.I recommend tying payments to progress made during the job.

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

Estimates, generally, must be professionally reasonable. A 10-20% overage might be considered reasonable, especially if the contractor discovered issues along the way that he couldn't have been aware of initially (for example, mold or flooding).

Independent contractors must register with the Department of Revenue unless they: Make less than $12,000 a year before expenses; Do not make retail sales; Are not required to pay or collect any taxes administered by the Department of Revenue.

You need a license if you meet one or more of the following criteria: Your business requires city and state endorsements. You are doing business using a name other than your full name legal name. You plan to hire employees within the next 90 days.