Vermont Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

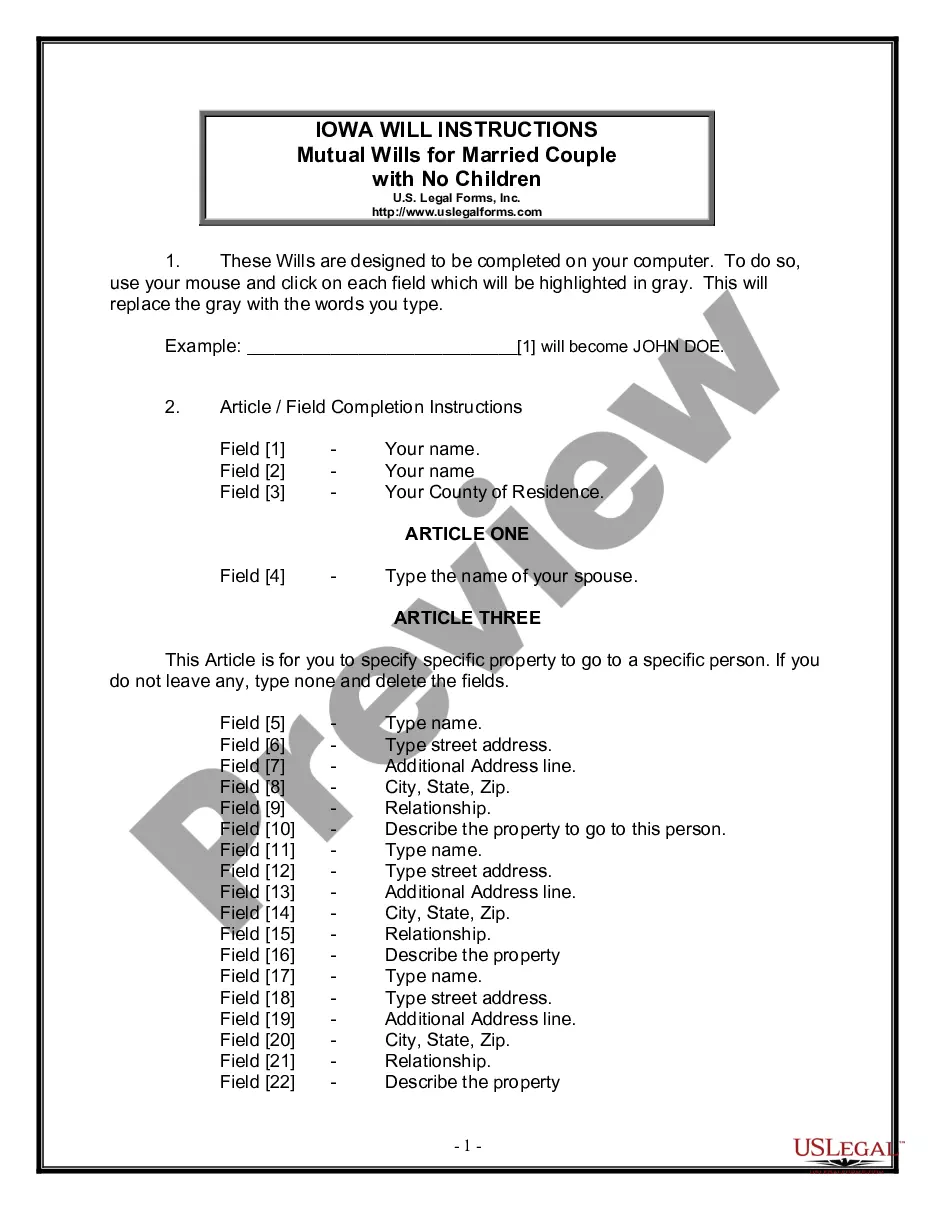

Have you been inside a situation the place you require papers for sometimes business or specific reasons almost every working day? There are a variety of authorized file themes accessible on the Internet, but getting versions you can rely on isn`t easy. US Legal Forms delivers thousands of type themes, such as the Vermont Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), which are composed to satisfy federal and state demands.

When you are already acquainted with US Legal Forms internet site and have an account, simply log in. Following that, it is possible to down load the Vermont Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) design.

Should you not offer an accounts and want to start using US Legal Forms, abide by these steps:

- Discover the type you need and make sure it is for your correct city/region.

- Make use of the Preview button to examine the shape.

- Read the information to actually have selected the appropriate type.

- In case the type isn`t what you are trying to find, utilize the Look for industry to obtain the type that meets your needs and demands.

- If you discover the correct type, simply click Buy now.

- Opt for the prices plan you need, complete the desired details to create your money, and pay money for the order with your PayPal or bank card.

- Decide on a practical document file format and down load your backup.

Find all of the file themes you have purchased in the My Forms food selection. You can obtain a more backup of Vermont Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) whenever, if necessary. Just click on the needed type to down load or print out the file design.

Use US Legal Forms, by far the most extensive assortment of authorized types, in order to save efforts and stay away from mistakes. The assistance delivers expertly manufactured authorized file themes which you can use for a variety of reasons. Generate an account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR * RI = NPRI.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.