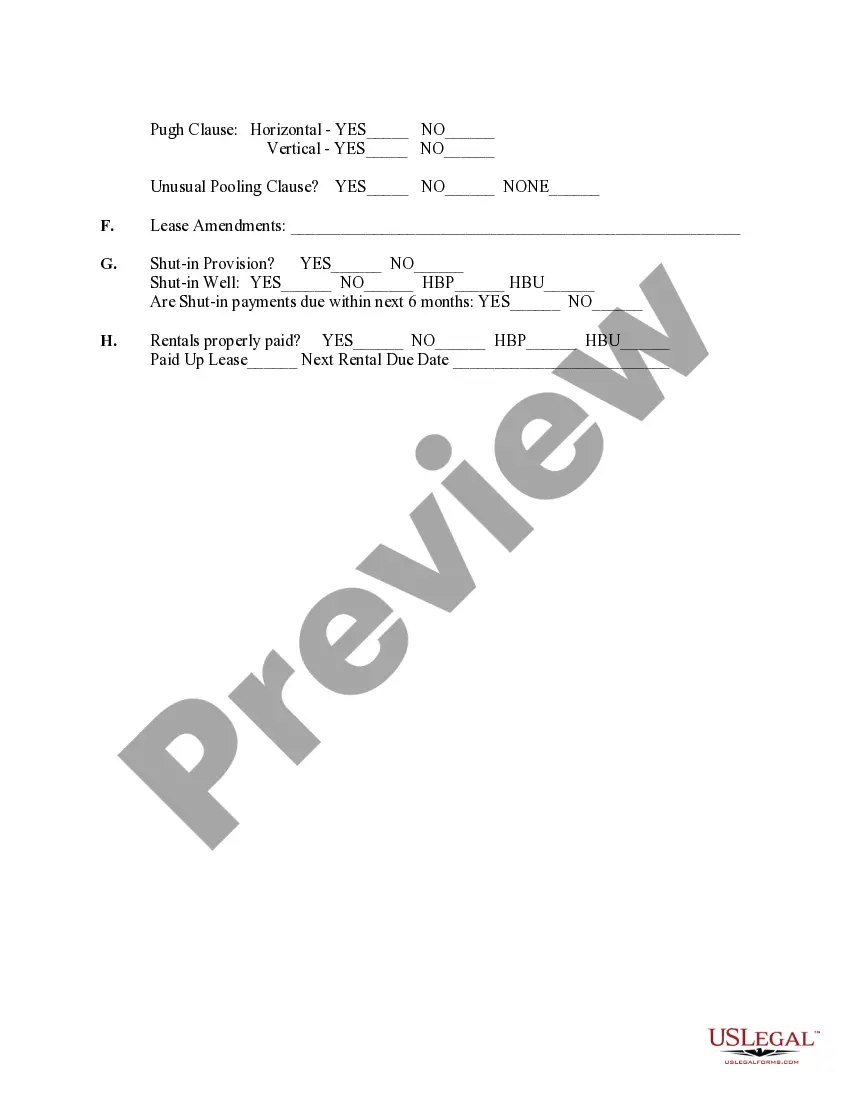

Vermont Lease Information

Description

How to fill out Lease Information?

If you want to total, down load, or printing legitimate papers themes, use US Legal Forms, the largest collection of legitimate varieties, which can be found online. Take advantage of the site`s simple and easy handy research to get the papers you want. Numerous themes for enterprise and specific purposes are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Vermont Lease Information with a couple of clicks.

In case you are previously a US Legal Forms buyer, log in to your account and click the Down load switch to obtain the Vermont Lease Information. You can even access varieties you previously saved within the My Forms tab of your respective account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape to the correct metropolis/country.

- Step 2. Utilize the Preview method to look over the form`s content material. Never overlook to read the explanation.

- Step 3. In case you are unhappy together with the kind, make use of the Research area near the top of the screen to discover other types in the legitimate kind web template.

- Step 4. When you have identified the shape you want, select the Buy now switch. Pick the costs program you prefer and add your accreditations to sign up for an account.

- Step 5. Method the financial transaction. You may use your credit card or PayPal account to complete the financial transaction.

- Step 6. Select the file format in the legitimate kind and down load it on the product.

- Step 7. Complete, change and printing or sign the Vermont Lease Information.

Each and every legitimate papers web template you get is your own for a long time. You possess acces to every single kind you saved inside your acccount. Click the My Forms portion and pick a kind to printing or down load again.

Remain competitive and down load, and printing the Vermont Lease Information with US Legal Forms. There are millions of specialist and express-particular varieties you can utilize for the enterprise or specific demands.

Form popularity

FAQ

Services are generally tax-exempt in Vermont, though there are exceptions: Services to tangible personal property. If labor is expended in producing a new or different item, a tax applies to the labor charge.

Retail sales of tangible personal property are always subject to Vermont Sales Tax unless specifically exempted by Vermont law. This applies to any sale, lease, or rental but does not include resale, sublease, or subrental.

A Vermont month-to-month lease agreement is a contract (written or oral) that allows a tenant to rent property from a landlord, in exchange for a fee (?rent?), for a period of thirty days at a time. The agreement remains active until either party gives proper notice to end it.

Purchase and Use Tax (32 V.S.A.) Purchase and Use Tax is due at the time of registration and/or title at the rate of 6% of the purchase price or the National Automobile Dealers Association (NADA) clean trade-in value, whichever is greater (see allowable credits and exemptions).

The Vermont Department of Taxes has released guidance for Landlords on how to report any Rental Housing Stablization Program (RHSP) funds received.

The amount of the credit may not exceed the amount of the Maine tax. Lease and rent payments are not subject to sales and use tax when they are not considered to be purchases. True leases of tangible personal property are not considered to be purchases.

Landlords must ensure that each dwelling unit has an adequate heating system and complies with all applicable codes. Landlords must allow tenants the full use and enjoyment of the dwelling unit and must comply with the rental agreement and the law regarding landlord access to the rental unit.

Some goods are exempt from sales tax under Vermont law. Examples include some agriculture supplies, prescription drugs, and medical supplies.